Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

We’d like to ask a small favour…

If you find any part of this newsletter useful, could you share it with just 1 person you think might benefit from receiving it. Thank you !

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: A pivotal week where several cross asset themes reversed, the BOJ and Fed were the focus and the softening in markets is starting to come through. There’s an exponential asymmetry building for Bitcoin at this juncture, read what it is below…

Crypto Native News: BitGo granted a BaFin custody license, Coinbase sees lots of SOL volume, and announces crypto futures and SBF found guilty of 7 counts of fraud.

Institutional News: APPG writes a letter to highlight the issue of banking for UK firms, the SEC subpoenas PayPal and European DeFi regulation to be separate to MiCA.

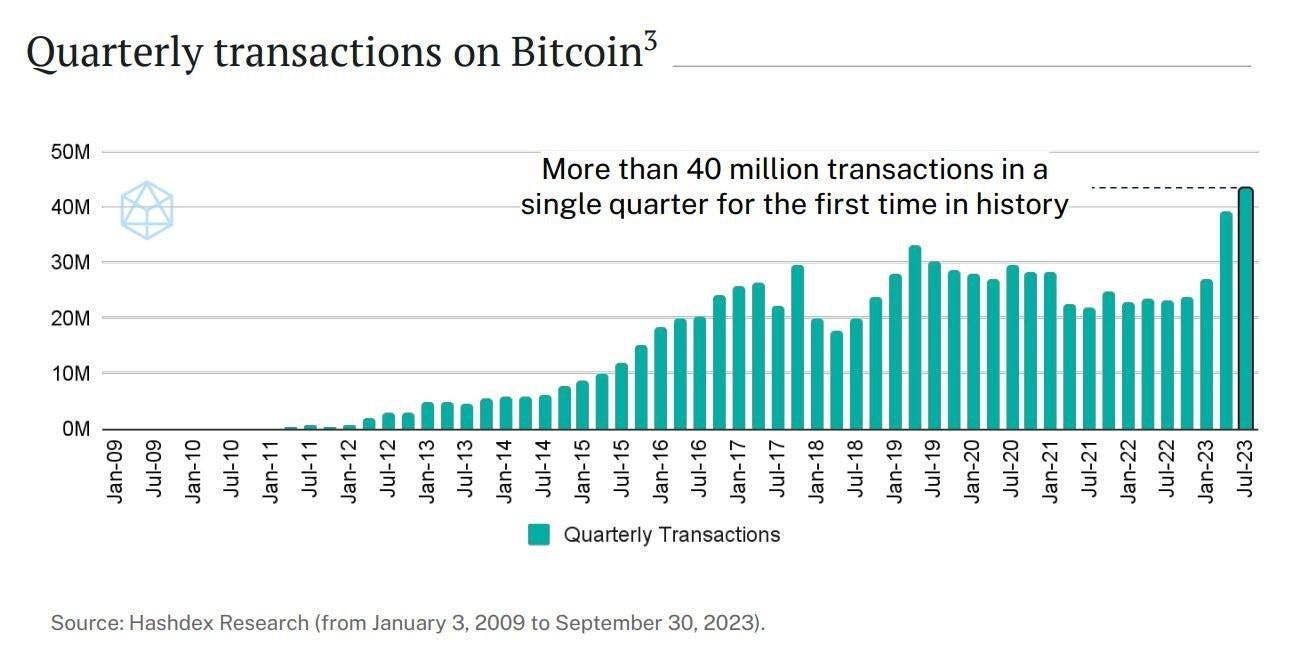

Chart of the Week: Quarterly transactions on bitcoin hits a record.

Top Jobs in Crypto: Featuring Orbit Cosmos, Kraken, Paysafe, Marex, Revolut and Finixio.

Macro Update

This is where we connect the dots between macro and crypto.

Bitcoin's Exponential Asymmetry

A huge week for macro saw Bitcoin once again hit new yearly highs as the momentum continues strong in a market under-positioned and forced to chase performance.

On the macro, this felt like a pivotal week which has reversed several underlying cross-asset themes, not least the unrelenting bond sell off.

It began in earnest with the Bank of Japan (BoJ), where expectations were growing for a significant change to the policy of Yield Curve Control (YCC) in the face of rising inflation and a currency under duress. As we wrote about last week, a significant change to policy in Japan, the world largest foreign creditor, would have huge ramifications for global asset markets as higher domestic yields would see foreign assets sold and repatriated back home.

In the event, the BoJ maintained interest rates at negative 0.1% (despite revising up inflation forecasts) and simply “tweaked” the YCC policy, changing the 1% limit on 10yr Japanese yields from a hard cap to a “reference point.” Whilst ending the pledge of daily bond purchases at 1%, they left open the possibility to conduct additional emergency bond buying, including at levels below 1%, dependent on the path of global yields.

The knee jerk reaction saw the JPY under renewed pressure, with USDJPY trading 151.72 highs, yields trading towards the 1% reference point. Interesting however, was BoJ governor Ueda’s comments that the YCC tweak came partly as a result of rising US long term rates.

This felt to us a little like passing the baton for maintaining bond market stability back to the Fed. Let us explain👇

The BoJ have seen their currency decimated and their balance sheet continually expand in an attempt to artificially support the bond market, with global yields dragged higher by the US. If the Bank of Japan stepped fully away from providing support, they would trigger a global volatility event and blow up the global bond market. Ueda’s comments serve as a warning shot to the US to get the bond market under control and take some pressure off the BoJ and their currency.

Once again, the global fiat economy cannot sustain high rates and require perpetual central bank liquidity, artificially inflating the assets which serve as the collateral underpinning the entire financial system. Someone’s printer has to go brrrr to prevent the global financial system from blowing up.

And so to the US. In many ways, the Fed was a non-event, with rates on hold for a second meeting (as expected) and little changes to the statement. Notably however, JPow in the press conference emphasised how financial conditions have tightened, with the move higher in yields doing the Fed’s job for it. He did little to talk up expectations for another hike, down playing the September projections for one more. Markets consequently moved immediately to price less than a 20% probability of a Dec hike.

The other big event as it relates to the yield curve, was the Treasury’s quarterly refinancing announcement (how much they expect to borrow, and how they will borrow, whether issuing shorter dated, or longer dated debt.) The revised issuance schedule was skewed more towards shorter dated issuance, with $112bn of longer dated issuance, down slightly from the originally planned $114bn and removing fears that expanding long end debt supply would swamp demand and send yields even higher.

US yields started to reverse sharply lower and the move received additional momentum with a slew of soft economic data, with a slowing in both ISM manufacturing and services and headlined by a soft labor market report, which showed the US adding a below expectations 150k jobs in October (lowest level since June), unemployment rising to 3.9% (highest level since Jan 2022) and average hourly earnings falling to 4.1%, it’s lowest level in over 2 years.

The softening we have been expecting in Q4 is starting to come through and markets are re-pricing the “higher for longer” narrative with now more than 100bps of easing priced for 2024. 2yr US yields fell sharply, testing towards 4.80% whilst the dollar reversed, hitting its lowest levels since September.

What does all of this mean for Crypto?

We were bullish coming into 2023 on the change in the macro dynamic as we transitioned away from the sharpest Fed hike cycle in history, towards the pause and eventual cuts. US data resilience has seen this transition play out more slowly than we had hoped. Whilst this thematic has seen Bitcoin as the best performing macro asset in 2023, momentum stalled throughout the summer as we were stuck in this “macro purgatory” unable to fully embrace the end of the hike cycle as the threat of one more hike continued to linger.

Ironically, Bitcoin’s recent bullish momentum stalled into the end of the week with the reversal in US yields, as a powerful tailwind recently, has been the rising term premia and fears on US debt sustainability. Even the prominent Mohamed El-Erian talked in the week about the Bitcoin “flight to quality.” Those fears receding, removing that tailwind.

However, rising yields driven by expectations of “high for longer” alongside a stronger dollar were competing headwinds and those are now reversing. Indeed, with broad asset markets a function of rates and liquidity, equities staged a sharp rally and we expect that momentum to continue into year end, given the level of bearish sentiment and under-positioning. Whilst Bitcoin correlations with equities and risk have de-coupled in recent weeks, Bitcoin remains a high beta asset and all things equal, will benefit from a more positive risk backdrop.

There’s an exponential asymmetry building for Bitcoin at this juncture. Either the slowdown in the US and global economy gathers momentum, seeing a return to easier policy and rising liquidity, or sticky inflation and data resilience enforce a higher for longer Fed keeping yields at levels that tear at the fabric of the global financial system and expose the unsustainability of the fiat economy. Bitcoin is emerging battle hardened and gaining credibility as quality collateral. Fidelity’s Jurrien Timmer beautifully calling it “exponential gold.” The macro world is waking up to this asset class. This bull run is just getting started 🚀

Native News

Key news from the crypto native space this week.

The US regulated crypto custodian BitGo was this week granted a custody license by the German Federal Financial Supervisory Authority (BaFin). Managing Director of BitGo Europe said “BaFin is recognised as one of the worlds key trendsetters in crypto regulation. It enables the progress that digital currencies entail while creating a secure regulatory framework”.

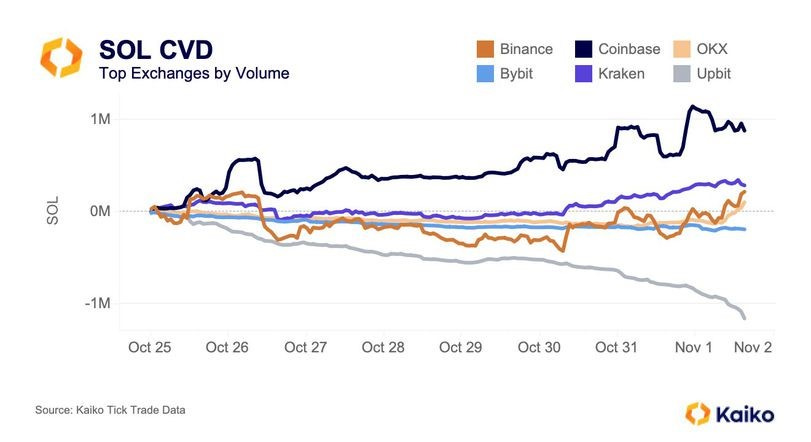

Solana SOL has risen over 50% in the last 2 weeks. Much of the buying has come though Coinbase. According to Kaiko Data, Since Oct. 25, SOL’s cumulative volume delta (CVD) has increased by nearly $1 million on Coinbase, indicating net capital inflows. The CVD metric tracks the net difference between buying and selling volumes over time. It’s a running total of net bullish/bearish pressures in the market, with positive values indicating an excess of purchase volume. Negative values suggesting the opposite. According to Kaiko analyst, Riyad Carey, the median order size on Coinbase has been more significant than other exchanges.

This week, Coinbase announced that US traders can now access crypto futures trading via Coinbase Financial Markets. This comes after Coinbase gained clearance in August to operate as a futures commission merchant (FCM). The futures traders must use the trading platform Coinbase Advanced to access the contracts and also have a spot trading account with the exchange. the contracts are sized with retail traders in mind at 1/100th of a bitcoin and 1/10th of Ethereum, thus the upfront capital requirements are smaller.

It was well covered in the crypto news, but in case you missed it, Sam Bankman-Fried was found guilty of all seven counts he was charged for. This included defrauding FTX’s customers, defrauding Alameda Research lenders and concealing the proceeds by laundering funds. A sentencing hearing has been scheduled for March 2024.

Institutional Corner

Top stories from the big institutions

In UK parliament, the Crypto and Digital Assets All Party Parliamentary Group (APPG), led by Dr Lisa Cameron MP, wrote a letter to the Economic Secretary to the Treasury. Cameron and another 10 members of the APPG across the House of Commons and the House of Lords wrote to Andrew Griffith MP, Economic Secretary to the Treasury and City Minister at HM Treasury and also to David Postings Chief Executive of UK Finance to raise the issue of access to banking services for the crypto and digital assets industry. The key line in the opening of the letter is that crypto businesses are struggling to get access to basic banking services and bank accounts in the UK. The issue is listed as a potential barrier to growth and innovation in the APPG’s recent report into the industry. Read the full letter HERE.

This week, the U.S. Securities and Exchange Commission (SEC) has subpoenaed PayPal over its USD stablecoin PYUSD, a cryptocurrency pegged to the U.S. dollar that was announced to the public this August. A statement from Paypal said "On November 1, 2023, we received a subpoena from the U.S. SEC Division of Enforcement relating to PayPal USD stablecoin," "The subpoena requests the production of documents. We are cooperating with the SEC in connection with this request." Read the full Subpoena HERE.

Following comments from EU officials this week, decentralised finance (DeFi protocols) are interpreted to be exempt from the scope of the European Union’s Markets in Crypto-Assets Regulation (MiCA). The initial scope of MiCA will focus on stablecoins and centralised exchanges. Mark Foster, the EU policy lead at the Crypto Council for Innovation said the European Commission will be mandated under MiCA to develop a detailed report assessing the pros and cons of DeFi over the next year or so “If there are risks that have been identified, they can propose legislation at a later stage for the EU to then potentially develop something on DeFi in the course of the next Parliament,” When speaking about stablecoins and centralised exchanges, Foster said “They were the things they felt needed to be prioritized, so when it came to other areas of the ecosystem, in particular DeFi as a broad concept and NFTs, there was a conscious choice by the legislator to say, ‘Let’s not do this now,’”

Chart of the Week

Because charts are just as important as macro.

In Q3 2023, Bitcoin settled more than 40 million transactions in a single quarter for the first time since inception.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Fundraising and Investor Relations at Orbit Cosmos

Structurer Crypto Derivatives at Kraken

Account Manager - Crypto at Paysafe

Product Owner Crypto at Revolut

Crypto Marketing Manager at Finixio

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.