Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Bullish evolution of the macro has prepared the ground for Bitcoins next leg to new record highs. Read why below.

Crypto Native News: Bitcoin scaling developers release and updated whitepaper, MetaMask starts the rollout of its blockchain based debit card, bitcoin miner Hut 8 releases its quarterly earnings.

Institutional Corner: Goldman Sachs holds a big chunk of bitcoin ETF’s, the IMF calls for increased taxes on crypto mining, South Koreas pension fund buys MicroStrategy shares.

Charts of the Week: BTC shifted to accumulation, BTC to Gold ratio drops to a low.

Top Jobs in Crypto: Featuring Revolut, Coin Juncture, XTX Markets, Crypto.com, WorldPay, Bitpace and Outlier Ventures.

Macro Update

This is where we connect the dots between macro and crypto.

Goldilocks and the Doomed Bears

Equities recorded stellar gains on a week where “recession fears” were replaced by a “goldilocks” thematic with inflation cooling whilst economic activity remains robust.

Core PPI on Tuesday came in at a much softer 2.4%, down from 3%, feeding expectations of a continued fall in CPI, which on Wednesday ticked lower, with the headline YoY rate falling to 2.9%. This is the first time it’s been below 3% in over 3 years. The New York Fed’s 3-year inflationary expectations also fell to 2.3%, its lowest since the series started in 2013. If there were any remaining fears at the Fed about cutting “too soon” this past week will have provided all the comfort they need. The inflation genie looks to have been put firmly back in the bottle.

Meanwhile, after the recessionary panic post the recent soft labor market report, retail sales in July grew 1%, the strongest reading in 18 months, suggesting the labor market cooling is yet to impact the consumer. Jobless claims also fell from 241k to 236k calming some of the fears about the pace of labor market deterioration.

Risk Melt Up…

As we said last week, the macro conditions for broad risk remain supportive, despite the Yen carry unwind wobble which we viewed more as a blow up of a levered momentum trade than the start of more concerning funding trade unwind. Whilst we believe we are starting to see the lagged impacts of monetary policy exert themselves more forcefully, our base case is for the US to slow to a mild recession (it’s hard for growth to collapse when the government is running deficits north of 6%) all the while, the disinflationary process continues, allowing the Fed to ease rates lower. This is a benign backdrop and we believe a now under positioned US equity market is about to melt up and hit new record highs in a “blow off top” type move that will cause a lot of pain and forced performance chasing.

As the Fed gets set to start the rate cutting cycle next month, we’re also seeing continued dollar weakness, with the broad dollar index hitting 5 month lows this week. This is an implicit easing of global financial conditions and forms a positive tailwind for risk. It also helps to reinforce the improved liquidity environment 🌊

The broadly weaker dollar is also easing pressure on the Chinese Yuan, giving China the cover to ramp up stimulus. And that stimulus is needed. Data this week highlighted the on-going economic weakness, with industrial production falling from 5.3% to 5.1%, whilst Fixed Asset Investment was a softer 3.6% in the Jan-July period from a year ago. The unemployment rate also edged up to 5.2% from 5% the month prior whilst property investment fell 10.2% YoY.

Perhaps more interesting, Chinese credit data showed new bank loans rising just CNY 260bn in July, down sharply from 2.13trn the month prior. Despite recent easing, consumer credit is not flowing and the PBOC will likely need to cut rates further and help encourage greater lending activity. We continue to expect a flood of liquidity to come out of China. It’s not happening yet, but it's coming. Further, if China sneezes, the rest of the world catches a cold and the slow growth, disinflationary pulse that China continues to emit across the world will have all major central banks soon reaching for the liquidity pump.

Our macro framework continues to tick all the boxes for Bitcoin to start the next leg higher.

✅ Rates falling

✅ Weaker dollar

✅ Rising global liquidity

✅ Supportive risk backdrop

✅ Low level investor positioning

Supply overhang…

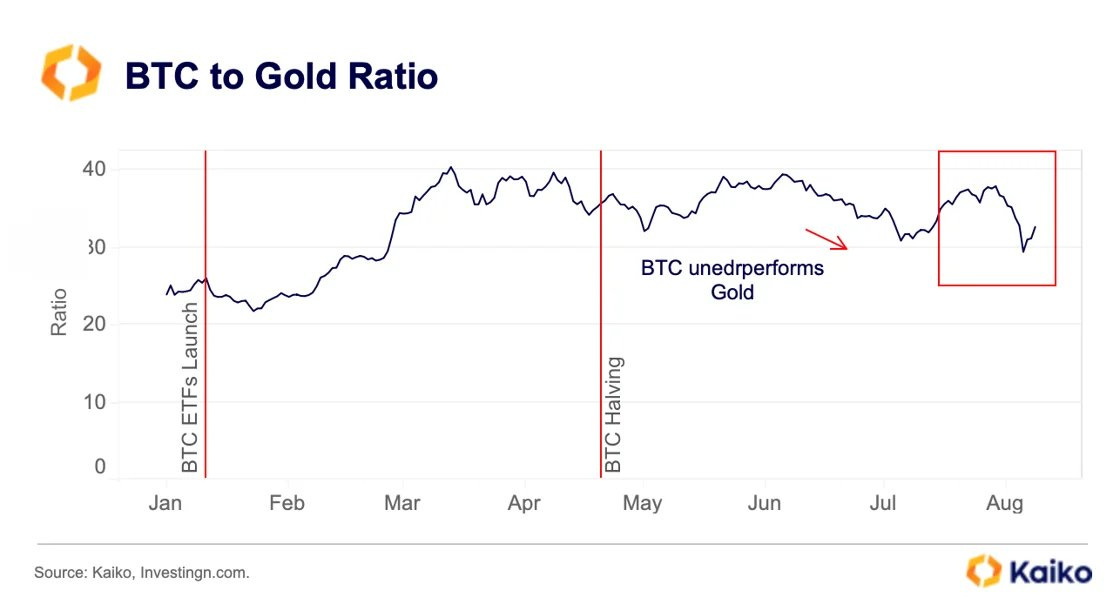

It’s been a somewhat frustrating week then to see Bitcoin trade in this broad 56k-62k range. Gold certainly appears to be getting the memo hitting new record highs above $2,500🥇

There remains perhaps a supply overhang that Bitcoin is struggling to digest. The US government this week transferring 10,000 BTC worth $600mio to their Coinbase account, the latest supply FUD, after a summer of German government selling and the Mt Gox distribution.

Still, hash rate has now started to recover post the halving suggesting the weak miner selling is likely done. The Bitcoin ETF’s were back to net positive inflows this week, albeit just $35.9mio net inflow. The latest 13F filings shows continued “institutional adoption” with now over 1900 holders of the BTC ETF’s. That’s a 30% increase on the prior quarter…despite prices not making new highs since March.

We are however in the summer lull. Commitment to risk is typically low in these periods, as is reflected by the low volumes trading on exchanges and so we’re yet to see real, sizeable demand come back into this market to off-set the negative supply dynamic.

Yet we remain very comfortable with the bullish evolution of the macro and continue to believe the Yen driven vol event at the start of August has prepared the ground for Bitcoins next leg to new record highs. Bitcoin led the risk asset rally in Q1. It’s a matter of time before it re-claims its place on the podium to take gold.

Native News

Key news from the crypto native space this week.

On Thursday, Bitcoin scaling developers released a new whitepaper on the second version of Bitcoin Virtual Machine, BitVM2, and the updated BitVM Bridge. The whitepaper details updated efforts to improve the efficiency of transactions within the Bitcoin network through improvements in transaction handling capabilities and, in some cases, updated cryptographic methods. The document stated that BitVM2's main aim is to increase Bitcoin's transaction capacity without modifying its core code or principles, such as decentralisation. The whitepaper explains that BitVM2 employs optimistic computation to scale Bitcoin with sidechains. It assumes that the operators of such networks act honestly until challengers demonstrate otherwise using fraud proofs. Read the whitepaper HERE.

MetaMask, the self-custodial crypto wallet for the Ethereum network, is starting the rollout of its blockchain-based debit card developed with payments firm Mastercard and crypto payments specialist Baanx. The MetaMask Card will initially be available in a "limited pilot of a few thousand digital-only cards" to users based in the European Union countries and the UK. The company plans broader distribution later this year, with a "full rollout" in the EU and U.K. and more pilot launches in other regions through the coming quarters. Mastercard has been working with Baanx on its Web3 payments initiative, connecting traditional payments with crypto platforms like hardware wallet firm Ledger and decentralised exchange 1inch.

Bitcoin mining firm Hut 8 released its quarterly earnings report this week and saw revenue jump 72% year-over-year to $35.2 million. Partially driving these returns was the decreased cost to mine bitcoin as its “cost per kilowatt-hour” fell 21% from the first to the second quarter as well as the firm’s growing computing power business lines. Still, like the majority of mining firms, Hut 8 recorded a net loss following the halving event in April, which split the bitcoin block subsidy. The company’s net losses totalled $71.9 million, largely due to a $71.8 million fair value adjustment on its holdings following the adoption of new Financial Accounting Standards Board rules for digital assets that require firms to recognise fair value price changes during specific reporting periods. Bitcoin dropped from $71,289 to $62,668 from the end of the first quarter to the second quarter.

Institutional Corner

Top stories from the big institutions

According to their 13F filing with the SEC this week, Goldman Sachs holds U.S. spot bitcoin exchange-traded fund shares worth around $418.65 million as of June 30. The investment bank’s largest spot bitcoin ETF holdings were 6.9 million shares of BlackRock’s iShares Bitcoin Trust, worth $238.6 million. According to Fintel data, Goldman Sachs is the third largest holder of the IBIT fund, behind Millennium Management and Capula Management Ltd. Goldman Sachs also disclosed 1.51 million shares of Fidelity’s FBTC, worth $79.5 million, and 660,183 shares of Grayscale’s converted bitcoin fund, worth $35.1 million. Its list of bitcoin ETF holdings includes $56.1 million worth of Invesco Galaxy bitcoin ETF and shares of three other funds from Bitwise, WisdomTree and Ark-21Shares. Read the full filing HERE.

On Thursday, the International Monetary Fund said an increase in electricity taxes for crypto miners by as much as 85% could play a significant role in curbing global carbon emissions. The blog post by the IMF says “Such a levy would raise annual government revenue of $5.2 billion globally and reduce annual emissions by 100 million tons around Belgium’s current emissions.” For artificial intelligence data centres, a targeted tax on their electricity use would need to be set at $0.032 per kilowatt hour, or $0.052, including air pollution costs. The post says “It is slightly lower than for crypto because data centres tend to be in locations with greener electricity. This could raise as much as $18 billion annually.” Read the full blog post HERE.

South Korea’s Pension Fund, National Pension Service (NPS), bought MicroStrategy (MSTR) shares worth nearly $34 million in Q2. The fund disclosed that it purchased 24,500 shares at an average price of $1,377.48, before MicroStrategy announced a 10-for-1 stock split in the beginning of this months. This brings the total number of shares to 245,000, valued at approx $32.32 million. NPS also holds 229,807 shares of Coinbase (COIN), worth over $45 million, based on Coinbase's last close of $197.12. The fund started buying shares in the crypto exchange in 2023, snapping up 282,673 shares at an average price of $70.5.

Charts of the Week

Because charts are just as important as macro.

The Accumulation Trend Score (ATS) indicates a market shift back to accumulation, with the ATS reaching its maximum value of 1.0, signalling significant accumulation over the past month.

The BTC to gold ratio, which measures the relative performance of the two assets, dropped to its lowest level since February on 5 August. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Product Owner Crypto Exchange at Revolut

Crypto Video Creators at Coin Juncture

Trading Operations Specialist for Crypto at XTX Markets

Manager, Treasury and Finance at Crypto.com

Senior Strategy Manager, Vertical Growth - Gaming, Crypto & Trading at WorldPay

Head of Customer Success at Bitpace

Token Growth Team at Outlier Ventures

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

Love it!