Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Ubyx raises $10 million to build a global stablecoin clearing system, Coinbase received MiCA license in Luxembourg,

Institutional Corner: JP Morgan announces the pilot of a permissioned USD deposit token, BBVA advising clients to buy cryptocurrencies, Texas becomes the first U.S. state to create a publicly funded, stand-alone bitcoin reserve.

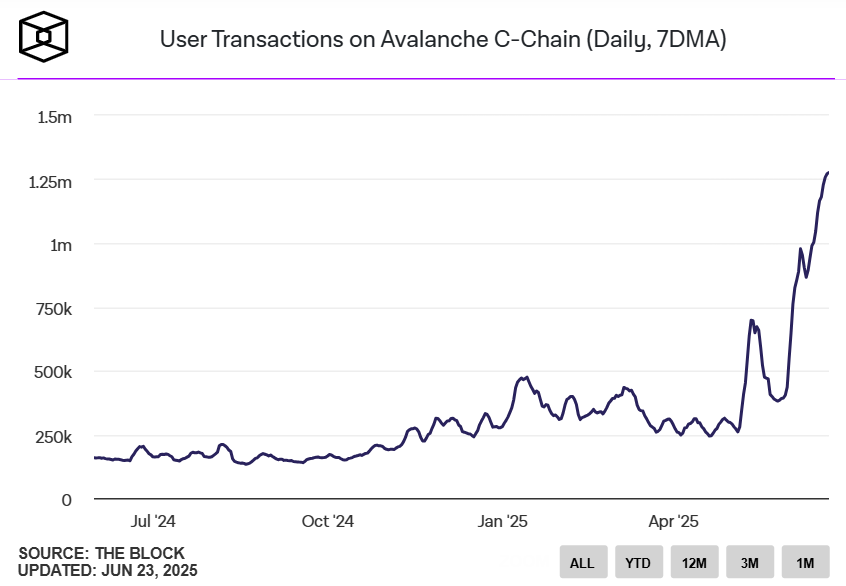

Charts of the Week: Ethereum users stake a record 29% of supply, transactions on Avalanche hitting records, US spot Bitcoin ETFs hit $1 trillion cumulative trading volume, BlackRock now holds 3% of all Bitcoins in their ETF.

Top Jobs in Crypto: Featuring Blockchain.com, CF Benchmarks, Ledger, KuCoin, BitMart and LSEG.

Macro Update

This is where we connect the dots between macro and crypto.

Market Solstice

Saturday the 21st of June was the summer solstice, the longest day of the year. Although for those of us in markets, there were a few days this past week which felt like that!

Despite the “Goldilocks” macro environment, Geopolitical uncertainty hung over markets, limiting the appetite to take risk.

Indeed, some of those fears were realised with this weekend's attacks by the US on several Iranian nuclear sites. As we’ve written about previously, we typically like to fade geopolitical driven risk-off in a “sell the fear, buy the news” redux.

Bitcoin and the broader crypto space took a heavy hit over this weekend as the tradable risk proxy, but as I write, early moves across equities, rates and FX are relatively muted which augurs well for a recovery. Even oil, despite the Iranian parliament reportedly voting to close the Strait of Hormuz is currently flat, after an initial opening spike (fwiw we still view this as unlikely. Despite 20% of the world’s oil passing through the Strait, circa 40% is for China who receives circa 50% of their oil from the Gulf region. It would therefore materially impact China, as well as Iran itself, closing off its ability to export its own oil, so vital to their economy.)

A good chart from the team at Steno Research supports our thesis on fading geopolitics. US involvement in conflicts have often marked the local lows for the S&P 500. Alongside Trump saying “Now is the time for peace” one suspects we are past the peak fear for this market and the wall of worry will be climbed once more.

Return to ZIRP…

In macro-land, the latest FOMC was the data highlight, although, whilst holding as expected, there was little new to add to the current “wait and see” approach, which perhaps disappointed some in markets looking for a more dovish committee. The Summary of Economic Prediction (SEP) forecasts also raised expectations for both inflation and unemployment, whilst downgrading growth, although the forecast for 2 more rate cuts in 2025 remained unchanged. Tariff uncertainty continues to cloud the outlook although JPow noted that “despite elevated uncertainty, the economy is in a solid position,” and the Fed remains “well positioned to respond in a timely way to potential economic developments.”

Interestingly, following the FOMC, Fed governor Christopher Waller made comments suggesting the central bank may be in a position to cut rates as soon as July. An audition for the Fed chair perhaps once JPow’s term comes to an end. It will be interesting to monitor Fed speak over the coming week to see how many others are leaning towards a July cut. Either way from our big picture view, the direction of travel remains towards cuts, whenever they should arrive, which reinforces the benign backdrop to these markets which should keep broad risk well supported.

Elsewhere, the Bank of England kept rates on hold as expected, although governor Bailey reiterated that “rates remain on a gradual downward path.” More significantly perhaps, the Swiss National Bank (SNB) made a return to ZIRP (zero interest rate policy) cutting rates to 0% to counter the disinflationary effects of a strong Swiss Franc and expressed a willingness to intervene in the currency to keep inflation on track. No doubt some of those dollars bought via intervention when it arrives will find their way into the Nasdaq 👀

The return to ZIRP is also interesting to us given a lazy consensus in markets that the days of zero interest rates are behind us. The move to zero from one major bank can exert a gravitational pull on global rates dragging everyone to the “lower bound” as capital flows towards other, higher yielding currencies which are incentivised to cut rates also to ease domestic currency strength.

In Japan meanwhile, policy rates were left at 0.5%, as expected, but the BoJ signalled it would slow the pace at which it tapers its purchases of Japanese Government Bonds (JGB’s) from April next year. The BoJ highlighting its sensitivity to bond market disruptions and the limitations on balance sheet normalisation. In a fiat world drowning in debt, central banks ultimately must keep a lid on yields and that financial repression will continue to weigh on fiat currency.

Overall, little change to the view here at London Crypto Club. Geopolitics and tariff concerns cast a cloud over an otherwise benign macro backdrop with easier rates and rising global liquidity, which we still see driving new record highs in equities and a break higher towards 120k for Bitcoin. The risk to the view is a choppy sideways summer lull. Patience required maybe, but given the resilience in the face of WWIII FUD, HODLERS can feel comfortable here.

Native News

Key news from the crypto native space this week.

Ubyx, a startup founded by ex-Citigroup executive Tony McLaughlin, has raised $10 million to build a global stablecoin clearing system. The seed round was led by Galaxy Ventures, with backing from Coinbase Ventures, Founders Fund, Paxos, VanEck. The London-based company is looking to solve a long-standing problem in the stablecoin market: fragmentation. Right now, it says, every issuer has to build its own off-ramp infrastructure, an expensive and inefficient process. Ubyx proposes a common clearing system that would allow stablecoins from multiple issuers to be redeemed at face value into bank or fintech accounts. Removing the need for each issuer to build out their own distribution network, Ubyx says, would help solve market fragmentation. Read the full press release HERE.

Coinbase has secured its Markets in Crypto Assets (MiCA) licence from the Luxembourg Commission de Surveillance du Secteur Financier (CSSF), enabling the company to offer a full suite of crypto products to all 27 EU member states. Coinbase said in their press release Luxembourg has always been a key player in Europe’s financial ecosystem, and we’re delighted to share that Coinbase is officially establishing its European crypto hub in this dynamic country, under the Markets in Crypto Assets regulatory framework (MiCA). The release added Over the past few years, Coinbase has worked closely with regulators across Europe, securing licences in Germany, France, Ireland, Italy, The Netherlands and Spain. Now, with MiCA, we’re uniting these efforts under a single framework, enabling millions of Europeans to access regulated, trusted, and secure crypto services.

Institutional Corner

Top stories from the big institutions

JPMorgan has announced the pilot of a permissioned USD deposit token called JPMD on Base, the layer 2 Ethereum network built by Coinbase. This week the bank filed a trademark application for a crypto-focused platform named JPMD, designed to to offer services such as trading, exchange, transfer, and payment services for digital assets, as well as issuance of digital assets. According to a press release the institution-focused JPMD, an alternative to stablecoins for the bank’s clients, marks the first deployment of JPMorgan’s Kinexys distributed ledger technology studio on a public blockchain. Jesse Pollak, Creator of Base and VP of Engineering at Coinbase said “We are thrilled to see one of the world’s most prominent banks come onchain. Base offers sub-second, sub-cent, 24/7 settlement, which makes fund transfers between J.P. Morgan institutional clients nearly instant. Coinbase is a proud J.P. Morgan institutional client, and this pilot combines the credibility of both J.P. Morgan and Base to help bring institutional money into a more global economy.”

Payment card giant Visa has expanded its stablecoin capabilities across the Central and Eastern Europe, Middle East, and Africa (CEMEA) region, and has also formed a strategic partnership with African crypto exchange Yellow Card. The Yellow Card partnership will explore cross-border payment options, streamlining treasury operations and enhancing liquidity management. Chris Maurice, Co-Founder and CEO of Yellow Card said “Together with Visa, we’re building a bridge between traditional finance and the future of money movement. We look forward to continuing to innovate new solutions that can transform how money moves for even more secure, efficient, and transparent payment solutions.”

Spanish Bank BBVA is advising wealthy clients to invest up to 7% of their portfolio into cryptocurrencies, an executive said this week. BBVA's private bank advises clients to invest 3% to 7% of their portfolio in cryptocurrencies depending on their risk appetite, said Philippe Meyer, head of digital & blockchain solutions at BBVA Switzerland. Meyer told Reuters he believed BBVA was one of the first large global banks to advise its wealthy clients to buy cryptocurrencies. It had been executing on client requests to buy them since 2021.

Texas has become the first U.S. state to create a publicly funded, stand-alone bitcoin reserve after Governor Greg Abbott signed Senate Bill 21 into law over the weekend. The bill directs the state to establish a bitcoin reserve managed independently from the main treasury, joining a small but growing group of states exploring digital asset reserves. Unlike Arizona and New Hampshire, which passed similar legislation, Texas did not just authorize the reserve but is actively funding it. The state will be appropriating $10 million in order to purchase bitcoin for the reserve. Read the full bill HERE.

Charts of the Week

Because charts are just as important as macro.

Ethereum users have staked a record 35.35 million ether — about 29% of the token’s circulating supply.

The 7-day moving average (7DMA) of the number of transactions on the Avalanche chain reached 1 million, its highest in over a year. Again, hat tip to The Block for the chart.

US spot Bitcoin ETFs hit $1 trillion cumulative trading volume milestone in less than 18 months since launch. A hat trick from The Block this week!

BlackRock now holds 3% of all Bitcoins in their ETF.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Community Manager Web3 at Blockchain.com

Sr. Sales & BD Lead - CF Benchmarks

Wallet Operations Team Lead at Ledger

Institutional Sales Manager at KuCoin

Product Manager, Digital Assets at LSEG

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.