We have our first guest writer this week! Thanks to Theo Chapman, Co-Founder of Zonaris who tells us a bit more about the current state of institutional staking.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Given the positive macro dynamics, it was disappointing that Bitcoin failed to sustain a break above 31k, especially with the Ripple victory over the SEC. However, the peak rates, peak inflation narrative is growing stronger and will continue to be an increasingly positive driving force for crypto in H2.

BONUS SECTION - The State of Staking by Theo Chapman, Co-Founder of Zonaris

Crypto Native News: XRP trading volumes rise, Zodia and Hidden Road announce partnership.

Institutional News: Europe’s first bitcoin ETF to be launched, the European Banking Authority urges business to early adopt its stablecoin principles, the implications for Blackrock’s ETF.

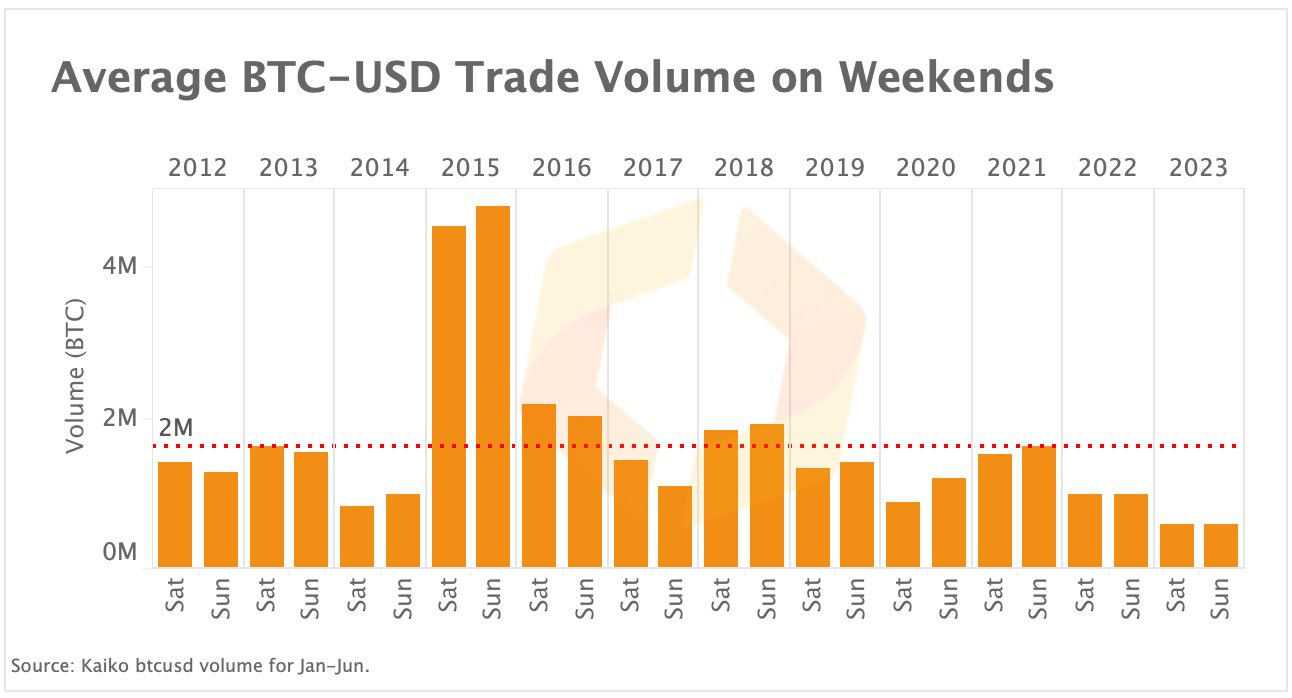

Chart of the Week: Bitcoin/USD weekend trade volumes falling.

Top Jobs in Crypto: Featuring Hivemind, Deutsche Bank, Blockchain.com, Ripple, Galaxy and the FCA.

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

The Growing Disinflationary Pulse

Sharp reversal in US yields this week as the global disinflation pulse we’ve been highlighting was in full view.

Focus was of course on the US which saw headline CPI record its 12th straight month of YoY declines at 3%. This was 9.1% a year ago! Core also fell to its lowest since Oct 2021 at 4.8%. Backing up the CPI data, PPI came in at just 0.1% YoY. Again, this was 9.8% a year ago.

The Fed remains on pace to hike this month, but it’s not clear why. Nothing in the data post the June pause suggests inflation is set to re-accelerate. Indeed, the disinflationary pulse emanating from China is growing stronger, with PPI clocking in a negative 5.4% YoY. Imports from the world’s second largest economy also declined 6.8% YoY.

2yr US yields closed the week at 4.77% having touched 5.11% just last week. 10yr yields at 3.83%. With the Fed hike cycle set to end, the dollar also continued its move lower, with the DXY breaking below the psychological 100 level.

Last week's headwinds are now flipping to tailwinds and as the pace of disinflation increases into H2, we expect those tailwinds grow stronger too.

China also continues to support global liquidity and Total Social Financing data this week clocked in at a massive 4.2trn Yuan for the month of June. Credit is starting to flow and typically correlates positively with Bitcoin.

Given the positive macro dynamics, it was disappointing that Bitcoin failed to sustain a break above 31k, especially with the Ripple victory over the SEC. Some talk that the US government's Silk Road holdings were back on the move perhaps weighing and it does feel like there’s a “flow” out there.

Nonetheless, the peak rates, peak inflation narrative is growing stronger and will continue to be an increasingly positive driving force for crypto in H2 as the lagged impacts of monetary policy truly hit. It’s just a matter of time before we break into a higher range.

Bonus Section - The State of Staking by Theo Chapman, Co-Founder of Zonaris.

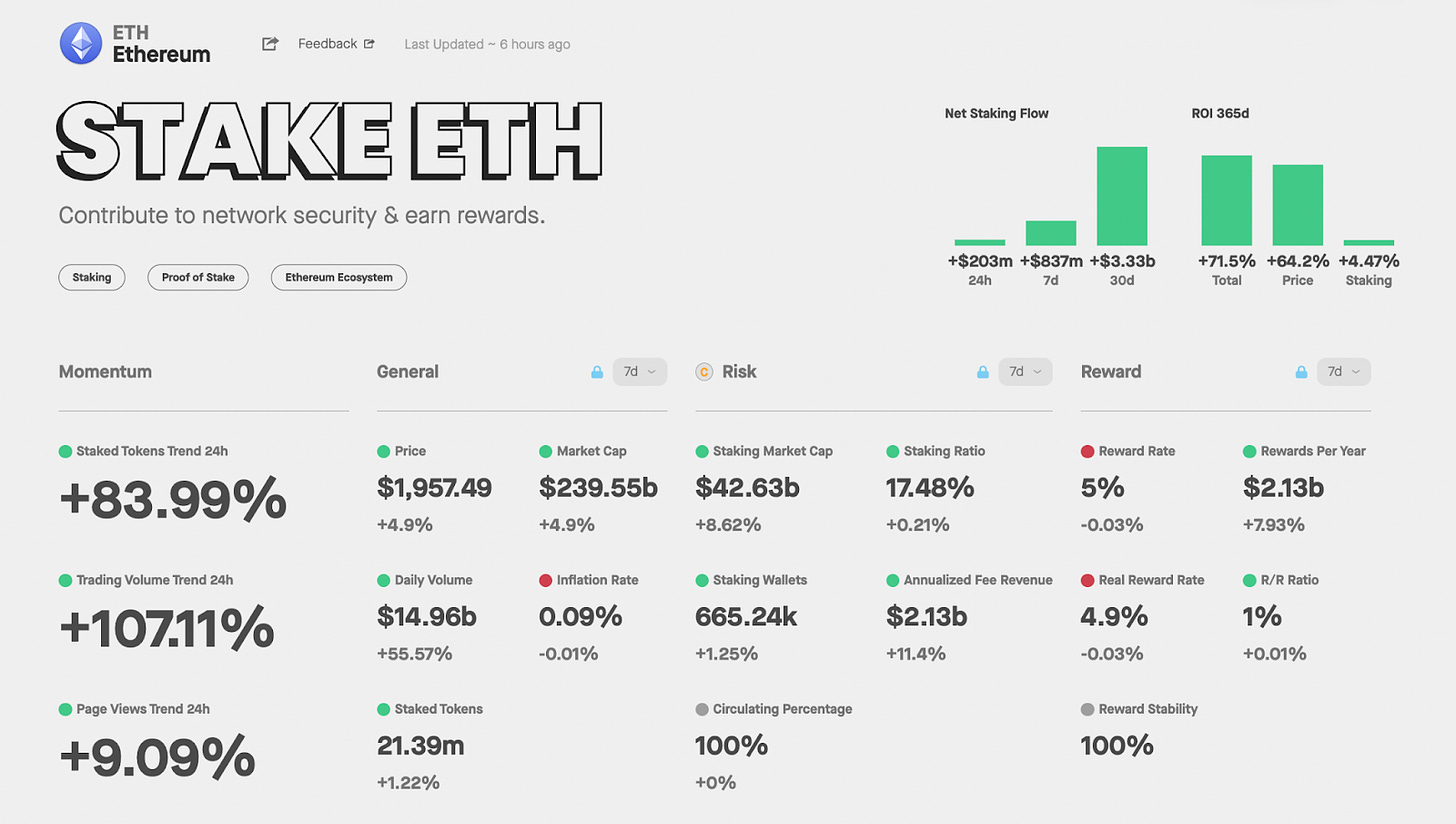

Staking is a strategic opportunity for institutional investors, where held crypto assets actively contribute to the blockchain network's operations via a system known as Proof of Stake (PoS). For institutions, staking provides a means for passive income generation while strengthening the network's security. It represents a crucial strategy in shaping the future of the crypto economy and aiding portfolio growth and diversification.

“It can be argued that staking is the closest thing we can get to blockchain’s risk-free rate” - Messari.

Staking has emerged as a favourite option for long-term investors seeking native yield on their PoS assets. As the crypto economy matures, this attractive opportunity becomes even more compelling. The PoS Staking Market Cap currently stands at a staggering $358bn, despite the ongoing bear market.

Debunking Myths about Crypto and Staking (credit: Kate Levchuk)

Myth #1: I am better off simply holding my assets until the price is right to sell.

Myth #2: My coins can only appreciate in value, so there's no need to stake.

Myth #3: APY fluctuates constantly and cannot be trusted.

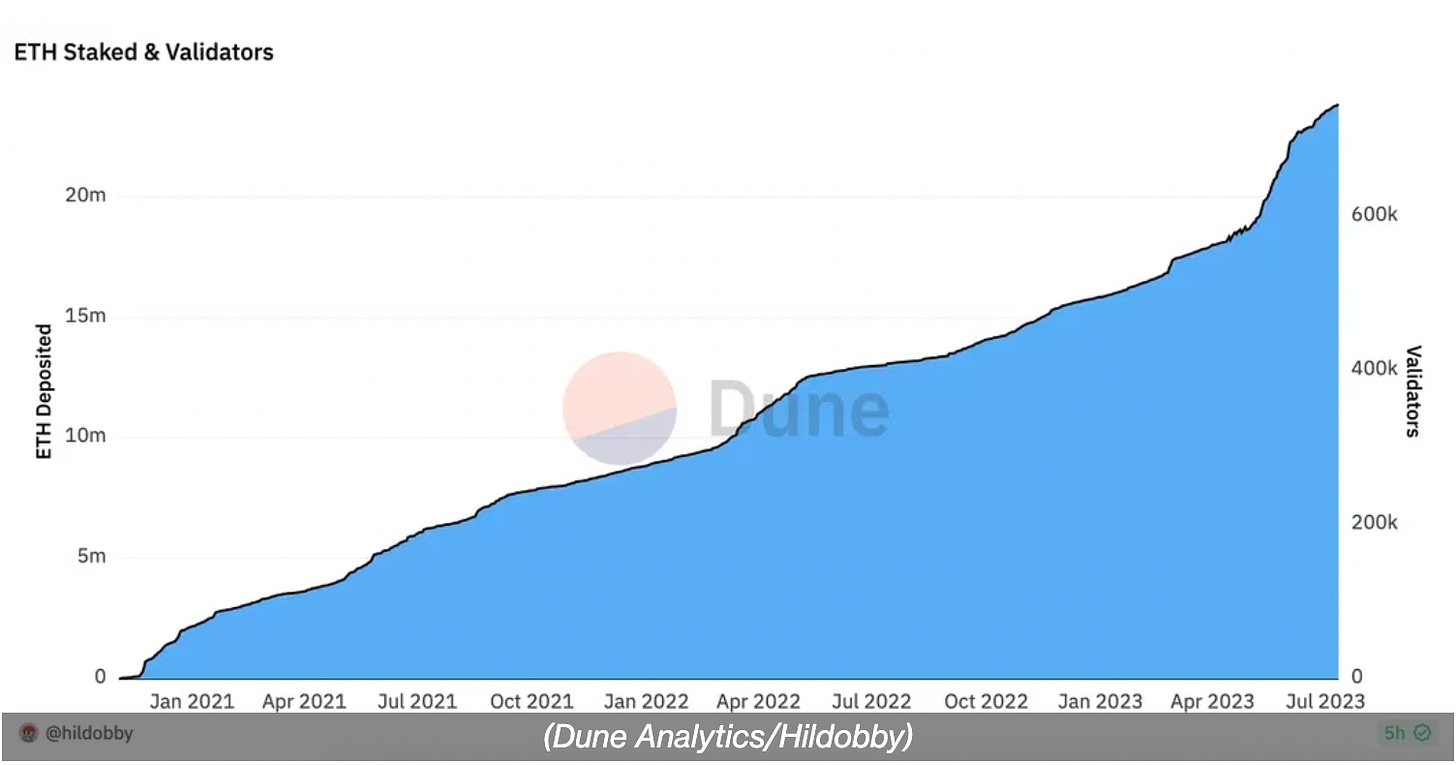

Since Ethereum’s Shapella upgrade in April, there has been a significant surge in ETH staking due to the availability of deposit withdrawals.

Witnessing $100M in daily ETH staking inflows has become commonplace. Yet, less than 20% of Ether is currently staked. Estimates suggest this figure could eventually escalate to 60%.

Source: Staking Rewards

In the months ahead, several intriguing staking sectors are worth monitoring. These include Lido, Ethereum's "cartel", a liquid staking protocol, which commands over 30% of all staked Ether. Additionally, Ethereum's most centralised layer, AWS, is a huge pain point for the protocol and community. With over 30% of Ethereum validators reliant on AWS, it represents a potential single point of failure - "you’re not decentralised if you spin up servers with Uncle Jeff!” As a result, decentralised staking alternatives are becoming increasingly popular.

Institutions aiming to stake a range of cryptocurrencies may opt for institutional staking providers such as Zonaris. Zonaris manages state-of-the-art distributed infrastructure, optimises yields, offers detailed reward reports through a dashboard, and ensures full regulatory compliance.

Find out more about Zonaris HERE

Native News

Key news from the crypto native space this week.

Following the news from Ripple/SEC this week, trading volumes of XRP rose significantly. Exchanges such as Coinbase, Bitstamp, Crypto.com and Binance US all relisted XRP after the news. The 24 hour volumes of XRP increased 18 fold from $613m to $11.3bn between 13 and 14 July. Looking more broadly, bitcoins dominance of the total crypto market fell 2.6% to 50.14%, the biggest one day decline since June 2022.

If you want a nice summary of the Ripple/SEC decision, check out this piece from Reuters: SUMMARY

This week, Zodia Custody announced a partnership with Hidden Road to offer institutional clients access to prime brokerage and custody services via Zodia’s off-exchange solution, Interchange. Mike Higgins, Global Head of Business Development for Hidden Road said “A sound regulatory framework is what institutions need most when it comes to trading digital assets and bringing together our two FCA-regulated offerings will support the maturation of market structure in digital assets. Hidden Roads collaboration with Zodia Custody adds value to credit network as we share a focus on security compliance and risk management”

Institutional Corner

Top stories from the big institutions.

Europe’s first bitcoin exchange traded fund is expected to be publicly listed this month, 12 months after its planned launch. Jacobi Asset Management originally announced that its bitcoin ETF was to list on Euronext Amsterdam in July 2022. However, it now says the fund is “on track” to launch this month, having decided that last year “the time wasn’t right” following the Terra Luna cryptocurrency crash in May 2022 and crypto exchange FTX’s collapse in November. The asset manager says “demand has shifted since last summer”. In Europe all digital assets exchange traded products so far have been structured as exchange traded notes, rather than funds.

The European Banking Authority (EBA) has urged businesses to use its guiding principles for stablecoin issuance before restrictions are implemented. The EBA has suggested businesses voluntarily follow certain “guiding principles” on risk management and consumer protection. On July 12, the European Banking Authority (EBA) released its first set of measures for public comment to clarify the Markets in Crypto-Assets regulation (MiCA) requirements for issuing a stablecoin set to take effect on June 30, 2024. The measures contain clauses such as a perpetual right of redemption and guidelines for managing complaints.

The Blackrock bitcoin ETF application has made the headlines over the last few weeks. But what are the actual implications for crypto markets? Bloomberg ETF analyst Eric Balchunas posted a report this week which suggested that $30 trillion worth of capital could suddenly unlock for the bitcoin market if Blackrocks spot ETF is approved by the SEC. That is the estimated amount of assets controlled by financial advisors in the US and may be willing to get exposure to bitcoin through a regulated ETF. Speaking of Blackrock, Balchunas added "They're very smart and they don't just throw filings out willy nilly”, the analyst said. "They clearly see something out there that they think they can get through the regulators”

Chart of the Week

Because charts are just as important as macro.

BTC/USD trade volumes on weekends are falling. Hat tip to Dessislava Ianeva for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Crypto Operations Analyst at Hivemind

Global Anti Financial Crim Lead for Digital Assets at Deutsche Bank

Junior Business Development Executive at Blockchain.com

Senior Payroll Manager, EMEA at Ripple

European Product Specialist at Galaxy

Associates in Digital Assets Supervision at the FCA

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.