Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: SEC FUD as both Binance and Coinbase sued, China continues to stumble post Covid re-opening, US data resilience starting to crack and a big week ahead !

Crypto Native News: Binance and Coinbase sued, and BitGo reaches agreement to buy Prime Trust.

Institutional News: MiCA published in the Official Journal of the European Union, the FCA announces tougher rules on crypto advertisers, Circle receives its MPI license in Singapore and the CFTC grants Cboe Clear Digital a clearing license.

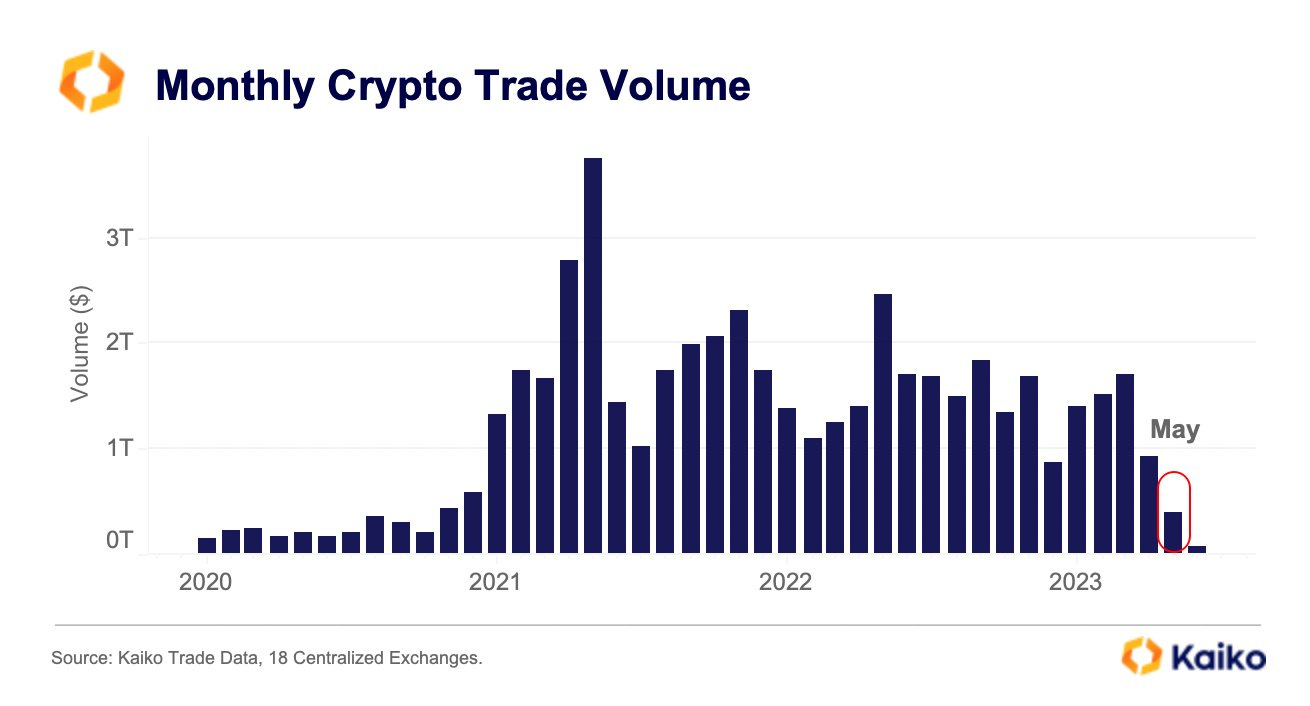

Chart of the Week: Crypto volumes on centralised exchanges at lowest since November 2020.

Top Jobs in Crypto: Featuring Blockchain.com, Hivemind, DRW BCB Group, Coinbase and Copper.

Macro Update

This is where we connect the dots between macro and crypto.

Just a SEC

Crypto was dominated this week by SEC FUD as both Binance and Coinbase were sued and the SEC’s crackdown against crypto continues.

At the heart of both lawsuits are accusations that both have failed to register as a securities exchange with the SEC.

However, the charges levelled against Binance are more serious, including subverting controls to secretly allow US customers to trade on Binance.com, commingling of customer funds and accusations that CZ owned and operated an entity used for wash trading and artificially inflating Binance.US trading volume.

The SEC also identified a list of tokens which they classified as securities which hit the alt space hard. That move lower, further compounded over the weekend with a questionable rumour of an unknown fund, Scimitar Capital, liquidating a $2bn portfolio.

With so much bad news baked in, these are the moments of despair that typically mark price lows. The resilience in BTC and ETH is encouraging.

On the macro, China continues to stumble post Covid re-opening and trade data this week saw imports down 4.5% and exports collapsing 7.5%. CPI also fell 0.2% month on month. PPI down 4.6%.

Under pressure from the government, China’s biggest state banks cut rates on demand deposits by 5bps and 15bps on 3 and 5 year time deposits. The liquidity pump is coming!

Combined with an ever weakening CNY, China is emitting a disinflationary pulse across the world which will slay the inflation dragon and drive global yields lower, reinforcing our “peak inflation, peak rates” view and providing a tailwind for crypto.

Indeed, signs this week that US data is softening drove Fed expectations dovishly with just 25% odds of a hike priced for Wednesday.

ISM Services barely in expansion territory at 50.3, with services employment contracting at 49.2. Jobless Claims spiking to 261k up from 233k and is the biggest rise in year to date claims, ex-Covid, since 2009.

The data “resilience” that has stopped markets fully embracing the shift in macro regime away from the hike cycle is slowly starting to crack.

A massive week ahead with US CPI and the FOMC. The macro, led by China, feels like it’s set to provide a positive tailwind and off-set the recent liquidity fears. With so much bad news priced in, are we about to receive a much needed spark from the macro?

Its a big week ahead in markets, check out this TWEET for the key events.

Native News

Key news from the crypto native space this week.

I’m sure you’re up to date with the SEC filing lawsuits against both Binance and Coinbase this week.

At the end of the week, Binance.US said it is halting USD deposits and has warned users to withdraw all US dollar funds by June 13th. A statement on Binance Twitter account in part reads: "The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. Binance.US and our business partners have not been spared in the use of these tactics, which has created challenges for the banks with whom we work. "As a result, in an effort to protect our customers and platform, today we are suspending USD deposits and notifying customers that our banking partners are preparing to pause fiat (USD) withdrawal channels as early as June 13, 2023. We encourage customers to take appropriate action with their USD."

Meanwhile on the Coinbase side, CEO Brian Armstrong said at a Bloomberg event on Wednesday that “Again, as these court cases play out it really is business as usual” He also added” We are not going to wind down our staking service” and noted that the exchanges staking service accounts for about 3% of overall new revenue. Armstrong also said that Coinbase would not be at risk of a bank run that others have suffered, saying “All the funds are backed one to one and you don’t have to take our word for it. As a company we have auditors who have gone in and verified all of that”.

According to some news sources, Cryptocurrency custody firm BitGo has reached a preliminary agreement to buy Prime Trust, another crypto custody specialist regulated in the state of Nevada. Las Vegas-based Prime Trust raised $107 million in funding midway through 2022, but the firm cut a third of its workforce at the end of January this year and announced it would cease operations in Texas where the firm was pursuing a money transmitter license. In a statement, Prime Trust Interim CEO Jor Law called the move "a significant enhancement for the industry." "No other company will have the breath of product and services nor depth of experience that this combined company would have. We are excited to offer our world-class infrastructure within a broader ecosystem and revolutionize the future of crypto" BitGo CEO Mike Belshe said the move would position the firm "to enhance its best-in-class, trusted solutions and to service the combined customer base."

Institutional Corner

Top stories from the big institutions.

On Friday, the European Union’s Markets in Crypto Assets law (MiCA) was published in the Official Journal of the European Union (OJEU). You can see the full register HERE. Publication of the 200-odd pages of law signals formal passage of a bill onto the EU’s statute book. In legal terms the law enters into force in 20 days’ time. And as a reminder, the full law requires crypto wallet providers to identify their customers when they transfer funds, offers crypto companies, such as exchanges and wallet providers, a license to operate across the bloc, and introduces new governance and financial requirements for stablecoin issuers.

The UK Financial Conduct Authority (FCA) said that advertisers of crypto services will face tougher rules in the UK from 8 October. Sheldon Mills, executive director, consumers and competition, said in a written statement “The crypto industry needs to prepare now for this significant change. We are working on additional guidance to help them meet our expectations”. The crypto companies must introduce a “cooling-off period” for first-time investors from 8 October. Firms in the sector must also scrap “refer a friend” bonuses, which will be banned as part of a package to ensure crypto investors understand risk properly. Sheldon Mills also added “It is up to people to decide whether they buy crypto. But research shows many regret making a hasty decision. Our rules give people the time and the right risk warnings to make an informed choice”.

This week, Circle’s Singapore affiliate, Circle Internet Singapore, has received a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS). It was the second company to receive it after Crypto.com. An MPI license allows Circle to offer digital payment token services and domestic and cross-border money transfer services. Circle has identified Singapore as its principal hub in Asia.

The Commodity Futures Trading Commission (CFTC) said it had approved an amended order of registration for Cboe Clear Digital to clear additional products as a derivatives clearing organisation. The amended order permits Cboe Clear to "provide clearing services for digital asset futures on a margined basis for futures commission merchants, in addition to the fully collateralised futures and fully collateralised swaps previously authorised," Read the full statement from the CFTC HERE.

Chart of the Week

Because charts are just as important as macro.

Crypto trade volumes on major centralised exchanges hit its lowest level since November 2020. Chart courtesy of Kaiko Data.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

OTC Crypto Sales Trader at Blockchain.com OTC Crypto Sales Trader | Blockchain.com | LinkedIn

Senior Crypto Operations Analyst at Hivemind Senior Crypto Operations Analyst | Hivemind | LinkedIn

Trader Assistant at DRW Trader Assistant, GD1 | DRW | LinkedIn

Transaction Monitoring Analyst at BCB Group Transaction Monitoring Analyst, 12 Month FTC | BCB Group | LinkedIn

Trading Execution Service Specialist at Coinbase Trading Execution Services Specialist | Coinbase | LinkedIn

Financial Planning Analyst at Copper Financial Planning Analyst | Copper.co | LinkedIn

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.