Quick shout out to Investor Snippets (Sponsor): Get Daily Market Insights in Just 3 Minutes

InvestorSnippets is a daily email with links and bite-sized news on the economy, stocks, and ETFs that only take 3 minutes to read. Curated from dozens of investment news outlets to ensure you stay informed on the top trending stories. Give it a try, it's free.

We have a bonus section for you this week! I attended the AYU Digital Asset Fund Forum. It was a fantastic event attended by multiple hedge funds, who provided their expert advice and opinion on digital assets. Read my summary of the key takeaways below.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Banking sector concerns continue to take centre stage, another Fed hike this week could make banks asset/liability mismatch even worse.

BONUS Section: Key takeaways from the AYU Digital Asset Hedge Fund Forum.

Crypto Native News: Coinbase asks a federal court to force the U.S. SEC to respond to its petition filed last year, Zodia Custody raises $36m.

Institutional News: Digital Token Identifier added to FIX messaging protocol, Visa starts a new crypto project, Franklin Templeton uses public blockchain, Standard Chartered report says Bitcoin could reach $100k by end 2024 and the ECB is looking into how financial transactions recorded on DLT platforms could be settled in central bank money.

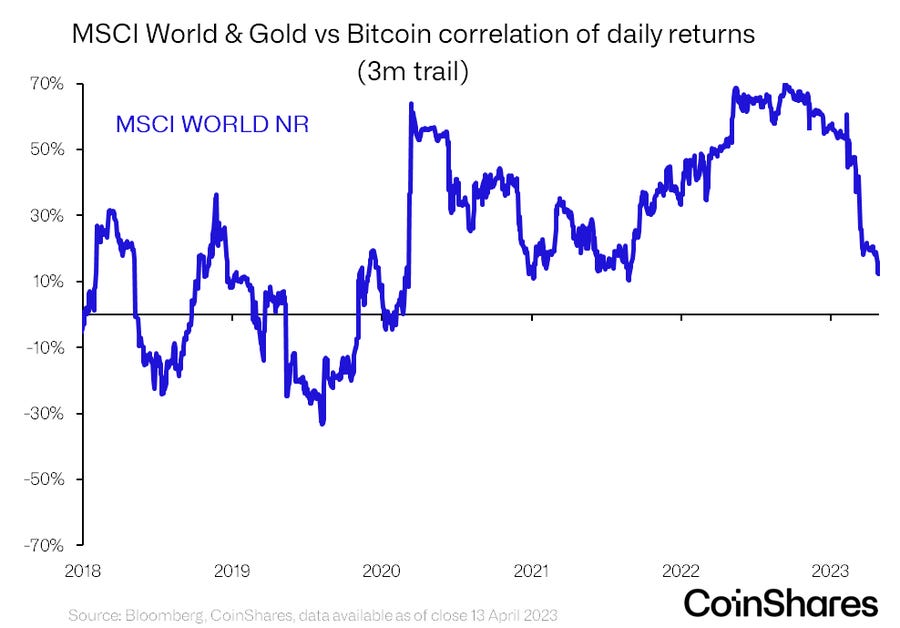

Chart of the Week: Bitcoin correlation to equities down to 12%.

Top Jobs in Crypto: Featuring Coinbase, Checkout.com, Algo Capital, Binance, Copper and Quant Capital

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

Hit Pause to Fast Forward

Banking sector concerns once again took centre stage this week, with First Republic Bank (FRC) revealing in their earnings update that deposits plunged more than $100bn in Q1 and with a clearly unsustainable position, looks set to be taken into FDIC receivership.

Bitcoin received a boost from its role as the hedge against fiat system failures and as usage of the BTFP and Fed discount lending window continues to tick up, it’s clear that banking system stress is not going away. Indeed, with every Fed hike, the asset/liability mismatch that banks are struggling to deal with gets worse and ultimately will lead to one of two outcomes. Either a deep credit crunch that forces rate cuts, or the Fed balance sheet explodes higher as they’re forced to supply liquidity to prevent a contagious collapse of the banking sector. Both scenarios will be bullish for Bitcoin and it looks a case of when, not if.

Ahead of the Fed and the week’s data threw up a stagflationary mix. Q1 GDP came in at a tepid 1.1%, weaker than the 2% expected and down from Q4’s 2.6% yet core PCE for Q1 stronger at 4.9%, up from 4.4%. Friday’s core PCE for March at 4.6% YoY down from 4.7% maybe allaying some concerns along with Powell’s favored core PCE services ex housing also softening at 0.24%. Focus now on how JPow balances the growth/recessionary risks against stubbornly high inflation, all against a back-drop of a brewing banking crisis!

This week also saw the new BoJ Governor, Kazuo Ueda’s debut policy meeting. Expectations have been growing that the BoJ is ready to tighten policy and move away from YCC, yet whilst maintaining the policy status quo on rates and current yield targets (as expected) the bank said it “decided to conduct a broad-perspective review” of its easing measures, with a planned time frame of around 1.5yrs to complete the review. The step away from YCC kicked into the long grass, JPY abruptly selling off, 10yr JGB yields down some 10bps.

This is an important development, not just as it relates to liquidity but also for the US bond market and our bullish duration view. With reduced near term risk of BoJ induced bond market volatility, US yields have a cleaner path to follow growth lower and provide a positive rates tailwind to crypto.

Broadly, the risk backdrop continues to look supportive. Better earnings out of the tech sector powering stocks higher. Vix as a measure of expected equity volatility now sits on a 15 handle, its lowest levels in over a year. The Move Index, a measure of bond volatility, also continues to drift lower from its Feb/March peak highs.

We understand concerns around recession, but rates and liquidity are such important drivers in this fiat based world. The growth slowdown and impending recession will go hand in hand with the bottom for the liquidity cycle and as the liquidity tide rises, all boats will be lifted.

As we come into a big week, headlined by the Fed, but likely early focus on FRC, it feels like powerful momentum is building behind Bitcoin. The Fed is about to hit pause, confirming our “peak inflation, peak rates, peak Fed” view of the world at the same time another fiat system bank fails. As the Fed hits “pause”, Bitcoin may be set to hit fast forward. Let’s go!

BONUS Section – Key takeaways from the AYU Digital Asset Hedge Fund Forum

Here’s a high level summary of 3 panel discussions led by digital asset funds and service providers. The topics were digital asset infrastructure, crypto fund of funds and family office experience of crypto.

Digital Asset Infrastructure: A big concern at present is the fiat to crypto on and off ramp. It would be helpful to have more consistency from the larger traditional banks, particularly on KYC and on boarding. Some funds have experienced the freezing of accounts with little or no notice. The post FTX bear market washed out some of the bad actors, with some of the better actors surviving or new ones being born. Of those that survived, there has been a step up from the crypto native exchanges, for example due diligence is better than before. There has also been a notable emergence of TradFi infrastructure, particularly in custody and trade execution. Panellists suggested using the “biggest” partners for custody and its important to have more than one custodian. They also suggested that the cost of services should matter less, you should be willing to pay for operational excellence from your infrastructure partners. From experience, some of the bigger custodians have large balance sheets but they aren’t at the forefront on tech integration yet. The biggest want from the fund managers was an instant settlement custodian. The way the market has redesigned the counterparty risk post FTX has been very positive, off exchange settlement is used much more now. One fund said they had 5% off exchange settlement which then changed to 95% off exchange settlement after FTX.

Crypto Fund of Funds: The main challenge in 2023 has been raising capital to allocate. There lots more people managing crypto using their own/friends/family money, but there’s been a lack of allocation to funds. The quality of fund of funds is improving. Due diligence is better and the business structures have improved, for example there are more independent directors on the board of funds. Looking at specific types of fund, there’s been a distinct lack of performance from trend following CTA funds. Correlation between coins is so high, its hard to find diversification and edge across the coin universe. Arbitrage funds have been less popular this year. In order to generate decent returns, you have to use leverage, so your counterparty risk naturally increases. The main bulk of liquidity is still on the CeFi exchanges, so in order to reduce your counterparty risk you need to do off exchange settlement. Long/Short directional funds and strategies have been the most popular so far this year. All of the panelists suggested that DeFi is likely to play a more significant role in the future, however, KYC and AML needs to be better understood and developed. When asked what they were most excited about for 2023, there was a mix of answers including more regulatory developments, continued opportunity in statistical arbitrage and RV trades and the continued movement of talent from TradFi to crypto!

Family Office experience of Crypto: Firstly, the panellists discussed the current appetite of the 3 types of investors. It was suggested that Institutional investors has slowed down fresh fund allocations. However, there were some exceptions where a long-standing relationships had been built so investments were still being made. Family Office investment was close to stopping post FTX, but there has been a pick up again in recent weeks. Fund of funds have been the most active of the 3 categories so far this year. What do family offices look for? Obviously, the simple answer is the highest returns, but the events of 2022 are a good barometer for fund success. Its easier to do well in a bull market, but not in a bear market. Last years performance is telling. There is also a mix of risk appetite between family offices. Some just “want to get off of zero” returns. They understand that its easier to have no “skin in the game” but its worth risking a few basis points for returns. Others look for much riskier gains in order to build generational wealth. A couple of panellists said that in the current environment, market neutral strategies are less interesting, they want directional strategy returns.

There was also a interesting fund “pitch off”, where 6 funds were tasked with ‘selling’ their fund to a panel, Dragons Den style. It was fascinating to watch successful fund managers put under the spotlight!

If you work in a fund, family office or investment firm, check out AYU. They are a private members club that connects the global investment community. You can find out more here: www.thisisayu.com

Native News

Key news from the crypto native space this week.

Coinbase asked a federal court to force the U.S. Securities and Exchange Commission (SEC) to respond to its petition filed last year, asking for formal rulemaking within the digital assets sector. Coinbase filed an Administrative Procedure Act challenge against the SEC on Monday. The exchange asked the Third Circuit Court of Appeals to order the SEC to provide "regulatory clarity" around how existing securities laws might apply to the digital asset sector. Monday's filing, however, is a pre-emptive move by Coinbase to argue that the SEC's approach doesn't provide sufficient regulatory guidance for U.S. companies operating in the crypto sector. The filing said "It is widely recognised – including by a sitting SEC Commissioner – that existing SEC registration and disclosure requirements are incompatible with digital assets, which differ fundamentally from the stocks, bonds and investment contracts for which the securities laws were designed, and that the SEC traditionally has regulated. The SEC at a minimum must set forth how those inapt and inapposite requirements are to be adapted to digital assets. But the SEC has refused to do even that”.

Standard Chartered’s spin-off crypto custodial unit Zodia Custody Ltd. closed $36 million in new funding this week. It was part of a round led by Japan’s SBI Holdings and marks a dilution of the British bank’s ownership over its subsidiary. Zodia is headquartered in London and was previously backed solely by Standard Chartered and Northern Trust, with Standard Chartered owning a 90% stake. The series A fundraise, which also saw the bank’s venture arm SC Ventures participate, followed the launch of Zodia’s business in Japan as a joint venture with SBI Holdings in February. SBI Holdings is now the firm’s second-largest shareholder. Julian Sawyer, Zodia’s CEO said in an interview “It is part of our strategy to be bank-backed, and all the good things that that brings,” he said. “That doesn’t mean there has to be a single bank.”

Institutional Corner

Top stories from the big institutions.

In a key development for electronic digital asset trading the Financial Information eXchange Protocol (FIX) – the industry-standard messaging protocol used in electronic communication between banks, asset managers, exchanges, vendors and regulators – has added greater support for cryptocurrencies and other digital assets. It’s done so by adopting the Digital Token Identifier (DTI) ISO standard. The DTI ISO standard is increasingly being used by industry as it uniquely identifies digital ledgers, digital tokens and cryptocurrencies using publicly available information. Over 1,300 DTIs have been issued so far, including private ledgers and tokenised assets. Stocks, bonds and other financial instruments already use various standardised ID codes to simplify trade connections. So the emergence of DTI will help with TradFi adoption of digital assets.

Visa announced this week that it will be starting a new cryptocurrency related product focused on stablecoin payments. Visa say the project is designed to drive mainstream adoption of public blockchain networks and stablecoin payments. They are currently looking to hire some senior software engineers to help with the project. Among preferred applicant qualifications, Visa listed a good understanding of layer 1 and layer 2 solutions alongside experience with writing smart contracts using the programming language Solidity. Cuy Sheffield, the head of Digital at Visa said “Particularly interested in experience using Github Copilot and other AI assisted engineering tools to write and debug smart contracts” Read the full job spec HERE.

Franklin Templeton this week announced that the Franklin OnChain U.S. Government Money Fund (FOBXX), the first U.S.-registered mutual fund to use a public blockchain to process transactions and record share ownership, is now supported on the Polygon blockchain. Franklin Templeton say they continue to see operational efficiencies through use of a blockchain-integrated system, including increased security, faster transaction processing and reduced costs, benefiting fund shareholders. The fund’s transfer agent maintains the official record of share ownership via a proprietary blockchain-integrated system that utilises blockchain technology for transaction activity. Roger Bayston, Head of Digital Assets at Franklin Templeton. "Extending the reach of the Franklin OnChain U.S. Government Money Fund to Polygon enables the Fund to be further compatible with the rest of the digital ecosystem, specifically through an Ethereum-based blockchain. This furthers our distribution reach through a Layer 2 (L2) blockchain that has a proven track record”

Standard Chartered released a research report this week titled “Bitcoin - Pathway to the USD 100,000 level.” The report says that Bitcoin’s value could jump to as much as $100k by the end of 2024. The collapse of Silicon Valley Bank and other mid-tier U.S. lenders has solidified the case for bitcoin as a “decentralised, trustless and scarce digital asset.” Some selected quotes from the report include: “The current stress in the traditional banking sector is highly conducive to BTC outperformance – and validates the original premise for Bitcoin as a decentralised, trustless and scarce digital asset,” “Given these advantages, we think BTC’s share of total digital assets market cap could move into the 50-60% range in the next few months (from around 45% currently).”

The Eurosystem, via the ECB is looking into how wholesale financial transactions recorded on DLT platforms could be settled in central bank money. The purpose of this initiative is to (i) consolidate and further develop the ongoing work of Eurosystem central banks in this area, and (ii) gain insight into how different solutions could facilitate interaction between TARGET services and DLT platforms. Read full details from the ECB HERE.

Chart of the Week

Because charts are just as important as macro.

Bitcoins correlation to equities is now only 12%.

Hat tip to James Butterfill for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Trade Surveillance Analyst at Coinbase

Customer Success Manager at Checkout.com

Portfolio Manager at Algo Capital

Business Development Lead at Binance

Accounts Receivable Analyst at Copper

Project Manager at Quant Capital

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.