Macro Dave is on holiday this week so we have a guest writer Mark McKee taking us back to basics with a section titled How different is Bitcoin from fiat money? Thanks Mark!

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Guest Writer: How different is Bitcoin from fiat money? by Mark McKee

Crypto Native News: Circle CEO estimates that 70% of USDC adoption is non-US, Quant removes the need for cryptocurrency during the token deployment stage and Visa introduces an experimental solution on Ethereum.

Institutional News: The Bank of England and Treasury create a new Academic Advisory Group for a digital pound, the AMF in France announce amendments to local crypto regulations and the MAS commits $150 to the Financial Sector Technology and Innovation Scheme.

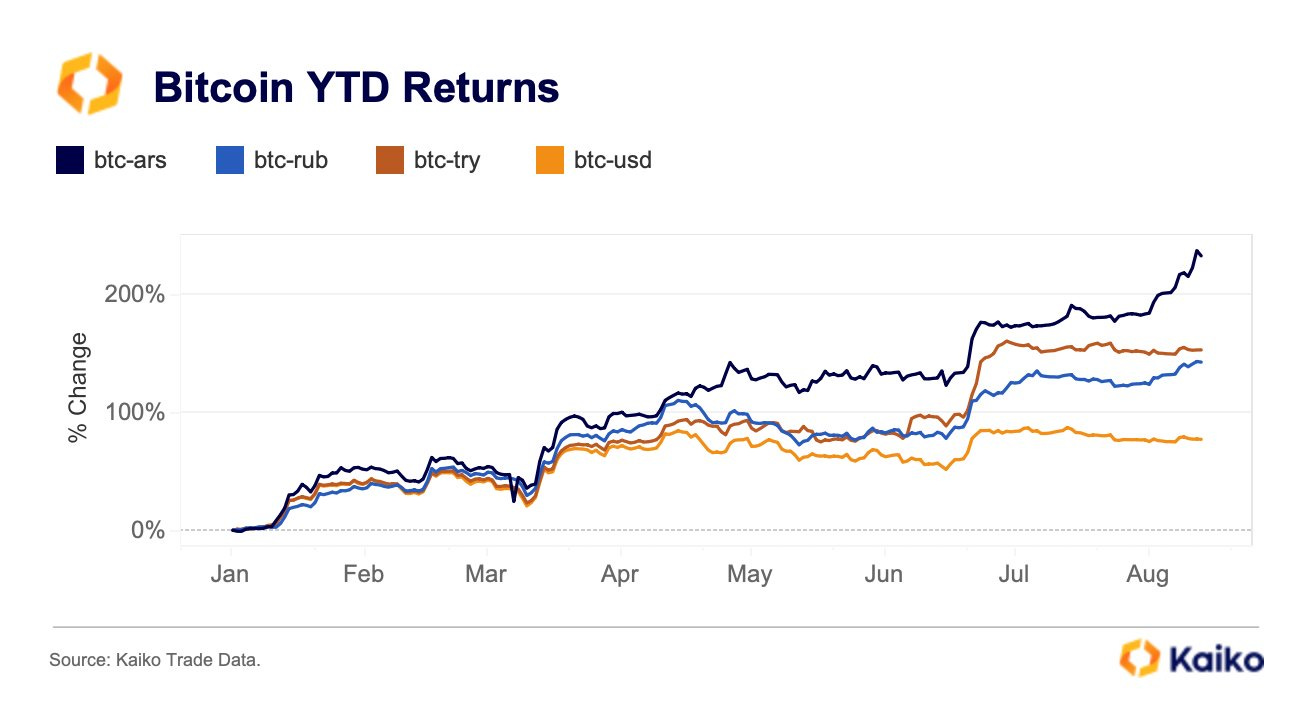

Chart of the Week: BTC vs EM

Top Jobs in Crypto: Featuring Keyrock, Binance, Coinbase, Blockchain.com, Copper and BNB Chain.

Want to be a guest writer for London Crypto Club ?

To help educate our readers further, were looking for people to write a guest slot on specific topics. If you have an idea and you would like to be featured in an upcoming episode of this newsletter, please reply to this email with your suggestion. I’m thinking crypto market microstructure, data analytics, DeFi, etc but totally open to suggestions. Thanks.

Guest Writer - How different is Bitcoin from fiat money? by Mark McKee

About the author: Mark McKee is a digital transformation consultant and technologist within the electronic trading functions of financial firms. He is also researching Bitcoin in the context of political philosophy, individual freedom, and the ontology of money at Birkbeck, University of London.

Is Bitcoin substantially different from fiat currency? If so, how? Do I need to be an expert in crypto to own it? These are important questions to consider when more and more people are investing in and buying goods and services with Bitcoin.

Before we get into first principles, a note that I will be referring only to Bitcoin as it is the original cryptocurrency and the one with the largest market worldwide. Bitcoin was first proposed in 2008 as electronic cash, or coin. You’ll never be able to hold a Bitcoin in your hand like paper money. As the famous Bitcoin white paper put it:

We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership.

(Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008, p2).

Bitcoin was designed for Internet commerce directly between consenting people, hence peer-to-peer. There is no middle bank or payment provider by design. As well as being peer-to-peer electronic cash, Bitcoin has since become a means for saving and investing too, so it is probably worth a quick reminder about the three functions money provides:

1. A medium of exchange: you give money in return for a good or service. I got my morning coffee by giving the agreed value to the barista

2. A unit of account: this is what accountants and CFOs get excited about as it relates to profits, losses, liabilities and assets

3. A store of value: a mechanism used to transfer purchasing power from today to the future, i.e., savings and investments

We also hear people talk about fiat money vs. Bitcoin. This can be misleading. Fiat money is that which is not backed by a physical asset. This has been the case for most of the world since the USA abandoned the convertibility of US dollars to gold in 1971. Thus fiat, meaning an arbitrary order or decree, is what sociologists and philosophers describe as a social construct. Our pounds, dollars and euros as fiat money are created through what are known as performative speech acts. This is same function as declaring someone a new national leader after an election or a priest declaring that a couple are now married. A bunch of people agree something in society, and we collectively commit to it.

And so too with Bitcoin. It is digital cash because enough people subscribed to that idea. It is not backed by any other asset, so it fits the definition of being fiat. Some argue that as the supply is limited to 21 million Bitcoins that it has similar characteristics to non-fiat gold, but that is missing the point as the only physical asset in the room is the gold. Bitcoin was designed and created digitally, making it a social construct, and it is not backed by any other asset. As our periodic table of elements tell us, gold (Au), with an atomic weight of 196.97 is an element that is not man made nor socially constructed by a declarative act. That ‘fiatness’ does not denigrate the value or the purpose of Bitcoin, but simply shows it in context to socially constructed money.

Finally, we can look at who issues and manages money. The pounds sterling you possess in your pocket or bank account, if you are a UK citizen, are issued by the Bank of England. This institution also serves as a central bank to control the supply of those pounds in the economy. Bitcoin has no bank or central policy-making team in charge of its issuance and supply. Decentralised computers across the Internet mine new blocks of Bitcoin as part of discovering the remaining coins that can be accessed. There is the possibility that at some point in the future the custodians of the Bitcoin codebase could get together and act like a central bank by inflating the supply, but this seems an unlikely scenario. This limited supply is therefore a key element in making Bitcoin a useful store of value, especially if you keep it in your own digital wallet. Your digital ownership means you don’t run the risk of being de-banked or having it confiscated for a bail-in should your bank collapse.

The upshot is that Bitcoin provides all three functions of money that were mentioned earlier, but it has different properties – mainly by being decentralised, peer-to-peer, limited in supply and private – that make it a unique and exciting asset to be involved with.

Mark returns next week with a section on "Should Crypto be Regulated?”

Native News

Key news from the crypto native space this week.

Speaking this week, CEO of Circle, Jeremy Allaire said “We estimate that 70% of USDC adoption is non-US, and some of the fastest growing areas are emerging and developing markets.” He said that strong progress was happening across Asia, Latin America (LATAM), and Africa.

Interesting announcement from Quant this week, who’s platform now allows you to circumvent the need for cryptocurrency during the token deployment stage. A common complaint for businesses building blockchain solutions is the fact that public chains charge ‘gas’ or ‘transaction’ fees to perform functions. These are charged in cryptocurrencies, which means that businesses have little choice but to hold crypto on their balance sheets to cover these costs. That’s not always easy – not least from a risk and accounting perspective. As of this week, Overledger Platform users will no longer have this problem when deploying tokens. Instead of having to hold crypto currency to pay for deployment gas fees, Overledger users can pay with platform credits which are charged in fiat currency. Read the full details from Quant HERE.

Global payments company Visa introduced an experimental solution on Ethereum that removes some of the barriers associated with paying gas fees on the network. The experimental solution on Ethereum's Goerli testnet streamlines the interaction between users and the network by leveraging account abstraction technology and the ERC-4337 standard, according to Visa. By doing so, the need for end-users to maintain ether (ETH), Ethereum’s native cryptocurrency, for transaction or “gas” fees is eliminated. Users will still have to technically pay a gas fee, but the method allows them to pay with any token such as USDC or USDT—removing a layer of friction in Ethereum payments. Visa can cover those fees as well. Read the full detail from Visa HERE.

Institutional Corner

Top stories from the big institutions.

This week the Bank of England said that The Bank in conjunction with HM Treasury is creating a new Academic Advisory Group to provide expertise during the design phase of the digital pound. It a statement the Bank of England said "We will bring together experts related to our work on the digital pound, including monetary policy, finance, competition economics, industrial organisation, behavioural science, law, innovation theory, marketing, and business". The BoE wants academics to help it, "understand the practical challenges of designing, implementing and operating a CBDC." The CBDC Academic Advisory Group will not have any decision-making responsibilities. It will serve as a platform for knowledge and research exchange. "Through this group, we seek to generate expert academic input and promote interdisciplinary discussions on a range of topics related to retail CBDC". Read the full release from the BOE HERE.

This week, the Autorité des Marchés Financiers (AMF), the French stock market regulator announced amendments to local crypto regulations — in part to bring them into line with the European Union’s Markets in Crypto-Assets (MiCA) regime. According to a blog post published by the AMF, the two main changes are the introduction of an enhanced registration framework for so-called Digital Asset Service Providers (DASPs) and tweaks to align local DASP licensing requirements with MiCA. In the blog post, the AMF said that DASPs seeking a license in France will be assessed for a wide range of requirements, including, “adequate security and internal control systems, systems for managing conflicts of interest, clear, accurate and non-misleading information, public pricing policies, specific custody provisions (segregation of client assets vs. own assets), prohibition on using client assets without their express prior consent, agreement signed with clients, resilient and secure IT system, a ban on using client assets without their express prior consent, a signed agreement with clients, and a resilient and secure IT system. Read the full blog post HERE.

The Monetary Authority of Singapore announced a commitment of up to $150 million Singapore dollars over three years under the Financial Sector Technology and Innovation Scheme — which includes a track to "support innovative FinTech solutions arising from emerging technologies such as Web 3.0." "MAS recognises the importance of partnering with the industry to support innovative FinTech solutions arising from emerging technologies such as Web 3.0". Read the press release from the MAS HERE.

Chart of the Week

Because charts are just as important as macro.

Inflation has been the story of the year. Well looking further afield from the developed markets, bitcoins value against the three weakest emerging markets currencies this year - the ARS, TRY and the RUB - has soared between 140% and 240% YTD. Its price in ARS just hit an all-time high! Chart from Kaiko Data.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Digital Assets Market Making at Keyrock

Creator Partnerships Manager at Binance

Business Development Executive at Blockchain.com

Accounts Payable Analyst at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.