Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “I love how it covers a multitude of topics but concise enough to read in one sitting. It has everything I need to know in crypto!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Some interesting macro headwinds, though “fiscal dominance” continues to debase the dollar, keeping both equities and Bitcoin moving higher.

Crypto Native News: D2X raises $10m, stablecoin market cap bounces back, Canton Network completes its pilot test.

Institutional News: EU parliament approves a new set of rules, Dubai’s DIFC announces a new Digital Asset Law, Swedens central bank Governor doesn’t like Bitcoin.

Charts of the Week: Digital Asset inflows hit a record, CME open interest hits a new all time high.

Top Jobs in Crypto: Featuring European Blockchain Convention, The Tie, fscom, Checkout.com, XTX Markets

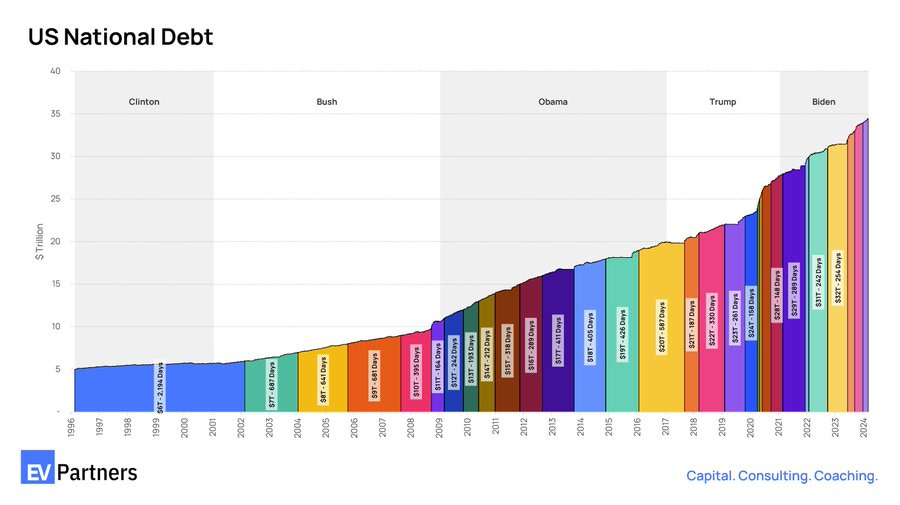

Macro Chart of the Week - Each colour shows $1 trillion getting added to the US national debt. Not that long ago, it took six years to add a bar. They’re now adding one every 90-120 days. Scary! Hat tip to Robert Sterling for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

The Ides of March

Another week, another record high for BTC, although a sharp reversal on Thursday, followed through on Friday and into the weekend, served as a little reminder of the inherent volatility in crypto.

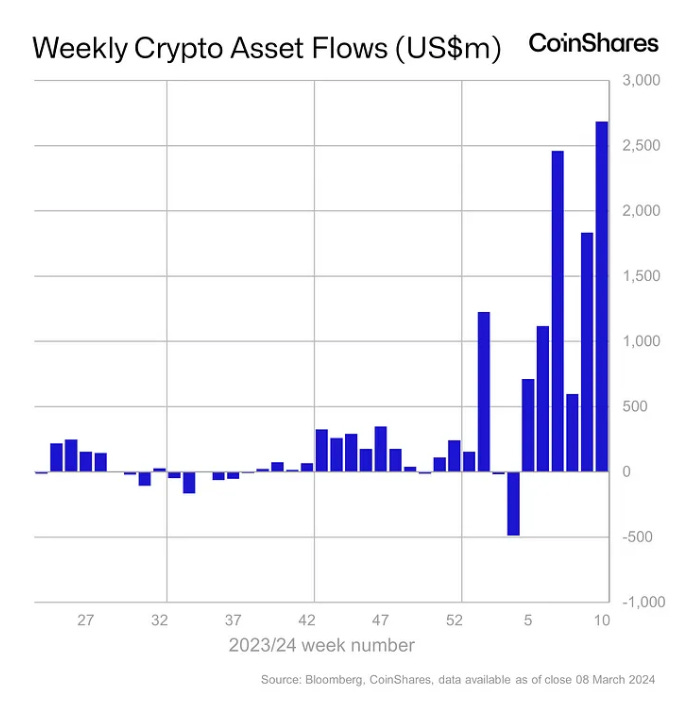

The positive demand/supply dynamic remains intact, with net 2.57bn of net inflows to the ETF’s last week, including the first $1bn+ inflow day. Worth noting the pace of inflows did slow Thursday and Friday to “only” 133mio and 199mio respectively. Reports also of a $1bn Microstrategy/BTC spread trade blowing up and being unwound (needing to sell BTC, buy MSTR) perhaps temporarily flipping the demand dynamic and driving the leverage flush. Positioning now looking cleaner and funding rates have normalised somewhat.

On the macro, what we reported to be tailwinds, flipped to headwinds once more as stronger US inflation data drove US yields and the dollar higher. Core CPI came in at 3.8% YoY, still ticking lower from 3.9%, but higher than the 3.7% expected. Headline inflation ticking up to 3.2%. Adding to concerns on sticky inflation, Producer price Input (PPI) also came in stronger, with PPI for Feb at 0.6%, double consensus estimates and the highest in 6 months, with YoY prices at 1.6% the highest since September.

Whilst US yields reacted, 10yr yields up 23bps on the week, the data is unlikely to materially impact the direction of travel for the Fed towards rate cuts. Indeed, Goldman’s noted that the composition of the CPI report was in fact “disinflationary” with a sharp normalisation in non-housing services inflation. Much of the inflation stickiness continues to be driven by shelter costs, a lagging indicator of inflation trends. Whilst the move from 3% to 2% will be more difficult than the move from 6% to 3%, the disinflation trend still remains in place, for now, and the market reaction looks, in our view, a touch overblown.

Nonetheless, the move higher in yields and the dollar removes what was becoming a tailwind and will add, at the margin, some weight to further BTC advances. Quite interesting too was the ability for USDJPY to trade higher, despite the Bank of Japan looking likely to hike rates this coming week and end negative interest rate policy NIRP.

This reinforces our view that a rate hike in Japan won’t be sufficient to trigger repatriation flows back to Japan, sparking a global asset sell off. Yield differentials with the rest of the world remain too wide. The BoJ have also stated their intention to keep a lid on yields in the event of removing the Yield Curve Control programme by offering “numerical guidance” on future bond purchases. Ultimately, the BoJ are tinkering around the edges of policy. Whether they call it QE, YCC or “numerical guidance on bond purchases,” the BoJ are unable to step away from artificially inflating its bond market and triggering a global bond sell off. Sorry bears, that’s just not going to happen.

Another macro headwind at the end of the week came from China. China injected RMB 387bn into the banking system via its medium term lending facility (MLF) keeping rates unchanged at 2.5%. However, with 481bn in loans set to expire, the operation resulted in the first net withdrawal of liquidity since late 2022. China, frustrated that banks are not lending the liquidity into the real economy, leaving it lay “idle” in the financial system, perhaps firing a warning shot to banks to get issuing loans. Concerns also remain around currency stability and the resurgence in US yields and the dollar complicates their efforts to ease and re-boot a struggling economy. As we continue to highlight. China is incentivised to keep a lid on BTC in order to maintain the “veil of stability” and discourage capital flight. A resumption lower in USDCNH will remove a big headwind for BTC to resume its charge higher. Keep watching!

Another interesting development this past week which feeds our long term bullish outlook on BTC, was a recent report from ISDA, highlighted by Joseph Wang (@FedGuy12 on X) urging US prudential regulators to permanently exclude US Treasuries from the supplementary leverage ratio (SLR) calculation. In short, the SLR defines the amount of capital a bank has to hold relative to its total leverage exposure. By excluding Treasuries from this, it implies banks do not need to hold capital against their treasury holdings, incentivising them to hold MORE treasuries as it doesn’t use up so much of the balance sheet.

In the words of ISDA:

“This is particularly important given the wave of new issuance expected in the coming years. US Treasury market outstanding issuance is at a record high of more than $26 trillion and is forecast to rise to $48 trillion by 2034, raising questions about how this supply will be absorbed. Given the vital role banks play in supporting liquidity and providing access to client clearing, a permanent exclusion will contribute to a safer, more efficient and more resilient US Treasury market.”

The Fed, Treasury and regulators continue to look for ways to fund the spiralling US deficit. An “operation twist” with the Fed buying more shorter dated T-bills, an end to QT plus Banks encouraged to buy US Treasuries would be quite a potent liquidity mix to juice our markets. For now however, the deficit continues to be funded via the RRP, which had an $80bn drawdown on Friday alone.

This “fiscal dominance” continues to debase the dollar and will keep both equities and Bitcoin moving higher for the foreseeable future, interspersed with some mild liquidity induced pullbacks.

Overall, little to change our big picture, bullish view on BTC.

The Fed continues to move towards rate cuts and will be joined by other major central banks such as the BOE and ECB.

US debt continues to be spiralling unsustainably out of control and whilst being funded by the RRP, is injecting a tidal wave of liquidity into the market which should keep Bitcoin and equities moving higher.

China, trying to maintain a veil of stability, is anything but stable and will need to continue to flood the system with credit to reflate it.

Japan, wanting to “normalise” can only tinker around the edges of policy and can’t fully step away from QE.

Meanwhile, the BTC ETF’s continue to open the door to whole new pools of capital that continue to flood in creating a powerful demand shock, set to accompanied by the powerful supply shock of the halving.

We do expect sizeable 30%+ corrections on the macro cyclicality, but the macro is turning generally more positive, not negative. This circa 10% correction off the highs looks healthy, flushing out some leverage, clearing the path for the next leg higher. We’re still early in this bull cycle 🚀

Native News

Key news from the crypto native space this week.

Netherlands-based D2X has raised $10 million in a Series A funding round led by Point 72 Ventures. The announcement came shortly after receiving unprecedented approval from Dutch regulators to operate a crypto derivatives trading platform in the Netherlands. The funding round, which concluded on Monday and was announced on Thursday, also saw participation from GSR Markets, Tioga Capital, Fortino Capital, Jabre Capital Partners, Picus Capital, and TRGC. D2X The describes itself as the first regulated crypto derivatives trading platform to operate seven days per week in the EU, focusing on serving institutional investors.

Since a low in August, the total stablecoin market capitalisation has bounced back, rising by $20 billion to $146 billion. The biggest contributor to this growth is Tether’s USDT. Tether was able to increase its total supply by over 52% since August, surpassing $100 billion in total circulating supply on March 5. Coming onto the scene more recently is Ethena’s synthetic dollar stablecoin USDe, rising from under $5m in total circulating supply on December 10 to around $980m now.

Financial blockchain provider Digital Asset has completed a test of its Canton Network this week. The Canton pilot, which involved 15 asset managers, 13 banks, four custodians and three exchanges, allowed the firms to transact and settle tokenised assets and deal with fund registry, digital cash, repo, securities lending, and margin management transactions. Digital Asset said "The successful execution of over 350 simulated transactions proved how a network of interoperable applications can seamlessly connect to enable secure, atomic transactions across multiple parts of the capital markets value chain," "It also demonstrated the potential benefits of using such a network to reduce counterparty and settlement risk, optimise capital, and enable intraday margin cycles.” Participants include abrdn, Baymarkets, BNP Paribas, BNY Mellon, BOK Financial, Cboe Global Markets, Commerzbank, DTCC, DRW, Fiùtur, Generali Investments, Goldman Sachs Harvest Fund Management, IEX, Nomura, Northern Trust, Oliver Wyman, Paxos, Pirum, Standard Chartered, State Street, Visa, and Wellington Management with Deloitte acting as an observer, and Microsoft as a supporting partner. Read the full release HERE.

Institutional Corner

Top stories from the big institutions

The European Parliament on Tuesday approved a new batch of rules to crack down on sanctions violations, including through crypto. The EU's restrictive measures apply to a wide range of financial services, including providing "crypto-assets and wallets," the adopted text said. Sanctions can involve freezing assets, including crypto.

Parliamentarians representing the 27 member states of the European Union cast 543 votes in favour of the new rules, with 45 voting against and 27 abstentions. The new rules were prompted by Russia's invasion of Ukraine and rising concerns that EU financial sanctions on Russia were being violated. Although sanctions are adopted at the EU level, individual states are tasked with enforcing those rules – and everything from "definitions of sanction violation" and "associated penalties" can change from country to country. Read the full release HERE.

The Dubai International Financial Centre (DIFC), a tax-free special economic zone in the United Arab Emirates city, announced the enactment of its new Digital Assets Law earlier this week. The enactments aim to help the DIFC keep pace with technological development in international trade and financial markets and to provide legal clarity for investors and users of digital assets. Established to promote financial services and attract international investment, the DIFC operates with its own legal system and courts based on English common law, separate from the wider UAE. The DIFC’s Digital Assets Law follows a review of the regulatory approach taken by various jurisdictions around the world and a period of public consultation carried out last year, coming into effect on March 8. DIFC Chief Legal Officer Jacques Visser said in a statement “We consider this legislation to be ground breaking as the first legislative enactment to comprehensively set out the legal characteristics of digital assets as a matter of property law, and to provide for how digital assets may be controlled, transferred and dealt with by interested parties.” Read the full release from the DIFC HERE.

Erik Thedeen, governor of the central bank of Sweden spoke in parliament this week and warned Swedes off investing in cryptocurrency. He said “I want as little Bitcoin as possible in the Swedish financial system,” “It’s an instrument that is impossible to value, and in practice it’s based on pure speculation.”

Charts of the Week

Because charts are just as important as macro.

Digital Assets ETFs/ETPs have smashed the 2021 record, with inflows now sitting at over $12 billion year-to-date compared to $10.6 billion for the whole of 2021

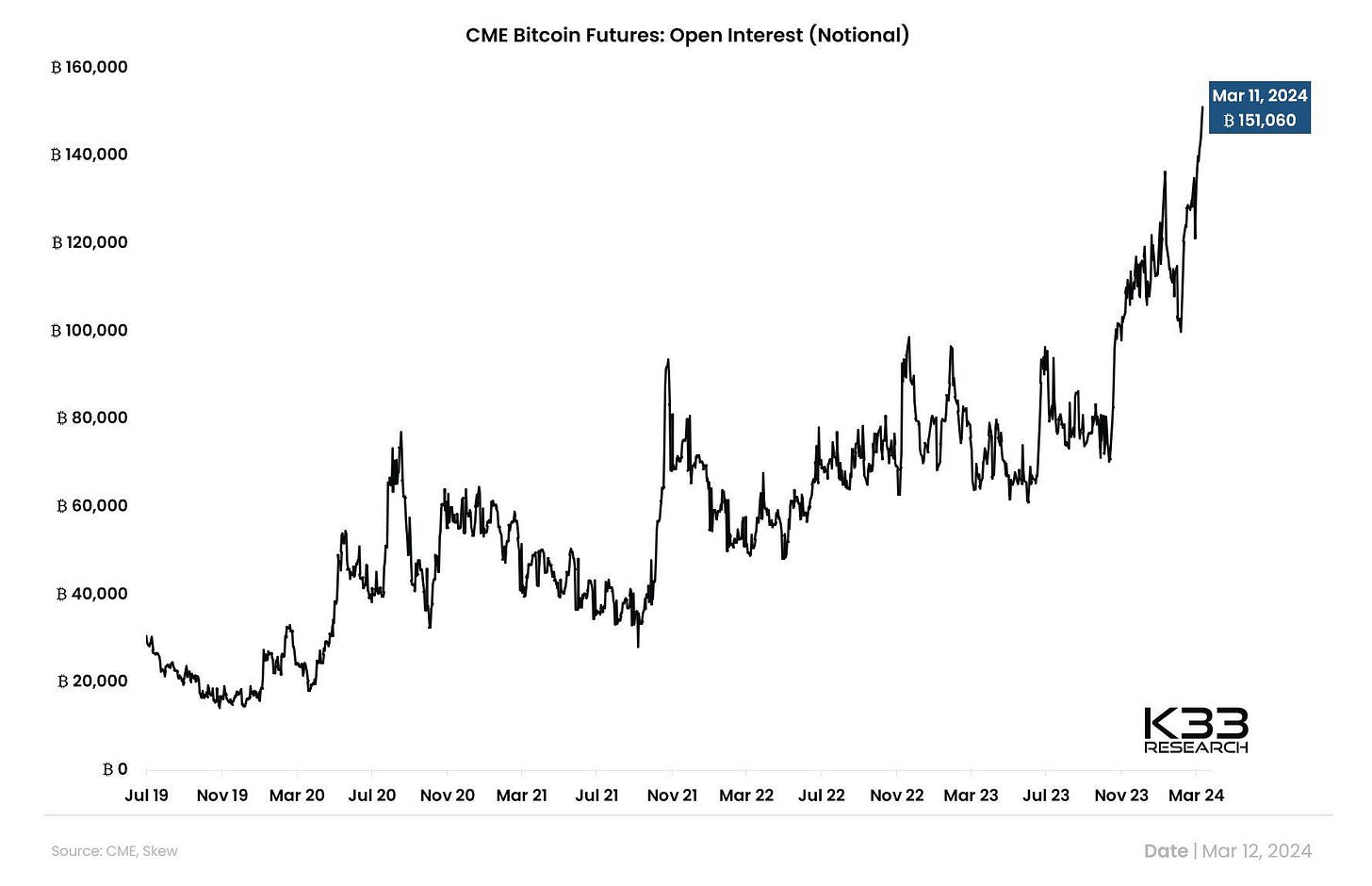

Notional CME open interest has reached a new ATH, surpassing 150,000 BTC for the first time. All growth in CME exposure over the past 3 weeks stems from 2x long BTC ETFs, which have seen their BTC equivalent exposure surge by 148% in 3 weeks.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Business Development Specialist for Crypto at European Blockchain Convention

Institutional Sales for Crypto at The Tie

Head of Digital Assets at fscom

Account Manager (Crypto and igaming) at Checkout.com

Trading Operations Specialist for Crypto at XTX Markets

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.