Connecting the Dots

Episode 110 - Macro Regime Change, Time to Buckle Up

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Coinbase releases its financial results, Tether acquires a minority stake in Juventus, Stablecoin circulating supply increases in 2025, Grayscale to have a spot Cardano ETF.

Institutional Corner: New York to establish a crypto taskforce, Barclays and Goldmans increase their bitcoin ETF holdings.

Charts of the Week: CEX’s see a drop in spot volumes, US exchange liquidity increasing.

Top Jobs in Crypto: Featuring Lantern Ventures, Trust Wallet, MBG Digital, Fireblocks, Kraken and Keyrock.

Macro Update

This is where we connect the dots between macro and crypto.

Macro Regime Change, Time to Buckle Up

Equities and Bitcoin closed another choppy week in positive territory as stronger inflation data was off-set by better news on tariffs and progress on the geo-political front.

CPI came in hot at 3% YoY up from 2.9%, whilst core CPI jumped to 3.3% from 3.2%. There was some seasonality in the numbers which since Covid has tended to come in strong in Jan and underlying core services inflation looks largely contained. However, this number will do little to assuage the fears of a Fed concerned on credibility and the prospect of resurgent inflation. JPow commented on the data in testimony saying that whilst significant progress has been made on inflation, they’re “not quite there yet” and they “want to keep policy restrictive for now.”

Additionally, Producer Price Inflation also came in stronger, although the components that feed the Core PCE index (the Fed preferred inflation gauge) point to a lower reading, with consensus estimates now looking for a 2.6% Y/Y print, down from 2.8% which helped to take some edge off the stronger data.

Net, despite the “hot” inflation prints, this week is unlikely to change much of the Fed’s thinking on inflation, even if it will continue to feed their caution. Markets are now only pricing one cut at the end of 2025. We still feel however that on top of the December seasonality, there is also the sugar high from the pre-election spending as well as some pulling forward of demand ahead of potential tariffs, impacting these numbers. Indeed, a look at Truflation suggests “real time” inflation has already faded back towards 2% from a 3% peak into mid Jan.

Truflation - back on the disinflationary path to 2%

The dog that didn’t bark…

Supporting our “fading US reflation” thesis, retail sales for Jan fell by the most in almost 2 years following 4 months of strong gains. Headline retail sales falling 0.9% MoM whilst the “control group” which feeds the Q1 GDP number fell 0.8%, the biggest drop since March 2023.

US yields ominously failed to push materially higher post the stronger inflation data and with the softer retail sales, we saw 10yr yields breaking back below 4.50% whilst the broad dollar made new year lows, completely unwinding the move higher post the December “hawkish pivot” from the Fed.

This move in the dollar, which we have been calling for, fading the consensus “Trump Trades,” is starting to gather momentum and will form a powerful tailwind for both crypto and broader risk. Particularly important is the move lower in USDCNH from above 7.3600 as recently as Feb 3rd, to now sub 7.26.

Tariff delays are of course having an impact here also and forcing the market to re-price the more aggressive tariff scenarios. This week, Trump outlined his reciprocal tariff plan which will be delayed until 1st April, giving Commerce Sec Lutnick time to speak to each country. Increasingly, the Trump rhetoric on tariffs looks, as we suggested, simply a negotiation tactic.

Trump’s lack of comments on China however are particularly interesting and feel a little like the “dog that didn’t bark in the night.” Both the dollar and Treasury yields have effectively topped out since Trump’s “very good” call for “both China and the USA.” 🤔

Treasury Sec Scott Bessent’s recent comments, saying they don’t want other countries weakening their currencies to manipulate trade and suggesting the “accumulation of large surpluses” implies there’s “not a free form trading system in place” are an important sign post to the goals of this administration. Ultimately, they want to address trade imbalances through a weaker dollar, rather than tariffs and that is likely the quid pro quo of negotiations.

A weaker dollar will also benefit global growth and also allow China to ramp up stimulus to arrest its deflationary spiral. Chinese yields are fast approaching zero and QE will likely follow, but China needs the cover of a weaker dollar to run the printing press. Everyone wins with a weaker dollar 🏆

Changing macro regime…

Time will tell if any back-door negotiations have been agreed with China, but it increasingly looks like a shift in the macro regime towards a weaker dollar and lower yields is starting to gain momentum.

Indeed, whilst we doubt the ability of DOGE to materially impact the overall deficit, given the outsized impact of social security and debt interest payments, clearly we’re heading towards a period of lower government spending which will re-inforce the bid for bonds and perhaps the end of fiscal dominance.

This shift in the macro dynamic towards a weaker dollar and lower yields will form a powerful tailwind for risk, propelling the Nasdaq to ever more record highs as well as mark the start of the next leg higher for Bitcoin.

Additionally, with talk of negotiations and an end to the Russian/Ukraine war, there’s a lot of risk premium that can “leak out” of asset markets.

This may well also see the end of gold's recent run higher (particularly if part of any deal with China is for China to buy more US treasuries and rebalance away from gold) which will drive BTC/Gold to new record highs.

This felt like a pivotal week for markets. We typically shy away from trying to time markets and focus more on the broad direction. However, given this shift in the macro, it feels like the next leg higher and breakout for Bitcoin is imminent. Buckle up 🚀

Native News

Key news from the crypto native space this week.

Coinbase released its financial results this week, posting revenues well above estimates. The crypto exchange posted fourth quarter revenue of $2.27 billion against consensus of $1.84 billion and $1.26 billion three months prior. Adjusted earnings for the three months of $1.3 billion topped consensus of $906.9 million. Trading volume in the fourth quarter was $439 billion, up 185% from the year-ago level. Transaction revenue of $1.56 billion was higher by 194% year-over-year. CEO Brian Armstrong said in his shareholder letter "Crypto’s voice was heard loud and clear in the U.S. elections, and the era of regulation via enforcement that crippled our industry in the U.S. is on its way out. Our goals in 2025 are to drive revenue, drive utility, and scale our foundations." Read the full shareholder letter HERE.

The investment arm of Tether, Tether Investments, said on Friday that it has acquired a minority stake in the sports club Juventus FC. Juventus shares rose 2.5% on the Italian stock exchange on the news and the club's fan token surged nearly 200% in minutes after release. Tether CEO Paolo Ardoino said "Aligned with our strategic investment in Juve, Tether will be a pioneer in merging new technologies, such as digital assets, AI, and biotech, with the well-established sports industry to drive change globally. Read the full release from Tether HERE.

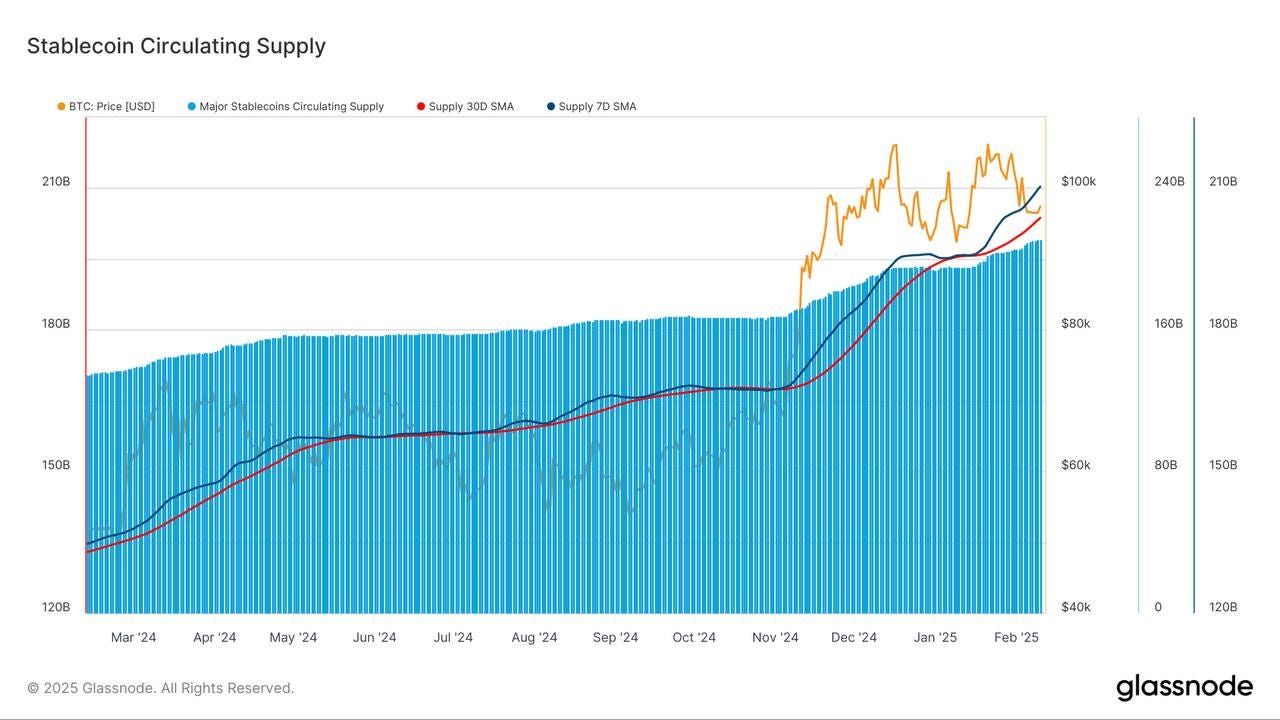

Stablecoin circulating supply has increased by $16.97bn since the start of 2025, rising from $194.2bn to $211.2bn. However, the pace of growth has varied, with a slowdown in early 2025 before picking up again in February. Throughout November and December, stablecoins were growing by ~$450m per day. In January, the rate declined to ~$400m per day, but February has seen a rebound, with $541m per day. This suggests renewed liquidity expansion after a period of deceleration.

A subsidiary of the New York Stock Exchange, on behalf of Grayscale, filed to create a spot Cardano exchange-traded fund this week. The exchange, NYSE Arca, filed a 19b-4 form on Monday on behalf of Grayscale to form a proposed Grayscale Cardano Trust. The custodian would be Coinbase Custody Trust Company, LLC and the administrator would be BNY Mellon Asset Servicing, according to the filing. NYSE Arca said in the filing. "The Exchange notes that the proposed rule change will facilitate the listing and trading of an additional type of exchange-traded product, and the first such product based on ADA, which will enhance competition among market participants, to the benefit of investors and the marketplace.” A 19b-4 form is filed by exchanges on behalf of issuers and is the second part of a two-step process for proposing a spot crypto ETF to the U.S. Securities and Exchange Commission. Once acknowledged by the SEC, the filing will be published in the Federal Register, initiating the agency's approval process. See the full filing HERE.

Institutional Corner

Top stories from the big institutions

New York state Sen. James Sanders Jr. introduced a bill Wednesday that seeks to establish a crypto task force. The bill, now under review by a Senate committee, would require experts to deliver their findings on crypto’s impact on state revenue and the environment toward the end of 2027. According to the text of the bill, the proposed 17-member panel would investigate crypto's effects on state tax revenue, environmental impact, and market transparency. The task force will include representatives from the Department of Financial Services, environmental conservation groups, and academic experts in economics. Members will serve without compensation but receive expense reimbursements. Read the full bill HERE.

In a 13F filing with the US SEC on Thursday, Barclays disclosed holdings of 2,473,064 shares in BlackRock’s U.S. spot Bitcoin exchange-traded fund IBIT, with a reported value of $131.2 million. This is a new position acquired during the fourth quarter of 2024. In its previous 13F filing for Q3, 2024, Barclays disclosed a minimal position in Grayscale's Bitcoin Mini Trust ETF, BTC, which it no longer holds. While Barclays' IBIT allocation is much more substantial, it still only represents approximately 0.04% of its $356.9 billion portfolio value as of 31st December. Barclays Q4 acquisitions place it in the top 10 holders of IBIT, according to Fintel data. The top known institutional holder of the BlackRock Bitcoin ETF is Goldman Sachs, having disclosed owning more than 24 million shares of IBIT as of 31 December, currently worth approximately $1.3 billion.

On that note, Goldman Sachs 13F filing shows that it has significantly ramped up its Bitcoin ETF holdings, with the bank now holding $1.57 billion across various Bitcoin ETFs, up 121.1% from the $710 million reported in Q3. The bank’s largest exposure lies in BlackRock’s iShares Bitcoin Trust (IBIT), where it now holds 24.07 million shares worth $1.27 billion, a more than 88% jump in shares since its last filing. The filing also reveals Goldman has added $288 million to Fidelity’s Wise Origin Bitcoin ETF (FBTC), marking a 105% increase from the previous quarter. Goldman now holds $3.6 million through Grayscale’s Bitcoin Trust (GBTC). Alongside its ETF holdings, the ninth-largest investment bank in the world has reported substantial options trading positions, with puts and calls totalling $760 million. The bank holds a $527 million put position and an $84 million put through IBIT and FBTC, respectively, as well as a $157 million call position through IBIT. Options allow Goldman to protect itself from potential losses by betting on price declines (puts) while also positioning itself to benefit if prices rise further (calls). See the full filing HERE.

Charts of the Week

Because charts are just as important as macro.

Major centralised exchanges saw significant declines, with spot trading volume dropping 25% and derivatives down 17%, while website traffic remained relatively stable. Hat tip to WuBlockchain for the table.

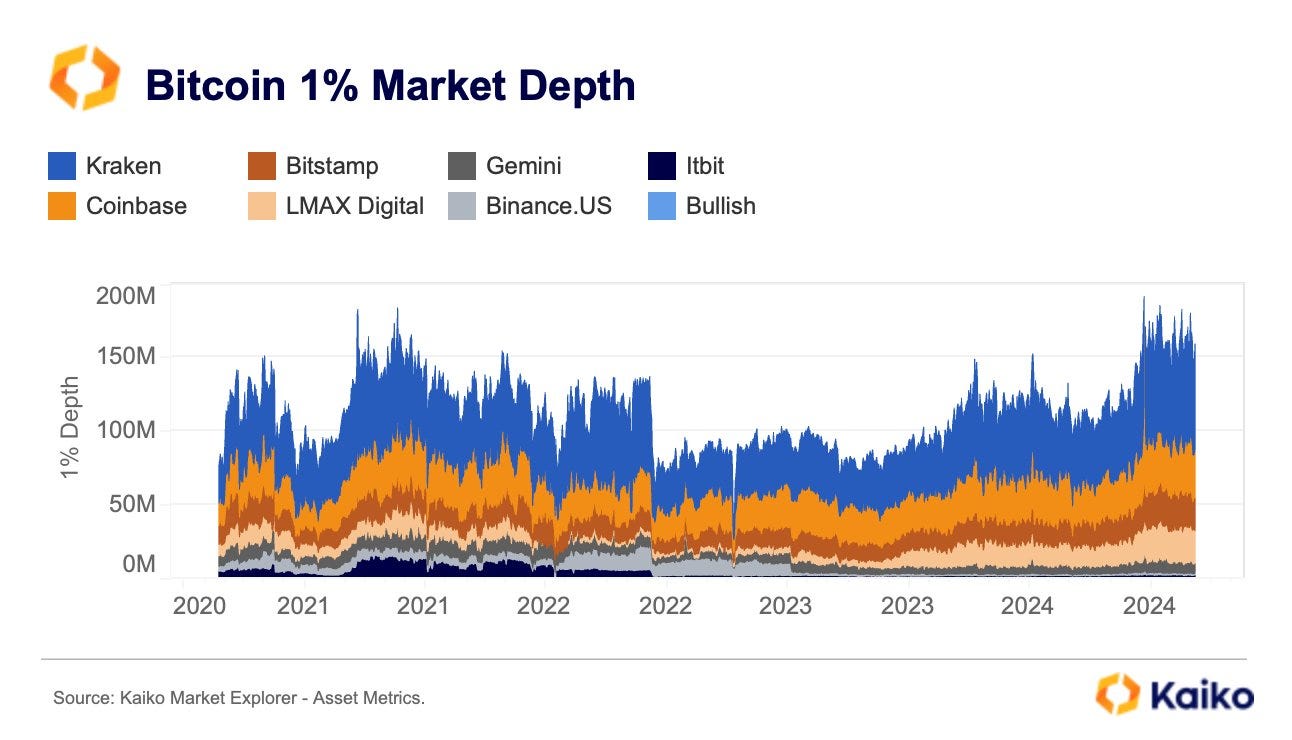

Bitcoin liquidity on U.S. exchanges has increased to levels not seen since the 2021 bull run. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Operations Associate at Lantern Ventures

Social Media Specialist - Web3 / DeFi / Blockchain at Trust Wallet

Crypto Affiliate Manager at MBG Digital

Senior Manager - EMEA Marketing at Fireblocks

Kraken Institutional - Sales Manager, Staking & Custody

Trading Assistant Crypto Options at Keyrock

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.