Connecting the Dots

Episode 152 - Uncertainty Feeding Consolidation

Welcome to the new subscribers that have joined us in the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Binance applied for a MiCA license in Greece, Ledger working on a potential IPO, BitGo IPO priced above the planned price.

Institutional Corner: PWC say institutional involvement in crypto markets has crossed a point where it can no longer be unwound, Thailand SEC plans to introduce comprehensive regulations this year.

Charts of the Week: Crypto card volume growing, BitMine continues to grow its ether holdings.

Top Jobs in Crypto: Featuring Binance, Uphold, Robinhood, Fidelity Investments, the FCA, Nomura, Circle and Wintermute.

Macro Update

This is where we connect the dots between macro and crypto.

Uncertainty Feeding Consolidation

A volatile week for equities and broader risk assets saw geopolitical noise and renewed Japanese bond and currency instability cast a shadow over what remains, at least on the surface, a constructive macro backdrop.

Underscoring that positive macro story, updated estimates of US Q3 GDP showed a stronger growth rate of 4.4%, up from Q2’s 3.8%, driven by higher exports and investment. While clearly backward-looking, it reinforces the point that the U.S. economy entered 2026 in robust shape. Meanwhile, the Fed’s preferred inflation gauge, Core PCE, ticked slightly higher to 2.8% — still well above target, but with little sign of re-acceleration.

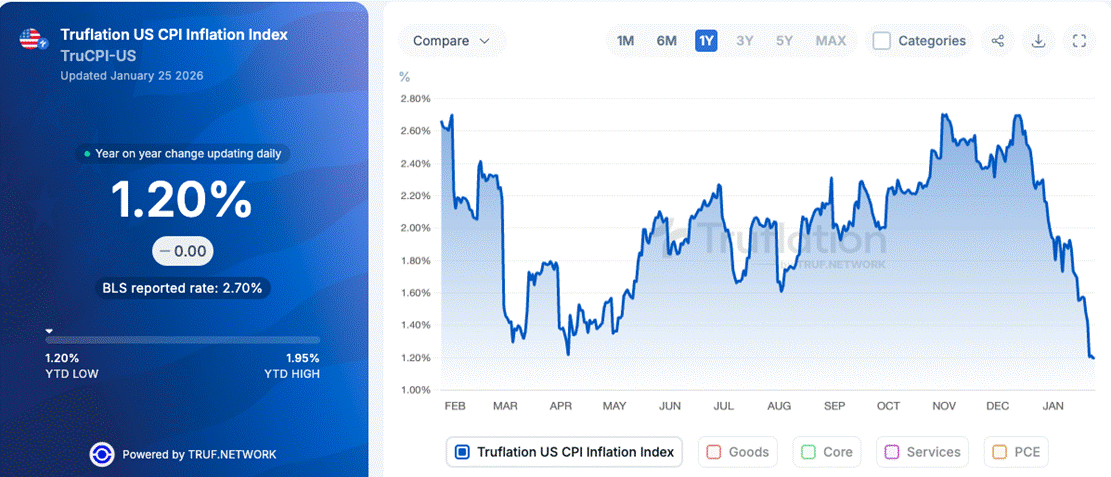

Indeed, measures of “real time” inflation such as those provided by Truflation, suggest a sharp disinflationary impulse, with CPI currently seen at 1.2%. While the absolute level should be treated with caution, directionally this measure has tended to lead official data by around six months, reinforcing our view that the Fed is likely to deliver more than the two rate cuts currently priced by markets.

Greenland tensions thaw…

Early-week risk sentiment was weighed down by renewed tariff threats on Europe tied to President Trump’s renewed push around Greenland. As we suggested, however, the TACO trade (Trump Always Chickens Out) once again proved instructive. As the week progressed, rhetoric softened, culminating in an announcement that Trump and NATO Secretary General Mark Rutte had agreed on a “framework for a future deal” covering Greenland and broader Arctic cooperation. Tariff threats were subsequently withdrawn — a now familiar pattern in Trump’s negotiating playbook.

Fresh uncertainty emerged over the weekend, however, with Trump threatening 100% tariffs on Canada should it pursue a trade deal with China. While we expect this too to fade, it nonetheless injects further near-term caution into markets.

Japanese Intervention

The more consequential development this week was Japan. Prime Minister Sanae Takaichi confirmed an early parliamentary election for 8 February, alongside proposals for a temporary two-year reduction in the consumption tax on food from 8% to zero. Markets quickly focused on the implications for an already fragile fiscal position.

The result was a sharp sell-off in JGBs, with 10-year yields reaching 2.26% — their highest level since 1997 — and 30- and 40-year yields posting their largest weekly moves since last April’s “Liberation Day” tariff shock. USDJPY pushed toward 160 despite broader dollar weakness, underscoring that this move is fundamentally about debt dynamics rather than Bank of Japan policy, which was unchanged at a largely uneventful meeting.

As we noted last week however, Japan’s dilemma will ultimately result in more liquidity as the BoJ is forced to increase bond purchases to “smooth” bond market volatility, whilst the US, in helping keep a lid on USDJPY, will help supply dollar liquidity through FX swaps.

Late on Friday, USDJPY sold off sharply from above 159 to below 156, after reports that the Fed had asked banks for USDJPY pricing — almost certainly in coordination with Japan’s Ministry of Finance. The message is clear: yen weakness and bond volatility have reached a pain point, and coordinated intervention is now firmly back on the table.

Dollar Breakdown

Heading into this week, this will likely underpin broader dollar weakness, which has already been under pressure on the “de-dollarisation” trade as Trump weaponises the dollar and its “exorbitant privilege” - gold and silver continue to be the chief beneficiaries on this dollar rotation.

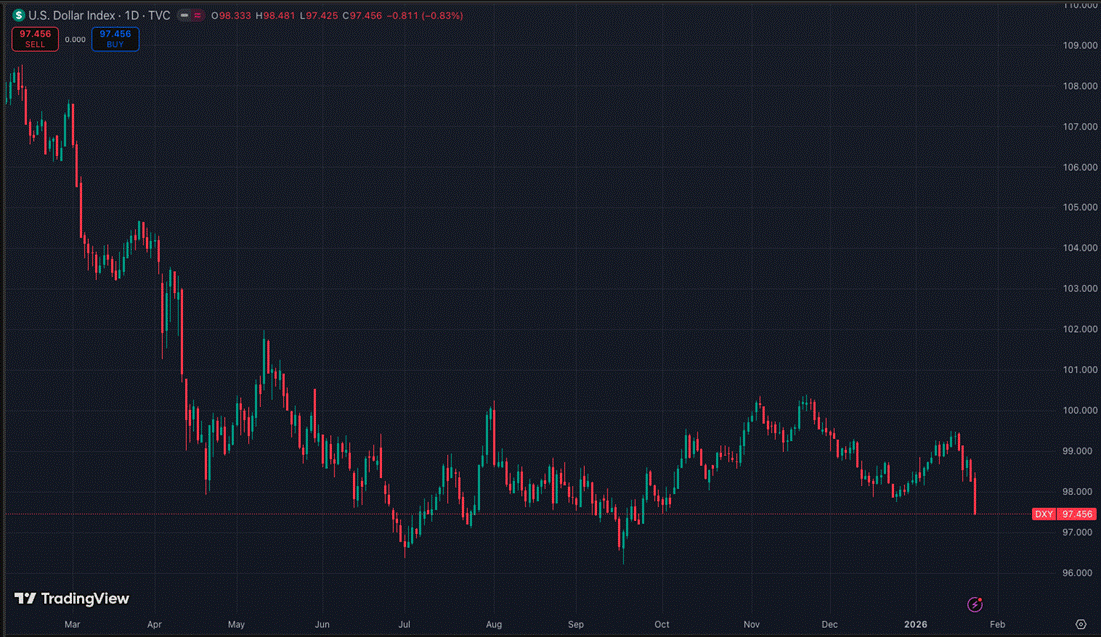

US Dollar breaking down

The DXY is now at its lowest levels since the beginning of October, which coincided with Bitcoin peaking at its record highs. This breakdown, whilst typically acting with a 3 month leg, will be rocket fuel for broad risk and continues to feed the easy financial conditions and rising global liquidity.

Bitcoin, however, has yet to fully respond. After a failed attempt to break the $98k level, BTC has retraced sharply and now trades below $90k. While the structural supply picture has improved — with long-term holder and whale distribution easing — demand remains insufficient to absorb selling from short-term holders who bought near the highs and are now distributing into rallies.

Geopolitical uncertainty and Japan-related volatility have stalled any meaningful rebuild in conviction, with ETF flows turning negative once again.

In short, Bitcoin’s problem right now is less about supply and more the absence of marginal demand willing to absorb short-term holder distribution amid elevated macro uncertainty.

Shutdown Risk

Adding to the near-term uncertainty is the rising probability of another U.S. government shutdown when the current funding extension expires on January 30th. Prediction markets such as Polymarket now assign odds north of 70%, following a spike in political tension after a fatal ICE agent shooting. Senate Democrats have since indicated they would block a funding bill unless Department of Homeland Security funding is separated or reworked, complicating negotiations.

As seen during the October shutdown, this dynamic is negative for liquidity. A rebuilding Treasury General Account drains cash from markets as issuance absorbs liquidity that cannot be recycled via government spending. While the Fed is now offsetting some of this through T-bill purchases and balance-sheet expansion — the opposite of last October — the uncertainty itself is likely to keep risk appetite constrained.

Conclusion

In short, the macro backdrop remains broadly supportive: disinflation is progressing, growth remains resilient, and global liquidity dynamics are turning more favourable. However, elevated political uncertainty — from Japan to Washington — is delaying the handoff from improving fundamentals to renewed risk appetite.

For Bitcoin, this likely means more consolidation in the near term. The setup is improving, but patience is still required.

Native News

Key news from the crypto native space this week.

Binance has formally applied for a pan-European license known as MiCA (Markets in Crypto-Assets) that digital asset firms operating in the continent must obtain before July 1. Despite earlier speculation that Binance would seek its license in Malta or Latvia, the exchange opted to file in Greece, where it has also set up a holding company. The Binance spokesperson said “Greece is an important contributor to the EU’s economic framework, with an economy growing above the EU average and a strong regulatory environment that promotes financial stability, transparency, and investor protection.”

According to the Financial Times (FT), crypto hardware wallet maker Ledger is working with Goldman Sachs, Jefferies and Barclays on a potential U.S. IPO that could value the company at over $4 billion, possibly as soon as this year. Founded in 2014 and based in France, Ledger was valued at about $1.5 billion in 2023. CEO Pascal Gauthier said the company is having a record year as rising hacking and scam risks boost demand for secure self-custody devices.

Crypto custodian BitGo Holdings Inc priced its U.S. initial public offering at $18 per share, above the company’s planned price of $15 to $17. The company moved 11.8 million shares and collected $212.8 million from investors. The sale puts BitGo’s total worth at $2.08 billion. The offering comprises 11,821,595 Class A common shares, with 11,026,365 being offered by BitGo directly and 795,230 sold by certain existing stockholders, according to its statement. BitGo also granted underwriters a 30-day option to purchase up to 1.77 million additional shares. Read the full announcement from BitGo HERE.

Institutional Corner

Top stories from the big institutions

According to a report by PWC this week, institutional involvement in crypto markets has crossed a point where it can no longer be unwound. In its Global Crypto Regulation Report 2026, the consulting firm argues that rather than being driven primarily by trading activity or speculative demand, digital assets are increasingly becoming embedded in payments, settlement, treasury operations, and balance-sheet management. PwC says crypto is no longer confined to exchanges or trading venues, but is increasingly used to move and manage money, often behind the scenes and invisible to end users. Stablecoins and tokenised cash equivalents are flowing through internal transfers, cross-border payments, and corporate treasury operations, intertwining traditional finance with blockchain-based infrastructure. Read the full report HERE.

Thailand's Securities and Exchange Commission plans to introduce comprehensive regulations on digital asset-related products and activities this year. The Bangkok Post reported Thursday that the Thai SEC plans to issue formal guidelines supporting the establishment of crypto ETFs and the introduction of crypto futures trading on the Thailand Futures Exchange (TFEX). The set of new rules is expected in the early part of this year. SEC Deputy Secretary-General Jomkwan Kongsakul said that the agency views crypto ETFs as particularly attractive to investors because they eliminate concerns over hacking and wallet security, according to the report.

Charts of the Week

Because charts are just as important as macro.

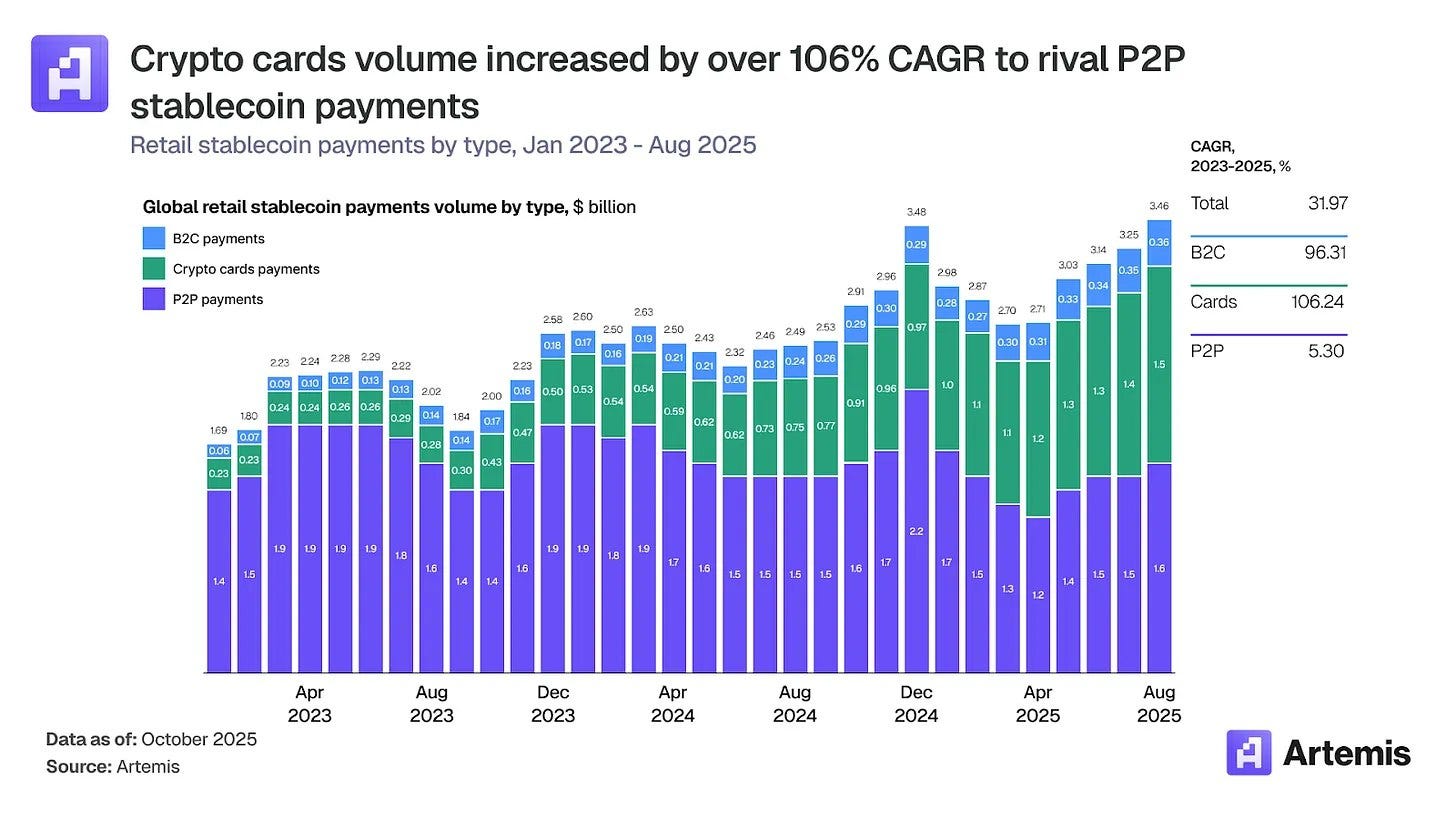

Crypto card volume has grown from approximately $100 million monthly in early 2023 to over $1.5 billion by late 2025, a 106% compound annual growth rate.

Annualised, the market now exceeds $18 billion, rivalling peer-to-peer stablecoin transfers ($19 billion), which grew by just 5% over the same period.

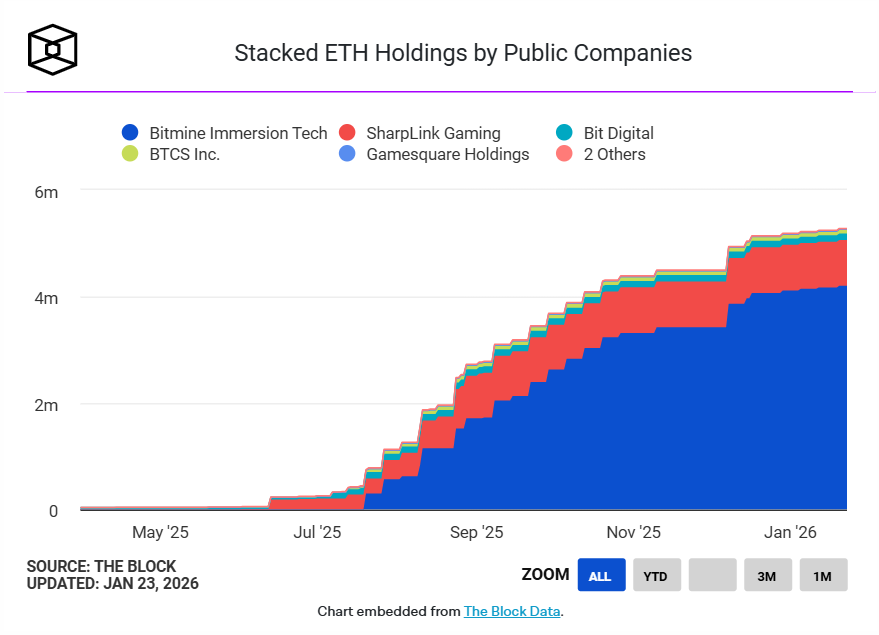

BitMine Immersion Technologies, the world’s largest Ethereum treasury holder, has grown its ether holdings to more than 4.2 million ETH following another week of acquisitions. The company reiterated its long-term goal of acquiring 5% of Ethereum’s circulating supply, equivalent to roughly 6 million ETH at current issuance levels.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Research BD Manager/Director at Binance

Senior Manager of Crypto Operations, Risk at Robinhood

Quant Developer Digital Assets at Fidelity Investments

Associate, Payments and Digital Assets at the FCA

Product Manager, Digital Solutions at Nomura

Principal Product Manager, Onchain FX at Circle

Algorithmic Trader at Wintermute

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.