Would love to hear from those of you on the ground in Singapore at Token2049. What is sentiment like? What are the key themes? Please let us know by replying to this email.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The US remains the cleanest shirt in the laundry, credit ramping up in China and the Fed nears the end of its rate hike cycle.

Crypto Native News: Coinbase launches a new lending service for institutions, Ripple buys Fortress Trust and the SEC pushes back against Ripple Labs' efforts to block its appeal.

Institutional News: The FASB votes for a new set of crypto accounting rules, The IMF and FSB release a new crypto policy roadmap and the FCA extends the deadline for some crypto regulations.

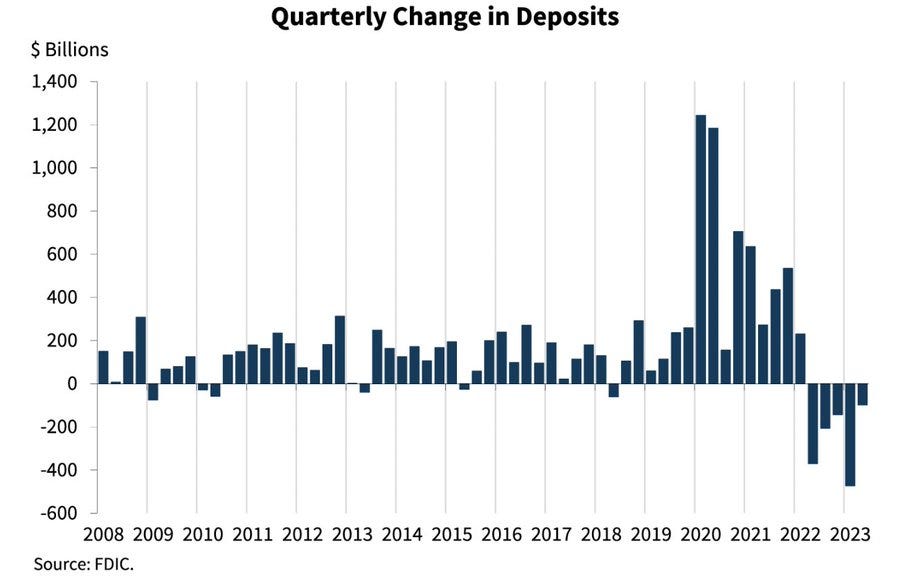

Chart of the Week: US banks have lost deposits for 5 quarters in a row.

Top Jobs in Crypto: Featuring Binance, Hivemind, Paypal, Kraken, Copper, Clearbank and Ripple.

Macro Update

This is where we connect the dots between macro and crypto.

Bracing for a Fed Pause

Crypto continues to feel the squeeze from a strong dollar and higher yields, with “US exceptionalism” a dominant theme with still resilient US data versus the rest of World slowdown.

China services PMI showed activity expanding at the slowest rate this year whilst final services PMI in Europe weakened further to 47.9 from 48.3. Underscoring the problems in Europe, its “growth engine”, Germany, saw factory orders plunge 11.7% MoM in July, the biggest monthly drop since April.

Meanwhile, US service sector ISM unexpectedly jumped to its highest levels since Feb. Jobless claims also fell to the lowest levels for 6 months. Whilst this does little to change expectations that the Fed will pause next week, the US is clearly the cleanest shirt in the laundry right now.

Good news is however bad news in a market dominated by rates and liquidity, with major US indices closing lower on the week as yields climbed higher. Compounding the strength in US yields was also a huge day of corporate bond issuance last Tuesday (NB: when credit investors buy corporate bonds, they sell treasuries to hedge out the interest rate risk putting upward pressure on yields)

Keeping the pressure on into this week, comments from the Bank of Japan’s Ueda that the BoJ could end its negative interest rate policy by the end of this year saw JGB yields spike higher and global bonds under more pressure on Monday morning. This move higher in yields continues to suffocate crypto.

Reinforcing the negative dynamic is the unrelenting pressure on the Chinese currency, CNY, which breached the psychological 7.35 level to record 16 year lows against the dollar.

We’ve written before about the importance of CNY stability as it relates to the broader dollar and yields. TLDR: A plunging CNY drives broad dollar strength and puts upward pressure on yields as treasury reserve assets are sold to raise dollars for currency intervention.

For crypto, China also needs to maintain the veil of stability and as they look to discourage capital outflows, it’s in their interests to keep Bitcoin “contained.” CNY stability will likely be a prerequisite if Bitcoin and the broader digital asset complex is to take a new leg higher.

More encouraging as it relates to liquidity, the latest credit data out of China showed credit is ramping up as China’s efforts to encourage lending filter through to the real economy. Aggregate financing, a broad measure of credit, was 3.12trn Yuan in August, up from 2.5trn a year ago and greater than the 2.7trn expected.

China’s credit impulse is typically positively correlated to Bitcoin and if the currency can find some stability, we may well be set to bounce from these lows as liquidity flows.

Overall, as we wrote recently in the episode “wake me up, when September ends”, we continue to be stuck in this broad 25k/30k range with the move higher in USD and yields pressuring us to the lower end of that range. CPI this week followed by the FOMC next will be key data releases.

We remain constructive however on broad risk as the Fed nears the end of its rate hike cycle. In fact, given the catalysts for higher yields over the past week, it’s noteworthy that US yields failed to make new highs. Fed commentary is leading us towards the “pause.” Don’t underestimate the positive trigger that will have for risk and crypto when it arrives.

Native News

Key news from the crypto native space this week.

Hitting the headlines this week, was news that Coinbase had launched a new crypto lending service in the U.S. for institutional clients. The new platform was quietly revealed in a U.S. Securities and Exchange Commission filing on 1 September, which showed $57 million had already been raised for the program. The new service differs from the controversial Lend program that Coinbase cancelled in 2021. That was pitched at retail customers, and SEC officials objected. This latest lending service is instead geared toward institutions, which means regulation is less onerous – on the presumption large investors have the sophistication to handle it. Read full details of the filing HERE.

This week, Crypto payments firm Ripple continues announced a deal to purchase Fortress Trust, a blockchain infrastructure firm. The deal expands Ripple’s collection of regulatory licenses. Through technology and licensing, Fortress Trust — a subsidiary of Fortress Blockchain Technologies that holds a Nevada Trust License — offers infrastructure services to enterprise crypto clients. Ripple CEO Brad Garlinghouse said in a statement, “As an early investor in Fortress Blockchain Technologies, we’ve had a chance to get to know the team, its vision and technology. Since their launch in 2021, they’ve built an impressive business with recurring revenue and a strong roster of both crypto-native and new-to-crypto customers”

Staying with Ripple, there’s been some to-ing and fro-ing in the press between the SEC and Ripple in recent weeks. On Friday the SEC pushed against Ripple Labs' efforts to block its appeal of a judge's ruling that largely favoured Ripple. In the new court filing, the SEC argued that the summary judgment by U.S. District Judge Analisa Torres in July raised "precisely the kinds of 'knotty legal problems'" that warrant interlocutory—or provisional—review by a federal appeals court under a law that allowed certain rulings to be appealed before a case concludes.

Institutional Corner

Top stories from the big institutions

The Financial Accounting Standards Board (FASB) in the US unanimously voted to release a new set of crypto accounting rules, which are expected to be published by the end of the year. Companies that hold or invest in cryptocurrency will be required to report their holdings at fair value, a measurement that aims to capture the most up-to-date value of an asset—including rebounds in value after prices dip. The new standard may inject some volatility into the earnings of companies that are heavily invested in crypto. Companies and accountants have told the FASB that the ability to record recoveries will be an improvement over the current practices. Jeff Rundlet, head of accounting strategy at accounting software company Crypto. “It’s a great step forward for the entire crypto market. I think it’s a great step toward mainstream adoption,” “I can see finalizing this proposal to help large corporations that are maybe scared to hold crypto on their balance sheet because they’re scared of the technical complexities.” See the FASB details HERE.

The International Monetary Fund (IMF) and the Financial Stability Board (FSB) published a joint policy roadmap. The policy paper was commissioned by the G20 under India’s leadership and combining the standards set by the FSB, IMF and other international standard setters. The report suggests that “comprehensive regulatory and supervisory oversight of crypto-assets should be a baseline to address macroeconomic and financial stability risks.” The report also suggests that “strengthen monetary policy frameworks, guard against excessive capital flow volatility and adopt unambiguous tax treatment of crypto.” The report also reiterates the IMF stance that a crypto blanket ban will not help in mitigating the associated risks. Read the full release from the IMF/FSB HERE.

The FCA has extended the deadline for some of the new market regulations to take effect, moving them from October to 8 Jan start. New UK regulations are set to kick in next month and will require crypto firms to make their marketing clear, fair and prominently labelled with risk warnings. They will also prohibit incentive schemes such as ‘refer a friend’ bonuses. However, some of the more technically demanding features have had their deadline extended, features such as a cooling-off period. Such a period might allow consumers a certain timeframe to reconsider their investment decisions without penalties. A statement said “As a proportionate regulator, we’re giving firms that apply a little more time to get the other reforms requiring technology and business change right. We’ll maintain our close eye on firms during this extended implementation period.” Read full details HERE.

Chart of the Week

Because charts are just as important as macro.

US banks have lost deposits for 5 quarters in a row.

Hat tip to Jack Farley for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Crypto Operations Analyst at Hivemind

Listing Business Development Manager at Binance

UK Crypto MLRO Manager at PayPal

Senior Software Engineer at Copper

Platform Team Leader at ClearBank

Financial Risk Analyst at Ripple

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.