Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Coinbase in talks to buy Deribit, Tether to be audited by one of the “Big 4”, Fidelity to filed for a Solana ETF and a blockchain-based version of its U.S. dollar money market fund.

Institutional Corner: The IMF updates its balance of payments standards to reflect digital assets, Pakistan aiming to attract bitcoin mining operators to absorb surplus electricity, the German regulator prohibits the sales of Ethena’s USDe.

Charts of the Week: Comparison of bitcoin bear markets, US-listed Bitcoin miners control 30% of network Hashrate, Correlation of crypto to US stocks has reduced since the US elections, Tether was the 7th largest buyer of US treasuries in 2024.

Top Jobs in Crypto: Featuring Moneturn, OKX, Kucoin Exchange, Blockchain.com, Coinbase and Binance.

Macro Update

This is where we connect the dots between macro and crypto.

The Green Shoots of Spring

US equities broadly snapped multi week declines to close the week higher, continuing the positive momentum provided by the softer inflation data and helped by a more cautious sounding Fed.

The Fed held rates steady at 4.25%-4.5% as expected and their updated forecasts perhaps captured the “stagflationary” dynamic which has weighed heavily on risk, with inflation forecasts for 2025 revised higher (2.5% raised to 2.8% on core) growth forecasts revised lower (2.1% lowered to 1.7%) and unemployment forecasts higher (from 4.3% to 4.4%). The median of the “dot plot” remained at 50bps of cuts for 2025, despite a slightly more hawkish shift in the dots.

However, giving the overall meeting a notably dovish tone, the Fed dropped the characterisation of the risks to growth and inflation as being “balanced” noting recession risks had risen and sounded rather sanguine on inflation, suggesting inflation coming from tariffs would be “transitory” and that longer term inflation expectations remain anchored, consistent with the Fed’s 2% target.

As we’ve noted previously, the reason “stagflation” fears are so negative for risk is based on the concerns that the Fed will be unable to respond to a slowdown due to the inflation constraint. This sounded like a Fed willing to, once again, look through short term boosts to inflation emanating from tariffs, with a preparedness to cut should the downside risks to growth and employment materialise. In our view, this was a successful, mini pivot away from the blind hawkishness displayed in December when the economy was riding the pre-election spending sugar high.

Preparing the path for debt refinancing…

Additionally supportive for markets, the Fed slowed the pace of Quantitative Tightening (QT), slowing the treasury run off from $25bn a month to $5bn a month. This was signalled in the minutes from the previous meeting, with concerns that the debt ceiling impasse was creating uncertainties surrounding liquidity and reserve levels in the banking system.

This in effect is an additional $20bn per month liquidity boost to markets and largely drove the bullish response across assets. We further think that as the debt ceiling gets lifted (when not if) and the the Treasury issues a wave of new bonds to rebuild their cash buffers held at the Fed (the TGA) then the Fed will ultimately be required to perform some kind of monetary operation to support the front end of the treasury market (recall, the increased issuance over the past year or so has been funded by the RRP drawing down from near $2trn.)

JPow last month already floated the idea to congress about the Fed easing the supplementary leverage ratio (SLR) reducing the capital requirements for holding Treasuries in order to free up bank balance sheets to buy more of them.

The steps are being put in place then to provide the liquidity required to fund the huge $7trn debt refinancing which the treasury is rolling over this year. The difficulty of course is navigating the path towards this liquidity support and whether Powell and the Fed can act proactively to get ahead of the funding issues that will occur without timely liquidity support. If they can be sufficiently proactive, then we believe markets have bottomed already and will perform strongly for the rest of 2025.

If however the Fed is slow to respond, then we envision a sharp funding and liquidity crisis which likely occurs when the debt ceiling lifts and the TGA gets rebuilt. This has the potential to drive another deep drawdown in both crypto and equities. Either way, the liquidity support will arrive and we remain of the view that both equities and Bitcoin finish the year substantially higher.

The fact remains, that the US and other high debt, fiat economies, are unable to survive without ever increasing liquidity support a.k.a money printing, which debases the value of fiat currency in perpetuity and drives hard assets ever higher. Nothing stops this train, even the efforts of DOGE which are barely going to make a dent on a spiralling deficit, which now sits at $36.6trn.

The Green Shoots of Spring…

Signs then that markets have put in a low, with the momentum unwind and broad de-risking having run its course. Caution however into this week as we approach Quarter end, where we expect liquidity to tighten as the RRP builds with banks “window dressing” balance sheets. The TGA continues to draw down however, with the debt ceiling imposition, and can provide an off-set to the RRP build. With US equities down on the quarter too, the “rebalancing” flows for funds (that need to maintain pre-defined weights of equities against other assets in their mandated portfolios) will lend to more positive flows into equities.

Brace then for a choppy week where positioning and flows into quarter end dominate, but with the US administration appearing to have “front loaded” a lot of the bad news, we suspect a relative softening going into Q2. Liquidity continues to move higher, with the slowing of QT adding to the positive pulse. The easing of financial conditions resulting from a weaker dollar and lower yields will also start to feed through positively for risk. This week was perhaps giving signs of the green shoots of spring…

Native News

Key news from the crypto native space this week.

According to a report from Bloomberg, Coinbase is in advances talks to buy the largest crypto options exchange, Deribit. The report says the two companies have already contacted regulators in Dubai, where Deribit holds a license. The license would be handed over to Coinbase if the deal goes through. Bloomberg suggested at the start of the year that Deribit’s valuation sits somewhere between $4 billion and $5 billion. Total volume on Deribit nearly doubled last year. It hit $1.2 trillion, according to Deribit. The company also reported that total options notional volume jumped 99% to $743 billion in 2024.

The CEO of Tether, the world's largest stablecoin issuer, reportedly called a full audit by a "Big Four" accounting firm a "top priority" for the company. Paolo Ardoino, who became Tether's CEO in December, 2023, told Reuters that the company is engaging with one of the four leading professional services firms — Deloitte, EY (Ernst & Young), PwC (PricewaterhouseCoopers), and KPMG — in order to conduct a full audit of the company's finances, which he called a "top priority." Tether did not disclose which of the four firms it is currently engaging with. The comments come shortly after Tether appointed Simon McWilliams as its new CFO, setting its sights on a full financial audit of the company. CEO Ardoino said "With his leadership, we are moving decisively toward a full audit, reinforcing our role in supporting U.S. financial strength and expanding institutional engagement.”

CSC Delaware Trust Company, a subsidiary of business formation specialist CSC, registered a new entity named "Fidelity Solana Fund," according to a filing published Thursday. The registration is a possible first step towards a proposal of a Solana exchange-traded product by Fidelity, which also manages the world's second-largest spot Bitcoin ETF, the Fidelity Wise Origin Bitcoin Fund (FBTC). FBTC boasts about $16.5 billion in assets under management (AUM), second only to BlackRock's iShares Bitcoin Trust with its $48 billion in AUM. A Fidelity spokesperson confirmed the veracity of the filing, but declined to give additional details on whether or not the trust is the first step towards an ETF proposal. A number of other asset managers have filed proposals for Solana ETFs, but the SEC applications submitted by VanEck, 21Shares, Bitwise and Canary Capital were rejected.

Also this week, Fidelity Investments has filed to register a blockchain-based version of its U.S. dollar money market fund. According to a Friday filing to the U.S. Securities and Exchange Commission, the company seeks to register an "OnChain" share class of its Fidelity Treasury Digital Fund (FYHXX) and use blockchains as transfer agent. FYHXX holds cash and U.S. Treasury securities and was launched late last year. The filing said that the OnChain class of the fund currently uses the Ethereum network, and the firm may expand to other blockchains in the future. The registration is subject to regulatory approval, with the product expected to become effective on May 30. Read the full filing HERE.

Institutional Corner

Top stories from the big institutions

The International Monetary Fund (IMF) has overhauled its balance of payments standards to reflect the growing impact of digital assets. According to the newly released Balance of Payments Manual, Seventh Edition (BPM7), cryptocurrencies like Bitcoin are now classified as non-produced non-financial assets, while certain tokens are treated akin to equity holdings. The updated manual, published on Thursday, marks the first time the IMF has integrated detailed guidance for digital assets into its global statistical standards. The framework divides digital assets into fungible and nonfungible tokens, with further distinctions based on whether they have a corresponding liability. Bitcoin and similar tokens without liabilities are categorised as capital assets, while stablecoins, which are backed by liabilities, are treated as financial instruments. A statement from the IMF said “Crypto assets without a counterpart liability designed to act as a medium of exchange (e.g., Bitcoin) are treated as non-produced nonfinancial assets and recorded separately in the capital account.” In practice, this means cross-border crypto flows involving assets like Bitcoin will be recorded in capital accounts as acquisitions or disposals of non-produced assets. Meanwhile, tokens with a protocol or platform — such as Ethereum or Solana (SOL) — may be classified as equity-like holdings under the financial account if their owner resides in a different country from the originator.

The government of Pakistan is reportedly exploring the possibility of attracting bitcoin mining operators to absorb surplus electricity and reduce the financial burden of capacity payments in the power sector. According to a report from the Pakistani media Dawn on Saturday, the Ministry of Energy’s power division has begun consultations with stakeholders to design a special electricity tariff for emerging sectors, including cryptocurrency mining. The aim is to attract investment without resorting to government subsidies. The report cited industry data suggesting that Bitcoin mining operators spend 60-70% of their mining revenue on electricity. In Pakistan, discussions around crypto mining have reportedly gained momentum following a recent meeting between Power Minister Awais Leghari and Bilal Bin Saqib, CEO of the newly formed Pakistan Crypto Council (PCC). They explored how the country’s excess electricity could be leveraged to attract global bitcoin miners. The conversation continued during the PCC’s first official meeting on Friday, chaired by Finance Minister Muhammad Aurangzeb and attended by senior officials including the State Bank Governor Jameel Ahmad and the heads of the Securities and Exchange Commission and other relevant ministries.

BaFin, the German financial regulatory authority, has prohibited all public sales of Ethena GmbH’s USDe — a synthetic dollar — claiming the token violates the European Union’s MiCAR regulations and accused the firm of selling unregistered securities in the region. BaFin told Ethena to freeze the reserve assets that back the token, close down the website portal, and ordered the firm to stop taking new customers, the regulator wrote in an announcement. BaFin also appointed a representative to monitor the ongoing situation with Ethena. In a translated statement, BaFin said: “The BaFin also has reasonable grounds to suspect that Ethena GmbH in Germany sells securities in the form of sUSDe tokens from Ethena OpCo. Ltd. without the required prospectus. The USDe and sUSDe tokens are interconnected in such a way that investors can receive a sUSDe token in exchange for a USDe token.” Despite the ban on primary sales and issuance of the token, secondary sales of the token will not be prohibited or affected, the regulator said. In a statement on X, Ethena Labs said the backing of USDe remains unaffected, and the token can still be redeemed via Ethena BVI Limited.

Charts of the Week

Because charts are just as important as macro.

The current Bitcoin bear market, defined as a 20% or more drop from the all-time high, is relatively weak in terms of magnitude and should only last for 90 days, according to market analyst and author, Timothy Peterson. Peterson compared the current downturn to the 10 previous bear markets, which occur roughly once per year, and said that only four bear markets have been worse than the price decline in terms of duration, including 2018, 2021, 2022, and 2024. The analyst predicted that BTC will not sink deeply below the $50,000 price level due to the underlying adoption trends. However, Peterson also argued that based on momentum, it is unlikely that BTC will break below $80,000.

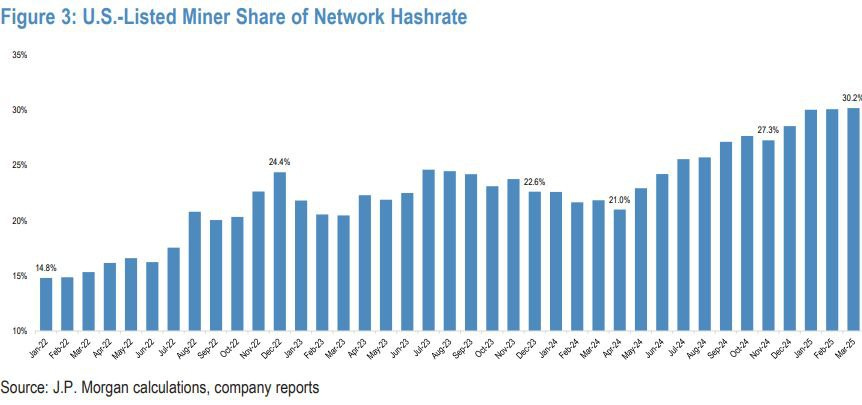

US-listed Bitcoin miners control 30% of network Hashrate, an all-time high. These 14 miners have gained 800bps of market share collectively since the Halving.

Correlation of crypto to US stocks has reduced since the US elections.

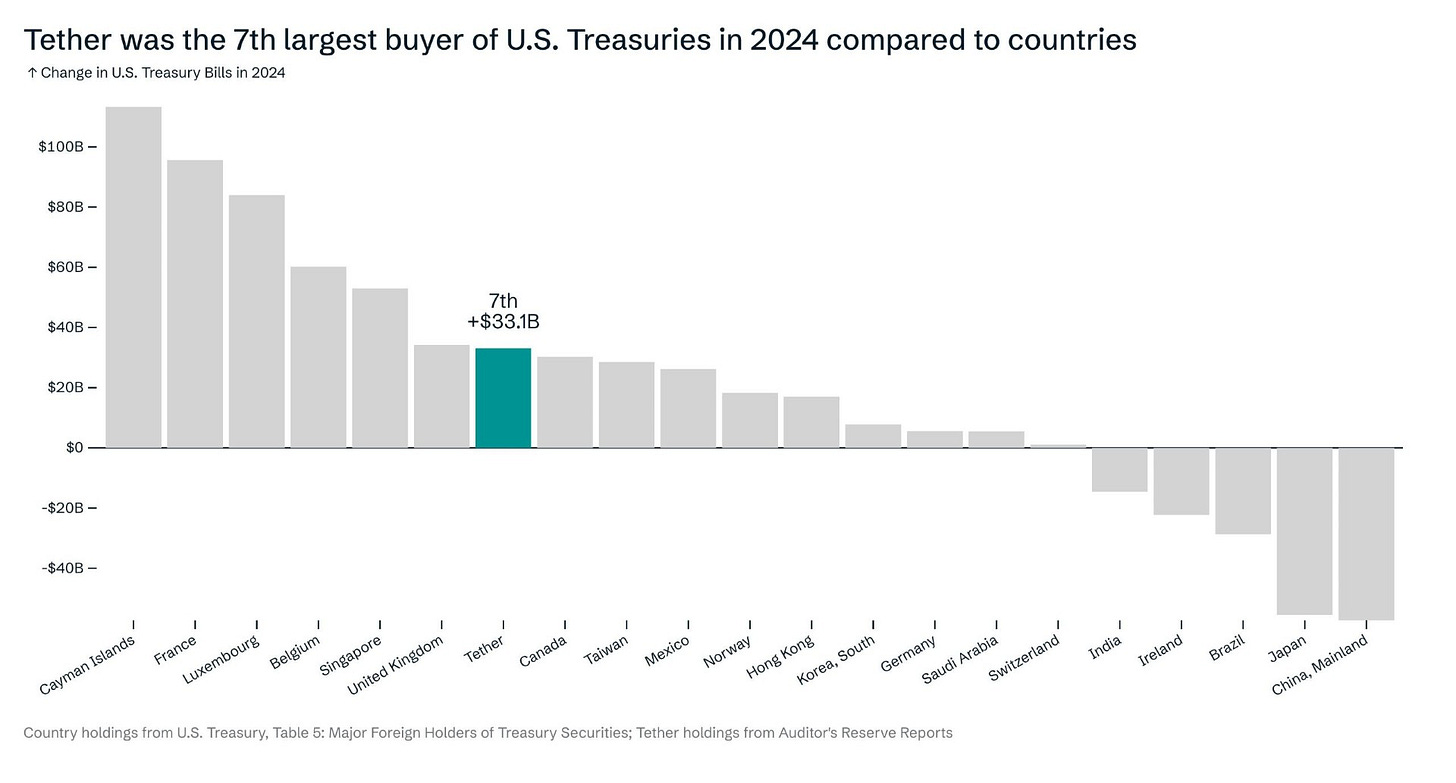

Tether was the 7th largest buyer of US treasuries in 2024, compared to countries.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Influencer Manager for Crypto at Moneturn

Affiliate Manager at Kucoin Exchange

Sales Operations Associate at Blockchain.com

Senior Manager, Fintech and International Partnerships at Coinbase

Post Listing Research and Account Manager at Binance

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.