Macro is back! Well Dave is back from his holiday and the macro section returns.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Jackson Hole passes and we remain in ‘macro purgatory’. The global slowdown is underway, but markets are yet to feel the full effects of the aggressive rate hikes. Wake me up, when September Ends !

Crypto Native News: Komainu receives its Dubai license, Coinbase take a minority stake in Circle and Tether releases its reserves report.

Institutional News: The RBA completes its CBDC pilot, JP Morgan releases its analysis on CME bitcoin futures.

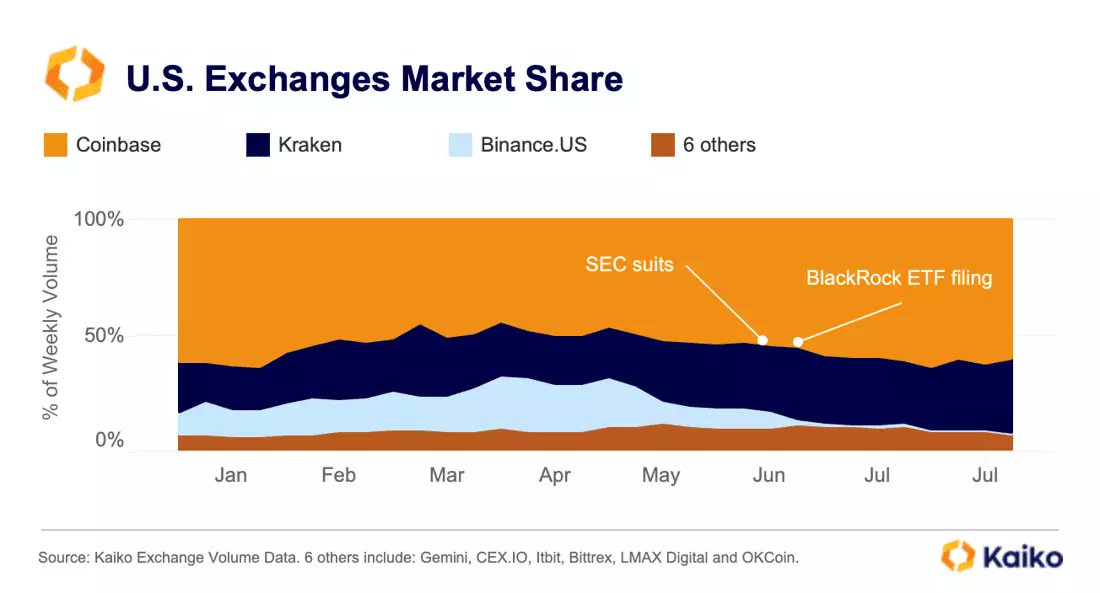

Chart of the Week: What exchanges have benefitted from the reduction in BinanceUS market share ?

Top Jobs in Crypto: Featuring Bitget, Hivemind, the FCA, Ripple, Aave, CryptoRecruit and Binance

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

Wake Me Up, When September Ends

The Macro headwinds continue to blow hard as yields and the dollar continue the recent push higher amidst still resilient US data and global bond market volatility. The global nature of the bond sell off looks somewhat curious given the signs outside of the US of a significant slowdown, particularly in Europe as well as Asia.

Clearly, the recent Bank of Japan tweak to Yield Curve Control and China’s efforts to support a weakening currency (and so selling FX reserves) are key drivers of the move higher in yields, rather than this being a return to a global “reflationary” environment.

Case in point, PMI’s in Europe last week continue to paint a picture of contraction, with the services PMI catching “down” to manufacturing, now printing sub 50 and the composite PMI falling to a 33 month low of 47.0 from 48.6 in July. In the UK, business activity recorded its weakest month in August since Jan 2021 as the composite PMI also fell into contraction territory at 47.9 down from 50.8.

Even in the US, PMI’s came in soft, with service sector activity falling to 51 from 52.3 and the composite at 50.4 just avoiding a dip into the contraction zone. Weak earnings from US retailers meanwhile suggest the resilient consumer is starting to roll over. Further downgrades for US banks point to increasingly tight credit going forward.

This is not a global economy that’s re-accelerating. China continues to weigh heavy as it battles deflation, slowing growth and debt-laden property sector that is imploding and is emitting a disinflationary pulse across the world.

Whilst we respect then, the negative macro drivers that continue to weigh on crypto, we also remain of the view that this is unsustainable and continue to look for US yields to correct lower as the global rate hike cycle nears its end.

Speaking of which, the big focus last week was JPow’s speech at Jackson Hole, with markets looking for new clues on the direction of policy. In the event, we learnt little new, with a somewhat balanced view on the risks to growth and inflation but with a commitment to continue to do more, should the data so require, to return inflation back to 2%. Little to dissuade from the view that the Fed will pause in Sep. Data will dictate if another hike comes in Nov.

We continue then to be in this “macro purgatory” - unable to fully embrace a Fed pause until the “long and variable lags” of previous hikes show more forcefully in the data so that the Fed can officially pivot towards a more dovish outlook. In Powell’s words, “we are navigating by the stars under cloudy skies” - translated: “We don’t know what we’re doing from here”

Expect crypto to continue to trade in narrow ranges until we gain more clarity on the macro path forward. Signs that yields may have topped out should release recent pressure, but it’s difficult to see a macro spark short term to propel us into a higher range.

Yet with the global slowdown underway, more liquidity likely to be injected from China and economies yet to fully feel the effects from an aggressive rate hike cycle, we expect fireworks in Q4 and crypto to make new highs. Wake me up, when September ends.

Native News

Key news from the crypto native space this week.

Digital Asset custodian, Komainu announced this week that it had received approval from Dubai’s Virtual Asset Regulatory Authority (VARA) to provide its custody services to clients in Dubai. Komainu is among the first to receive a full Virtual Asset Service Provider (VASP) in Dubai and its Head of Strategy Sebastian Widmann said “VARA has created a robust regulatory framework allowing firms like ourselves to innovate, whilst operating safely and exploring the future potential of digital assets, which includes tokenization and DeFi services”. VARA has a four-stage licensing process: a provisional permit, preparatory and operating minimal viable product (MVP) licenses and a so-called full market product (FMP) license. Reaching this final step in VARA’s licensing process allows the company to provide institutional staking and collateral management in the region via its Komainu Connect platform.

Coinbase announced this week that it was acquiring a minority stake in Circle Internet Financial. As part of the move the companies also announced that they are dissolving their Centre Consortium partnership that had issued USD Coin (USDC), the world’s second-largest stablecoin. Circle will now bring issuance and governance of USDC fully in-house. Six more blockchains will gain native support for USDC, which is pegged to $1, bringing the total number of supported blockchains to 15.

Tether released a reserves report on Thursday showing that the stablecoin issuer maintains a liquidity cushion of nearly $3.3 billion to provide stability to the Tether ecosystem. the capital cushion is spread over 15 blockchains. The Solana ecosystem leads in terms of the value pre-authorized for issuance, currently standing at $1.57 billion, with Ethereum and Tron taking up the next two slots with pre-authorization of $617 million and $353 million, respectively. The total assets under Tether stand at $86.1 billion, with total liabilities amounting to $82.8 billion — thus confirming a reserve backing of over 100%.

Institutional Corner

Top stories from the big institutions

The RBA, Australia’s central bank, completed its pilot of a central bank digital currency this week, highlighting 4 main areas where it will be useful. The RBA and the Digital Finance Cooperative Research Centre unveiled their findings in a 44-page report on Wednesday. The pilot program revealed four primary areas that could be improved by a CBDC, including the enablement of “smarter" payments where a tokenized CBDC enabled a range of complex payment arrangements that were not currently supported by existing payment systems. The report also detailed that a CBDC may support financial innovation in areas such as debt securities markets, could promote innovation in emerging private digital money sectors and enhance resilience and inclusion within the wider digital economy. Read the full report HERE.

The biggest investment banks continue to jump on the crypto research bandwagon. In their report this week, JP Morgan provided analysis of CME bitcoin futures markets. They suggest that the unwinding of long positions appears to be nearing its completion stage rather than being in its initial stages. "As a result, we see limited downside for crypto markets over the near term”. Crypto markets have fallen as the recent positive news has faded, with the SEC delaying its decision on spot bitcoin ETF approvals, the agency being confident in appealing the XRP ruling, and Congress debating stringent regulations on stablecoins. The report added "The fading of the above previously positive news has induced a wave of long position liquidations in recent weeks that are still reverberating," but "unwinding of long positions appears to be at its end phase rather than its beginning."

Chart of the Week

Because charts are just as important as macro.

Coinbase and Kraken have captured nearly all of the market share that BinanceUS has lost in the past three months.

Hat tip to Kaiko Data for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Crypto Operations Analyst at Hivemind

Lead Economist - Markets (Crypto) at the FCA

Lead Product Manager - Payments Platform at Ripple

Senior Payroll and Benefits Specialist at Aave

Algo Trader at Crypto Trading firm via CryptoRecruit

Social Media Manager, Product Marketing at Binance

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.