Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The broad dollar continues its rise, which would usually be negative for bitcoin, however, we explain why that’s not the case this time. There’s little to disrupt the positive macro backdrop supporting this move higher for Bitcoin.

Crypto Native News: Crypto.com receives EMI regulation from the FCA, Binance releases its 13th reserve report, Swiss city Lugano allows residents to pay taxes in crypto, Zodia Custody announces its new “network of networks” and bitcoin miner Phoenix Group completed an IPO in Abu Dhabi.

Institutional News: Soc Gen issues its first digital green bond, Fidelity meets with the SEC to discuss its potential spot bitcoin ETF.

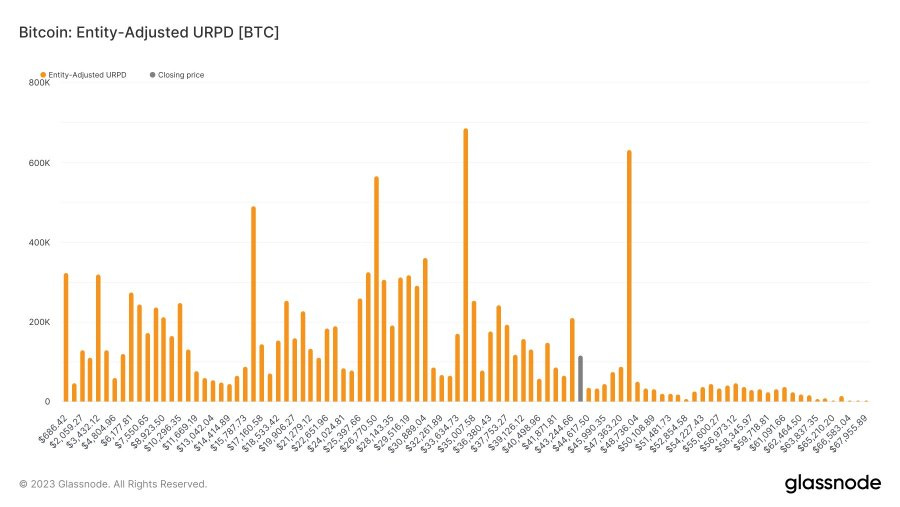

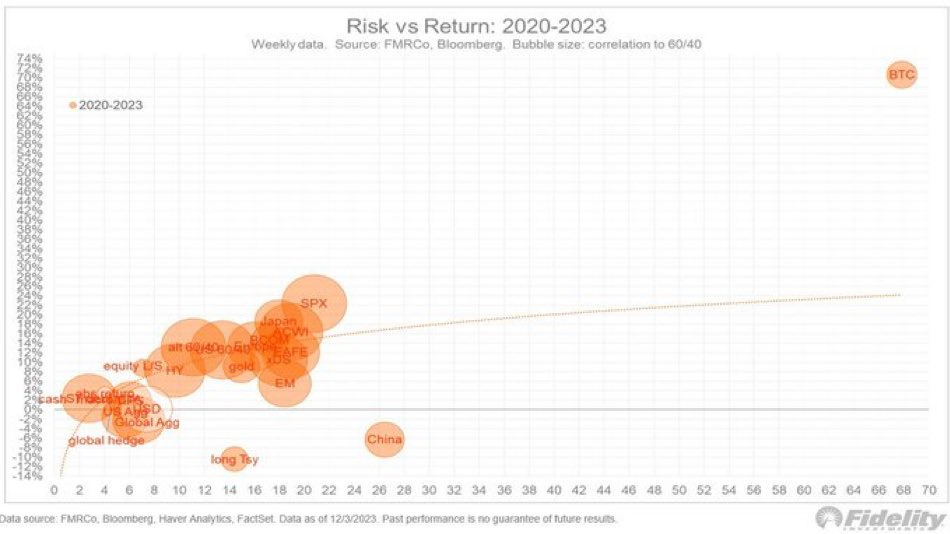

Charts of the Week: Little bitcoin supply between 45-47k, and a great chart showing the outsized risk reward for bitcoin.

Top Jobs in Crypto: Featuring Fireblocks, Web3Studio, Ripple, DWS, Numeus and Chainlink Labs.

Macro Update

This is where we connect the dots between macro and crypto.

Macro on Track

A mixed week for markets and macro data which saw equities flat to small up and long end bond yields continuing the path lower. BTC continued to forge new highs 💪. Underlying global growth concerns are percolating, perhaps best reflected in the continued fall in oil prices, with WTI trading at one point sub $70, despite the OPEC production cuts.

German Factory orders declined 3.7% in November (vs +0.2% exp) highlighting the deepening slowdown in Europe, with markets now pricing 140bps of cuts from the ECB next year. ECB’s executive board member Schnabel also flipping dovish in saying that, given recent inflation numbers, further rate hikes are “rather unlikely.”

Friday’s stronger 199k non farm payrolls print in the US calming some of the recessionary fears, despite signs earlier in the week of a softening in the labour market, with JOLTs Job openings falling to 8.7mio in October, the lowest level since Q1 2021. Overall, Friday’s robust employment report (unemployment rate falling back to 3.7% from 3.9%) did little to change expectations for the Fed who’s focus remains on the continued fall in inflation. University of Michigan 1 year inflation expectations falling to 3.1% from 4.5% providing further evidence of the on-going moderation in prices and garnered more market attention than payrolls.

Japanese government bond yields climbed 15bps from the lows as hawkish comments from BoJ officials continue to fuel expectations of a move away from negative interest rates. We at London Crypto Club believe the BoJ will miss that window as inflation rolls back over. Latest CPI data coming in at 2.6% down from 3.3% and quarterly GDP annualized a negative 2.9% 😳.

Interesting perhaps, that global bond yields showed a reduced sensitivity to Japan, which speaks to the underlying strength in the bond market as we price the start of a cutting cycle. 10 year US yields falling to 4.10% before bouncing post payrolls and we expect have a lot further to fall and form a persistent tailwind for Bitcoin.

The broad dollar also recovered (despite the sharp fall in USDJPY) as amidst global slowdown fears, the US remains the cleanest shirt in the laundry. Typically, this would be negative for Bitcoin, all else equal, yet the reasons “why” the dollar is bouncing is critical.

Let us explain.

The dollar is the ultimate safe haven currency and so usually bounces in risk off environments which is typically bad for BTC (although the new “flight to quality” narrative is changing that dynamic.) The dollar also typically rallies when yields are moving higher on expectations for tighter monetary policy, which is negative for non yield producing assets like BTC. The dollar also strengthens when global liquidity is low. There’s over $17trn of debt issued outside of the US and so when liquidity is low, there’s a global scramble to find dollars. Low liquidity is negative for BTC.

FX however is a relative game and the dollar also bounces when there is a global growth slowdown and US exceptionalism exerts itself. In this case, being accompanied by falling yields and rising liquidity, dollar strength is less of a headwind to crypto. This is the environment we find ourselves in now. Should those moves become more disorderly and spill over into risk, then dollar strength may become more problematic. Wednesday’s FOMC poses some risk there.

Overall however, little to disrupt the positive macro backdrop supporting this move higher for Bitcoin. Clearly we’re in a disinflationary, slowing growth world, which the market is reluctantly trying to adjust to. We’re also encouraged by the outperformance of the altcoin space which last week we suggested should start to occur as rates and liquidity become the predominant driver of the Bitcoin rally. All good signs of a crypto bull market getting in swing.

Further, we’ve seen a reduction in open interest this week, suggesting real underlying spot demand is driving this move, rather than over leveraged euphoria. Indeed, more than a euphoric rally, we field more questions asking “when” a correction comes. The PTSD of a brutal bear market weighs heavy! This remains a market under positioned risk and needing to chase performance. Significant bull market corrections will come. This doesn’t feel like that moment.

Native News

Key news from the crypto native space this week.

Crypto.com received authorisation from the UK Financial Conduct Authority as an Electronic Money Institution (EMI). With this EMI authorisation, Crypto.com will offer a suite of UK-localised e-money products. Kris Marszalek, CEO of Crypto.com said “The UK has and continues to be a hugely important market for our business and the greater industry,” “We look forward to continuing to collaborate with a global regulatory leader in the FCA in our collective pursuit of responsible innovation for crypto.” Read the full press release from Crypto.com HERE.

Binance released its thirteenth reserve report as of 1 December 2023. User BTC holdings decreased by 4.05% compared to the previous month, settling at 561,000 BTC, a reduction of 23,656 BTC. User ETH holdings decreased by 0.67%, settling at 3.88 million ETH, a reduction of 26,323 ETH. User BNB holdings decreased by 0.74%, settling at 30.98 million BNB, a reduction of 230,000 BNB. User USDT holdings increased by 5.67%, settling at 16.1 billion USDT, an addition of 866 million USDT. According to DeFillama, Binance’s reserve assets have seen a net inflow of $311 million over the past month. Read full details from Binance HERE.

The Swiss city Lugano announced this week that it has started accepting BTC and USDT as payment for taxes and all other community fees. Lugano will accept the payments in an automated process through the cryptocurrency platform Bitcoin Suisse. Lugano citizens and companies will be able to pay all local invoices — regardless of the nature of the service or the amount invoiced — with Bitcoin. Residents are also able to pay taxes or services with Bitcoin through the Swiss QR-bill by scanning the code on the invoice and paying with their preferred mobile wallet and the selected cryptocurrency. As a reminder the Swiss canton of Zug started accepting Bitcoin and Ether for tax payments from local companies and individuals in 2021. Read the full details of this weeks release HERE.

Zodia Custody announced a new “network of networks” to link together different institutional crypto accounts. The product, named “Interchange Connect,” gives institutional investors a way to easily transfer crypto across different accounts held at the likes of Metaco, Fireblocks and Copper’s ClearLoop, while settling trades off-exchange. It is due to go live in Q1 2024. James Harris, Chief Commercial Officer at Zodia Custody, said in a statement. “Interchange Connect massively opens up the possibilities for institutions by connecting our own bank-grade infrastructure and unique custodial solutions to others, ensuring that institutions gain additional secure, reliable and compliant end-to-end service capabilities.” Julien Sawyer , CEO of Zodia Custody said “No one party will be solely able to evolve the infrastructure underpinning the digital asset ecosystem — but together, we can provide the tools and services to bring digital assets into the mainstream.”

Crypto mining firm Phoenix Group completed a $371 million IPO on the Abu Dhabi Securities Exchange (ADX) and saw a 50% increase on the first day of trading, with an oversubscription of 33 times. This IPO marks the first listing related to a crypto company in the Middle East. The largest business group in Abu Dhabi, International Holding Co., controlled by a key member of the royal family, purchased 10% of Phoenix’s shares in early October.

Institutional Corner

Top stories from the big institutions

Societe Generale issued its first digital green bond as a Security Token directly registered by SG-FORGE on the Ethereum public blockchain. Soc Gen said the inaugural operation is structured as a EUR 10m senior preferred unsecured bond with a maturity of 3 years. An amount equivalent to the net proceeds of the bond will be exclusively used to finance or refinance Eligible Green Activities, as defined in the Sustainable and Positive Impact Bond framework of Soc Gen. Soc Gen also said this is a first step towards using blockchain as a data repository and certification tool for issuers and investors to foster transparency on ESG and impact data on a global scale. Read the full release from Soc Gen HERE.

Asset Management firm Fidelity met with the SEC this week to discuss its potential spot ETF. Fidelity provided the regulator with a presentation entitled "Bitcoin ETF Workflows" that included slides that detailed "In-Kind" creation and redemption models. A quote from the presentation said "Arbitrage and hedge are more efficient with physical creations," "Self-clearing ETF market maker firms can facilitate efficient arbitrage in acting as Agency AP for non-self-clearing ETF market maker firms with Crypto Affiliates. Allowing for physical creation and redemption is critical to enhance trading efficiency and secondary market pricing for all participants." Read the full details of the meeting HERE.

Charts of the Week

Because charts are just as important as macro.

Very little bitcoin supply sits in between 45k-47k. UTXO Realized Price Distribution (URPD) shows at which prices the current set of Bitcoin UTXOs were created (i.e. each bar shows the amount of existing bitcoins that last moved within that specified price bucket). Hat tip James Van Straten for highlighting the chart.

Great chart showing the outsized risk reward for Bitcoin vs all other assets. Hat tip to Anthony Pompliano for highlighting the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Product Marketing Manager at Fireblocks

Web3, NFT, Crypto Partner Manager at Fracas Web3 Studio

Staff Product Security Engineer at Ripple

Senior Risk Manager Digital Assets at DWS

Senior Trading Infrastructure Engineer at Numeus

Product Manager at Chainlink Labs

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.