Episode 52! The one year anniversary of this newsletter! Thanks very much for each and every subscriber, were really grateful for you taking the time to read this newsletter each week.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

Macro Update: Dovish central bank speak continues to fuel a repricing of rates, a significant shift in the Feds messaging. “Rates and liquidity” the dominant factor in crypto as BTC looks to tag 40k.

Crypto Native News: Coinbase release their 5th Transparency Report, deputy secretary to the US Sectary speaks on stablecoins.

Institutional News: UK Government asks people to disclose the crypto capital gains, MD of the MAS speaks on digital currencies, Brazil announces a new tax on crypto capital gains and JP Morgan release their latest digital asset report.

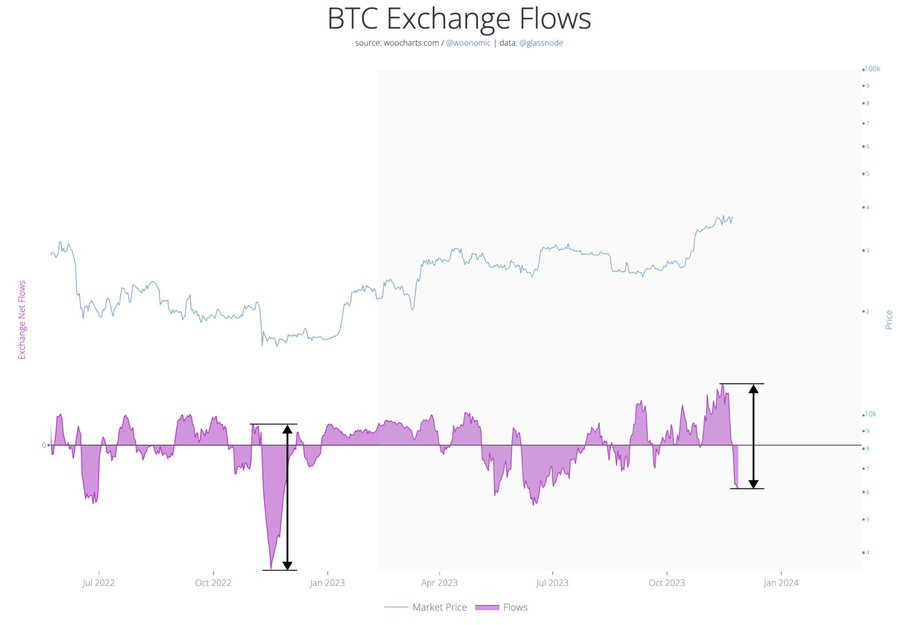

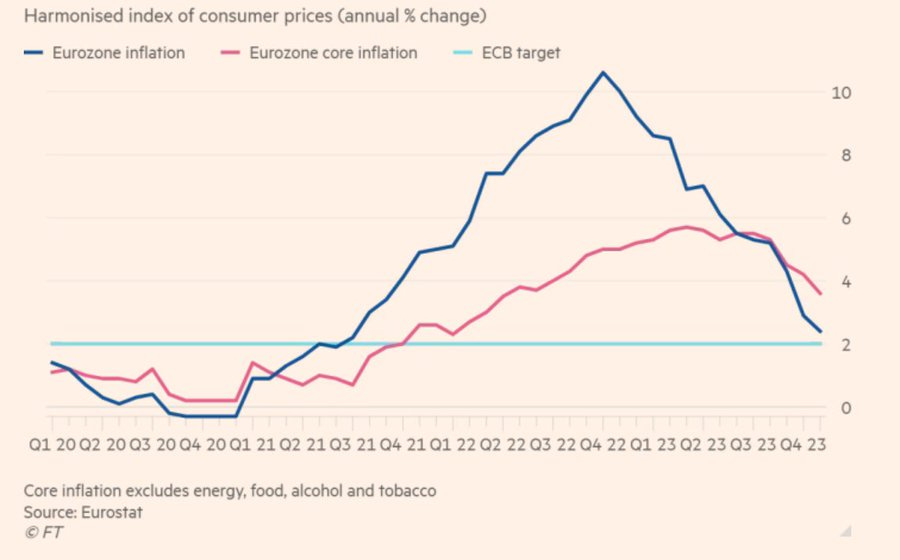

Charts of the Week: Bitcoin flows moving off exchanges, large fall in Eurozone inflation.

Top Jobs in Crypto: Featuring Revolut, Monkey Tilt, Galaxy, Socios.com, Circle and Copper

Macro Update

This is where we connect the dots between macro and crypto.

This is What it Sounds Like, When Doves Cry

Another week and another new yearly high for Bitcoin.

Dovish Central Bank speak continuing to fuel a repricing of rates with 2 year US yields dropping to the lowest levels since June, sub 4.55%

One of the more hawkish Fed members, Christopher Waller, on Tuesday sparked the move by saying that he is “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%,” confirming the view of a Fed on hold. He further suggested that if inflation continued to moderate over the next 5 months, the Fed “could start to lower the policy rate just because inflation is lower.”

JPow on Friday also did little to walk markets back on the current dovish expectations, noting that policy rates are “well into restrictive territory” with an emphasis that the past tightening moves will continue to impact the economy. The Fed, seemingly content with the recent dovish re-pricing and March is now priced for an 80% chance of a rate cut. This is a significant shift in the Fed’s messaging.

Underpinning that contentment, the Fed’s preferred measure of inflation, core Personal consumption expenditures (PCE) continued to come lower at 3.5%, down from 3.7% and the lowest level since April 2021. The so-called “Fed Whisperer,” Nick Timiraos, highlighting that the 6-month annualised rate of core inflation fell to 2.5%, not far from the 2% target. Job done!

The job is certainly done in Europe, where CPI came in at a softer 2.4%, down from 2.9%. Official speakers are still trying to temper expectations of a rate cut, yet the ECB are quickly starting to look behind the curve. Memories are short in the Central Bank world. Not so long ago, battling a disinflationary economy, there was much talk about the need to raise the inflation target to allow “escape velocity” for an economy stuck in “secular stagnation.”

If central bankers made a mistake in 2021 of keeping rates too low for too long, they are now repeating the same errors on the other side of the coin, keeping rates too high for too long. There’s little regard for the lagged impacts of policy playing through and so the required response comes too late and is necessarily required to then be extreme.

Einstein’s definition of insanity is to do the same thing over and over and expect different results. Bitcoin, with a pre-programmed, predictable monetary policy offers some sanity in a world run by central bankers that Einstein would define as insane!

Broad asset markets are consequently scrambling to price a new, easier monetary regime. Gold is breaking out and making new record highs. USD and yields are breaking lower. Liquidity is moving higher. Risk as proxied by the VIX (equity volatility index) and MOVE (bond volatility index) are looking very stable.

This dynamic is rocket fuel for Bitcoin and the wider crypto space. Whilst we would argue the positive “headline impact” of a spot ETF approval has been fully priced, this paradigm shift in the macro dynamic is completely under priced and under-positioned for.

As we transition to the “rates and liquidity” narrative as the dominant crypto driver, away from the “flight to quality” narrative that drove BTC outperformance, BTC dominance should also recede and alt coins outperform (sorry to the BTC maxi’s out there, we don’t make the rules!)

Indeed, whilst BTC looks destined to tag 40k, the break out in ETH above 2150 might well be a more significant level in driving the next leg higher for digital assets broadly.

Breaking out - a sustained break above 2150 could ignite the next leg higher for crypto

Overall, it feels like the moves experienced both across crypto and equities in recent weeks have been driven by short covering and performance chasing into year end. Markets have been stuck playing the 2022 playbook and Macro bears were lulled into this “structurally higher inflation and rates” story, both of which have peaked and starting to reverse.

JPow fired the starting gun on the bear market in November 2021 when he signalled the upcoming hike cycle, by saying it was time to drop “transitory” in relation to inflation. Whilst he has been less explicit in calling on a rate cutting cycle, the dovish signalling by the Fed over the past week, despite markets pumping is a significant moment and one the market is yet to position for. This is what it sounds like, when doves cry.

Native News

Key news from the crypto native space this week.

On Friday, Coinbase released their 5th Transparency Report. The report is intended to provide customers with data about requests for their information they receive from government agencies and law enforcement. The report notes that Coinbase continue to see an increase in requests from jurisdictions across the world and over the reporting period of 1 Oct 22 to 30 Sept 23 there were 13,079 requests made, a 6% increase from the previous year. Requests also come from 19 new jurisdictions. Some other facts from the report include: 19 Countries sent requests for the first time in 2023, including: Armenia (11), Cameroon (8), Costa Rica (6), Colombia (3), Moldova (3), Côte d'Ivoire (2), New Caledonia (2), Pakistan (2), Sri Lanka (2). 73% of law enforcement requests were from the U.S., Germany, U.K. and Spain. United States: Remained the top country with the highest number of requests in both 2022 and 2023, with a slight increase in 2023. Read the full report HERE.

Speaking at a Blockchain Association event in Washington this week, Wally Adeyemo deputy secretary of the Treasury took aim at stablecoins. Adeyemo warned of the dangers of non-U.S. stablecoin issuers that use dollar backing, arguing they need to address their use by bad actors. Speaking of stablecoins he added "We cannot allow dollar-backed stablecoin providers outside the United States to have the privilege of using our currency without the responsibility of putting in place procedures to prevent terrorists from abusing their platform," "While some have heeded our calls and taken steps to prevent illicit activity, the lack of action by too many firms – both large and small – represents a clear and present risk to our national security," Adeyemo said. and finally he said "I want to directly address those within the digital asset industry who believe they are above the law, those that willfully turn a blind eye to the law, and those that promote assets and services that aid criminals, terrorists, and rogue states," he said. "My message is simple: We will find you and hold you accountable." A situation to keep watching.

Institutional Corner

Top stories from the big institutions

The UK Government called on crypto users to voluntarily disclose any unpaid capital gains or income taxes to avoid penalties, and published guidance on how to pay them. The tax disclosures should reflect capital gains or income from exchange tokens like bitcoin (BTC), non-fungible tokens (NFTs), and utility tokens. The post from the HMRC says “Users who have already made crypto tax disclosures to the U.K. Treasury have 30 days from the disclosure date to make all necessary payments. If the deadline is not met, the Treasury will take steps to recover the money, and users may face penalties” Read the full details from HMRC HERE.

The Managing Director of the Monetary Authority of Singapore spoke on digital currencies this week. Ravi Menon says a future monetary system will comprise of 3 components: central bank digital currencies, tokenised bank liabilities and “well-regulated” stablecoins. He wasn’t so kind when speaking about cryptocurrencies saying that private digital coins “have miserably failed the test of money because they can’t keep value,” He added that “Nobody keeps their life savings in these things. People buy and sell these things to make a quick buck.”

The Brazilian President published an executive order aimed at increasing revenue by taxing the capital income from financial investments obtained abroad by individuals who reside in Brazil. The Income obtained abroad from financial investments will be taxed upon the sale or maturity of assets, while profits and dividends from controlled entities will be taxed on Dec. 31 of each year. The measure also includes the taxation of assets in trusts. Income up to 6,000 reals ($1,203) will be tax exempt, while income above that but below 50,000 reais will be taxed at 15%. Income exceeding 50,000 reais will be taxed at 22.5%.

Interesting comments from JP Morgan on the wider Digital Asset ecosystem this week. According to a report, the recent recovery in decentralised finance and NFT’s though positive is not yet strong or conclusive. After a slowdown of almost two years, NFT sales volume and DeFi total value locked have increased in recent months. The recovery has “created some optimism that the worst is behind us in terms of the medium term trajectory for DeFi/NFT activity, but it is premature to start feeling optimistic about it.” They added that Ethereum’s well known issues, including low fees and transaction speeds have hindered the blockchains growth despite recent DeFi/NFT revival.

Charts of the Week

Because charts are just as important as macro.

BTC flows are moving off exchanges. Hat tip to Willy Woo for the chart.

Eurozone inflation fell from 2.9% in October to 2.4% in November, better than the consensus forecast of 2.7%. For its part, core inflation declined from 4.2% to 3.6%. The data will reinforce the markets' pricing of rate cuts in 2024, something that the ECB has been pushing back on. Hat tip to Mohamed El-Erian for highlighting the FT’s chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Head of Product (Crypto Exchange) at Revolut

Crypto Marketing Manager at Monkey Tilt

2024 Institutional Sales Summer Internship Program at Galaxy

Business Development Director for Financial Partnerships at Circle

Security Engineer at Copper.co

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.