Connecting the Dots

Episode 95 - Liquidity Trumps All

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Findings of the crypto report from a16z, CoinDesk acquired CCData, Ripple name the participants that will help with liquidity of their new stablecoin, MiCA compliant stablecoins dominate the euro stablecoin market.

Institutional Corner: Aspen Digital says Asia-based investment managers are entring crypto, Euroclear acquires a stake in Marketnode, DBS Bank rolls out token services, the Central Bank of the United Arab Emirates (CBUAE) has granted in-principle approval to AED Stablecoin.

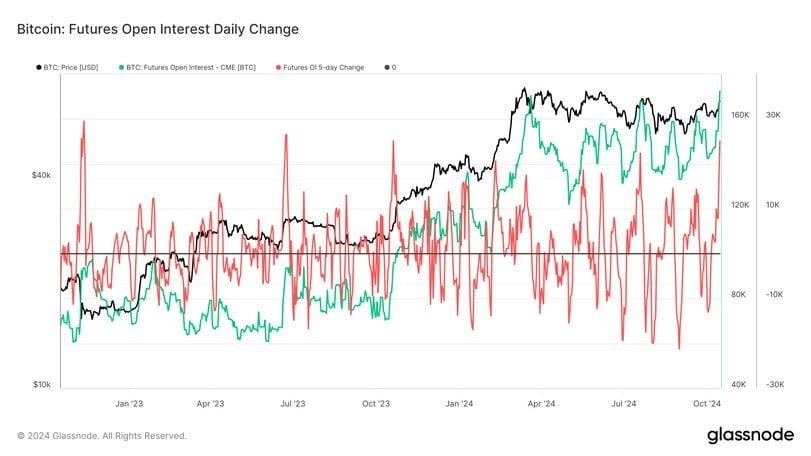

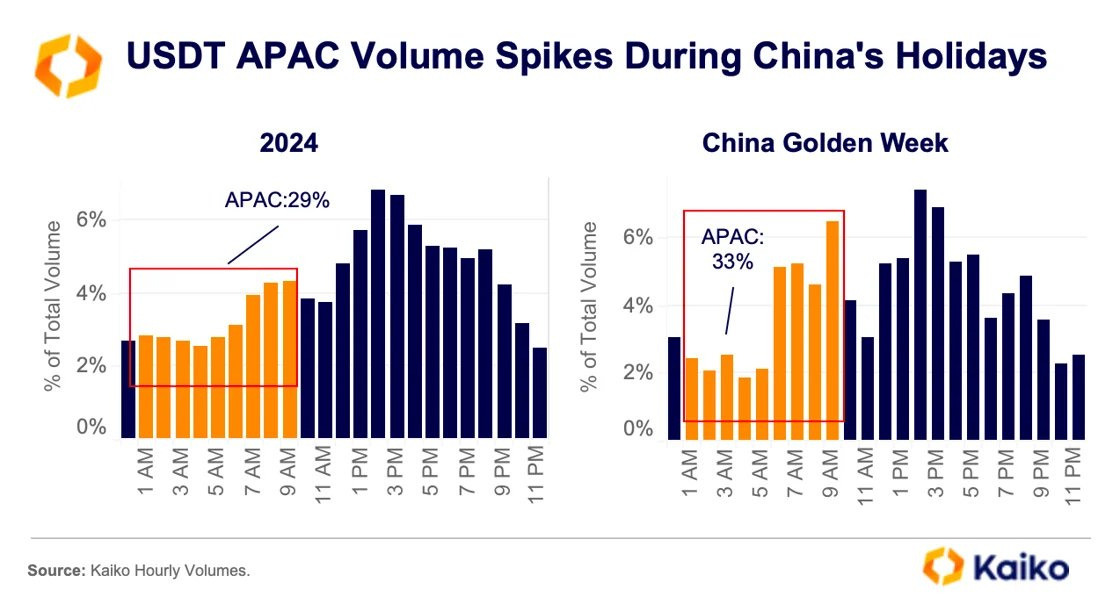

Charts of the Week: CME Bitcoin futures open interest hits all time high, USDT volume spiked during the China holiday and meme tokens are leading the month to date returns.

Top Jobs in Crypto: Featuring DRW, Coinbase, Nansen, Cryptio, Revolut, Galaxy.

Macro Update

This is where we connect the dots between macro and crypto.

Liquidity Trumps All

Bitcoin started to click into gear this week, breaking above the September highs to briefly tag 69k. We ended last week's note saying the rising tide of liquidity will lift all boats, but the Bitcoin boat gets lifted highest and that certainly played out this week, with BTC up circa 10%.

The good news is that we think this is just the beginning, with major central banks just at the start of the rate cutting, liquidity easing cycle, whilst China is set to provide a tsunami of liquidity.

Certainly gold is benefitting from this “easy” environment, making new record highs. Perhaps no surprise given Chinese investors' admiration for gold combined with China going full currency debasement mode to artificially inflate their markets and economy.

China unveiled more support measures this week as the latest data revealed that disinflation and slowing growth have become more entrenched. Growth expanded 4.6% YoY in the third quarter, the slowest pace of growth since early 2023 when China was just emerging from lockdowns. Inflation meanwhile came in at a below consensus 0.4% in September, down from 0.6%. Core inflation at 0.1% was the lowest level since Feb 2021. Producer prices also fell further, from -1.8% to -2.8%.

QE with Chinese characteristics…

Ahead of the figures, top banks cut deposit rates rates for the second time this year by 25bps. Officials also announced they would boost credit available for unfinished housing projects by $500bn. Further, on Friday, China kicked off the share buy back and equity swap programs announced in September. The re-lending facility allows financial institutions to borrow from the PBOC to re-lend that money to listed companies and major shareholders to fund share buy-backs. The PBOC also announced the start of a swap facility allowing institutional investors to borrow directly from the central bank to buy stocks. Net these measures will pump 800bn Yuan ($112bn) into the stock market. QE with Chinese characteristics 🌊

Elsewhere, the ECB cut rates 25bps as expected and whilst they didn’t pre-commit to additional cuts, likely have much further to go, with inflation now sat at 1.7%, below the 2% target and growth in the Euro area slowing. US data, meanwhile, maintained a resilience, with retail sales rising 0.4% last month, up from 0.1% the month prior. Initial jobless claims also fell to 241k from 260k. Little sign of a recessionary collapse in the labour market.

Debt insanity…

Yet perhaps that should come as no surprise when the US government continues to run war time level deficits, which jumped to 6.3% of GDP in Q3, up from 5.6% in Q2. Indeed, in just the last 3 weeks, US debt has risen $500bn - yes 500bn in 3 weeks - to now sit above $35.76trn. There’s an election to win don’t you know!

These numbers are insane yet are a feature of fiat, debt driven economies. As the debt intensity of growth rises (for each unit of growth requires a greater unit of debt) to sustain growth, the debt will need to rise exponentially and so we have a perpetual debasement of fiat currency which will drive hard assets such as gold and Bitcoin perpetually higher. It’s just maths! Goldman Sachs this week suggesting S&P 500 nominal returns over the next 10 years will only be 3% are WRONG because the rate of currency debasement will necessarily be much higher than that and so we would expect the run rate of annual nominal returns to continue to be north of 10%. Sorry Goldman’s, but your analysis assumes a constant USD value which is patently invalid.

Trump Trades…

Whilst the “goldilocks” backdrop of rising liquidity, major central banks cutting rates amidst global disinflation and a slowing, not collapsing US economy continue to push stocks higher (remember our frequent warnings: Don’t overcomplicate it) the recent momentum shift towards Donald Trump in the prediction markets and polls are also adding a tailwind. Stan Druckenmiller this week highlighting the market is re-establishing Trump victory trades, with popular “Trump Trades” such as bank stocks, tightening credit spreads, a stronger dollar and of course crypto all outperforming in the past week. This momentum will be important to keep an eye on with the election now coming more sharply into focus.

Perhaps importantly for markets, a “red sweep” looks more likely than a “blue sweep” and a Kamala victory with a split congress would remove the risks of Kamala implementing more of the market damaging policies such as unrealised capital gains tax. For a market that we believe is under positioned risk into the election, “pain” feels higher and despite historically stocks correcting in the last couple of weeks into the election, we think there’s a chance that many will be forced to chase the market and re-weight higher.

For Bitcoin and more broadly crypto, there appears a risk asymmetry, especially given recent positive comments from Kamala, expressing an openness to crypto. At worst a Kamala victory maintains the status quo. At best, a Trump victory accelerates the positive momentum. Either way, aside from the short term volatility it might create, we believe the macro cycle will play a more dominant role over the next 12 months and right now, that looks set to propel us to new record highs. Liquidity Trumps all 🚀

Native News

Key news from the crypto native space this week.

A study published this week by a16z crypto, the web3 venture capital arm of the investment firm Andreessen Horowitz, found crypto activity and usage are at an all-time high this year. The report estimated around 617 million global cryptocurrency owners, with up to 60 million monthly active users, as of September. Monthly active crypto addresses climbed above 220 million in 2024, with Base at the top for Ethereum Virtual Machine (EVM) chains at 22 million addresses and Solana dominating non-EVM chains with over 100 million addresses. This year also saw the highest number of mobile wallet users, with the United States comprising 12% of global users. a16z crypto Data Scientist Daren Matsuoka said "We appear to be at an inflection point for crypto infrastructure, which has rapidly advanced the scaling of blockchains and will unlock new possibilities for applications and user activity, the steep decline in user transaction fees has helped stablecoins find product-market fit. We've also seen an emerging shift in behaviour around NFTs that's very interesting, with more low-cost, social collecting and less activity in high-priced, speculative secondary markets."

CoinDesk announced that it has acquired CCData, a U.K. FCA-regulated benchmark administrator and provider of digital asset data and index solutions. The purchase also includes retail site, CryptoCompare, which serves over 300,000 active users. The acquisition increases CoinDesk’s information services and data products, while offering enhanced cross-sell opportunities to CCData and CryptoCompare’s extensive number of institutional and retail clients. Sara Stratoberdha, CoinDesk CEO said “Over the past ten years, CCData has become one of the most respected and reliable data platforms for digital assets, earning the trust of numerous users seeking to understand and leverage their potential, we are thrilled to begin integrating CCData’s high-quality, robust, and trusted data platform and retail suite across CoinDesk’s existing products and services to unlock greater opportunities for our customers.” Charles Hayter, CEO and Co-Founder of CCData said “We are incredibly excited to join forces with CoinDesk as we embark on the next chapter of CCData’s journey, CoinDesk is an integral pillar of the digital asset sector, from its award-winning journalism to flourishing index business. I am deeply proud of what CCData and CryptoCompare have accomplished over the past decade, and with CoinDesk as our partner, I’m confident that we will continue to build a legacy that supports and empowers our clients and the broader crypto industry.” Read the full release from CoinDesk HERE.

Ripple named the market participants that will help them support the liquidity of their new stablecoin RLUSD. Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA and Bullish will be the initial exchange and platform partners. In addition market makers B2C2 and Keyrock are also set to support the liquidity of the stablecoin. Ripple CEO Brad Garlinghouse said in a statement “With our initial exchange partners, clear utility and demand for RLUSD, and a strong focus on regulatory compliance, Ripple’s stablecoin is poised to become the gold standard for enterprise-grade stablecoins.” Integrated into Ripple's cross-border payments network, RLUSD is designed for enterprise use cases, including real-time, global payments, providing a stable bridge for on/off ramps between fiat and crypto and supporting the tokenisation of real-world assets such as commodities and securities.

According to a report from Kaiko Research, since the implementation of select provisions of the EU’s Markets in Crypto-Assets (MiCA) regulations in June, MiCA-compliant stablecoins, such as Circle’s EURC and Société Générale’s EURCV, have dominated the euro-stablecoin market. The report says "In the euro-stablecoin market, the market share of MiCA-compliant euro stablecoins, including Circle's EURC and Société Générale's EURCV, reached an all-time high of 67% last week." This shift has been largely driven by Coinbase, which the report said overtook Binance as the leading platform for euro-backed stablecoin trading in August. While Coinbase has embraced MiCA-compliant assets, Kaiko analysts said that Binance, "has been mainly promoting non-compliant euro stablecoins for non-European users through its zero-fee model."

Institutional Corner

Top stories from the big institutions

According to a report by digital asset technology platform Aspen Digital, a growing number of Asia-based private wealth managers are entering the crypto market, with some forecasting bitcoin will hit $100,000 by year's end. The report says that digital assets have emerged as an alternative investment class for private wealth in Asia, with 76% of family offices and high-net-worth individuals investing in cryptocurrencies and 16% planning to do so in the future. That's a notable increase from the previous study in 2022, when 58% had exposure to digital assets and 34% planned to invest. Most respondents cited higher returns as a primary driver, with an increasing number of respondents citing diversification and inflation hedge appeal as key motivations to invest in digital assets. Decentralised finance (DeFi) remained a significant area of interest, with 67% of respondents interested in DeFi development, followed by 61% in artificial intelligence and decentralised physical infrastructure network (DePin), 50% in blockchain infrastructure 47% in real-world assets (RWA) tokenization. The latest findings are based on a survey of more than 80 family offices and high-net-worth individuals conducted in the second half of this year. Most respondents had assets under management (AUM) between $10 million and $500 million, with 20% boasting an AUM of $500 or more.

Euroclear, a global provider of financial market infrastructure, has made its first foray into Asia by acquiring a strategic stake in Marketnode, a Singapore-based digital market infrastructure firm specialising in blockchain tech. The investment by Euroclear is aimed at leveraging blockchain to modernize financial market infrastructure, focusing on simplifying fund management and reducing settlement times through distributed ledger technology. The financial terms of the deal were not disclosed. Euroclear is a global financial services company that provides post-trade services, including the settlement of securities transactions, custody of financial assets, and collateral management. Singapore state-owned investment company Temasek, one of Marketnode’s founding shareholders, positioned the deal as a significant endorsement of Singapore’s financial innovation.

DBS Bank, the largest bank in Singapore by assets, has rolled out a suite of new services dubbed “DBS Token Services” as the bank continues to develop blockchain-based options for institutional clients. In a statement shared with The Block, DBS said that the new banking products integrated tokenization and smart contract-enabled capabilities with its existing banking services. According to the statement, the DBS Token Services integrated the bank’s Ethereum Virtual Machine-compatible permissioned blockchain, its core payment engine and multiple industry payment infrastructures. Also, smart contracts enable programmability for institutions to govern the use of funds. Specifically, the new services include Treasury Tokens, Conditional Payments, and Programmable Rewards. Lim Soon Chong, group head of global transaction services at DBS Bank, said that DBS Token Services enables companies and public sector entities to “optimise liquidity management, streamline operational workflows, strengthen business resilience, and unlock new opportunities for end-customer or end-user engagement.”

The Central Bank of the United Arab Emirates (CBUAE) has granted in-principle approval to AED Stablecoin under its Payment Token Service Regulation framework. AED Stablecoin’s preliminary license approval makes it a frontrunner in the race to become the first issuer of a regulated dirham-pegged stablecoin in the UAE. The development eases concerns about potential restrictions on crypto payments, which had arisen following the CBUAE’s recent release of its licensing framework, which prohibits crypto for payments unless it involves licensed dirham-pegged tokens. If fully approved, AED Stablecoin’s AE Coin could serve as a local trading pair for cryptocurrencies in exchanges and decentralised platforms, while allowing merchants to accept it for goods and services.

Charts of the Week

Because charts are just as important as macro.

Bitcoin futures open interest (OI) on the Chicago Mercantile Exchange (CME) has hit a new all-time high of 172,430 BTC ($11.6 billion).

Increase in USDT trading volume during China Golden Week holiday. Hat tip to Kaiko Data for the chart.

Meme tokens leading the month to date returns at +4.80%. Hat tip to CCData for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Business Development Manager, Cryptoassets at DRW

Execution Services Trader at Coinbase

Business Development Executive at Nansen

Product Owner Crypto Exchange at Revolut

Director Treasury Markets at Checkout.com

VP Quant Developer (Risk Engineering) at Galaxy

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.