Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: US data resilience but China battling a slowing economy, our peak rates, peak inflation thematic continues to play out and together with continued positive crypto news, H2 is looking bright.

Bonus Section: Key takeaways from this weeks Hedgeweek Digital Assets conference.

Crypto Native News: Quant Network releases Overledger Platform, Hidden Road granted Dutch crypto service provider registration, Coinbase chosen by Cboe for ETF surveillance sharing agreements.

Institutional News: HSBC Hong Kong allows customers to trade bitcoin and ether ETF’s, the European Commission releases a proposal for the digital euro, the EU agrees on capital requirements for banks holding crypto, the UK Financial Services and Markets Bill received Royal Assent and the CME announced the launch of their Ether/Bitcoin Ratio futures (EBR).

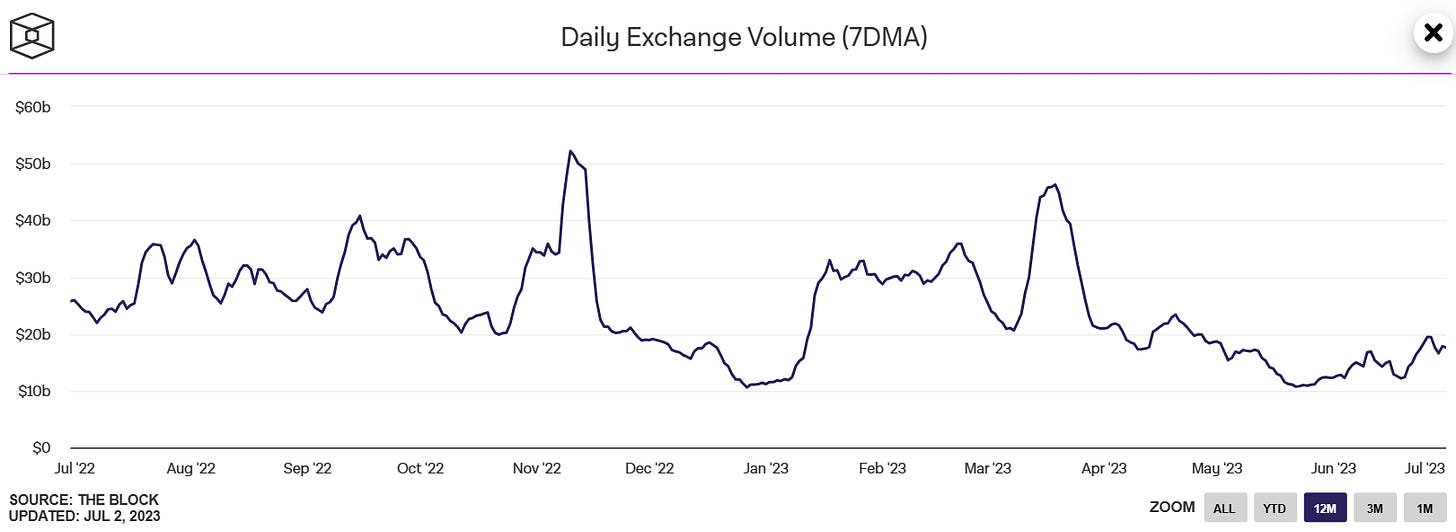

Chart of the Week: Crypto spot volumes on the largest exchanges ticking higher.

Top Jobs in Crypto: Featuring Matrixport, DCG Group, Fireblocks, Coinbase, Kraken and Copper.

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

Prepare for Take-off

June rounded out a strong month, quarter and H1 for risk as the market continues to adjust to an easier macro regime as the pace of central bank hikes slow and inflation continues to head lower, albeit at a slower pace than Central Banks would like to see (major central banks at Sintra this week continuing the hawkish speak, with Japan the notable exception).

Friday’s US Core PCE at 4.6% YoY, edging down from 4.7%, although worth noting the Fed’s preferred measure of Core PCE services ex-shelter on a 3 month annualised basis is now at 3.8% down from 4.4%. Heading in the right direction.

Adding to the sense of “goldilocks” is a resilience in the US data which, despite more concerning forward looking indicators, continues to come in stronger versus expectations. US Q1 GDP revisions up to 2% from 1.3% a case in point.

China, on the flip side, is battling an increasingly slowing economy. June Manufacturing PMI at 49 showing a third month of contraction, whilst non manufacturing activity at 53.2 was the weakest since China abandoned its zero Covid policy. The currency is acting as the escape valve with USDCNH briefly above 7.28 on Friday and the PBOC appears generally content to let it slide as they look to boost competitiveness (especially as export competitor Japan’s currency continues lower.) This is hugely disinflationary and will continue to keep Western inflation numbers heading lower.

Significantly, the weakness in CNH is not feeding substantially into broader dollar strength given the lack of PBOC interventions and consequently is not forming the bearish Bitcoin headwinds that we’d typically expect. Instead, it’s likely the weakness is driving capital outflow towards harder assets in order to protect from the currency debasement and as Arthur Hayes recently pointed out, it’s reminiscent of China’s 2015 shock devaluation which saw the price of Bitcoin triple.

US yields have been grinding higher as markets price “higher for longer” and offers some challenge to our bullish crypto view, however the longer duration yields, such as 10yr remain well off the highs from October and even below March levels pre the SVB collapse. As the lagged, hard data catches down to the forward looking indicators, we continue to expect the “peak rates” narrative to hold strong and accelerate into H2 and provide a tailwind to digital assets.

Overall, the peak inflation, peak rates thematic which we expected to drive Bitcoin and broader risk assets higher in 2023 continues to play out. With the lagged impacts of data accelerating the negative feed through into the second half of the year, we expect these dynamics to start to play more forcefully.

Combine that with the improved Crypto newsflow and the potential for a BTC spot ETF approval, Crypto looks set to explode higher into year end.

Bonus Section - high level takeaways from Hedgeweek Digital Asset Conference.

Firstly, its worth highlighting the number and quality of attendees. There must have been around 200 attendees many of whom were highly experienced traditional finance professionals now collaborating and building in crypto. This write up doesn’t include details of all of the individual round tables, but a high level summary of the panellists views.

How are crypto exchanges building trust?

- The crypto native exchanges have done a lot of “growing up” in the last year. For example, due diligence packs have improved, and the sharing of financial statements and balance sheets has increased.

- Many exchanges are applying for regulatory and broker licenses across multiple jurisdictions.

- There’s an increased willingness for crypto exchanges to allow integration with third party custodians. Though this is still at early stages and workflows/relationships are still to be defined.

Will the market ever be fully “institutionalised” ?

- The key requirement for mass adoption is a bank backed custody solution with clear segregation of assets.

- And for the banks to come into the space regulatory clarity is required.

- The appetite from the big institutions is there, but the reputational risk is currently a hinderance, they don’t want to make a mistake on counterparty risk or custody.

- Blackrock entering the space and partnering with Coinbase is very significant. That’s a key barometer to watch for future progression.

- The downside of large institutions entering is the increased dominance of Bitcoin. There are other amazing protocols in crypto that will get ignored.

Challenges for the crypto space.

- Still lacking in infrastructure. In particular custody solutions which aren’t user friendly enough.

- When infrastructure building, there’s often a tug of war between the those with a financial background and those with a tech background.

- In the here and now, there’s a lack of new capital, funds and projects are struggling to raise.

- The evolution of AI will be a challenge to the Blockchain space.

What makes you excited about crypto?

- The big institutions continue to come slowly but surely.

- Regulatory clarity. Significant progress has been made by the authorities in Europe, Asia and the Middle East.

- “Flight to quality”. The bad actors have been filtered out and the best solutions are getting the biggest take up.

- Lots of VC money has come into the space. That money is usually “sticky” and will stay in the space for 3-7 years.

Native News

Key news from the crypto native space this week.

This week Quant Network unveiled the Overledger Platform. The Overledger Platform is the same infrastructure used in Project Rosalind – the Bank of England and Bank for International Settlements’ retail CBDC project. Overledger is an enterprise-grade yet low-code blockchain platform that enables you to deploy your use case on multiple chains, issue chain-agnostic digital assets, connect them to other networks, and develop multi-chain applications quickly without compromising on security. Read full details of the release HERE.

Hidden Road, the global credit network for institutions, today announced that its Netherlands entity, Hidden Road Partners CIV NL B.V., has recently been granted a Crypto Service Provider registration by De Nederlandsche Bank (DNB), the Dutch Central Bank. This registration enables Hidden Road to offer counterparties the ability to transact between fiat and digital assets in various products.

Cboe was the latest firm to file for a spot bitcoin ETF this week. Fidelity, WisdomTree, VanEck, ARK Invest, Galaxy/Invesco and BlackRock all filed for spot bitcoin ETFs over the past few weeks, hoping to succeed at launching a product the U.S. Securities and Exchange Commission (SEC) has rejected for years. In its refiled applications, Cboe said Coinbase's platform "represents a substantial portion of U.S.-based and USD denominated Bitcoin trading" as it named the U.S. crypto exchange as its partner for these surveillance-sharing agreements. Read the full release from Cboe HERE.

Institutional Corner

Top stories from the big institutions.

As of this week, HSBC Hong Kong now allows customers to trade bitcoin and ether exchange-traded funds (ETFs) listed on Hong Kong's stock exchange. The development marks HSBC Hong Kong as the first bank in the region to allow trading in crypto ETFs. CSOP Bitcoin Futures ETF and and CSOP Ether Futures ETF are both managed by CSOP Asset Management and track the standardised, cash-settled Bitcoin futures contracts and Ether futures contracts traded on the Chicago Mercantile Exchange (CME), respectively.

On Wednesday, the European Commission released a proposal for a digital euro that would ensure free access to the CBDC across the bloc and establish a legal framework so that digital euro payments can be made from device to device, both online and offline. The proposed legislation aims to guarantee privacy akin to that of physical cash, with online transactions offering the same level of protection as existing digital means of payments, "with no one able to see what people are paying for when using the digital euro offline." The proposal says "The digital euro would be available alongside existing national and international private means of payment, such as cards or applications and it would work like a digital wallet where people and businesses could pay with the digital euro anytime and anywhere in the euro area”

This week, EU lawmakers agreed on capital requirements for banks holding crypto. On Tuesday, the Members of European Parliament (MEP’s) agreed a transitional prudential regime for crypto assets and on amendments to enhance banks' management of ESG risks. The regime will take effect until the European Commission (EC) implements the Basel III banking reforms, and aims "to make sure that banks will have to disclose their exposure to crypto-assets." The MEP’s also started that "The Commission should come up with a relevant legislative proposal to implement these future Basel standards and specify the prudential treatment of such exposures during the transitional period." MEP Jonás Fernandez added the transitional arrangements will include "setting capital requirements for crypto assets until the Commission puts forward a specific legislative proposal." He added the new banking legislation should lower the risk of future banking crises. Read the full release from European Parliament HERE.

This week in the UK, the Financial Services and Markets Bill received Royal Assent. We’ve wrote about the bill in recent weeks but as a reminder The Financial Services and Markets Act 2023 is central to delivering the Government’s vision to grow the economy and create an open, sustainable, and technologically advanced financial services sector. The crypto related ‘goals’ of the bill include: enabling the regulation of cryptoassets to support their safe adoption in the UK and establishing ‘sandboxes’ that can facilitate the use of new technologies such as blockchain in financial markets. Read the full announcement HERE.

The Law Commission in the UK, which is funded by the Ministry of Justice, released a report on crypto. The Law Commission is an independent body is made up of lawyers, judges and professors, and makes recommendations for law reform that the government could decide to take forward. The report suggests that the UK should create a tailored framework for using crypto as collateral. The framework would go beyond the existing UK regulations for collateral arrangements for traditional finance. The report also suggests the government to set up “a panel of industry-specific technical experts, legal practitioners, academics and judges” to advise courts on complex legal issues relating to digital assets. Read the full report from the Law Commission HERE.

The Chicago Mercantile Exchange (CME) announced the launch of their Ether/Bitcoin Ratio futures (EBR), which will be available from 31 July. market participants may now efficiently execute a relative value trade between Ether futures (ETH) and Bitcoin futures (BTC) contracts in a single trade. Ether/Bitcoin Ratio futures allow traders to efficiently express a view on the relative value of the two cryptocurrencies without a directional bias on the overall cryptocurrency market.

Chart of the Week

Because charts are just as important as macro.

Crypto spot volumes at the largest exchanges slowly ticking higher.

Hat tip to The Block for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Institutional Sales for Europe at Matrixport

Investment Associate at DCG Group

Business Development Representative at Fireblocks

Trading Execution Service Specialist at Coinbase

Product Manager - Financial Operations at Kraken

Client Service Support Advisor at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.