Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Unsustainable fiat monetary system with the US debt exceeding $33tn for the first time, major central banks pause their hiking cycles but the move in bond markets is concerning.

BONUS Section - Token Takeaways - The key takeaways from Token2049.

Crypto Native News: The SEC dealt a blow in their lawsuit against Binance US, Coalition Greenwich report on crypto, and Coinshares launches a new hedge fund division.

Institutional News: Citibank announces Citi Token Services, Laser Digital launches a Bitcoin Fund and the Economic Crime and Corporate Transparency Bill is reviewed by the House of Lords.

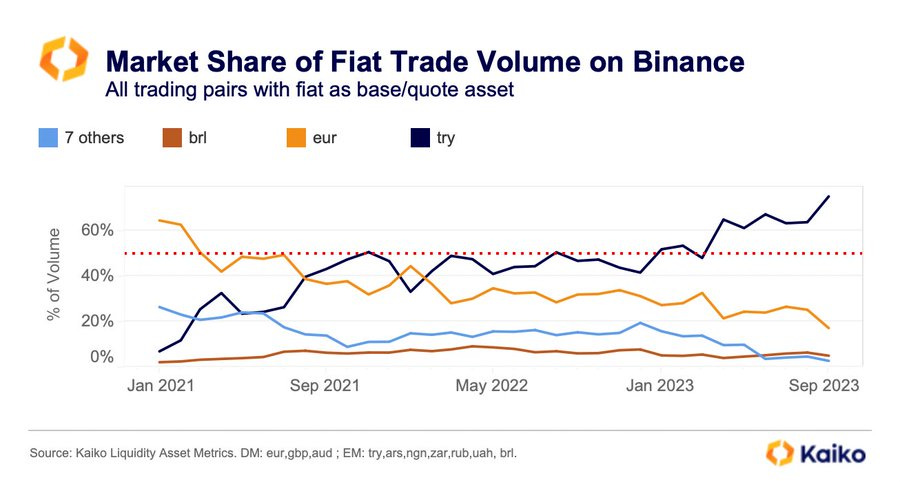

Chart of the Week: Turkish lira the most traded fiat currency on Binance though September.

Top Jobs in Crypto: Featuring Binance, Hivemind, Ripple, Pulsar, Gemini and Wintermute.

Macro Update

This is where we connect the dots between macro and crypto.

Fiat Fragilities

The Fed was the Central Bank highlight of an otherwise light data week last week and sparked further bond market turmoil. Whilst rates were held steady at a target range of 5.25-5.5%, with expectations of still one more hike in 2023, the hawkish surprise for markets came in the form of upwardly revised projections for 2024, with 50bps less cuts now expected given the continued resilience of the US economy.

US bonds resumed the sell off with 10yr yields hitting 4.5% and the dollar hitting its highest levels since March 8th, just before the Silicon Valley Bank (SVB) collapse. Equities consequently trading heavily, with US indices down over 3% on the week.

Crypto however remains resilient and despite giving back an early week climb to 27.5k, BTC is back trading around 26k and BTC volatility continues to get crushed, even if the skew favours downside protection as caution prevails. A delay to the Mt. Gox repayments by a year perhaps providing an off-set, alongside continued expectations of a spot BTC ETF approval.

Nonetheless, as we commented last week, this resilience of BTC in the face of strong macro headwinds from higher rates and stronger dollar is curious and continues to feed our bullish confidence heading into Q4.

Indeed, a reminder of the longer term bullish thesis of an unsustainable fiat monetary system came this past week, with US debt exceeding $33 trillion for the first time. The move higher in yields is in large part being driven by this US debt supply dynamic. Meanwhile, US regional banks have been quietly moving lower, with the KBW Regional Banks Index back below the spike lows post SVB collapse and at the lowest levels since early July.

KBW Regional Banks Index - Quietly breaking down

To that end, we place little value in Fed “dot plots” which typically have a poor forecasting record, especially as it relates to them “breaking things.” For all the talk of a hawkish Fed, the fact remains that they “paused” and JPow seemed in no rush to deliver a further hike. The hawkish rhetoric merely gives optionality for a Fed trying to maintain inflation fighting credibility yet we continue to expect the lags to feed more forcefully into Q4 and that this tightening cycle is done.

Elsewhere, the Bank of England surprised markets with a pause in the hiking cycle as did the SNB. With the ECB also likely done hiking, it’s difficult for us to embrace the bearish narrative that is engulfing markets. This is a vastly different macro backdrop to 2022 where asset markets had to endure the sharpest Fed tightening cycle in history.

Nonetheless, the move in bond markets is concerning and it appears dislocated from a backdrop of slowing global growth and central banks at the end of the hike cycle. The US treasury will be particularly concerned with debt spiralling and interest costs eating up an ever larger part of the budget. All the while, a US government shutdown looms, barring agreement on a funding deal by the 30th Sep.

This all has a “feel” of something quietly breaking as the fragilities of a fiat system addicted to debt re-surface. All roads lead to more liquidity. Bitcoin’s resilience is perhaps a forewarning.

Token Takeaways

I spoke to some people who attended Token2049, here were their key takeaways:

The event was much more “institutional” than previous years which was retail and degen heavy.

There was less NFT/art focus but more institutional custody, liquidity, regulatory reporting and portfolio management providers.

Some of the bigger buyside firms spoke about the challenges of scale. Some of the big asset managers have more assets under management (AUM) in their funds than the entire size of the crypto industry. Large buyside firms are showing lots of thought and considerations on building the infrastructure rails.

It was highlighted in conversations that in TradFi, banks offering everything. In Crypto its different, there’s multiple firms that offer specific expertise and complete specific tasks.

Another theme was the huge amount of Layer 2 (L2) projects trying to get traction. Many will not survive, but they are positive for the scaling of the market as a whole.

Native News

Key news from the crypto native space this week.

The Securities and Exchange Commission (SEC) was dealt a blow this week in their ongoing lawsuit against Binance.US after a judge denied their request for immediate inspection of the trading platform’s software. The SEC had told the court that Binance.US was not cooperating with its investigation into the exchange. The judge has scheduled a follow-up hearing for 12 October.

Analytic firm Coalition Greenwich released a report this week, surveying traders, PM’s, analysts and researchers from some of the worlds largest asset managers and professional investors. The report covers firms located in the US, UK and Europe. The report found that 48% of the surveyed firms have crypto assets under management (AUM). Almost 80% of respondents expect industry-wide digital AUM to grow on a compound annual growth rate (CAGR) basis over the next five years. 25% of the firms interviewed already have specific digital asset strategies, with that number expected to rise to 33% within the next two years. Many of the funds are mostly looking to build products that they are already familiar with — such as exchange-traded funds (ETFs).

European crypto asset manager CoinShares International Ltd has launched a new hedge fund division, CoinShares Hedge Fund Solutions, as the company expands into the U.S. market. The Jersey-based firm’s move aims to increase the company's product suite, targeting qualified U.S. investors with a range of private investment strategies. Lewis Fellas will head up the division and said in a statement “The design of our strategies reflects the team’s deep and practical knowledge of digital assets and showcases the firm’s ability to develop new products that meet the demands of institutional investors,” “The long-awaited return of interest rate-driven volatility is a great opportunity that we plan to capture with our novel fund products,” Fellas added. “Each product that will be offered is designed to mitigate counterparty risk whilst providing investors with clearly defined asset class and strategy exposures.”

Institutional Corner

Top stories from the big institutions

This week, Citibank announced the creation and piloting of Citi Token Services for cash management and trade finance. The service uses blockchain and smart contract technologies to deliver digital asset solutions for institutional clients. Citi Token Services will integrate tokenized deposits and smart contracts into Citi’s global network, upgrading core cash management and trade finance capabilities. Citi say institutional clients have a need for ‘always-on’, programmable financial services and Citi Token Services will provide cross-border payments, liquidity, and automated trade finance solutions on a 24/7 basis. Read the full press release from Citibank HERE.

This week Laser Digital, the crypto unit of Japanese bank Nomura, launched its asset management business with a bitcoin fund. The Bitcoin Adoption Fund provides "long-only" exposure to bitcoin for institutional investors. Laser Digital will use Komainu, which Nomura co-founded in 2018 with Ledger and CoinShares, to custody the fund's assets. Sebastian Guglietta who runs Laser digitals Asset Management arm said “Technology is a key driver of global economic growth and is transforming a large part of the economy from analogue to digital. Bitcoin is one of the enablers of this long-lasting transformational change and long-term exposure to bitcoin offers a solution to investors to capture this macro trend".

The Economic Crime and Corporate Transparency Bill was introduced in September 2022 and primarily aims to tackle crypto-related financial crimes. Over the past year, the bill went from the House of Commons to the House of Lords and is now in the final stages of approval. This week the bill was reviewed by the House of Lords who agreed on certain amendments to clarify its intent of targeting monetary proceeds from fraud or other financial crimes. The bill also aims to set provisions for corporate transparency and overseas business registrations. At the final stage, the House of Commons will either decide to accept the proposed amendments or recommend changes to the bill. Following the approval, the bill will be signed into law through royal assent, a method by which a monarch formally approves an act of the legislature. You can read the full bill HERE.

Chart of the Week

Because charts are just as important as macro.

Through early September, the Turkish lira has become the largest fiat trading pair on Binance, accounting for 75% share of all fiat volume.

Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Creator Partnerships Manager at Binance

Senior Crypto Operations Analyst at Hivemind

Client Solutions Director at Ripple

Senior Developer Middle Office at Pulsar

Director Consumer Sales Europe at Gemini

Director Institutional Sales Europe at Gemini

Investment Associate at Wintermute

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.