One half of London Crypto Club was at European Blockchain Conference (EBC) in Barcelona last week. Once again it was another great event with a good breath of attendees. A couple of key takeaways were the ongoing adoption of Blockchain Technology and investment continuing to pour into the crypto/blockchain space.

Onto the newsletter, here’s what you’re getting today…

Macro: US rates continue to reprice, PBoC record liquidity injection.

Crypto Native: Laser Digital’s latest investment, BUSD and salaries being paid in crypto.

Institutional News: ECB Digital Survey, FCA unregistered Crypto firms and CBDC from Japan.

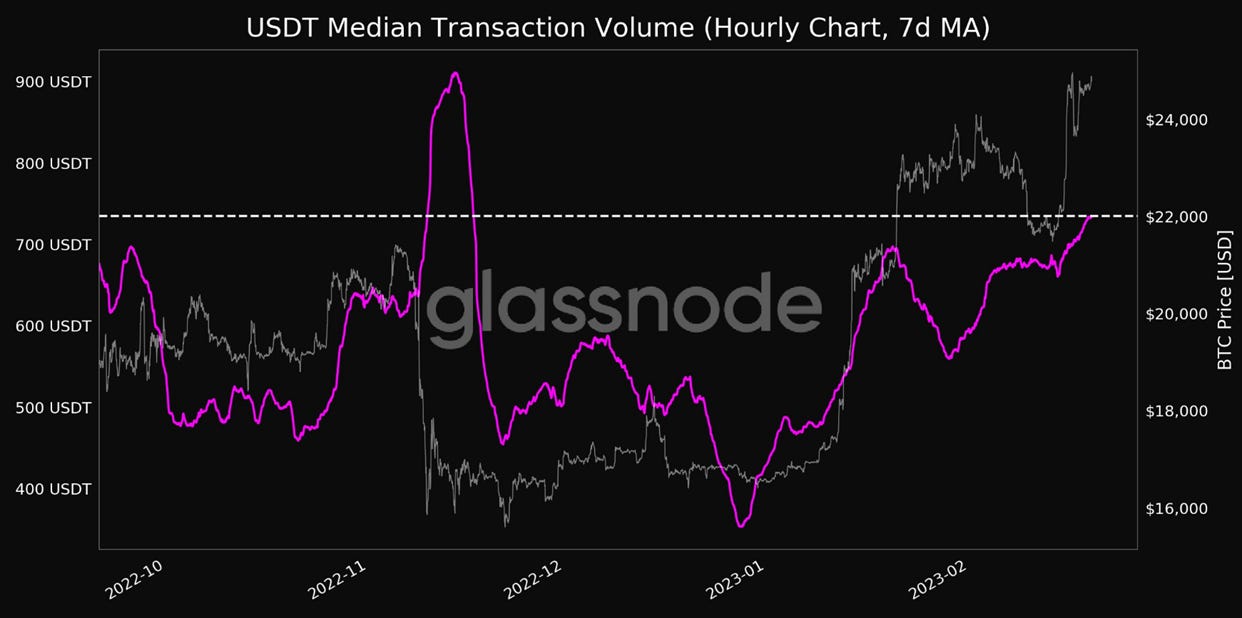

Chart of the Week: USD Tether Volumes

Top jobs in Crypto: Featuring Copper, Binance, FCA, Wintermute and Hudson River Trading.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

US inflation data dominated the macro last week and continued to support the peak inflation view, with the headline rate coming in at 6.4%, down from 6.5% the month prior. Core inflation meanwhile at 5.6% is at its lowest levels since Dec 2021.

The numbers however came in hotter than expected and on a monthly basis were up 0.5% Vs 0.1% in December, but with most of the increase coming from the lagging housing sector. Core services, ex-shelter (which JPow has said he’s focused on) came in at 0.27% MoM, the lowest level since October 2022.

Overall, little to really alter the view at the Fed that “the disinflationary process has begun,” however progress remains slow. Fed speak this past week also continued with the hawkish tone, emphasizing a willingness to do more should inflation remain above target.

Markets consequently continued to re-price rates, with a terminal rate now priced around 5.3% which suggests potential for 3 more 25bp rate hikes. All things equal, this should be hitting risk hard, yet a powerful off-set has been continued improvement in market liquidity emphasised on Friday by the PBOC injecting a RECORD net 632bn Yuan via its 7 day reverse repo. PBOC and BoJ balance sheet expansion continues to outpace the contraction by the Fed and ECB. It's all about rates and liquidity. Liquidity is dominating right now!

Native News

Key news from the crypto native space this week.

Laser Digital, the crypto subsidiary of Japanese bank Nomura, this week announced a strategic investment in decentralised protocol (DeFi protocol Infinity. Infinity is an institutional focused lending and borrowing platform founded by Kevin Lepsoe, a former head of structuring at Morgan Stanley. Details in the press release say that Infinity will use the investment to accelerate the development if critical infrastructure targeted for “Institutional Defi”, also known as Hybrid Finance. Hybrid Finance brings the benefit of blockchain technology to the space with an interoperable protocol for benchmarks rates, credit, and counterparty management.

On Monday the New York Department of Financial Services said it ordered the firm behind Binance USD, Paxos Trust Company, to stop minting the tokens. Paxos said it was also told by the U.S. Securities and Exchange Commission that the firm should have registered the stablecoin product as a security. Following Mondays announcement, this week there were approximately $2.5bn in outflows from Binance Stablecoin, BUSD. This saw BUSD market cap fall from $16.1bn to $13.7bn. Much of this flowed into USD Tether who’s market cap grew $2.37bn this week from $67.8bn to $70.1bn. (See chart of the week for more).

Deel Labs, the global HR platform, released their latest report “The State of Global Hiring”. There were some interesting crypto topics. The global workforce has lost some interest in receiving payment in cryptocurrency. The percentage of overall payroll withdrawals in crypto were at 4% in December 2022, down from 5% in the first half of the year. However, in Latin America (Latam) the number of remote workers choosing to get paid in crypto rose from 61% to 64%.

Institutional Corner

Top stories from the big institutions.

On Wednesday the ECB released a survey titled “Take aways from the horizontal assessment of the survey on digital transformation.” Some of the high level takeaways from the survey include: (distributed-ledger technology) based solutions are currently barely used across banks (less than 20%). In terms of crypto-related activities and exposures, this is still insignificant. To implement their digital transformation strategy, banks prefer to cooperate with external partners, mostly by buying in services (software as a service – SaaS) and using consultants. On average, banks invested 2.8% of their operating income and 5.2% of their workforce in digital transformation projects in 2021. Read the full report here: Take-aways from the horizontal assessment of the survey on digital transformation and the use of fintech (europa.eu)

Supervisors from the European Central Bank (ECB) said on Wednesday that banks in the European Union should start applying caps on bitcoin holdings ahead of global norms set by the Basel Committee on Banking Supervision (BCBS) taking effect. A letter from the ECB on the subject said “The BCBS standard is not yet legally binding pending its transposition in the European Union,” “However, should banks wish to engage in this market, they are expected to comply with the standard and take it into account in their business and capital planning.”

With the SEC whipping up a storm over the past week, now seems a good time to think about what might come next ! The Financial Conduct Authority (FCA) has 51 unregistered crypto companies serving clients in the UK, which it has flagged but has not yet taken action against . Most of these companies have been on this list since 2021. If crypto firms want to operate in the UK, they are (in theory) obligated to register with the FCA and comply with its anti-money laundering rules. Heres where you can read more detail about unregistered Crypto business in the UK Unregistered Cryptoasset Businesses (fca.org.uk)

Another week, and another central bank taking about a central bank digital currency (CBDC). The Bank of Japan this week said it plans to begin its CBDC pilot in April 2023. The pilot test will continue to work on the technical feasibility of the “digital yen” and extend the experiment to modelling a CBDC ecosystem.

Chart of the Week

Because charts are just as important as macro.

There’s been lots of focus on stablecoins over the last few weeks. Our chart of the week (from Glassnode) shows that USDT median transaction volume reached a 3 month high this week.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Risk Product Manager at Copper

Senior Manager, Media and Issues Management at Binance

Graduate Algo Trader at Wintermute

Crypto Trading Support Engineer at Hudson River Trading

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.