Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: US data reducing the rate hike views, China QE adding positive liquidity momentum leading to positive macro tailwinds.

Crypto Native News: Circle shifting from Ireland to the US, crypto VC raises increasing

Institutional Corner: Deutsche Bank works with MAS on tokenisation, Robinhood launches Solana staking, Biden forces a Chinese-backed crypto miners to sell US land.

Charts of the Week: Bitcoin correlation to US stocks rises, Brazilian trade volumes rise in 2024.

Top Jobs in Crypto: Featuring Ministry of Defence, Mynth, 121 Recruiters, CryptoRecruit, The Tie, FCA, XBTO.

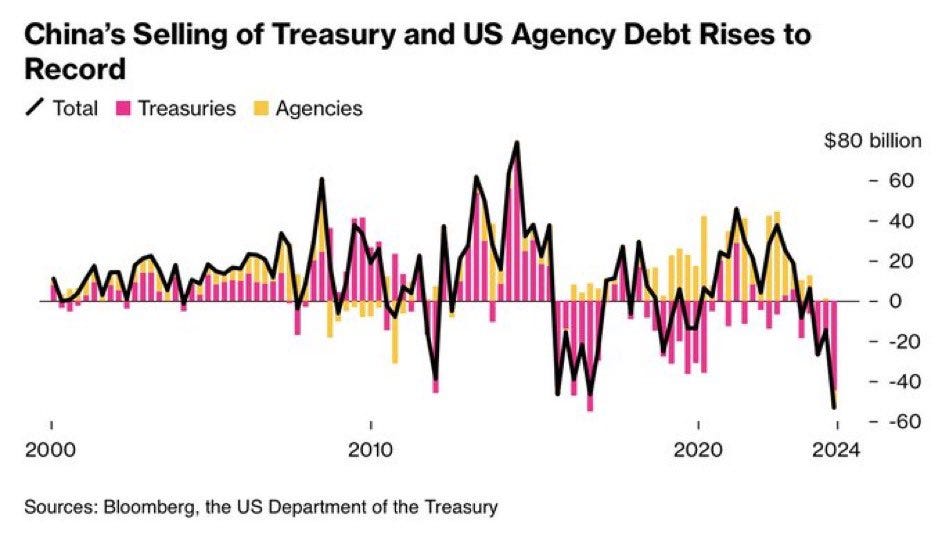

Macro Chart of the Week - China’s selling of treasuries and agency debt rises to a record.

Macro Update

This is where we connect the dots between macro and crypto.

Stars Aligning

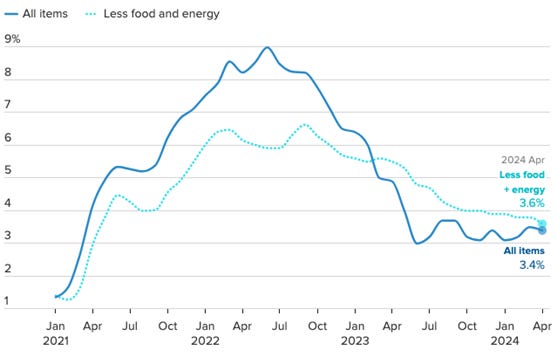

With the macro back in the driving seat for Bitcoin, all focus this week was on the big inflation print. There’s an asymmetric risk/reward into data post the recent FOMC in which JPow took the idea of hikes off the table, instead looking for data to form a path to cuts, or else remain on hold. The CPI data which came in softer than expectations helped the market along the path to cuts, with 2 cuts now priced back in for 2024.

Headline CPI rose 0.3% in April, a tick below expectations, with the YoY rate inching down to 3.4%. The all important core inflation also came in weaker on the month at 0.3% with YoY core inflation at 3.6%, the lowest level since April 2021. We’ve been highlighting how the market moved too far to price out the Fed and this data will help moderate the more hawkish views and kill market chatter on the potential for rate hikes. Indeed, CPI is following a typical path from other high inflation periods, with sharp disinflation, followed by a bumpy plateau, before the next leg down.

US CPI - Bumpy, not re-accelerating

Adding to the positive momentum for markets, in a “bad news is good news” redux, retail sales also came in weaker, flat on the month Vs 0.4% exp, whilst the “control group” which strips out a number of items and feeds the GDP calculation fell 0.3% on the month. Signs that the US consumer is weakening, which in turn will keep inflation under control.

The softer data marked the 6th straight week of negative data surprises and dealt another blow to the US “reflation” narrative that was a key driver for the move higher in US yields and the dollar. We suspect we’re at the start of a more pronounced bond rally which should keep US yields heading lower and in turn weigh on the dollar, which will provide a nice tailwind for Bitcoin and broader risk. With liquidity also improving in Q2 with a lower bond issuance schedule, alongside the $35bn additional reinvestment from the Fed on the QT taper, plus the Treasury set to start $2bn a week in treasury buybacks, the path higher from here should be clearer.

China QE…

Adding to positive liquidity momentum, China significantly stepped up stimulus measures last week. First firing the starting gun on plans for an ultra-long bond issuance, to support investment. Crucially, the PBOC hinted in April that it would buy these bonds on the secondary market to “better control interbank rates”. QE with Chinese characteristics. On Friday, China also announced a historic rescue package to stabilize the ailing property sector. The PBOC slashed the minimum downpayment required for both first and second time buyers but more importantly, said it would set up a RMB 300bn lending facility to allow state owned banks to purchase unsold homes. This is essentially a form of QE for real estate, monetising the property sector 🤯

Major fiat economies remain in a perpetual need to artificially inflate the assets which are the collateral underpinning their debt driven economies and in the process, continually debase fiat currency. The best property to own is digital property!

We suggested 2 weeks ago post the dovish Fed, alongside the pseudo yield curve control enacted by the Treasury that liquidity was likely to flow and drive a “buy everything rally” that will see equities and Bitcoin push to new record highs. Equities recorded those new highs last week and with Bitcoin now testing the key resistance into the 67K zone as I write, it’s a matter of when, not if Bitcoin also makes new highs for this cycle.

Adding to powerful macro tailwinds, the spot BTC ETF inflows have picked back up, with $716mio in net inflows this past week. May inflows have now unwound the entirety of April’s outflows 💥

Additionally, the 13F filings have shown some of the largest institutional funds holding the ETF’s, with the likes of Millennium Management holding $2bn worth of shares alongside some other heavy weights from the hedge fund world. Perhaps more interesting, the State of Wisconsin Investment board was also revealed as a holder of the ETF’s 👀 As FRNT Financial’s CEO Stephane Ouellette stated, “the 13F releases show that the growth of Bitcoin ETFs can’t just be attributed to retail traders buying in brokerage accounts…clearly portfolio managers, institutional investors and banks have at least begun to test the waters on ownership.”

Bitcoin was lacking a fresh narrative as we consolidated off the record highs set post the ETF launch. Yet with the macro turning hugely positive, with major central banks set to start cutting rates, US pseudo YCC, China QE plus the return to large positive net inflows and the powerful demand/supply dynamic that brings, the stars are aligning and momentum building for an explosive leg higher. It’s go time 🚀

Native News

Key news from the crypto native space this week.

Stablecoin issuer Circle plans to shift its legal base from Ireland to the United States. Circle's parent company recently filed required paperwork with the High Court of the Republic of Ireland to redomicile the firm. The reasons for the move are unknown, but news reports this week suggest a potential initial public offering could be a reason. As a reminder, in January, Circle filed for an IPO of its equity securities under plans to become a publicly traded company. The firm confidentially submitted a draft registration statement S-1 form to the U.S. Securities and Exchange Commission — a common approach for companies seeking to go public, offering them the flexibility to finalise their plans away from the public eye.

According to the latest update from PitchBook, in Q1 2024, crypto fundraising increased significantly with start-ups securing $2.4 billion across 518 deals. According to the report, this “represents a 40.3% increase in invested capital and a 44.7% jump in deal volume compared with the previous quarter.” The report also mentioned that Infrastructure start-ups “led the way in funding during the quarter, with the largest rounds raised by Ethereum restaking platform EigenLayer ($100.0 million Series B) and fully homomorphic encryption (FHE) development platform Zama ($73.0 million Series A).” The largest deal of the quarter “went to Together AI, developer of an open-source, decentralised cloud platform for large foundation models.” The start-up raised a $106.0 million early-stage round “led by Salesforce Ventures at a $1.1 billion pre-money valuation.”

Institutional Corner

Top stories from the big institutions

Deutsche Bank will work with the Monetary Authority of Singapore on their Project Guardian to help test asset tokenisation implementation. The German bank will be part of the asset and wealth management workstream, exploring an interoperable blockchain platform that provides services to tokenised and digital funds, according to a Tuesday release. The firm will then suggest protocol standards and best practices. Anand Rengarajan, Deutsche Bank head of securities services for Asia Pacific and the Middle East and global head of sales said in a statement "Contributing to Project Guardian will bolster our efforts to help shape the new frontier of asset servicing, and strongly position us to contribute to industry progress, and not only anticipate our clients’ needs but exceed their expectations," said Project Guardian to help test asset tokenisation implementation. Read the full release from DB HERE.

Robinhood’s European crypto branch launched Solana staking. The feature will offer roughly 5% APY at launch, though that could vary as staking rewards change. This is slightly below the staking rewards offered by Coinbase at 5.42% and Phantom Wallets a 7.58%, at time of writing. Robinhood chose Solana for its first staking product because SOL’s one of the most popular tokens among its EU customers, and staking on Solana is simpler than on Ethereum. Robinhood also mentioned that the company was drawn to Solana’s shorter bonding period — the amount of time it takes before newly-staked assets begin earning yield. Solana’s bonding period is roughly two days, while Ethereum’s varies from a few days to a few weeks.

U.S. President Joe Biden issued an order this week, forcing a Chinese-backed cryptocurrency mining company to sell land near a Wyoming nuclear missile base, citing national security concerns. The company, MineOne, acquired the real estate in June 2022, placing its operations within a mile of the Francis E. Warren Air Force Base, a “strategic missile base and key element of America’s nuclear triad,” according to the White House. The company’s site reportedly contained “specialised and foreign-sourced equipment potentially capable of facilitating surveillance and espionage activities”. Read the full order HERE.

More than 500 different entities have disclosed holdings in Bitcoin ETFs, according to Bloomberg Intelligence. That is more than 200 times the average of two to three holders for new ETFs. Global investment-management firm Millennium is the biggest ETF holder so far, with almost $786 million in BlackRock’s ETF, another $750 million into Fidelity’s, $188 million in Grayscale’s GBTC, and $41 million in both ARK Invest’s and Bitwise’s spot Bitcoin funds.

Charts of the Week

Because charts are just as important as macro.

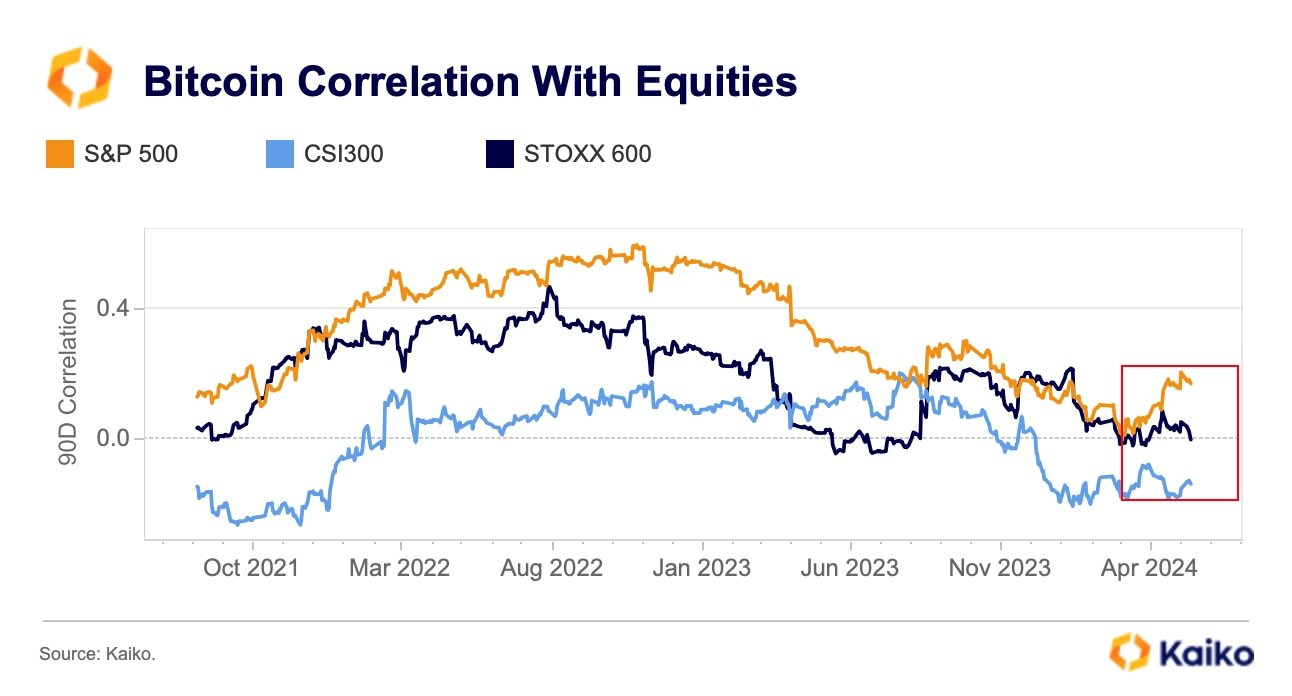

Last week BTC's 90-day correlation with US equities rose to 0.17 bouncing back from a multi-year low of 0.01 in March. Overall, Bitcoin’s correlation with risk assets remains well below its bull market highs of over 0.6. Hat tip to Kaiko Data for the chart

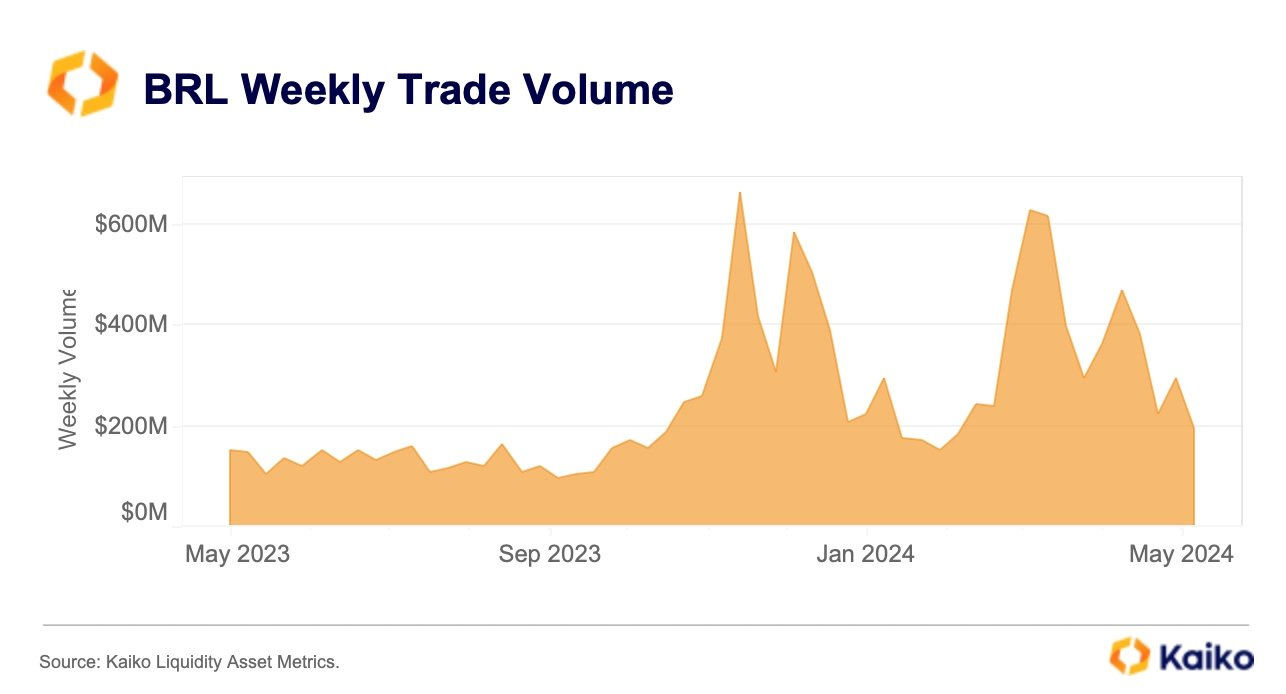

Brazilian weekly trade volume in BRL is up 30% since 2023 and is outpacing increases in USD trade volumes. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Custodian at Ministry of Defense

Crypto Liquidity Specialist at Mynth

Finance Operations - Crypto via Blockchain 121 Recruiters

Portfolio Manager at Crypto Firm via CryptoRecruit Recruiters

Institutional Sales for Crypto at The Tie

Senior Crypto Policy Advisors at the FCA

Investor Relations / Digital Assets at XBTO

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.