Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Bybit hacked for $1.4bn, the SEC dismissed its lawsuit against Coinbase, Latam crypto users expected to increase significantly, FTX initiates its first round of payments.

Institutional Corner: The SEC launches a new crypto crime organisation, Robinhood to launch crypto in Singapore, Standard Chartered expects more sovereign wealth funds to buy bitcoin.

Charts of the Week: Bybit market depth drops, stablecoin supply increases.

Top Jobs in Crypto: Featuring CoinTelegraph, Joy Network, CoinMarketCap, Figment, KuCoin and TON Wallet.

Macro Update

This is where we connect the dots between macro and crypto.

Slow Down and HODL

A mixed week for equities and Bitcoin. After the S&P 500 made record highs Tuesday and Wednesday, we erased all gains in the tail end of the week as growth concerns started to weigh alongside tariff/geopolitical uncertainties. With equities falling into the weekend, Bitcoin, after eying up $100k, was getting pulled lower, before the historical Bybit hack knocked us back to the 95k zone. Some weeks, only the casino wins!

On Wednesday, the FOMC minutes revealed little new in terms of monetary policy, with the “wait-and-see” approach re-iterated as participants require more evidence of disinflation to continue with rate cuts. However, as we’ve been suggesting, the Fed did discuss the possibility of pausing or slowing the balance runoff pending resolution of the debt limit, given the potential for big swings in reserve balances.

In other words, the Fed is telling us that Quantitative Tightening (QT) is set to come to an end. Indeed, banking reserves have remained ample, despite QT, as the Reverse Repo (RRP) has been getting drained and effectively sterilising the effect of QT. As the RRP approaches zero, the Fed will need to end QT to stop banking reserves from falling.

This again is positive from a liquidity point of view and underscores our positive view on risk, which should accelerate once the Treasury General Account (TGA) begins to be drawn down. This occurs once the “extraordinary measures” are exhausted, which is 80% through - signs this week of the process beginning with the TGA down circa $70bn over the week.

Don’t mention the R word…

The positive mood following the FOMC minutes however was soured with renewed growth concerns after Walmart’s earnings which, whilst topping estimates for Q4 (remember the pre-election sugar high we’ve been talking about) produced soft forward looking guidance with a soft consumer outlook.

On Friday, the pessimism was compounded with the S&P Global PMI’s which suggested the economy ground to a halt in February, led by the service sector contracting at 49.7, its lowest reading in over two years.

Equities sold off and 10yr yields reversed lower to challenge the 4.40% 2025 lows with dare we say, recession fears percolating. The turn in risk pulling Bitcoin lower which, as mentioned, had been threatening another challenge of $100k. Then, to completely thwart efforts of a breakout, news broke regarding the $1.4bn Bybit hack, the largest hack in crypto history. Bitcoin falling back and despite Bybit’s admirable handling of the hack, including already fully replacing the stolen funds, we enter the week with a sense of fear and caution.

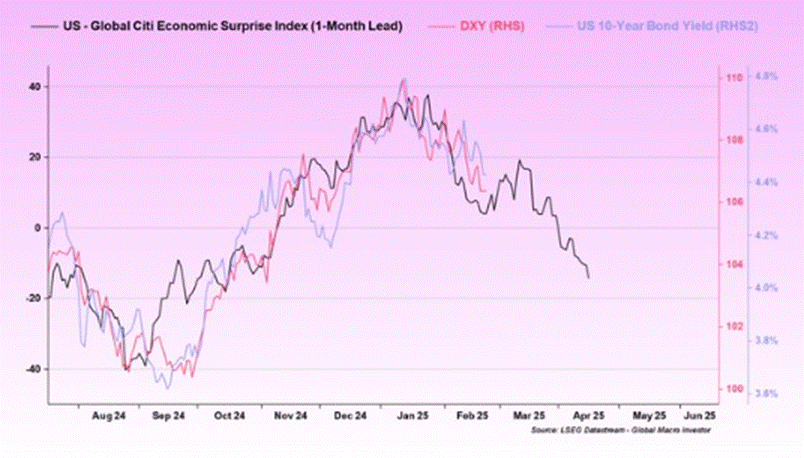

We were frustrated then in our call last week for an imminent breakout in Bitcoin given this macro regime shift, with the US dollar and yields starting to break down. The softening US data pulse reinforcing this breakdown ✅

A great chart by Global Macro Investor’s Julien Bittel highlighting how negative surprises in the economic data are leading the dollar lower as markets reprice US growth expectations relative to the rest of the world 👇

A weaker dollar alongside weaker yields easing financial conditions and contributing to a positive liquidity environment.

Central Bank Put is alive…

We find it difficult with this backdrop, to join the bearish sentiment that appears pervasive in crypto and risk markets coming into this week, given we remain a function of rates and liquidity. The Fed turned hawkish at exactly the wrong time, yet we remain on track for our base case of a slowing, not collapsing US economy. The market now needs to start pricing more rate cuts and the data dependent Fed will also flip dovish, catching “down” to market pricing. Indeed, given the contribution of public sector hiring over the past year, the labour market may well start to display levels of weakness that put rate cuts quickly back on the table, despite still sticky inflation.

Even in Japan, the only major economy hiking, last week said the BoJ is ready to increase bond purchases if long term yields rise sharply. The Central Bank Put remains alive and kicking!

Expect then this knee jerk risk-off to slow down fears to give way to the stimulative impact of lower rates and a weaker dollar and rising global liquidity. Month-end can make for some choppy moves too but events over the past week reinforces our bullishness heading into March, especially for Bitcoin and the wider crypto space. HODL.

Native News

Key news from the crypto native space this week.

The big news of the week came on Friday after nearly $1.5bn was stolen through a hack on Bybit. This is reportedly the the largest crypto heist in history and and the biggest single theft of any kind ever recorded. Bybit CEO Ben Zhou revealed that the exploiter breached the exchange's multisig cold wallet and "transferred all ETH (Ethereum) in the cold wallet" to an unidentified address. He noted that "all other cold wallets are secure" and withdrawals were working normally following the hack. As Bybit continued to recover from the exploit, the exchange launched a recovery campaign for the stolen funds, pledging 10% of recovered funds for "ethical cyber and network security experts who play an active role in retrieving the stolen cryptocurrencies in the incident." Read more from Bybit HERE.

The US Securities and Exchange Commission has agreed to dismiss its lawsuit against Coinbase, which had accused the company of operating as an unregistered securities broker. According to an announcement from Coinbase, the dismissal is still subject to approval by an SEC commissioner before the suit is officially withdrawn. Coinbase CEO Brian Armstrong said “If this goes through, it’s a really big deal, not just for us, but for the whole crypto industry, the 50 million Americans who hold crypto, and I think for the rest of the world because this is an important signal about where things are going.” Read the full response form Coinbase HERE.

A survey by Binance Research of more than 10,000 investors in Argentina, Brazil, Colombia and Mexico showed that 95% of the users planned to increase their cryptocurrency holding in 2025. According to a report by payments firm Triple-A, Latin America led the world in crypto adoption in 2024, growing by 116%. The region now has 55 million cryptocurrency users, making up nearly 10% of total cryptocurrency users. The expansion has been intensified due to rising asset prices, regulatory advancements and new products such as the ETF’s. As a reminder, Brazil became the first country to approve a spot XRP ETF last week.

On February 18th, FTX initiated its first round of repayments. Those who lost up to $50,000, classified by the exchange as the “Convenience Class,” were expected to receive 100% of their claims plus 9% annual interest based on their holdings. The repayments mark a significant step in the crypto industry’s recovery, however, FTX now faces claims from restricted jurisdictions. On 21 February FTX creditor and advocate Sunil Kavuri shared a list of countries ineligible for claims, including Russia, China, Egypt, Nigeria, and Ukraine. Kavuri said there were many claims from countries “not eligible for FTX distributions.” The FTX creditor and advocate added that the bankrupt exchange was already reviewing its options. In its February 18th announcement, FTX said its next repayment distribution date will be May 30. This round will cover “Class 5 Customer Entitlement Claims and Class 6 General Unsecured Claims.” These are users who had assets on the exchange when it collapsed. It also includes other creditors, such as trading partners and vendors.

Institutional Corner

Top stories from the big institutions

The US Securities and Exchange Commission announced that is is launching a new organisation tasked with combatting crypto-related crime. The new Cyber and Emerging Technologies Unit will work with the SEC’s crypto task force to “root out those seeking to misuse innovation to harm investors and diminish confidence in new technologies.” It will replace the Crypto Assets and Cyber Unit, will be led by SEC attorney Laura D’Allaird and will be made up of around 30 fraud specialists and lawyers from across the SEC. Read the full release from the SEC HERE.

Trading platform Robinhood Markets Inc. aims to launch its crypto services in Singapore by late 2025, following its acquisition of European digital-assets exchange Bitstamp in a $200 million deal completed in June 2024. Johann Kerbrat, Vice President and General Manager of Robinhood Crypto, said that the company plans to roll out its crypto services in Singapore after completing the Bitstamp acquisition in the first half of 2025. While Robinhood has yet to set a specific launch date, Kerbrat said that Bitstamp’s licenses in Singapore were a key reason behind the acquisition. “Part of the reason why Bitstamp was attractive was because of their licenses with Singapore, in addition to its institutional business,” he said, citing the exchange’s in-principle approval from the Monetary Authority of Singapore (MAS) under the country’s Payment Services Act. Robinhood is also targeting further expansion in Asia by acquiring brokerage licenses, allowing the company to diversify its revenue by adding traditional financial products such as equity trading to its suite of digital asset services.

In its most recent crypto report, Standard Chartered’s Head of Digital Asset Research said he expects more Sovereign Wealth Funds to buy bitcoin and maintains his $500k BTC price forecast by 2028. Geoff Kendrick said in the report "While hedge funds once again dominated the buying in Q4, bank buying (which started in Q3) was also very strong. Even more importantly, Abu Dhabi's sovereign wealth fund reported a 4.7k BTC equivalent position in Blackrock's IBIT ETF. While this is small for now, we would expect the size to increase over time and, indeed, for other sovereigns to also start buying." Kendrick expects "more super long-term long-only money" — such as state pension funds like the State of Wisconsin Investment Board and the State of Michigan Department of the Treasury — to invest in bitcoin. He also predicts central banks could follow, pointing to the Czech National Bank considering a bitcoin allocation of up to 5% of its €140 billion reserves (around €7 billion) and the Swiss National Bank in the early stages of bitcoin investment consideration.

Charts of the Week

Because charts are just as important as macro.

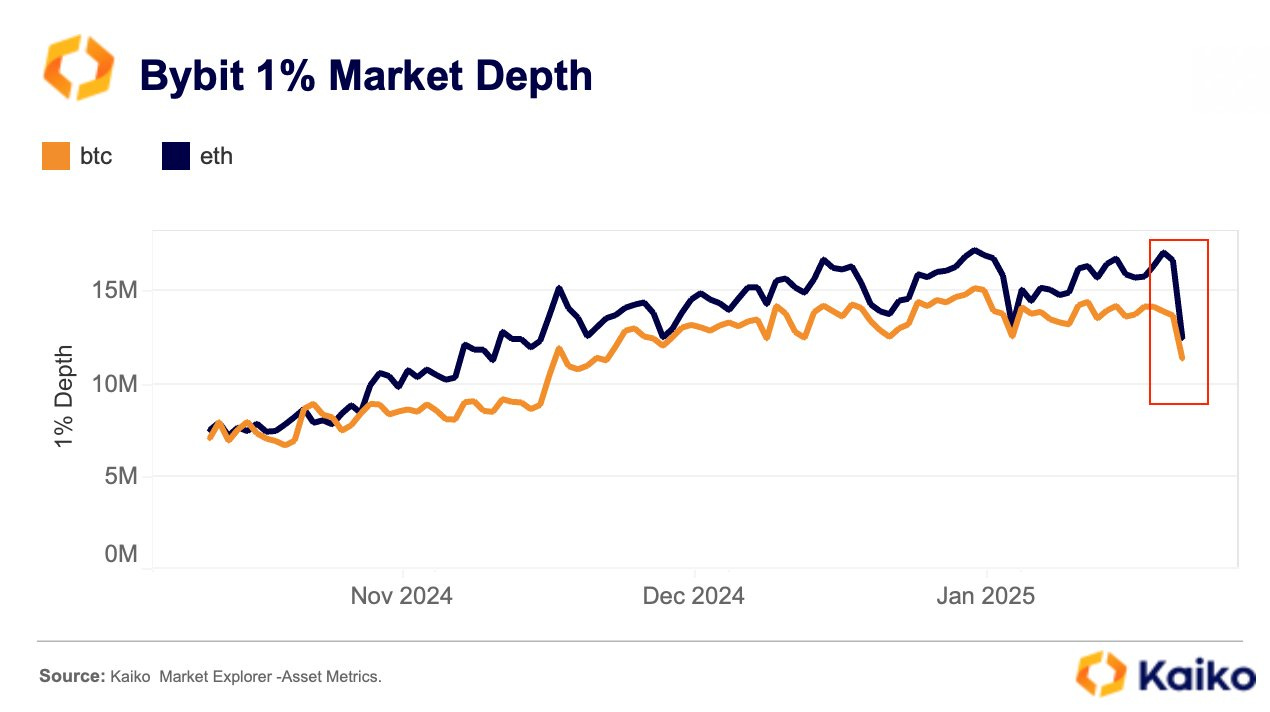

Bybit’s daily BTC & ETH 1% market depth dropped to a yearly low after the hack on 21st Feb. Hat tip to Kaiko Data for the chart.

Stablecoin supply is now above $215bn.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Twitter Threads Writer at CoinTelegraph

Product Manager Crypto at Joy Network

Senior Product Designer - On-chain data at CoinMarketCap

Institutional Business Development Manager, Europe at Figment

Institutional Sales Manager at KuCoin

Senior Product Manager at Ton Wallet

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.