Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Heading into the second half of the year then, we feel the macro is unfolding perfectly. Read why below.

Crypto Native News: Binance received MVP VARA license, CoinShares confirmed its FTX claim sale, Coinbase partners with Stripe, BitWise say ETH ETF flows could be large and Mt Gox to distribute bitcoin payments.

Institutional Corner: State Street Global Advisors to partner with Galaxy on crypto products, VanEck files for SOL ETF.

Charts of the Week: Lots of ETH held by long term holders, Base continues to grow, Memecoins the most profitable crypto sector in H1.

Top Jobs in Crypto: Featuring Revolut, Checkout.com, Ripple, Kraken, Coinbase, OKX and Importable.

Macro Chart of the Week - The weight of Tech shares in the S&P 500 has risen to near 35%, the highest level since the dotcom era. Hat tip to Scott Melker for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

On Track

A relatively quiet week on the macro front saw markets dominated by the machinations of month and quarter end. Portfolio rebalancing and quarter end “window dressing” by banks tend to make for choppy trading and generally have a negative impact on market liquidity. Perhaps in that context, it was no surprise to see Bitcoin continue to trade heavily and chop around the 60k level.

✍️ Side note: Banks report financial and regulatory information at the end of every quarter and under the leverage ratio framework, disclose their capital relative to their total exposures. High leverage ratios can impose high capital costs, so banks typically reduce activity such as repo lending to “window dress” the balance sheet and make it appear like they take less leverage than they actually do throughout the quarter. The reduction in lending activity consequently having a negative impact on liquidity. Opaque, centralised systems not operating on a public, transparent blockchain get to game the system this way 😜

The key data release on the week was the Fed’s preferred inflation measure, core PCE, which continued to slow from 2.8% to 2.6% YoY and just 0.1% on the month. The disinflationary process continues, albeit slowly and continues to keep Fed rate cuts in play. Markets are now pricing a 72% probability of a September rate cut with a high probability of 2 cuts by year end.

The first Presidential debate also captured attention. Broadly for markets, neither candidate matters too much as they’re both intent on continuing to run insane level deficits which will continue to debase the currency and drive asset prices higher in fiat terms. Trump's outperformance on the night against Biden who’s mental faculties are clearly failing, is a marginal positive for Bitcoin given Trump’s recent pro crypto stance. Yet just reading that sentence back, Bitcoin as the hedge against the failure of current economic and political structures never looked more appealing!

The macro unfolding perfectly…

We started this year bullish Crypto and tech as major central banks move towards their respective cutting cycles alongside an improving liquidity environment. Crypto and tech overlaid with their secular trends to benefit the most and at the halfway point, they indeed lead the way with Nasdaq up over 17% and Bitcoin up over 40%. One call that so far has been wrong is with bonds, where we expected a slowing economy and rate cutting cycle to ignite a bond rally and drive yields lower. 10yr yields are up circa 50bps since the start of the year. The US running emergency level deficits helping the economy remain resilient in the face of high Fed rates and driving a relative economic divergence with the rest of the world. This has helped the dollar outperform, with the broad index up circa 5%. Higher yields and a stronger dollar acting as a persistent headwind to crypto, off-set with improving global liquidity.

Coming into the second half of the year, US growth is starting to falter and there are signs the labor market is starting to crack. Whilst the US continues to run ever increasing deficits, the debt intensity of growth is rising (each unit of growth requires a greater unit of debt) and we expect the bond rally we were expecting at the start of the year can finally begin in earnest in the second half of this year as the economy slows. US yields and the dollar then become a tailwind and start to propel the next leg higher of this Bitcoin bull market.

This reversal in US yields and the dollar will be particularly important for the JPY and CNY dynamic. The Bank of Japan, whilst tightening policy is still having to engage in QE to prevent bond yields spiking uncontrollably higher (when you’re running a debt/GDP deficit of around 220%, the central bank will necessarily need to monetise those bonds) and this is seeing the currency decimated against the dollar. China meanwhile is also battling a disinflationary economy and sprawling housing market crisis and also engaging in pseudo QE, yet trying to maintain control of the currency and avoid huge capital outflows.

Of course, this is unsustainable. China has started to run a “crawling peg” slowly devaluing the currency whilst trying to maintain control with interventions, selling FX reserves to support CNY. Short term, this actually reduces liquidity and has been a factor weighing on Bitcoin. Yet it feels we’re nearing a breaking point. Either China and Japan spiral into full currency crisis or they are saved by a dovish Fed and reversal in US yields. We think the latter will be how this resolves. Both scenarios however drive us to the extreme risk tail scenarios at which Bitcoin thrives.

Meanwhile, the shifting political winds have been a positive surprise we didn’t anticipate, the significance of which is still under priced. With Donald Trump quick to grasp the electoral benefits of being pro-crypto, Democrats have realised the anti-crypto stance is not a hill worth dying on. Gensler’s wings have been clipped and the SEC are now being forced to U-turn on previously stated positions. ETH being classed as a commodity was not on many bingo cards to start the year. With the ETH ETF’s set to launch in July, bringing fresh capital flows into the space, we look very much on track for “alt season” to begin and lead a broad crypto rally, lifting all boats. This looks and feels like any other post halving cycle.

Heading into the second half of the year then, we feel the macro is unfolding perfectly. Major central banks have begun the rate cutting cycle and the US is getting ready to follow. The global liquidity cycle is set to accelerate. Meanwhile ETF’s are opening new channels for capital to flow in at a time when the political environment is becoming more crypto friendly. Some of the negative flow drivers such as weak miners selling post halving should also abate.

After a breathtaking start to the year, followed by post-halving consolidation, the conditions are brewing for Bitcoin to perform even stronger in the second half. Don’t lose sight of the bigger picture 🚀

Native News

Key news from the crypto native space this week.

Binance announced that it has received a Minimum Viable Product (MVP) Virtual Asset Service Provider (VASP) licence from Dubai’s Virtual Assets Regulatory Authority (VARA) for its local exchange in Dubai, Binance FZE. All UAE resident users will gradually be contacted via email to update their KYC information by submitting certain documents by the KYC deadline. The MVP license means that Binance can offer an approved range of virtual asset related services to suitably qualified retail and institutional investors in Dubai within an internationally benchmarked legislative framework for virtual asset service providers (VASPs). The transition to an MVP License, from a Provisional License received earlier this year, means Binance can open a client money account with a domestic bank and provide the following services to qualified customers:

Virtual asset exchange services

Conversion between virtual assets and fiat currencies

Transfer of virtual assets

Custody and management of virtual assets

Virtual token offering and trading services

Virtual asset payments and remittance services

CoinShares International Limited, announced this week the successful sale of its FTX claim. The agreement, subject to customary closing conditions, will yield a recovery rate of 116% net of broker fees, resulting in a return of £31.32 million on a £26.6 million claim. Jean-Marie Mognetti, CEO of CoinShares, commented: "The resolution of the FTX situation has been highly favourable for CoinShares. This exceptional recovery rate is a testament to the diligence and expertise of our team. We remain dedicated to leveraging this success to reward our shareholders and to drive further growth and innovation within the digital asset industry."

Coinbase partnered with payments firm Stripe this week. Stripe will incorporate Coinbase's Layer 2 network Base into its crypto payout products, and Coinbase will add Stripe as a way for its customers to buy crypto with credit cards or Apple Pay inside the Coinbase Wallet. Additionally, Coinbase customers will be able to use the stablecoin USDC via Base on Stripe to streamline fiat-to-crypto conversions and facilitate money transfers to over 150 nations. Coinbase said in their statement "Crypto is the future of money because it is unrestricted by international borders or banking hours, and reduces both friction and fees for users. These three key integrations lay a strong foundation for Stripe and Coinbase to begin building a better payments future for users around the world." Read the full release from Coinbase HERE.

Bitwise CEO Matt Hougan said in a report this week that Ether spot exchange-traded funds (ETFs), which are expected to be approved for trading in the U.S. in coming months, are likely to attract $15 billion of net inflows in their first 18 months. The report said that one way to estimate potential inflows is to consider the relative market caps of bitcoin and ether. Bitcoin is currently 74% of the combined market value. U.S. investors have invested $56 billion in spot bitcoin ETFs since their introduction in January, a number that is expected to grow to $100 billion or more by the end of 2025 as large wirehouses approve the products for trading on their platforms. Hougan added “Using this $100 billion figure as a reference, spot ether ETPs would need to attract $35 billion in assets to reach parity, a process I expect will take about 18 months” Read the full report HERE.

Defunct bitcoin exchange Mt. Gox is set to begin distributing bitcoin and bitcoin cash repayments from July, according to a notice sent by Rehabilitation Trustee Nobuaki Kobayashi on Monday. “The Rehabilitation Trustee has been preparing to make repayments in Bitcoin and Bitcoin Cash under the Rehabilitation Plan. Now that these preparations are in place, the Rehabilitation Trustee will commence the repayments in Bitcoin and Bitcoin Cash … from the beginning of July 2024,” Kobayashi wrote in the notice. Kobayashi has asked the users for patience, adding that the order of the payments will depend on the respective cryptocurrency exchange. Notably, over $9.4 billion worth of Bitcoin is owed to approximately 127,000 creditors of Mt. Gox. These creditors have been waiting for over 10 years to recover their funds following the exchange’s collapse in 2014 due to multiple unnoticed hacks. Read the announcement HERE.

Institutional Corner

Top stories from the big institutions

State Street Global Advisors and Galaxy Asset Management said they are working together to build crypto products that offer exposure to crypto companies as well as spot and futures-based exchange-traded funds (ETFs). State Street Global Advisors, a unit of financial services giant State Street, filed an application with the U.S. Securities and Exchange Commission to register a crypto-based fund called the SSGA Active Trust. Galaxy will be responsible for the day-to-day management of the fund’s investments, according to the filing. The company is affiliated with Galaxy Digital, a financial services company that specialises in digital assets. Anna Paglia, State Street Global Advisors chief business officer said “We believe that the digital assets landscape is so much more than the single crypto components and that crypto native companies are best equipped to understand that ecosystem and its correlation with financial markets.” See the filing from State Street HERE.

Investment management firm VanEck filed with the U.S. SEC for the country's first potential spot SOL exchange-traded fund (ETF). Matthew Sigel, announced that investment manager has become the first company to propose a spot SOL ETF. Sigel wrote on X (formerly Twitter) that VanEck believes Solana is a "competitor" to the Ethereum blockchain and its "unique combination of scalability, speed and low costs may offer a better user experience for many use cases." He added that VanEck deems the SOL token is a commodity as it functions similarly to the world's two top cryptocurrencies, Bitcoin and Ether. "SOL's decentralised nature, high utility, and economic feasibility align with the characteristics of other established digital commodities," 21Shares followed suit on Friday, see their filing HERE.

Charts of the Week

Because charts are just as important as macro.

78% of ETH is owned by long-term hodlers. Hat tip to IntoTheBlock for the chart.

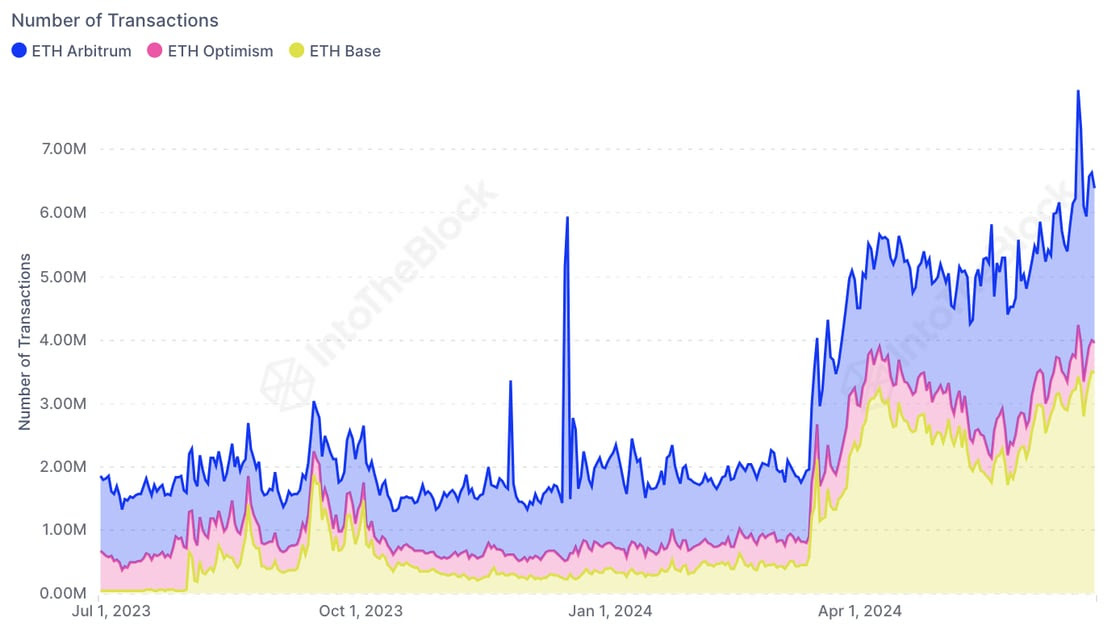

In Q2, Base emerged as the top performer among Ethereum Layer 2 solutions, recording a substantial increase in transactions. Hat tip to IntoTheBlock again for the chart.

Memecoins became the most profitable sector in the first half of 2024.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Product Marketing Manager for Crypto at Revolut

Junior Account Manager for Crypto and iGaming at Checkout.com

Senior Manager, Business Development (Institutional DeFi) at Ripple

Kraken Institutional - Sales Manager - Staking

Money Laundering Reporting Officer UK at Coinbase

Head of Product Marketing, Institutional at OKX

Blockchain Protocol Engineer at Imporbable

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.