Welcome to the new subscribers that have joined us over the last week. We have an action packed edition of Connecting the Dots for you today.

Despite the holiday shortened week in the UK, there’s been a raft of news and macro events which we digest for you below.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family.

And give us a follow on twitter if you want daily insights https://twitter.com/LDNCryptoClub

Onto the newsletter. Here’s what you’re getting this week:

Macro: Inflation heading the right way but Fed speak still tough, liquidity conditions remain supportive and our peak inflation, peak rates view remains in tact.

Crypto Native News: Ethereum Shapella Upgrade, Twitter partners with eToro to offer stocks and crypto trading and Binance CEO CZ speaks at Hong Kong’s Web 3 festival.

Institutional News: LSEG to offer crypto derivatives trading platform, big buyside institutions to test Avalanche Blockchain, a number of firms questioned on their dealings with SVB, IMF MD speaks on CBDC’s and Congress to meet this week on stablecoin’s role in payments.

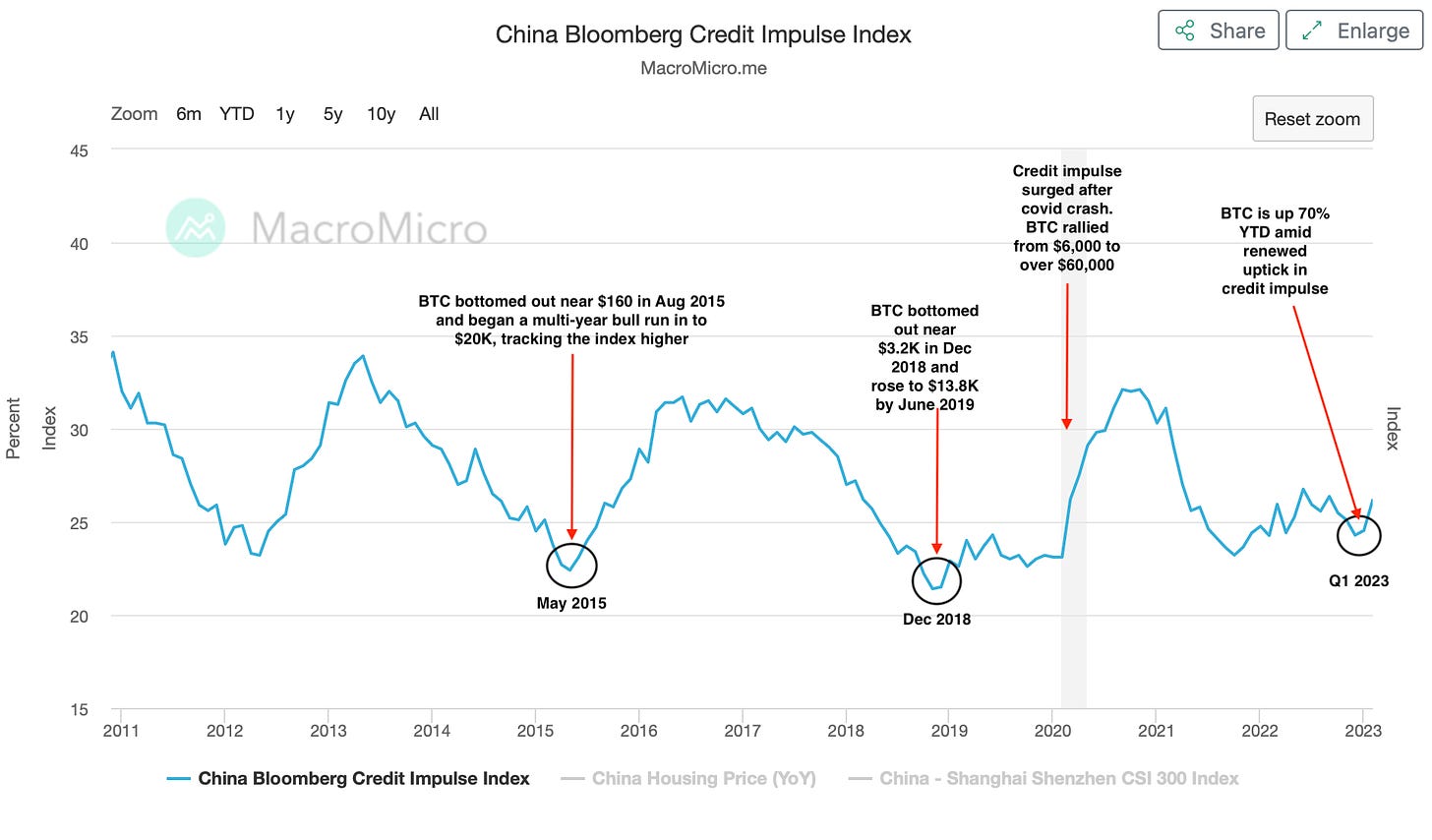

Chart of the Week: China credit impluse index on the up!

Top Jobs in Crypto: Featuring Bitget, Binance, Bitpanda, Wintermute, Ripple and Coinbase.

Macro Update

This is where we connect the dots between macro and crypto.

Plenty of important data releases to occupy us this past week, with US CPI headlining. The number came in soft on headline dropping from 6% to 5%, the smallest gain since May 2021, with monthly inflation at 0.1% below expectations at 0.2%. Taking some shine off the number was still elevated core at 5.6%, with housing related costs driving a core month on month print of 0.4%. Progress however continues to be made and a very weak PPI print on Thursday, which fell 0.5% MoM (Vs +0.1% exp) taking headline PPI to 2.7% from 4.9% in Feb, continues to suggest inflation is heading the “right way.”

Fed speak however, continues to talk tough, even if most members are teeing up a one and done for May. Hawkish comments from Waller on Friday that “inflation is far above target, so monetary policy needs to be tightened further” helped lift odds for a Mar 25bp hike to 85%. Interesting in the FOMC minutes, that staff economists now forecast a “mild recession” later this year. US retail sales falling 1% in March a further sign that the world’s largest consumer is starting to feel the bite.

Putting it all together, the slowdown in the US economy looks to be under way (with even the Fed economists now forecasting recession). Inflation continues to ease. The lagging labor market on the face of it continues to look strong, yet we’ve seen signs over the past couple of weeks of cracks starting to appear. The Fed is still trying to maintain “credibility” talking tough on inflation and look set to deliver one more 25bp hike in May before taking a pause.

We were surprised then that US yields moved higher on the week (2 and 10yr yields up circa 10bps) although after a big move lower post the banking failures, markets perhaps taking a breather. Indeed, solid bank earnings from heavy weights JPM, Citi and Wells Fargo allaying some of those “banking crisis” fears, although we all know the problems lie in the regional banks and those problems have not gone away (regional bank stocks continue to trade heavy).

Broad liquidity also remains supportive, although the Fed balance sheet declined another 17.6bn last week. Nonetheless, it remains 275bn larger than the 1st March and has expanded by $64bn YTD. Underscoring the positive liquidity environment, the Chinese Credit impulse continues to pump with New Bank Loans for March rising to 3.9 trillion Yuan (up from 1.8trn prior) taking Aggregate financing to 5.4trn Yuan (up from 3.6trn) as the PBOC’s liquidity measures filter through to the real economy. China’s credit impulse typically correlates positively with risk and BTC.

Little overall then to dissuade our positive outlook here, as we continue to ride this peak inflation, peak rates dynamic. The Vix index at 17.07, the lowest levels in over a year suggesting “risk” looks comfortable and the MOVE index (which measures bond volatility) although elevated has also moved lower. The dollar made new year lows last week before bouncing Friday and adds an additional positive tailwind. Despite the huge YTD moves so far, the positive dynamic for our high beta crypto bags continues to build nicely .

Native News

Key news from the crypto native space this week.

Shapella Upgrade - Crypto sprang into life this week as the much vaunted ETH Shanghai upgrade was finally, successfully delivered. The network maintained stability throughout the upgrade, with high and stable validator participation, and the feared withdrawals and supply dump look mostly contained to partial withdrawals of the issuance rewards on the Beacon chain. Most of the full withdrawals came from Kraken which has been forced by the SEC to close its staking as a service business, but otherwise it appears stakers are hodlers. ETH continues to hold onto its gains over the past week and trades at 2,100 as I write.

On Thursday Twitter announced a partnership with trading company eToro, to let users view charts and trade stocks and cryptocurrencies. Currently its already possible to view real-time trading data on Twitter from Trading View. With the eToro partnership, Twitter ‘cashtags’ will be expanded to cover far more instruments and asset classes. You’ll also be able to click a button that says “view on eToro,” which takes you through to eToro’s site, and then buy and sell assets on its platform. eToro uses TradingView as its market data partner and its CEO said “As we’ve grown over the past three years immensely, we’ve seen more and more of our users interact on Twitter [and] educate themselves about the markets”. “There is very high quality content, real-time content on financial analysis of companies and what’s happening around the world. We believe this partnership will enable us to reach those new audiences [and] connect better the brands of Twitter and eToro.”

Binance CEO Changpeng Zhao spoke at the Web3 Hong Kong Festival this week and said that crypto regulation rather than unclarity is a better option for the crypto market. "Having no regulatory clarity is the worst. Having bad restrictive regulations are better than that," "And then having unclear ones and then chasing people by enforcement is really, really bad." The comments from CZ came after Binance was sued by the CFTC last month for allegedly operating an "illegal" exchange and a "sham" compliance program. He added that there is a very natural tendency for regulators to borrow guidelines from the traditional financial industry and apply them to crypto — but crypto is different and a nascent industry. It should be allowed to grow, and then there are "always nefarious players, scammers, etc.," so "we need to find ways to limit those guys." Zhao said that most regulators don't have crypto industry experience, like how traditional financial regulators have previously worked for banks and understand that industry better” "So it's really important to very actively engage with regulators," he said. "We can't just say, hey, look, this is decentralized. We are nowhere." Governments trying to control crypto may, in fact, help grow its adoption, according to Zhao." They are trying to control crypto by shutting down banks, shutting down fiat access, putting more restrictions in the traditional financial markets, which actually pushes more people into crypto, which is doing the reverse of what they want to do."

Institutional Corner

Top stories from the big institutions.

On Thursday, The London Stock Exchange Group (LSEG) announced that it will offer a regulated platform for trading crypto derivatives. LSEG said the platform would be run by LCH, its French clearing arm, and GFO-X, a marketplace for digital assets, which is regulated by the Financial Conduct Authority. LSEG hopes the exchange will be up and running by the fourth quarter of this year, subject to regulatory approval in Paris. Frank Soussan, head of LCH DigitalAssetClear, said institutional investors wanted to trade bitcoin but that they needed “a framework which they are familiar with and comfortable with, which at this stage is traditional market infrastructure, a regulated market venue”. Arnab Sen, CEO and Co-Founder of GFO-X, said: “Recent market events in the trading of digital assets have highlighted the need for a safe, regulated venue where large financial institutions can trade at scale, while keeping their clients’ assets protected.”

A number of large buyside institutions are testing a new version of the Avalanche blockchain to explore how the technology could make financial transactions more efficient. T Rowe Price, Cumberland, Wisdomtree and Wellington Management are some of the firms that will experiment with financial trade execution and settlement on the blockchain with a new application called Spruce. Blue Macellari, head of digital assets strategy at T Rowe Price said “This is an opportunity for us to begin to explore…in a super low risk environment where there’s no capital at risk.” The firms that have partnered to test Spruce valueless token system on foreign exchange and interest rate swaps, which could have potential cost savings and reduced risks associated with DeFi.

This week, letters were sent from Senator Elizabeth Warren and Representative Alexandria Ocasio-Cortez to Circle, BlockFi and 12 other non-crypto related tech firms asking questions on their relationship with Silicon Valley Bank. Looking at the crypto specific firms, Jeremy Allaire and Zac Prince, the respective chief executives of Circle and BlockFi, were questioned on the length of their financial relationships with SVB and the amounts deposited with the bank, along with what “agreements” were made between their firms. The letter said “Congress, bank regulators, and the public are owed an explanation for the bank’s hyper-reliance on tech industry firms and investors," They added the extent of SVB’s depositors in the tech industry resulted “in an abnormally high percentage of deposits” not insured by the Federal Deposit Insurance Corporation and questioned the executives on “the role that companies like yours might have played in precipitating the $42 billion single-day-run on SVB.” “Obtaining information on these factors is important for understanding how SVB failed and how to prevent the next failure.”

Hong Kong hosted the Digital Economy Summit this week. Ahead of the event the Hong Kong Financial Secretary Paul Chan said in a blog post that although crypto markets have been highly volatile, it’s the “right time” to push Web3 adoption in the Chinese administrative region. Chan said that when planning Hong Kong’s budget, he identified Web3 Technologies as one of 3 areas of focus. Chan added “In order for Web3 to steadily take the road of innovative development, we will adopt a strategy that emphasises both ‘proper regulation’ and ‘promoting development,’” said Chan. “In terms of proper supervision, in addition to ensuring financial security and preventing systemic risks, we will also do a good job in investor education and protection, and anti-money laundering.” Read more about the event HERE.

This week The IMF Deputy Managing Director spoke on the IMF’s approach to Central Bank Digital Currencies (CBDC’s). The IMF say they have seen unprecedented levels of global interest in CBDCs. By the end of February 2023, over 40 countries had approached the IMF to request assistance. Countries’ questions range from objectives and design choices to pilots and analysis of macro-financial implications. You can read the full speech HERE.

US taxes are due next week and the Internal Revenue Service (IRS) has made adjustments to its 1040 income tax form to be more explicit about what counts as crypto holdings. Filing instructions include new wording for crypto investments, calling them “digital assets” instead of “virtual currency”. That therefore, means that not only cryptocurrencies are included but also NFT’s. The 2022 tax form also expands a question related to crypto, requiring taxpayers to specify whether they received it as a “reward, award or compensation”.

Ahead this week, US Congress will meet to discuss the following topic: "Understanding Stablecoins’ Role in Payments and the Need for Legislation." The Wednesday hearing agenda includes reviewing 72 pages of draft legislation which you can read HERE "to provide requirements for payment stablecoin issuers, research on a digital dollar, and for other purposes." The draft bill includes extensive definitions, establishes requirements at the federal and state level to issue stablecoins, and sets up standards for interoperability, reporting, and enforcement. The legislation also calls for a two year moratorium on new stablecoins until a study can be completed by the U.S. Treasury.

Chart of the Week

Because charts are just as important as macro.

China's credit impulse index, which measures the change in new credit or bank lending as a percentage of the gross domestic product, has bounced from 24% to 26% this year, indicating a renewed credit expansion relative to the growth rate.

Hat tip to Omkar Godbole, Co-Head of Markets at Coindesk for highlighting the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Broker Partner Business Development Manager at Bitget

Listing Business Development Manager at Binance

Trading Operations Expert at Bitpanda

Onboarding Analyst at Wintermute

Institutional Operations Analyst EMEA at Coinbase

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.