Thank for all of your support this year, were grateful for each and every reader that’s joined us on the London Crypto Club journey. We’ll be taking a break for a couple of weeks, returning in the new year. We wish you and your families a Happy Christmas and New Year.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our year end summary and why we think bitcoin propels to new highs in 2024.

Crypto Native News: Flow Traders, DWS and Galaxy announce AllUnity, Kucoin settles lawsuit in New York and Binance volumes fall.

Institutional News: S&P release its stablecoin assessment, the FASB published an accounting standards update on crypto assets.

Charts of the Week: Stablecoins drove more on chain value transfer than BTC and ETH, China inflation data a pre-cursor to global recession and a big chunk of BTC supply not moved in the last 2 years

Top Jobs in Crypto: Featuring Uphold, Status, Cryptio, Copper, Hivemind and Chainlink Labs.

Macro Update

This is where we connect the dots between macro and crypto.

The Powell Pivot

A dovish Fed sparked a “buy everything” rally last week, continuing to catch an under positioned market off-guard and driving the Nasdaq to new record highs 🚀

The Fed kept rates on hold as expected but indicated that the hike cycle is done, saying that they would take multiple factors into consideration for “any” more policy tightening. The biggest dovish surprise however came from the “dot plot” which showed a median forecast of 3 cuts for 2024 (Vs 2 previously.)

In the press conference, where some push back to recent dovish pricing was expected, JPow did little to dissuade markets and even said that rate cuts were a topic of discussion at the FOMC meeting. Overall, the Fed believes they’re now at peak rates with lagged effects of prior tightening still to come through. Further, with inflation continuing to come lower (headline CPI slowed from 3.2% to 3.1%) real rates are getting tighter affording room to cut, something Janet Yellen highlighted earlier in the week (not to put political pressure on the Fed into an election year of course 😉)

We highlighted the subtle dovish pivot by the Fed in our piece “This is What it Sounds Like When Doves Cry” but this was a full on endorsement by Powell for markets to embrace the end of the global hike cycle and position for a lower rate world.

To highlight how dramatic this pivot from the Fed has been, the so called Fed mouthpiece Nick Timiraos sarcastically noted “what a difference two weeks can make:”

Dec 1: “It would be premature to speculate on when policy might ease”

Dec 13: “Rate cuts are something that begins to come into view and clearly is a topic of discussion”

Markets have subsequently priced a full cut for March 2024 and 150bps of cuts for the year. US yields and the dollar fell sharply, with 10 year yields falling sub 4% and the dollar hitting the lowest levels since August.

Helping relative dollar weakness, the ECB and BoE interest rate decisions, whilst both on hold, took a decidedly more hawkish, higher for longer tone, despite the ECB slashing 2024 inflation forecasts. Ironically, we believe the ECB will need to cut before the Fed given the poor growth outlook and pace of disinflation. Perhaps they were also blind sided by the Fed pivot and didn’t have sufficient time to reconsider their stale, behind the curve policy stance. Pivots from the ECB and BoE are however imminent.

What might have caused such a dramatic pivot, especially when the US data, whilst softening, remains resilient?

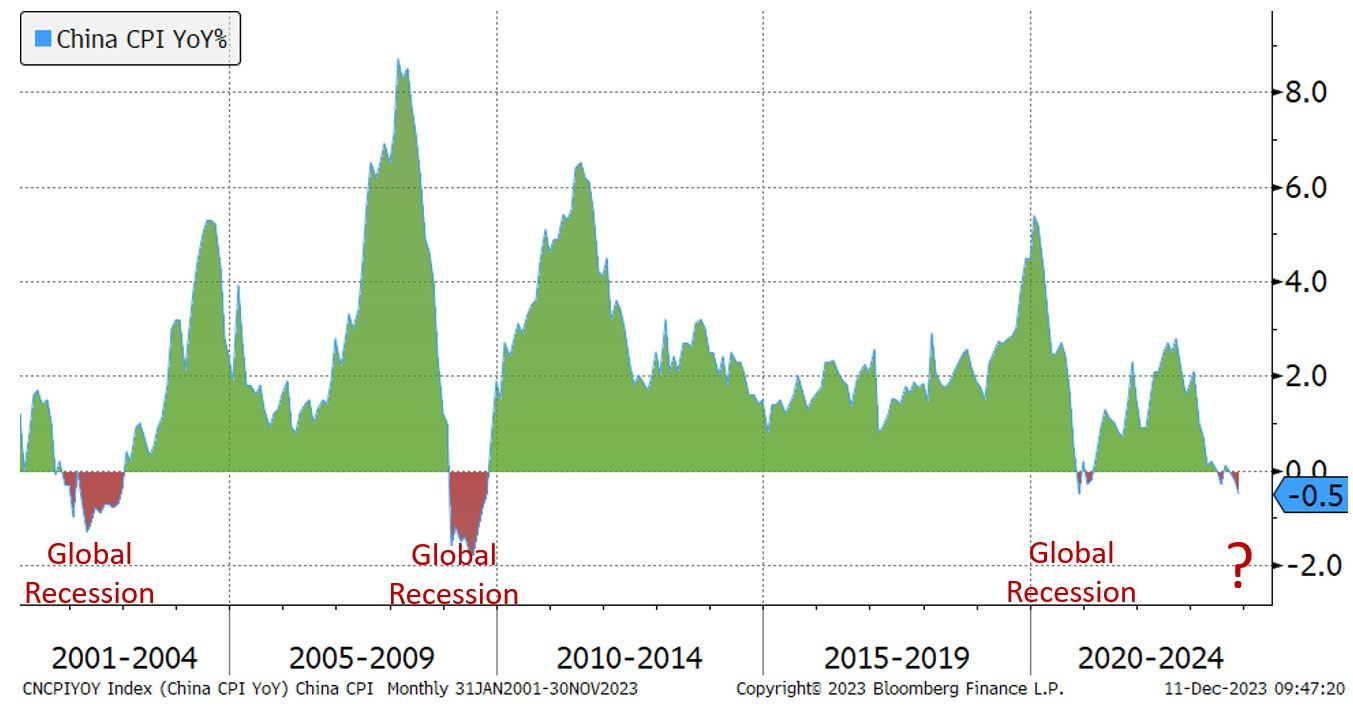

Perhaps China, battling deflation, is becoming an increasing concern. Yellen’s recent China visit and subsequent comments around the Fed being able to cut rates amidst falling inflation may be a signal of cooperation. China needs to ramp up stimulus whilst maintaining currency stability to deter capital outflows. They need US rates and the dollar lower. Japan also has alluded to the fact that US policy rates have been a factor forcing them to raise the YCC cap level. In trying to maintain the cap, Japan has seen its currency devalue significantly.

Yet in a highly interdependent global financial system, the Fed can’t simply act independently of these two major economies. If Japan stops their bond market interventions and domestic yields spike, US treasuries would get sold hard as the largest foreign UST holder returns capital back to Japan. Equally, China’s attempts to keep a lid on USDCNH involve selling treasury reserves to raise the dollars to buy back CNH. The Fed signaling the end of the hike cycle and a lower rate path ahead relieving much of that pressure and so avoiding a more catastrophic sell off in US Treasuries, already under pressure from an unsustainable debt spiral.

Closer to home, we previously suggested the Fed will either need to cut rates or end QT, once the Reverse Repo Facility (RRP) hits zero in Q1. This is now sitting at just $683bn, down from over $2trn just 6 months ago. The spiraling debt issuance has currently been funded by issuing shorter date T bills, teasing out the money parked in the RRP. Once that runs out, we likely face a spike in front end yields and a potential funding rate crisis similar to that experienced in the repo blow up of 2019. JPow will be aware of this and needs to get ahead of it.

We also have the BTFP facility that helped save the regional banks back in March this year, set to expire in March 2024. This facility, allowing banks to borrow cash against underwater treasuries marked at par, continues to get tapped for record amounts. The problems in the banks have not gone away, the can was simply kicked down the road. Even the Too Big To Fail banks, which can mark their underwater treasuries to par under the “held to maturity” loophole are reportedly sitting on $700bn of unrealized losses. Bills are due to be paid and the Fed will need lower rates to stop the system imploding.

This is the key point. Central bank policy is no longer simply about the domestic economy and inflation. It’s also about maintaining financial stability and ample liquidity to keep asset prices sufficiently high to keep the debt coverage ratio sufficiently low to prevent the debt system from collapsing. The Fed, governing the world's reserve currency is de facto the world's central bank and so can’t indefinitely ignore those global imbalances. Rates are simply too high for this highly indebted system to handle. JPow is preparing the market for the liquidity wave he is set to unleash. Not because the real domestic economy needs it, but because the global financial economy requires it for its survival.

Bitcoin’s rally stalled into the 45k zone and has consolidated lower in what feels like a healthy correction as some profit is taken and some leverage taken out. Yet make no mistake. This Fed pivot marks a paradigm shift in this cycle. Our bullish macro thesis for Crypto continues to be validated. Lower rates and mass injections of liquidity in 2024 are set to propel us to new record highs. We look forward to accompanying you on that journey. Merry Christmas and a Happy New Year !

Native News

Key news from the crypto native space this week.

Dutch market maker Flow Traders along with German asset manager DWS and crypto firm Galaxy, announced that they will form a partnership called AllUnity. AllUnity will be regulated by BaFin, Germany’s financial supervisory authority and will issue a fully collateralised EUR stablecoin. The press release says “the partnership will combine DWS’ strong portfolio management and product structuring capabilities, Flow Traders’ leading liquidity provisioning expertise and connectivity in both traditional and digital assets globally, and Galaxy’s technical infrastructure and track record of delivering innovative digital asset solutions to investors.” Read the full release HERE.

Crypto exchange KuCoin agreed to block New York users from its platform and pay $22 million to settle a lawsuit brought by the state as part of its push to rein in digital assets companies. Attorney General Letitia James sued Seychelles-based KuCoin in March, accusing the platform of failing to register with the state before letting investors buy and sell cryptocurrencies on its platform. As part of the settlement KuCoin also agreed to stop trading securities and commodities in New York.

According to data from CCData, spot volumes traded at Binance have declined throughout the year. Binance's market share so far in December was just 30.1% versus 55% at the start of the year. From January to September, the exchange’s monthly spot volumes declined by over 70% from $474 billion to $114 billion. In second place to Binance's 30% is Seychelles-based OKX, which has seen its market share grow to 8% in December from around 4% to start the year, according to CCData. The numbers are similar when looking at combined spot and derivatives trading, where Binance saw a decline in market share to 42% from 60% while OKX's grew to 21% from 9%.

Institutional Corner

Top stories from the big institutions

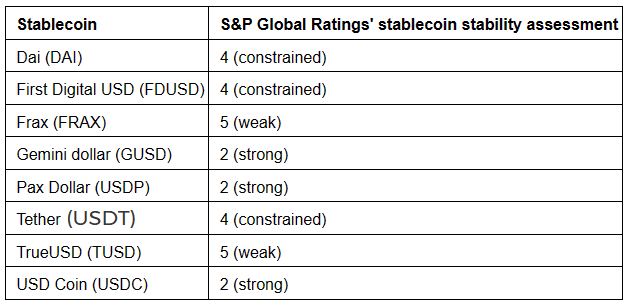

S&P Global Ratings announced the launch of its stablecoin stability assessment, which aims to evaluate a stablecoin's ability to maintain a stable value relative to a fiat currency. S&P Global Ratings say they apply an analytical approach to assess a stablecoin's stability on a scale of 1 (very strong) to 5 (weak), using the following metrics:

Asset quality risks, including credit, market value, and custody risks.

Analyse to what degree any overcollateralization requirements and liquidation mechanisms may mitigate these risks.

Consider five additional areas: governance, legal and regulatory framework, redeemability and liquidity, technology and third-party dependencies, and track record.

Below is the results of the study:

The Financial Accounting Standards Board (FASB) published an Accounting Standards Update (ASU) intended to improve the accounting for and disclosure of certain crypto assets. The amendments in the ASU improve the accounting for certain crypto assets by requiring an entity to measure those crypto assets at fair value each reporting period with changes in fair value recognised in net income. The finalisation of these rules will now allow firms to report cryptocurrencies at fair value starting in December 2024. Companies with significant exposure to crypto have advocated for this change. In May, Andrew Kang, the CFO of Microstrategy, which owns 174,530 BTC, currently worth USD 7.42B, wrote to the FAS to urge an update to accounting standards. Kang argued that fair value reporting for the firm’s BTC ‘would enable us to provide investors with a more relevant view of our financial position and the economic value of our [BTC] holdings, which in turn would facilitate the ability of investors to make informed investment and capital allocation decisions.’ Read the full details from the FASB HERE.

Charts of the Week

Because charts are just as important as macro.

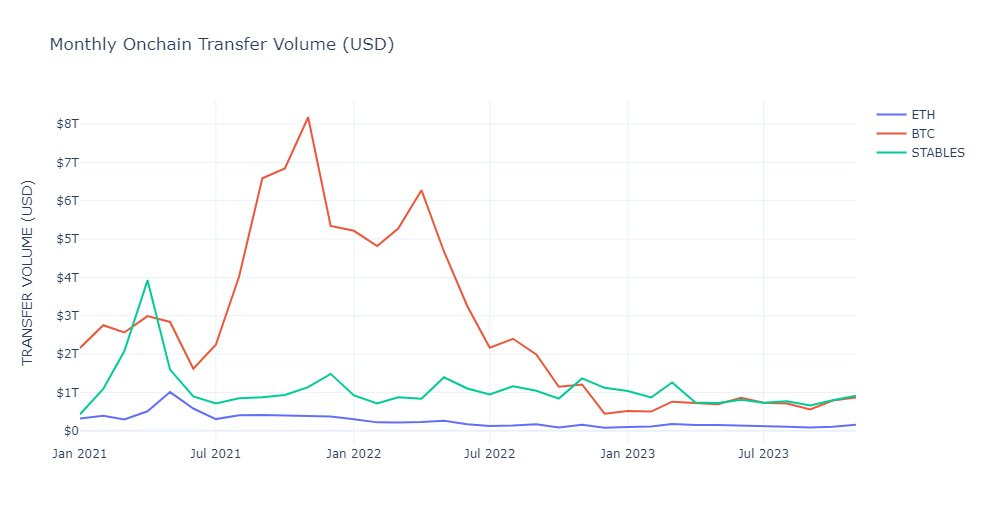

In November, stablecoins drove more on-chain value transfer than ETH and BTC. That month, there was ~$𝟵𝟭𝟰𝗕 of Stablecoin transfer volume, ~$𝟴𝟲𝟵𝗕 of BTC transfer volume, and ~$𝟭𝟱𝟱𝗕 of ETH transfer volume. Hat tip to Kofi for the chart.

Each time inflation in China turned negative the global economy was in a recession: 2001, 2008-09, 2020... Hat tip to Jeffrey Kleintop for the chart.

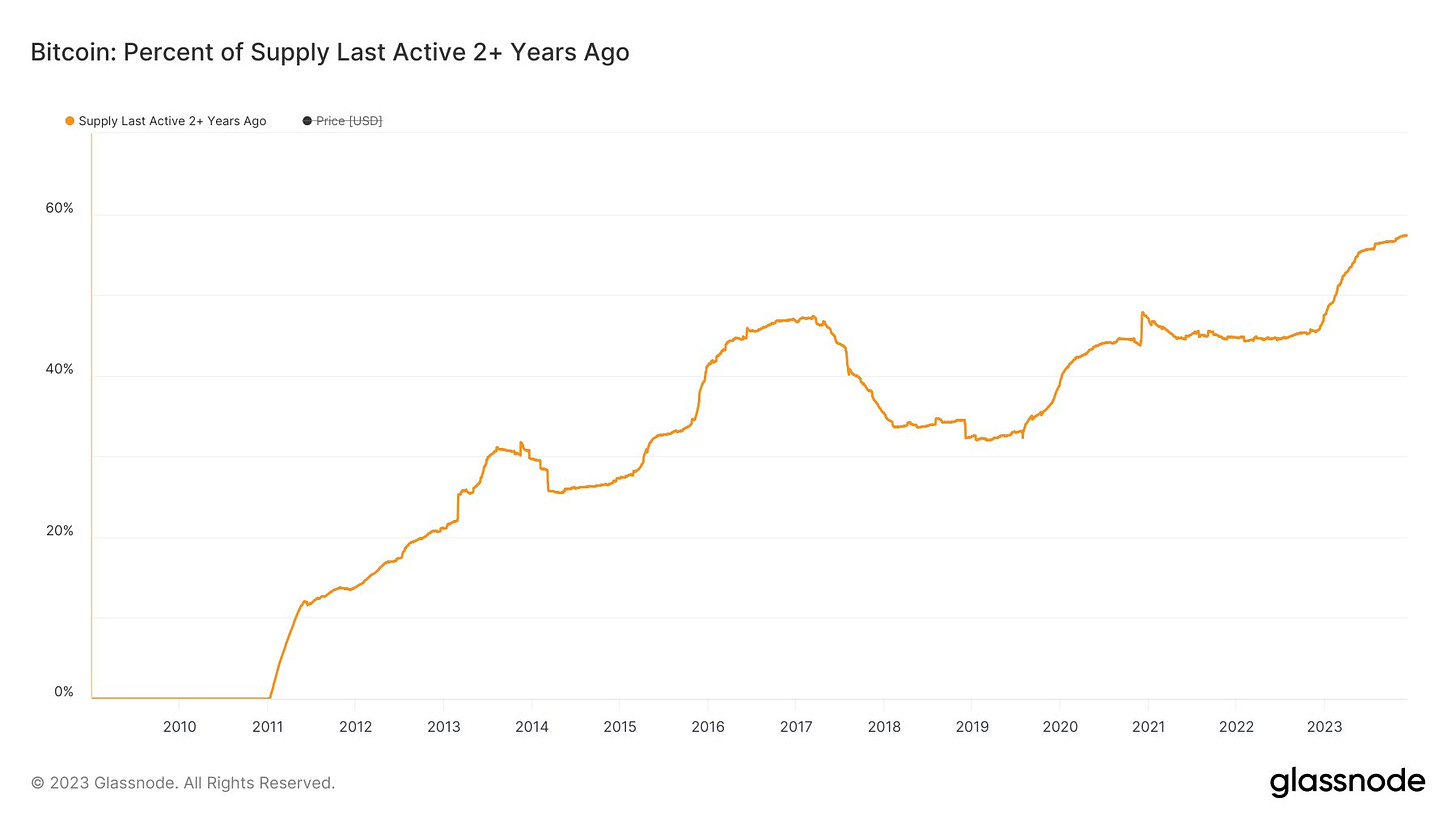

More than 57% of all bitcoin in circulation has not moved in the last 2 years. Hat tip to Anthony Pompliano for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Copywriter, Crypto Marketing at Uphold

Treasury Manager for Crypto at Status

Customer Success Manager for Digital Assets at Cryptio

Content and Social Media Manager at Copper

Business Development Lead foe EMEA at Chainlink Labs

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.