Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Fed likely done with hikes, China continues to shore up the economy which is keeping a lid on US yields and the macro dynamic looks more constructive for September.

Crypto Native News: Binance announced an end to BUSD stablecoin, SEBA Bank receives an approval-in-principle from Hong Kong’s securities regulator and X (Twitter) receives another currency license.

Institutional News: UK Travel Rule live from 1 September, SWIFT releases results of its blockchain experiments, Spot bitcoin ETF applications delayed.

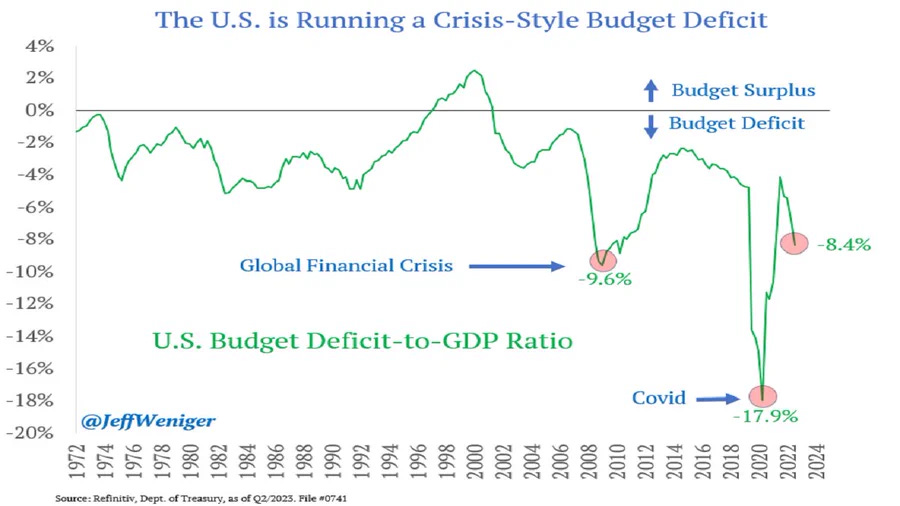

Chart of the Week: US still running deficit.

Top Jobs in Crypto: Featuring Galaxy, MANA Group, Quiver Trade, Coinbase Modulr, Fireblocks and ClearPay.

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

Slowly, then Suddenly

A big week of macro data continued to reinforce our assertion of a Fed that is now likely done with additional hikes, even if they’ll want to maintain optionality and frustrate a market looking to embrace a pause.

Indeed the Fed’s Bostic on Thursday told a conference that he thought rates were now “appropriately restrictive” and markets are now pricing circa 60% probability of “on hold” for the rest of the year, up from below 50% the previous week.

On the data front, early good news came from downward revisions to Q2 PCE inflation data, with QoQ prices revised a tick lower to 2.5% (and down from 4.1% prior quarter.) Core similarly revised lower to 3.7% whilst GDP came in at 2% Vs the 2.2% prior estimate.

JOLTS data pointed to signs of a cooling labor market, with a sharp fall in job openings from 9.17mio to 8.83mio, the lowest level since March 2021. Job quits, deemed a more reliable measure of labor market strength, also fell sharply from 3.8mio to 3.5mio.

Of course the headline act came on Friday with non-farm payrolls. Headline jobs came in at a stronger 187k (170k expected) although was off-set by a combined 110k downward revision to the prior two releases. The unemployment rate also jumped from 3.5% to 3.8%, its highest level since Feb 2022 and average hourly earnings continued to soften at 4.3%, down from 4.4%.

When the labor market cracks, the Fed will stop hiking. Those cracks are starting to appear, even if overall there is little for the Fed to be unduly concerned about. Slowly, then suddenly!

Meanwhile, China continues to issue measures to stimulate the economy and shore up the housing market, reducing minimum down payments for home buyers and encouraging lenders to lower rates on existing mortgages. Cuts to the foreign exchange reserve requirement ratio from 6% to 4% were also designed to bring currency stability, alongside lower daily fixings. A 50% cut to stamp duty on stock trading also designed to support the stock market and reverse those capital outflows.

These measures are important as it relates to keeping a lid on US treasury yields which have, in part, been under pressure as China is forced to sell US reserve assets to support the currency.

China currency stability is important then to help contain US yields and the dollar, easing the negative crypto headwinds from that toxic dynamic. Yields have backed off from the highs over the past week and the MOVE index (a measure of bond market volatility) has fallen to the lowest levels since Feb, which bodes well for liquidity and risk and therefore crypto.

The macro dynamic into September looks more supportive for Crypto, yet still remains in a range bound market until US yields can gather greater downside momentum and liquidity can turn higher. Alongside the positive news on the BTC ETF with the Grayscale victory over the SEC, we’re building nicely for a Q4 rally. Let’s go!

Native News

Key news from the crypto native space this week.

Binance announced this week that it will gradually end support for its BUSD stablecoin and will remove it from spot and margin trading pairs. In an announcement this Thursday, users were asked to convert their BUSD into other assets by February next year. In the shorter term, Binance is delisting BUSD as a loanable asset from 6 September and will cease withdrawals of BUSD tokens via BNB Chain, Alalanche, Polygon and Tron from 7 September.

This week, SEBA Bank, a Switzerland-based cryptocurrency bank, received an approval-in-principle from Hong Kong’s securities regulator, as the crypto-native bank continues to expand its presence in Asia. SEBA said that it has obtained the AIP for its license application that would allow it to deal in securities, including crypto-related products such as over-the-counter derivatives and structured products. The crypto bank will also be able to advise on securities and virtual assets, and offer asset management for discretionary accounts in both traditional securities and virtual assets. Amy Yu, SEBA’s CEO said “We see no issues in obtaining [a full official approval] by the end of this year,” “By the time I started, it was very clear that Hong Kong regulators were super gung-ho. They want to make a big push, facilitate as much as they could, and welcome these businesses back into the jurisdiction.”

This week, X (formerly Twitter), received a Currency Transmitter license in Rhode Island, which will allow it to store, transfer, and exchange Bitcoin and other digital assets on behalf of its users. The currency transmitter license is required for companies who want to perform these activities related to Bitcoin and crypto on behalf of its users. Twitter Payments, X’s payments arm now has 7 payment licenses across US jurisdictions. See the list of X’s licenses HERE.

Institutional Corner

Top stories from the big institutions

As of 1 September, the on year grace period for the UK’s travel rule came to an end. Cryptoasset businesses in the UK will now have to collect, verify and share information on all transfers over EUR 1,000 involving a crypto asset service provider (CASP) and take a risk based approach to transfers involving self hosted wallets. The travel rule is aimed at stopping money laundering and terrorist financing activities carried out on chain. Read full details on the travel rule from the FCA HERE.

SWIFT, the global financial messaging network that carries over 5bn messages annually, released a report titled “Successful blockchain experiments unlock the potential of tokenisation”. Part of the experiment focused on creating a single access point to enable interoperability within multiple DLT and non-DLT networks. Investors and institutions noted one key challenge of managing tokenised assets on different blockchains, each with its own functionality and liquidity profile. The results of the study showed that its infrastructure can seamlessly facilitate the transfer of tokenised value across multiple public and private blockchains. The findings can potentially remove significant friction slowing the growth of tokenised asset markets and enabling them to scale globally as they mature. Some of the institutional participants that took part included ANZ, BNP, BNY Mellon, Citibank, Clearstream, Euroclear, Lloyds and SDX. Read the full release from SWIFT HERE.

Lots of headlines regarding the spot bitcoin ETF applications this week. As you’re probably aware, the SEC has delayed a decision on the 7 large applications for 45 days. So mid October is the earliest we may see an approval. As a reminder, here’s a short summary of the big 7 bitcoin ETF applications:

Blackrock - filed on 15 June this year, Blackrock is the worlds largest asset manager with approx $9tn of assets under management. Their filing proposed Coinbase as the crypto custodian and spot market data provider, with BNY Mellon as cash custodian.

WisdomTree - already have experience running an ETP on the Switzerland stock exchange. The company filed back in March 2021 and has seen multiple delays. WisdomTree filed a new application days after Blockrocks this year.

Invesco Galaxy - A joint bitcoin ETF filed by Galaxy Digital and Invesco in September 2021. Invesco Capital Management LLC is the sponsor of the filing, but at present, it is unknown which firm will custody the Bitcoin for the filing.

Valkyre Investments - The ETF would refer to the Chicago Mercantile Exchange's reference price for Bitcoin and trade on NYSE Arca, "providing investors with an efficient means to implement various investment strategies," the firm wrote in its proposal. Crypto custodian Xapo would secure the fund's Bitcoin, holding it in cold storage. In June 2023, Valkyrie filed another Bitcoin spot ETF application with the SEC. A month later, it updated its filing, listing Coinbase as its surveillance-sharing partner.

Ark Invest - The investment firm led by Cathie Wood, filed its application for the Ark21Shares ETF in June 2021. ARK Invest has partnered with Swiss-based ETF provider 21Shares AG to offer the ARK 21Shares Bitcoin ETF.

VanEck - VanEck is one of the earliest Bitcoin ETF applicants. Its first attempt at a Bitcoin ETF—the VanEck SolidX Bitcoin Trust, in partnership with SolidX—came all the way back in 2018. Again, VanEck have filed numberous times with the latest on 22 June 2023 for approval to launch the VanEck Bitcoin Trust on the Cboe BZX exchange.

Fidelity/Wise Origin - Once again, this combo has seen numerous filings with the latest coming at the end of June 2023. Fidelity named Coinbase as the market for its surveillance-sharing arrangement. It was added to the SEC's official calendar on the same day as BlackRock's application.

Chart of the Week

Because charts are just as important as macro.

US running large deficit, despite high employment and relatively decent growth.

Hat tip to Jeff Weniger for the chart

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

European Product Specialist at Galaxy

Business Development Director at MANA Group

Crypto Ad Manager at Quiver Trade

Senior Risk Solutions Structurer at Coinbase

Sales Development Representative at Modulr

Network Business Lead at Fireblocks

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.