Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The powerful ETF flow dynamic continues to push BTC higher, small signs that Januarys strong US data may have been a blip and the Feds’s Waller makes some very interesting comments.

Crypto Native News: Zodia Custody launches their Gateway product, Riot Platforms purchases new bitcoin mining machines.

Institutional News: The BIS releases a paper on stablecoins, VanEck releases a new digital asset platform, JP Morgan says bitcoin could fall to $42k and El Salvador’s bitcoin profit reaches 40%.

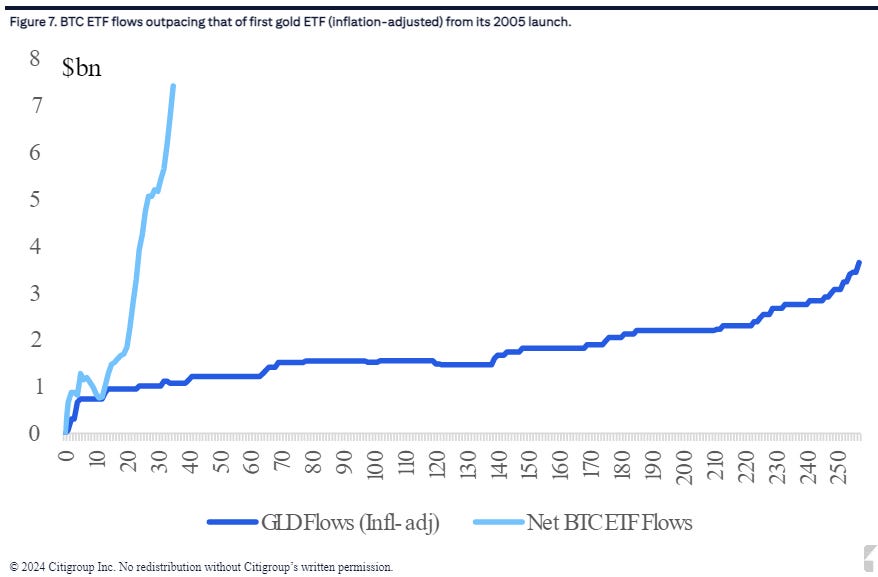

Charts of the Week: BTC ETF inflows outpace gold, weekend trading volumes fall, but midweek volumes on the rise.

Top Jobs in Crypto: Featuring Vortex Foundation, RISQ, Hudson River Trading, Copper, ICAP, Kraken and Ripple

Macro Update

This is where we connect the dots between macro and crypto.

Stick or Twist?

Another big week for crypto as Bitcoin took the next leg higher, rising circa 20% on the week, touching highs north of 64k before an untimely outage from Coinbase spooked the market and tempered gains.

The demand/supply mismatch which we continue to highlight remains the key driver as the spot BTC ETF’s become the most successful ETF launch in history, headlined by Blackrock’s IBIT ETF which is the fastest ever ETF to get to $10bn aum.

Net inflows actually turned negative at the end of the week, despite continued strong inflows into the Nine’s, with Grayscale outflows accelerating to $492mio on Friday, following $599mio outflow on Thursday. This is suspected to be related to Gemini/Genesis bankruptcy selling. However, Gemini’s announcement that investors in the “Earn” programme will receive 100% of their digital assets back in-kind (that is, in the crypto coin/token itself, not a dollar cash value) likely means the redeemed Grayscale shares will be used to re-purchase Bitcoin spot to return to investors. This could add to a powerful demand flow dynamic over the coming weeks 👀

Nonetheless, the powerful, positive demand dynamic looks set to keep pushing Bitcoin higher. Increasing numbers of wealth management platforms are starting to offer access to BTC ETF’s to their investor base. We can’t emphasise strongly enough how this is just the start of a bigger move. Huge pools of untapped capital, previously unable to access the hardest asset on the planet, are now starting to move in.

On the macro, which we’ve highlighted as being a headwind for much of the year to date, we saw some interesting developments which potentially forms an additional tailwind for crypto.

In particular, the dollar and yields appear to have topped out and are starting to reverse lower. Thursday’s release of the Fed’s preferred inflation gauge, Core PCE, ticked lower to 2.8% YoY from 2.9% prior and perhaps came as some relief after the recent stronger core CPI which came in at an above consensus 3.9%. Whilst there remains some emergent signs of underlying inflation strength, it is not sufficient to change the direction of travel towards rate cuts, even if the timing of the first cut continues to be pushed out.

Additionally, there were signs this week that January’s strong data was maybe a blip, with ISM Manufacturing activity substantially below expectations, falling from an 18 month high of 49.1 back to 47.8 (sub 50 implies contraction) The softer data flow seeing the Atlanta Fed’s GDP tracker for Q1 falling from 3% to 2.1%. 2yr US yields subsequently 13bps lower on the week, dragging 10yr yields back below 4.20%. With the yield headwind abating, Nasdaq was free to rip to more, new record highs.

Perhaps most interesting to us on the macro, and somewhat under-reported, were comments on Friday by the Fed’s Waller who said he would “like to see Treasury holdings shift to a larger share of shorter dated securities” whilst also linking the QT taper to the run down of the RRP. In a nod to our assertion that the Fed’s #1 role is to provide sufficient liquidity to keep assets artificially inflated to stop the ponzi, fiat system from collapsing, he also said “balance sheet plans are about getting liquidity levels right…not about policy rate.”

We have highlighted that part of what’s driving stocks and crypto to record highs, is liquidity being injected back into the market. This has been done via the US Treasury running insane deficits (in the last 4 days alone, the deficit increased by $100bn 🤯) and funding it by issuing short dated T-bills, which, cash sat in the RRP, has been teased out and used to purchase. There’s now $440bn left to still come into this market (if you’re trying to fade this market, this is what you’re battling against) but when that runs out, that’s the point where we see a more significant, liquidity induced correction coming.

However, Waller's comments imply consideration of an “operation twist” of sorts, where they could rebalance the Fed’s treasury holdings towards the front end, effectively allowing the Fed to purchase the T-bills and keep front end yields suppressed. Whilst in theory it’s balance sheet neutral (as they would be selling longer dated bonds) combining it with the end of QT (which implies less treasury supply in the long end) would neutralise the impact on yields in the long end and this will help bring down yields across the entire treasury curve…which kind of looks and feels like QE 🤔

It felt like Gold was the first to get the memo on the Waller comments. Certainly one to keep an eye on. One thing is for sure. With the spiralling US deficit, one way or another, when the RRP runs out, the Fed will need to fund the government and take the debt back on the balance sheet. The Fed sounds like they’re making those plans. If the Fed are going to twist, you want to stick with BTC 🚀

London Crypto Club recommends….FINK ! After seeing the dire state of commentary and research after leaving broking, David thought retail could benefit from institutional research made bitesize with actionable ideas coming from it… so that’s what he did — he created Macrodesiac which is now Fink. Check it out HERE.

Native News

Key news from the crypto native space this week.

Zodia Custody launched Zodia Custody Gateway this week. It is a curated marketplace-like experience to allow institutions discover and select vetted partners and services. Zodia Custody say the marketplace will help reduce the time and effort it takes for clients to select trusted providers and functionality. The Gateway product is built to be an evolving marketplace of products and services, providing financial institutions a growing array of partners to increase connectivity to the digital asset space from a single source. Through Gateway, the digital asset custodian aims to bring an “app store” style experience to selecting products and services. From its launch, clients will be able to access Yield, Staking, and Prime services, with more to be announced in due course. Read the full release from Zodia Custody HERE.

Riot Platforms an industry leader in vertically integrated Bitcoin mining, announced this week that it has entered into a new purchase agreement with Shenzhen MicroBT Electronics Technology Co, through its manufacturing subsidiaries, a prominent manufacturer of Bitcoin miners. Under the Agreement, Riot has purchased 31,500 next-generation M60S miners from MicroBT for a total cost of $97.4 million, reflecting a rate of $16.50 per TH. From this new order, 14,500 miners are set to be deployed in available capacity at the Rockdale Facility. The remaining approximately 17,000 miners from this order will replace underperforming machines at the Rockdale Facility. The chart below shows the estimated Hash Rate growth:

Institutional Corner

Top stories from the big institutions

This week, the Bank for International Settlements (BIS) released a paper titled Recommendations for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements. The report says that Stablecoins have the potential to enhance the efficiency of how financial services are provided, but they may also generate risks to financial stability. A widely adopted stablecoin with a potential reach and use across multiple jurisdictions, referred to as a "global stablecoin" (GSC), could become systemically important in and across one or many jurisdictions. Read the full report from the BIS HERE.

Global asset manager VanEck has rolled out a digital asset management platform and NFT marketplace with the goal of making it easier to share ownership and access of self-custodied assets. The platform is called SegMint and uses a model called "Lock & Key," which allows users to share access and ownership of an asset with others in a safe way while keeping control of it. Matt Bartlett, founder of SegMint said “We identified a significant pain point in the digital assets ecosystem—the challenge of sharing access and ownership in a self-custody world.” The idea behind the "Lock & Key" model is for a user to be able to issue keys to a secure vault. "Imagine having a secure vault where you can store your digital assets, and then effortlessly issue keys to others, granting them shared ownership without compromising security," the company explained. Initially, the platform will be targeted towards crypto-native users who are familiar with the use of blockchains, VanEck said, but its ultimate goal is to make it user-friendly enough for everyone to be able to use it.

A report from JP Morgan this week said that the upcoming bitcoin halving event in April could trigger a sharp fall in the price of Bitcoin, down to $42,000. The JPM analysts say that the reduction in block rewards will negatively impact miners profitability and lead to higher bitcoin production costs. The report says “The bitcoin production cost has empirically acted as a lower bound for bitcoin prices. The central point of our estimated production cost range stands at $26,500 currently which would mechanically double post halving event t $53,000.” The analysts also say that there is a possibility of a 20% decline in the Bitcoin networks hashrate post halving, primarily due to less efficient rigs exiting mining operations due to reduced profitability. This would consequently lower the central point of the estimated production cost range to $42,000, based on an average electricity cost of 0.05 $/kWh.

President Nayib Bukele of El Salvador has announced that with the rise in the price of Bitcoin, the country’s Bitcoin holdings have yielded profits exceeding 40%. Bukele further stated that El Salvador has no plans to sell its Bitcoin holdings. The average acquisition cost of Bitcoin for El Salvador is $44,292, and the nation’s treasury holds a total of 2,381 bitcoins.

Charts of the Week

Because charts are just as important as macro.

Bitcoin ETF flows outpacing the first gold ETF’s. Hat tip to Matthew Sigel for the chart.

The weekends share of bitcoin trading volume has now fallen to 13% so far this year. Hap tip to Kaiko Data for the chart.

On Wednesday, daily exchange traded bitcoin trade volume hit its highest level since FTX. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Trader at Vortex Foundation

Crypto Trading Support Engineer at Hudson River Trading

Regional Analyst, Marketing and Growth at Kraken

Senior Business Development Consultant at Ripple

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.