Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Crypto newsflow remains positive, but the macro is providing a headwind. Though crypto’s resilience is notable and highlights an underlying, idiosyncratic strength.

Crypto Native News: Circle to issue Japan stablecoin? Ripple looking to tokenise real estate and Bakkt expanding out of the US.

Institutional News: UK Finance lays out plans for tokenised markets, the FCA issues letter on crypto marketing, the MAS provides more regulatory clarity and the AMFE urges regulators to include DeFi in MiCA.

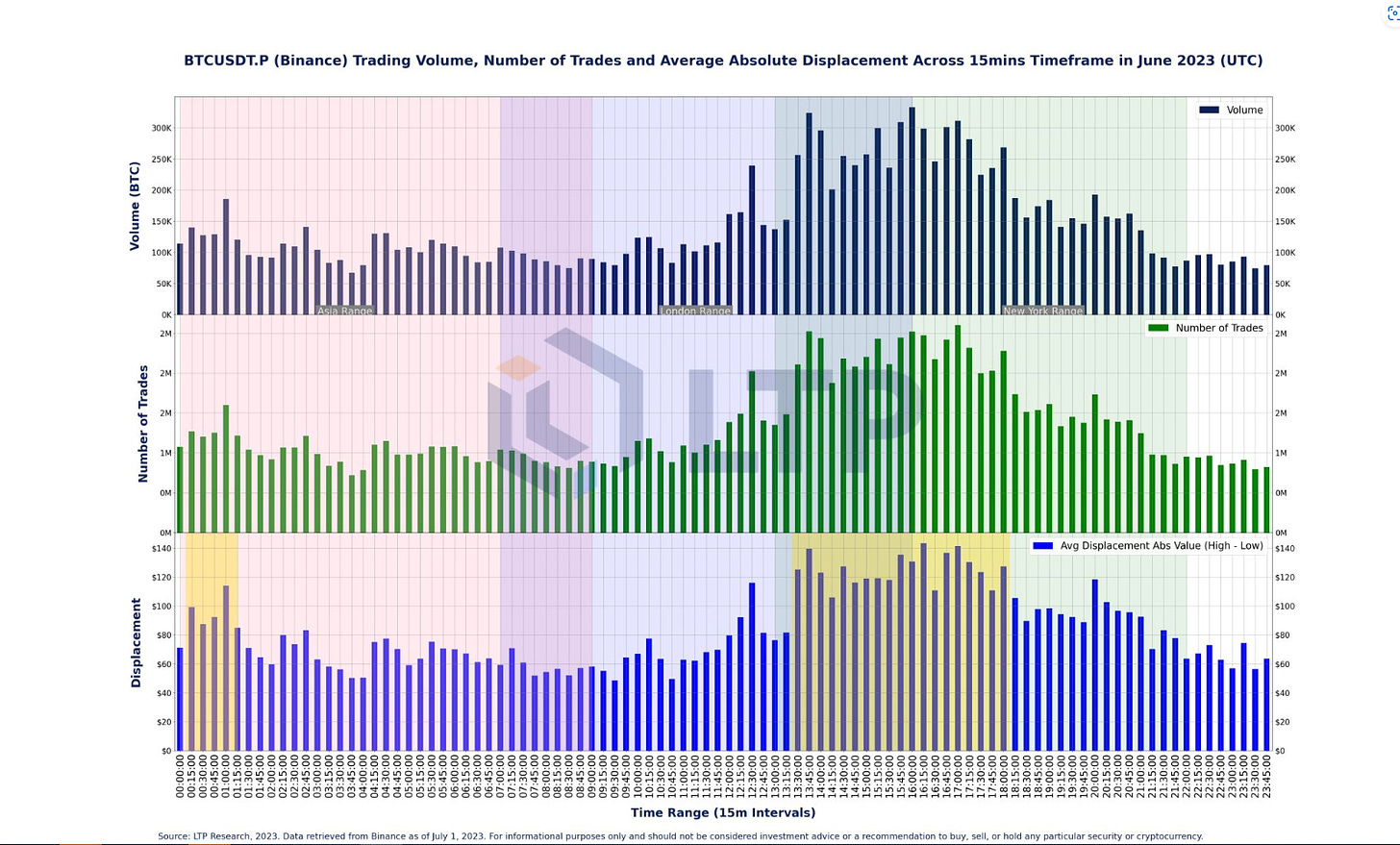

Chart of the Week: Crypto volumes higher during US hours.

Top Jobs in Crypto: Featuring Finixio, Coinbase, Ripple, Laser Digital, OKX and Coinshares.

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Macro Update

This is where we connect the dots between macro and crypto.

Bond Villain

A holiday shortened week and crypto majors traded a volatile range to end the week just a touch lower, yet it felt worse given the reversal off the new year highs for BTC above 31.5k.

Larry Fink’s comments recognising Bitcoin as an “international asset” and “digital gold” that can protect from currency debasement added to the positive narrative tailwinds that, combined perhaps with some short gamma chasing propelled us to new highs.

Yet the macro acted as a persistent headwind, with a viscous sell off in global bond markets weighing. It’s been difficult to pinpoint the catalyst. Bond markets have been trading heavily since last week’s upward revisions to GDP and a general refusal for the US economic data to die.

A blowout 497k ADP jobs print on Thursday seemed to trigger some towel throwing for bond longs, driving 10yr yields above 4% and 2yr to 5.11% highs. Ouch.

Non Farm Payrolls on Friday bringing some calm with a softer 209K print (smallest print since late 2020) and 110k of downward revisions to April and May combined. Earnings were stronger at 0.4% Vs 0.3% exp MoM but remained at 4.4% on a YoY basis and have been in a general downtrend. The Fed would like to see this come lower, but there’s no evidence of a wage/price spiral. The sharp reversal lower in 2yr yields was notable and perhaps suggests this bond move has run its course.

Elsewhere and adding to our sense of head scratching at LCC on the global bond move, data remained soft.

Deflationary flickers in Europe as PPI declined 1.5% and points to CPI falling sub 2% over the coming months. The composite PMI also fell into contraction territory at 49.9.

Meanwhile the cold front in China continues to be felt. China services PMI came in well below expectations at 53.9 raising concerns for the global growth outlook.

Risk of a Central Bank policy error is growing daily!

Curiously and offsetting the negative impact from higher yields, the dollar ended the week lower and with recent management changes at the PBOC, it feels a line has been drawn under RMB weakness. Or did Yellen on her visit strike some kind of deal? Either way, the dollar weakness is off-setting the negative impact of higher yields for crypto and is an important development to watch.

In light of these headwinds from the bond market, crypto’s resilience has been notable and points to underlying, idiosyncratic strength. Should Friday’s yield reversal mark the yield top and underlying USD weakness gather momentum, crypto majors can propel into a new higher range. The pressure is building.

Native News

Key news from the crypto native space this week.

Circle co-founder and CEO Jeremy Allaire said this week that his company are considering issuing a stablecoin in Japan. The statement from Allaire comes after Japan’s rules overseeing stablecoin issuance took effect on 1 June. As a reminder Japan’s parliament passed a bill for stablecoins, requiring that coins must be pegged to the yen or other fiat currency and holders must have the right to redeem them at face value. The legislation clarifies that stablecoins can only be issued by licensed banks, registered money transfer agents and trust companies.

Ripple highlighted another focus aside from CBDC and stablecoin development, tokenising real estate assets. During a fintech conference in Romania this week, Anthony Welfare, CBDC advisor at Ripple, presented a use case that combines the digital Hong Kong dollar (e-HKD), tokenised real estate and finance lending protocols. The pilot program aims to enable users to tokenise real estate assets and utilise them as collateral for loans, leveraging Ripple’s CBDC platform.

This week, Bakkt CEO Michael Gavin Michael said the company is looking at Hong Kong, the UK and the EU for international expansion, this is because the US continues to lack a clear regulatory framework. He added “We’ve said quite clearly that whilst we’re committed to the US market were looking for markets where there’s traction and using those markets as a way to fuel growth”. Bakkt international plans are supported by its recent purchase of US based crypto platform Apex Crypto.

Institutional Corner

Top stories from the big institutions.

This week, UK Finance, a lobby group for banking and financial institutions, laid down a five-year-plan for the country’s government to become a world leader in tokenised markets. The report is a result of consultations with market participants, the government, and regulators. It highlights some of the key benefits of tokenisation, or the translation of financial assets onto blockchains. These include could lower transaction costs, allow for instant payment settlements, and reduce counterparty risk through programmable smart contracts, as well as through recording immutable data on blockchain. You can read the full report HERE.

This week the Financial Conduct Authority (FCA) wrote to firms marketing crypto-assets to UK customers to comply with the incoming financial promotions regime or risk criminal charges. The FCA's order is effective from 8 October, and includes overseas firms that market their products to UK customers. The FCA letter issued Tuesday stated: "Promotions that are not made using one of these routes will be in breach of section 21 of the Financial Services and Markets Act 2000 (FSMA), which is a criminal offence punishable by up to 2 years imprisonment, an unlimited fine, or both." The FCA has outlined the requirements for promoting crypto-assets in the UK, with four legal methods:

An authorised person communicates the promotion.

An unauthorised person communicates the promotion, but an authorised person approves it.

A crypto asset business registered with the FCA communicates the promotion.

The promotion otherwise meets the conditions of an exemption in the Financial Promotion Order.

The Monetary Authority of Singapore announced that crypto service providers in Singapore would need to deposit customer assets under a statutory trust before the end of the year for safekeeping. The requirement comes after the MAS received public consultation around enhancing customer protection initiated in October 2022. The MAS has also restricted cryptocurrency service providers from facilitating lending and staking tokens to retail customers, but institutional and accredited investors could continue to take advantage of these services.

The Association for for Financial Markets in Europe (AFME) has urged regulators not to exclude DeFi from its MiCA framework. The paper from AFME says “We believe it is crucial to avoid the potential exclusion of so called ‘decentralised activities’ as this could open up opportunities for regulatory arbitrage and weaken the application of emerging frameworks”. They add that “This exclusion could create unintended risks to financial stability and potential knock-on impacts. While the current overlap of DeFi and TradFi is not yet significant, this should be actively monitored and managed” You can read the full paper HERE.

Chart of the Week

Because charts are just as important as macro.

Trading volumes higher during US hours. Hat tip LTP Research for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

International Derivatives Exchange Lead at Coinbase

Senior Product Manager, Blockchain Data at Ripple

Investment Analyst, Venture Capital at Laser Digital

Product Content Creator (Exchange) at OKX

Quantitative Trading Analyst at CoinShares

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.