Connecting the Dots

Episode 154 - The AI Paradox

Welcome to the new subscribers that have joined us in the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Coinbase announces its Q4 financials, Strategy accounts for 93% of BTC treasury purchases last month.

Institutional Corner: CFTC names several cryptocurrency executives to a new Innovation Advisory Committee, JPMorgan’s estimated bitcoin production cost falls to $77k, Standard Chartered lowered its short-term and full-year price forecasts for major cryptocurrencies.

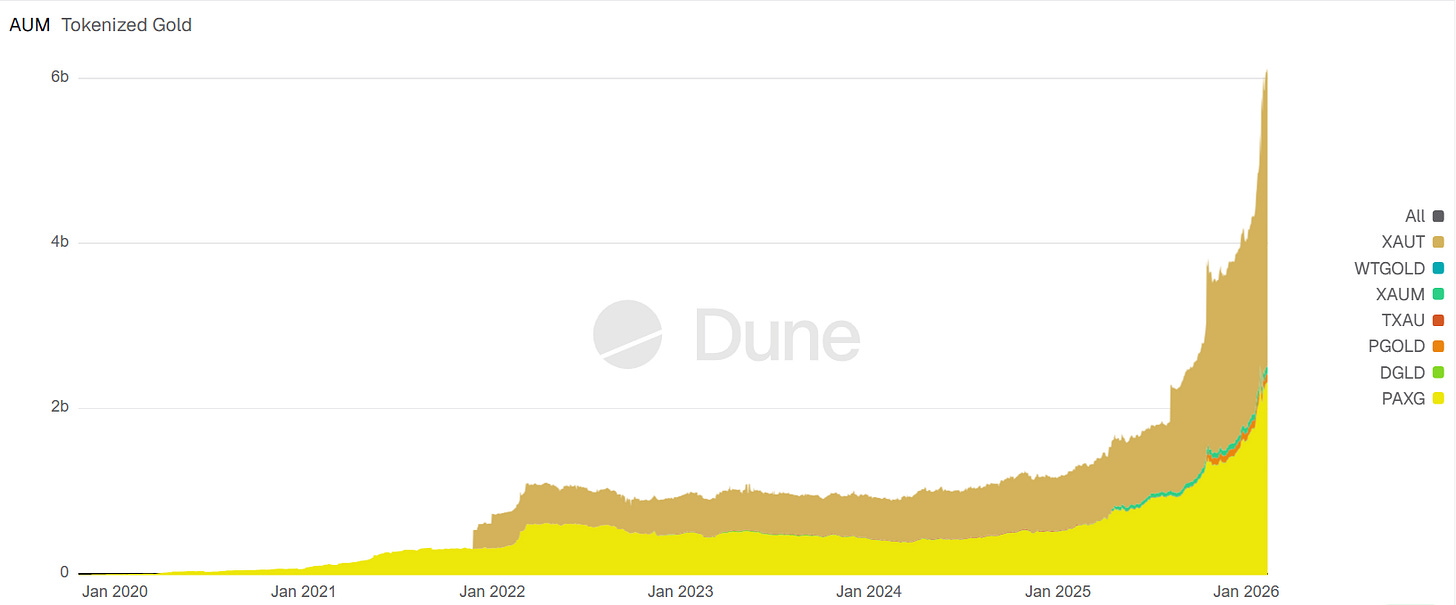

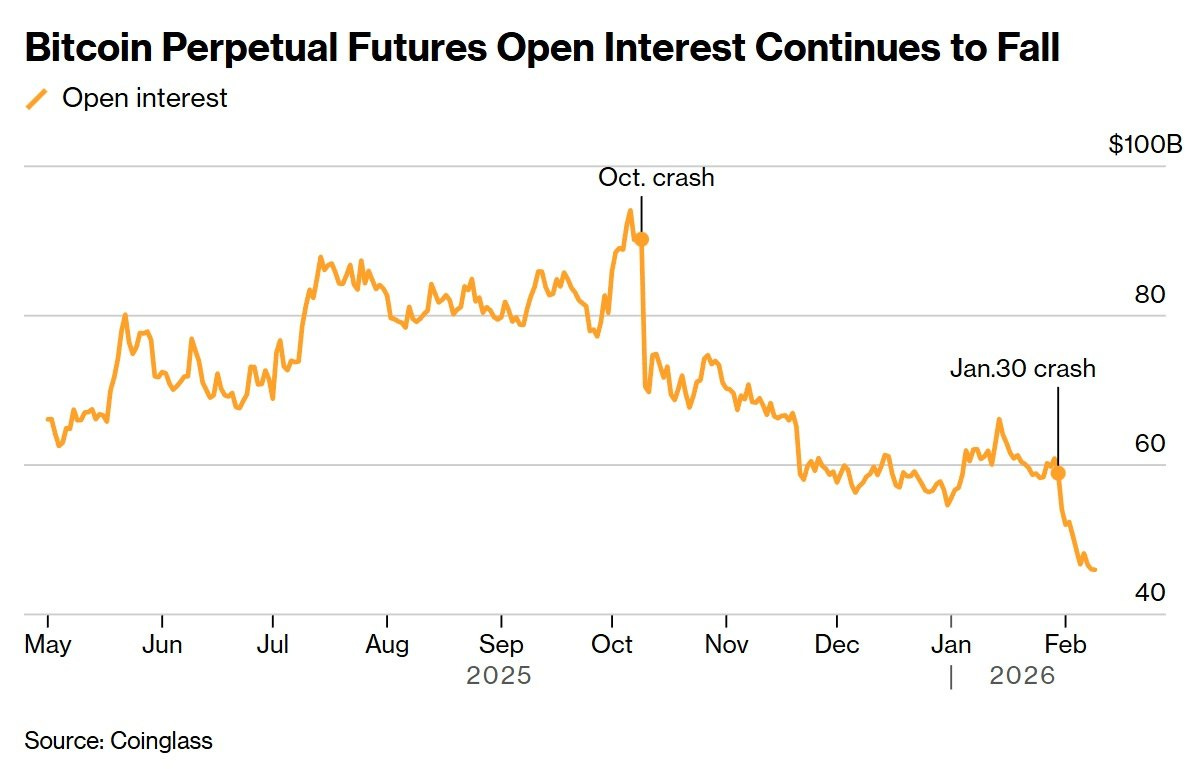

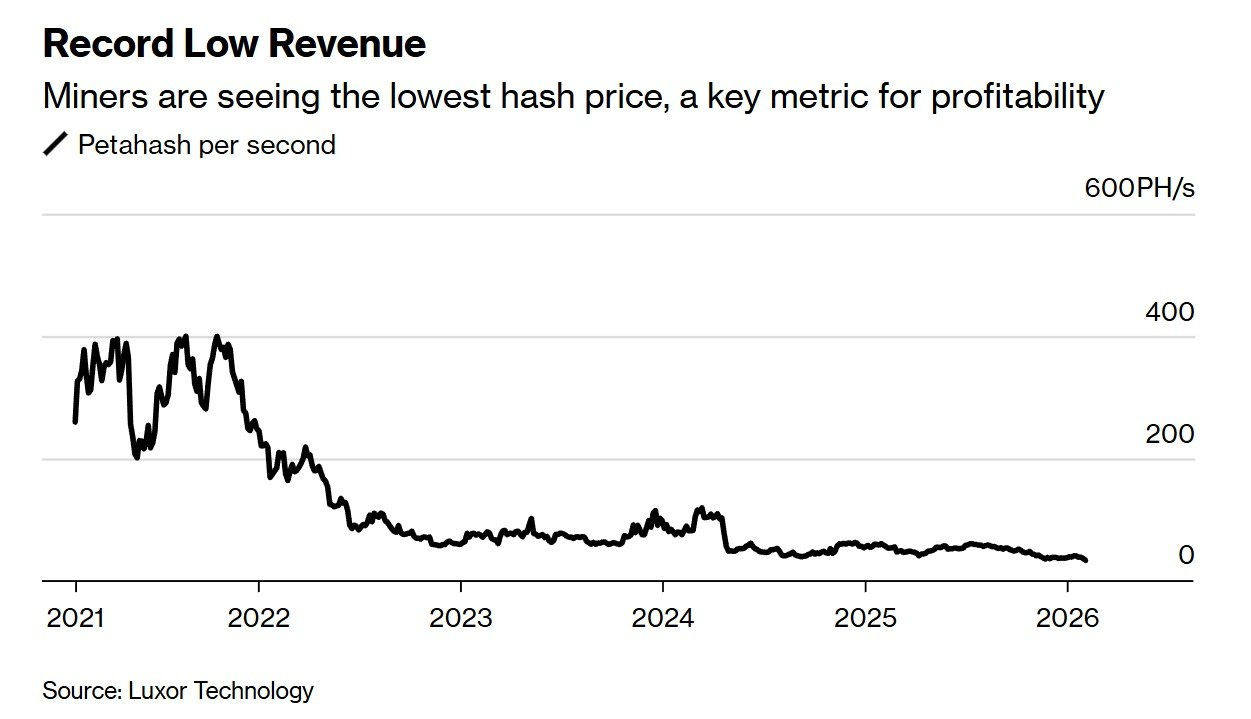

Charts of the Week: Total market cap of tokenised gold has surpassed $6 billion, Bitcoin perpetual futures open interest remains 51% below its October peak, BTC hash price index has fallen to a record low.

Top Jobs in Crypto: Featuring One.io, Ctrl Alt, Crypto.com, Citi, Coinshares, Flight3

Macro Update

This is where we connect the dots between macro and crypto.

The AI Paradox

Another volatile week saw the tech-heavy Nasdaq leading broad indices lower, as concerns around the disruptive potential of AI and short term negative impacts of the huge CapEx spending on free cash flows weighed heavily on sentiment.

This despite a continued “goldilocks” macro backdrop, underscored by a soft CPI report which saw headline inflation fall from 2.7% to 2.4%, with core inflation ticking down from 2.6% to 2.5%. A stronger Non Farm Payrolls employment report which showed a consensus beating 130k jobs added in Jan alongside a fall in the unemployment rate from 4.4% to 4.3% dampened expectations for Fed rate cuts, something we found strange given the huge revisions to 2025 figures which saw total job gains in 2025 revised from 584k to 181k.

Jan’s better headline print (which if current trends hold likely gets revised lower) doesn’t come close to making up for the revisions and the fact that the labour market is weaker than previously assumed by the Fed. With disinflation taking hold, led lower by the lagged impacts of cooling shelter inflation, we expect at least 4 rate cuts in 2026, especially with the dovish rate lean of the incoming Warsh. US 2yr yields making a 3 year low and breaking lower suggests we’re not alone in this view 👀

Either way, we continue to head towards easier rate policy and a disinflationary environment with robust growth. Alongside a still abundant global liquidity regime and the US liquidity impulse turning positive with the Fed’s renewed balance sheet expansion under the Reserve Management Purchases (RMP), we have a fertile backdrop for broader risk, all things equal ✅

AI Uncertainty

Yet of course, all things aren’t equal and the pure data driven “macro” is taking a backseat to the aforementioned AI concerns. Bitcoin is getting caught in the cross-hairs of these concerns and the consequent rotations out of tech and software, towards “value” and energy.

Let us explain 👇

Recent AI related CapEx announcements from the major cloud computing providers - or “Hyperscalers” - which across the major firms is set to total $700bn in 2026 is a challenge to market liquidity as that cash is effectively being taken out of the market to be spent on AI infrastructure, rather than being made available for dividends and stock repurchases - previously a big support for the MAG7 firms. The consequent fall in free cash flow (FCF) also likely means these Hyperscalers need to focus more heavily on debt or equity to fund further investments - case in point, Google’s parent company Alphabet just issued a rare 100 year “century bond” raising over $1 billion to help finance large AI and data-centre capex plans 😳

Additionally, markets are uncertain on the likely return on invested capital (ROIC) and the timing of those returns, from these huge AI investments, especially given some of the power and grid constraints. The delayed cash flow returns from these investments also makes “growthy tech” companies implicitly “longer duration” which is causing share prices to correct as they discount these cash flows over a longer time horizon.

Bitcoin is the longest duration asset as it has no cashflow, so in theory, shouldn’t be impacted, other than the fact that investor portfolios have inadvertently become longer duration and so they need to sell down longer duration assets to rebalance the portfolios, negatively impacting Bitcoin.

Then there’s the disruption to software and other tech companies that are likely themselves to be disrupted by AI. Software companies being hit on the idea that AI coding tools have made it so easy to build software that businesses like Salesforce are heading towards zero. Additionally, software companies that charge on a per-user basis are going to see a sharp reduction in revenues as the number of users required to run a business, given the adoption of AI, is set to dramatically fall.

This chart shows how correlated Bitcoin has been to the moves in Software stocks (using the iShares IGV - a software ETF). Whilst we view Bitcoin as a fundamentally different asset with fundamentally different characteristics, clearly as a bet on tech and innovation, Bitcoin sits in the same “risk bucket” and is currently being pulled lower with this current sell off 👇

BTC Vs IGV - Software stocks and proxies getting smoked

There’s a great article by Finbarr Taylor on X, however, called “In Defense of SaaS” which you can read here:

In this, Finbar suggests the move is somewhat overdone given a lot of these software companies aren’t simply lines of code, but huge “networks of customers, ecosystem integrations, reservoirs of proprietary data and repositories of institutional trust - all wrapped up in code that happens to be the least defensible part of the whole package”.

He also highlighted the “BofA Paradox”, an observation made by Bank of America’s Vivek Arya about the current sell off.

Investors are simultaneously pricing in two mutually exclusive scenarios. Either AI Capex is deteriorating to the point that it won’t deliver ROI (bad for the AI thesis), or AI is so powerful that it will destroy all software companies (bad for SaaS). Both can’t be true at the same time. If AI is powerful enough to SaaS, then companies building AI infrastructure are going to see massive returns. If AI infrastructure won’t pay off, then AI isn’t actually powerful enough to destroy SaaS.

Shoot first, ask questions later…

For markets that hate uncertainty, we’re witnessing a “shoot first, ask questions later” kneejerk response to AI related uncertainty, killing popular momentum trades and seeing a rebalance of portfolios as well as a broader de-risking as portfolio managers cut exposures. Even gold and silver are selling off as a result.

Bitcoin we feel from here should be relatively well insulated given the massive deleveraging that has already taken place. Whilst correlations with tech remain high, it doesn’t require a “duration repricing” or have margin compression to suffer and so the AI disruption risks are significantly lower and we would argue Bitcoin and crypto more broadly are compliments to a world driven by AI and autonomous agents.

Quantum continues to pose a threat, and maybe that narrative has additionally weighed on Bitcoin, although this is starting to shift as the community is finally becoming more proactive in addressing those risks.

These latest moves are not macro/liquidity related, rather a de-risking wave triggered by AI related uncertainty and portfolio duration extension. Positions are being cut, risk reduced, momentum being unwound.

Once that process completes, then capital looks to get re-deployed. Broad equity indices should start to reverse higher on the supportive macro/liquidity backdrop, which will provide a natural tailwind to Bitcoin. Indeed, there’s a good argument to be made that as portfolio managers assess where to re-deploy capital, Bitcoin is viewed as a “cleaner” play, given it’s already a long duration asset and whilst correlation with software and tech has been high, it doesn’t have the same disruptive uncertainty - Bitcoin and crypto are the disruptors.

Strap in then for a volatile few weeks ahead, but when this market settles, the winners will likely be quick out of the gate. Bitcoin we’re still betting, will be the fastest horse 🏇

Native News

Key news from the crypto native space this week.

Coinbase announced its Q4 financials on Thursday. The company disclosed $1.78bn in Q4 revenue, representing a 22% decrease compared to a year ago, while fourth-quarter revenue also fell short of analysts’ expectations of $1.84 billion. Coinbase posted a net loss of $667 million for Q4, marking a reversal from a year ago, when the firm notched $1.3 billion. Coinbase said the loss stemmed from a $718 million decrease in the value of its investment portfolio, which was largely unrealised.

According to a report from Bitcoin Treasuries, Strategy accounted for 93% of Bitcoin purchases among digital asset treasuries last month. Strategy acquired 40,150 Bitcoin during the period compared to 3,080 Bitcoin among competitors. In total, digital asset treasuries added nearly 43,230 Bitcoin worth $3.5 billion last month. That marked an acceleration from 28,900 Bitcoin in December, but it was far less than the 147,000 Bitcoin acquired in November 2024 amid President Donald Trump’s re-election.

Institutional Corner

Top stories from the big institutions

The U.S. Commodity Futures Trading Commission has named several cryptocurrency executives to a new Innovation Advisory Committee, which will weigh in on how the commodities watchdog should oversee the role of “breakthrough” technologies like artificial intelligence and blockchain technologies in markets. CFTC Chair Michael S. Selig said “Today marks an important and energizing moment at the CFTC as the Innovation Advisory Committee takes shape. The IAC’s work will help ensure the CFTC’s decisions reflect market realities so the agency can future-proof its markets and develop clear rules of the road for the Golden Age of American Financial Markets.” The committee includes representatives for several blockchains, including Etherealize’s Vivek Raman, Solana Labs’ Anatoly Yakovenko, and Ripple’s Brad Garlinghouse, and major blockchain projects like Sergey Nazarov, CEO of Chainlink Labs, and Hayden Adams, CEO of Uniswap Labs. Executives from centralized cryptoexchange Bullish, Coinbase, Crypto.com, Gemini, and Kraken are included alongside other trading platforms like Bitnomial and Robinhood. The founders of the two leading prediction markets, Shayne Coplan of Polymarket and Tarek Mansour of Kalshi, were also named.

In a report published this week, JPMorgan’s estimated bitcoin production cost — which has historically served as a “soft price floor” or support level — has fallen to $77,000 from $90,000 at the start of the year as network hashrate and mining difficulty recently declined. JPMorgan analysts led by managing director Nikolaos Panigirtzoglou said “The decline in mining difficulty provides relief to remaining miners, enabling more efficient miners to capture the market share lost by higher cost miners forced offline, thus preventing a spiralling lower in bitcoin production costs. Indeed, we already see a rebound in the hashrate, pointing to a potential increase in mining difficulty and bitcoin production cost at the next network difficulty adjustment.” The recent decline in bitcoin’s network hashrate triggered the steepest drop in mining difficulty since China’s 2021 mining ban, bringing the cumulative decline in difficulty to about 15% year to date, the analysts noted. Mining difficulty adjusts roughly every two weeks to keep bitcoin’s average block time near 10 minutes, meaning a drop in hashrate automatically leads to lower difficulty. The analysts pointed to two main reasons behind the decline. First, bitcoin’s price drop this year made mining unprofitable for higher-cost operators, particularly those using outdated equipment or facing high energy costs, prompting them to switch off machines. Second, severe winter storms in the United States, especially in Texas, forced large mining operations offline as grid operators curtailed electricity to conserve power.

Investment bank Standard Chartered lowered its short-term and full-year price forecasts for major cryptocurrencies. The bank now expects bitcoin to fall to around $50,000 in the coming months with ether to fall to around $1,400. Geoff Kendrick, Standard Chartered's head of digital assets research, said the selloff in recent weeks could extend as ETF investors, many sitting on losses, are more likely to reduce exposure than “buy the dip.” Kendrick added that once prices establish a bottom he expects a recovery through the rest of 2026. He reduced his year-end target for bitcoin to $100,000 from $150,000, ether to $4,000 from $7,500, Solana to $135 from $250, BNB $1,050 from $1,755 and AVAX $18 from $100. Kendrick left his longer-term projections unchanged, maintaining end-2030 targets of $500,000 for bitcoin and $40,000 for ether, arguing that usage trends and structural drivers remain intact.

Charts of the Week

Because charts are just as important as macro.

The total market capitalisation of tokenised gold has surpassed $6 billion, with an increase of more than $2 billion since the beginning of this year. Among them, Tether Gold (XAUT) and Paxos Gold (PAXG) together account for approximately 96.7% of the market share. Tokenised gold has locked up more than 1.2 million ounces of physical gold

Bitcoin perpetual futures open interest remains 51% below its October peak

The hash price index, a measure of Bitcoin mining revenue, has fallen to a record low of approximately 3 cents per terahash; consequently, Bitcoin mining difficulty has dropped by 11%, marking its largest negative adjustment since the 2021 China ban.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Chief Financial Officer at Ctrl Alt

Blockchain Defi Developer - Quant Trading Team at Crypto.com

Digital Assets Liquidity Product Manager at Citi

Cyber Security Engineer at Coinshares

Senior Social Designer at Flight3

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.