Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Latest CBDC and stablecoin report from CCData, Celcius to distribute 2nd payout to creditors, former Revolut employees launch Bleap - a bank on the blockchain.

Institutional Corner: The FCA announces its crypto roadmap, Hong Kong preparing to exempt investment gains in crypto, Bern parliament approves a motion to explore Bitcoin mining as a way to utilise surplus energy and stabilise its electricity grid, Brazil introduces a bill seeking to establish a bitcoin reserve, Taiwan enacts its anti money laundering rules a month earlier.

Charts of the Week: Total crypto market cap reaches an all time high, altcoin volumes at the highest level since 2021, stablecoin market cap reaches an all time high, Uniswap has record monthly volume.

Top Jobs in Crypto: Featuring MoonPay, OpenPayd, Kraken, Crypto.com Bullish and LSEG.

Macro Update

This is where we connect the dots between macro and crypto.

Headwinds to Tailwinds

A holiday shortened week in the US saw equities record further gains with the S&P 500 notching another record high. Bitcoin failed to break the vaunted 100k and with some well earned profit taking, made an early week correction back towards 90k before the incessant demand returned and we’re back eyeing 100k once more. It’s a matter of when, not if, we break 100k.

Reinforcing our bullish Bitcoin view, the macro headwinds that we’ve highlighted post election have started to fade and offer the potential to become tailwinds to the still powerful demand/supply dynamic which is driving Bitcoin higher.

The nomination of Scott Bessent as Treasury Sec has been well received by the bond market. We expressed our bullish bond view a couple of weeks ago, highlighting that the post election “reflation” fears looked overdone. Bessent, a Wall Street macro guy deemed moderate in relation to tariffs and likely to prioritise economic and inflation stability reinforcing that view. 10yr yields fell 22bps on the week and are now starting to “catch down” to oil. This in turn is starting to pull the dollar lower. The post election macro headwinds are now starting to become tailwinds 👀

US dollar and yields rolling over catching down to oil - headwinds become tailwinds

Trump’s tariff threats of course loom large but increasingly appear as a negotiation tactic. Trump on Monday threatened 25% tariffs on all goods from Canada and Mexico if they fail to curb illegal immigration into the US and vowed to impose an additional 10% tariffs on China until it prevents the flow of illegal drugs into the US. Quite quickly however, Trump was back tweeting of the “wonderful conversation” he had with the President of Mexico who has “agreed to stop the migration through Mexico and into the United States” whilst Canada’s Justin Trudeau was a dinner guest at Mar-a-Lago where Trump said they had a “productive meeting.” Interesting perhaps how little markets reacted to the threats on Monday 🤔

Fed preparing for mooaar liquidity….

On the data front, US PCE inflation, the Fed’s preferred measure of inflation, came in line with consensus forecasts with the headline at 2.3% YoY, up from 2.1% prior, whilst core PCE ticked up to 2.8% from 2.7%. The stronger inflation readings on the month supporting the recent Fed caution, although odds of a Dec rate cut nudged higher after the release to around 66%. Personal income also came in a very strong 0.6%, with personal spending a touch stronger than expectations at 0.4%.

All in all, the US economy remains resilient and inflation, whilst having made great progress over the past year, is in the “bumpy” phase. We continue to stick however with our view of a slowing, not collapsing, disinflationary US economy which will continue to provide the Fed with room to normalise rates from currently restrictive levels and we continue to move into an easier rate and liquidity environment.

Indeed, the latest Fed minutes showed the FOMC anticipates that it will be “appropriate to move to a more neutral stance of policy over time” even if there is some discussion on the pace and what level could be considered “neutral.”

Perhaps the most interesting part of the minutes however were the discussion around lowering the overnight repo rate by 5bps to align the rate with the lower end of the target range for Fed funds and “put downward pressure on other money market rates.”

Whilst described as a “technical adjustment” this is a Fed that is clearly growing concerned about market liquidity amidst a torrent of bond issuance for an out of control budget deficit. The RRP (cash reserves placed at the Fed) now sits at just under $200bn. The Fed will look to continue to drain this via reducing the RRP rate and as the RRP balance moves closer to zero, they will need to end quantitative tightening. We further expect they will need to do some “not QE, QE” type measures akin to the liquidity they were forced to provide during the repo blow up in 2019.

The key takeaway here. The Fed is growing concerned about market liquidity and is laying the groundwork to provide moaaar liquidity and those measures could come as soon as December’s Fed meeting. As we like to say at London Crypto Club, Central Banks have removed the downside, “left tail” risks to our markets and will continue to be the liquidity providers of last resort.

Whilst the Fed’s mandate is to foster full employment and target 2% inflation, the 3rd part of the mandate is to ensure stable market functioning and sufficient liquidity. Bitcoin will continue to ride on the wave of this perpetual need for liquidity to sustain spiralling deficits and the debt refinancing cycle and despite the hope and promise of Elon Musk and the D.O.G.E, nothing can stop this train. The exponential phase of this crypto bull cycle remains firmly ahead and it looks like the Fed are set to sponsor it 🚀

Native News

Key news from the crypto native space this week.

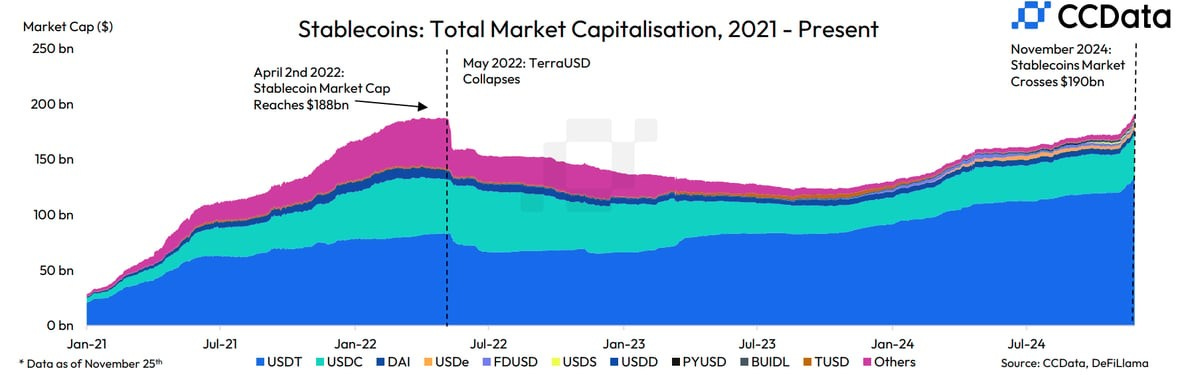

CCData published its CBDC and stablecoin report this week. In November, the total market capitalisation of the stablecoin sector rose by 9.94% to reach $190bn, surpassing the previous all-time high of $188bn set in April 2022, prior to the collapse of TerraUSD. This was the highest month-on-month growth in market capitalisation since November 2021 and the fourteenth consecutive increase in end-of-month market capitalisation, underscoring the sustained demand for stablecoins since October 2023. The monthly trading volume for stablecoin trading pairs on centralised exchanges grew by an impressive 77.5% to $1.81tn as of November 25th. In November, the market capitalisation of TetherUSD (USDT) rose by 10.5% to $133bn, marking another all-time high for the stablecoin. This increase represents the fifteenth consecutive month of growth in USDT’s market cap. USDT's market dominance currently stands at 69.9%. Major stablecoin issuers are entering the MiCA-compliant Euro stablecoins sector - with Tether investing in Dutch firm Quontoz to issue EURQ and Paxos acquiring Finnish EMT institution Membrane Finance. The market capitalisation of Ethena Labs’ USDe rose sharply by 42.2% in November, reaching a new all-time high of $3.86bn. This surge in demand for the stablecoin coincided with heightened interest in the Ethena ecosystem, following the foundation’s proposal to activate revenue sharing for ENA token holders on November 15th. Read the full report HERE.

According to a court filing submitted Wednesday, Celsius, the defunct crypto lender, is distributing $127 million to eligible creditors in a second payout from its bankruptcy proceedings. The filing said “As a result of the second distribution, each eligible creditor will receive a cumulative distribution in cash or liquid cryptocurrency equal to approximately 60.4% of the value of such creditor’s Claims as of the Petition Date.” The value of bitcoin for payout is set at a weighted average distribution price of $95,836.23. The filing added that eligible creditors who cannot receive liquid cryptocurrency through the designated distribution agent will be directed to receive the payout in cash. Read the full release HERE.

Former Revolut employees Joao Alves and Guilherme Gomes have raised $2.3 million in pre-seed funding, led by Consensys founder Joe Lubin’s Ethereal Ventures to build Bleap — a “bank account on the blockchain.” The capital raised brings the company to a $10 million post-money valuation. Maven11, Alliance DAO, Robot Ventures and Credibly Neutral also participated in the round alongside angel investors, including key executives from Revolut, Phantom, OKX, EigenLayer and Consensys. The funding will be used to help develop the self-custodial payments app, which enables customers to spend stablecoins in the real world via a linked Mastercard debit card, promising no conversion or exchange fees and up to 2% cashback on purchases. The former Revolut employees believe blockchain technology is the foundation for the future of finance, with the concept for Bleap first beginning to take shape in July 2023. Co- Founder Alves said “We wanted an app that combines blockchain’s power with the best of banking. A banking app that would be radically better than anything else available today.”

Institutional Corner

Top stories from the big institutions

The UK Financial Conduct Authority (FCA) this week announced its roadmap to fully regulate crypto assets by 2026, saying it aims to support a “safe, competitive and sustainable” market for cryptocurrencies in the UK. Matthew Long, director of payments and digital assets at the FCA, said that the regulator is “committed to working closely with the Government, international partners, industry and consumers to help [it] get the future rules right”. The FCA is proposing a series of consultation and discussion papers between now and 2026 in order to establish a regulatory framework for crypto assets. This roadmap will begin with discussion papers on market abuse as well as admission and disclosures during Q2 2024, with consultation papers on stablecoins, custody and and prudential elements expected during the first half of 2025. The roadmap finishes with the publication of final policy statements in 2026. Below is the visual that accompanied the announcement.

Hong Kong is preparing to exempt investment gains from crypto and other assets for sophisticated investors, aiming to enhance the region’s appeal as a wealth management hub. A consultation paper from the Financial Services and the Treasury Bureau proposes expanding capital gains tax exemptions to include overseas properties, carbon credits, private credit, and crypto. Those exemptions would apply to privately offered funds and eligible single-family office investment vehicles. Hong Kong already offers tax incentives for select private funds and family offices, such as a profits tax exemption, but the new proposal seeks to extend these advantages to crypto-related investments.

Switzerland’s Canton of Bern parliament has approved a motion to explore Bitcoin mining as a way to utilise surplus energy and stabilise its electricity grid. The initiative, introduced by the cross-party Parliamentary Group Bitcoin on 14 March 2024, passed with a decisive 85 to 46 vote in the Grand Council despite government opposition. The initiative directs the government council to assess how Bitcoin mining can repurpose unused energy and create economic opportunities. Introduced by the bipartisan Parliamentary Group Bitcoin, the “Cantonal Bitcoin Strategy III” proposal seeks to make Canton of Bern “an attractive location” for firms with an innovative Bitcoin strategy.” The motion tasks the government with preparing a report addressing three key points: identifying areas with unused energy in Bern, evaluating how Bitcoin mining could utilise this surplus in collaboration with Swiss mining companies, and assessing its potential to stabilise electricity grids during periods of supply fluctuation. The proposal says “Bitcoin mining companies bring in investments, create jobs, and help to develop renewable energy sources in many places around the world.”

A Brazilian lawmaker has introduced a bill seeking to establish a bitcoin reserve to diversify the nation’s financial assets. On Monday, Congressman Eros Biondini introduced a bill proposing the creation of the “Reserva Estratégica Soberana de Bitcoins (RESBit),” also known as the Strategic Sovereign Bitcoin Reserve. The proposal suggests allocating up to 5% of Brazil's approximately $372 billion international reserves to bitcoin through a phased acquisition strategy. The bill stated that establishing a bitcoin reserve could enhance the country's economic resilience to currency fluctuations and geopolitical uncertainties. The proposal also highlighted Bitcoin's adoption as legal tender in El Salvador and the approval of spot Bitcoin exchange-traded funds in the U.S. as examples of innovative national strategies. See the full bill HERE.

Taiwan’s Financial Supervisory Commission will enact new anti-money laundering rules on 30 November, a month earlier than it had initially planned, as the regulator pushes ahead with its fraud prevention efforts. The new rules require crypto service providers, such as crypto exchanges, to complete AML compliance registration. Non-compliance may lead to penalties, including imprisonment for up to two years and a fine of up to NT$5 million ($153,700). The FSC said in a statement on Wednesday that overseas “virtual asset service providers” (VASPs) must establish a company or branch office under Taiwan’s Company Act and complete the required AML registration before conducting operations within Taiwan. The regulator introduced these new regulations following amendments made to the laws in July. Read the full statement from the FSC HERE.

Charts of the Week

Because charts are just as important as macro.

Total Crypto Market Cap reached an all time high around $3.33Tn this week.

Weekly trading volume for the top 50 altcoins hit $305 billion in early November, the highest since October 2021.

In November, the total market capitalisation of the stablecoin sector rose by 9.94% to $190bn, surpassing the previous all-time high of $188bn recorded in April 2022, prior to the collapse of TerraUSD. This was the highest month-on-month increase in market capitalisation since November 2021.

Uniswap generated a record $38B in monthly volume across major Ethereum layer-2 networks, including Base, Arbitrum, Polygon, Optimism, and several others.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Sales and Trading Rep at OpenPayd

Senior Product Manager, Custody at Kraken

Senior Flow Trader - Quant Trading Team at Crypto.com

Manager, Trading Technology at Bullish

Product Manager, Digital Assets at London Stock Exchange Group (LSEG)

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.