Connecting the Dots

Episode 105 - The Liquidity Dam is Set to Break

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Circle donates $1m USDC to Trump’s inauguration committee, Securitize and QCP partner to incorporate BUIDL into Securitize yield generating strategies.

Institutional Corner: The UK Treasury amends financial legislation on crypto staking, Hong Kong sets up “supervisory incubator” to facilitate banks adopting blockchain technology, the US Consumer Financial Protection Bureau proposes a rule for reimbursing illicit activity and hacks, Standard Chartered has received a license in Luxembourg to offer crypto custody services.

Charts of the Week: AI and memecoins the most popular narratives of 2024, Ethereum experienced outflows in 2024, More corporates started buying Bitcoin in Q4.

Top Jobs in Crypto: Featuring ONE, Keyrock, Chainlink Labs, KuCoin Exchange, MEXC, Archimed Capital and OSL

Macro Update

This is where we connect the dots between macro and crypto.

The Liquidity Dam is Set to Break

Happy New Year to all of our readers 🎉

2025 wasted no time in getting going, with a volatile first week of trading. Broad risk began the year on the front foot supported by the liquidity that was drained into year end, returning to the market.

NB: ✍️ Banks “window dress” their balance sheets at month/quarter/year end, often parking cash overnight in the Fed Reverse Repo Facility (RRP) to make them look less risky. This helps reduce associated capital costs relative to their typical uses of balance sheet throughout the year, such as repo lending. Once that balance sheet snapshot is taken and given to the regulator, the capital is returned to markets as banks continue to facilitate riskier activity to receive higher returns.

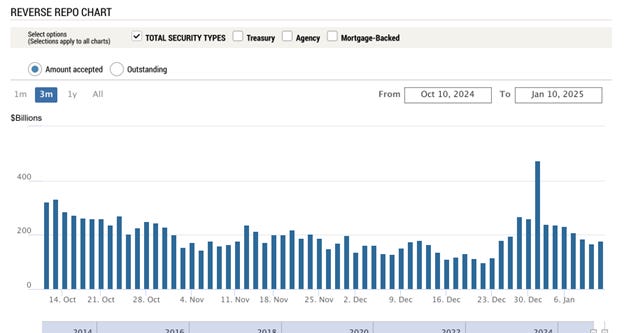

To provide some context, the RRP rose in the final couple of weeks of December circa $375bn. That’s essentially cash being taken out of the market. No wonder stocks had such a horrible end to the year! However, $295bn of that has already been returned in the first week of 2025, providing a supportive liquidity flow to begin the year 👇

With stocks pumping, Bitcoin traded back above $102k on Tuesday, before the new year celebrations were abruptly halted by a renewed sell off in US treasuries, dragging global bonds (ex-China) with it and pushing the US dollar to its highest levels since Nov 2022.

Markets are a function of rates and liquidity. Whilst liquidity is supportive, rates and the “dollar wrecking ball” are providing strong macro headwinds to start the year.

Why are US treasuries selling off?

We’ve been a little blindsided by the extent of the move in US treasuries, which we think is over done and are inclined to fade.

After clear signs of a weakening economy and rising downside risks to the labour market, which prompted a 50bp cut from the Fed in September, the data flow over the past couple of months has demonstrated resilience and shown signs of reacceleration. The sharp disinflation experienced over the past year or so has stalled and shown sign of moving back higher (core CPI has flatlined the past 3 months at 3.3%, whilst headline CPI which hit a low of 2.4% in October was back at 2.7% in November) This prompted the “hawkish pivot” from the Fed in December, who, despite cutting rates 25bps, lowered forecasts to a median of just 2 cuts in 2025, from 3 previously. The re-pricing of rates in the front end of the curve, pushing yields higher further out.

Data this week also reinforced the US “reflation” narrative. ISM Services on Tuesday coming in strong at 54.1 up from 52.1 whilst the prices component jumped to 64.4 from 58.2. JOLTS data on Tuesday also showed a rise in job openings and this really helped accelerate the bond sell off. Then Friday’s Non Farm Payrolls came in strong, showing the US added 256k jobs in December, versus expectations of 155k. This saw 10yr yields push towards 4.80% and close the week at 4.76%...ouch 😬

Donald Trump and the “Red Wave” is also raising expectations of more inflationary policy, with Trump threatening the imposition of tariffs on major trading partners which is adding to market nervosity on the path of inflation (although its worth noting, market expectations of inflation as measured via treasury inflation protected securities or TIPS, are only 20bps higher since the election.)

We also continue to have a deluge of treasury supply to digest as the US runs insane, war time level deficits over 6%.

This week saw the US issue $119bn in Treasury bonds across maturities (weighing on bond prices, pushing yields higher.) Additionally there was heavy corporate issuance through the week to Thursday. This adds additional pressure on treasuries as corporate bond investors are typically “credit” investors, so they sell US treasuries to hedge against interest rate risk, looking to express a view on tightening credit spreads. More treasury bond supply adding additional weight and pushing yields higher still!

This has been a perfect storm to drive Treasury yields higher. To recap the drivers for higher yields:

● Stronger data reducing expectations of Fed rate cuts

● Trump’s tariff threats raising expectations of inflation

● Heavy Treasury bond supply

We sought however to dispel some of these fears this week on X, in a response to a thread from @blknoiz06 which is worth outlining here as it underscores our core macro view and why we remain bullish Bitcoin and broad risk in Q1.

Inflation fears overblown…

Firstly on tariffs. We think markets are overestimating both the likelihood of tariffs or at least the size of the tariffs imposed (Trump goes big as a negotiation tactic and typically delivers much less.) It’s a bit too textbook to assume tariffs are inflationary. We didn’t see any substantial inflationary impact from the last time Trump was in power and the pass through to inflation can be quite benign, particularly if tariffs are offset by China led, global disinflation and a stronger dollar. Much also depends on the ability of companies to pass on higher tariffs in the form of higher prices to consumers.

Another inflationary view of Trump policy is his America first approach and de-globalisation, bringing manufacturing back home, from low cost production hubs, to the US. Evidence of on-shoring during Trump's first term however, was weak, and we instead saw a reorganising of supply chains with the likes of Vietnam and India beneficiaries. We also saw a move towards more automation, rather than employing more expensive US workers. So the likely inflationary impact here is also overstated.

Markets reacted this way last time Trump got elected and quickly, the dollar topped out. We expect the same again, especially as incoming Treasury Sec. Scott Bessent wants a weaker dollar, as does Trump. Ultimately, Trump wants to reduce US trade deficits, increasing exports. A stronger dollar runs counter to that aim.

We also think the recent strong data pulse in the US, underpinning a stronger dollar due to the economic divergence with the rest of the world, is simply a sugar high for the huge pre-election spending which will now begin to fizzle out and we resume back to the slowing growth, disinflationary trend that started to take hold throughout the summer.

We also can’t ignore the deflationary spiral in China which is exporting disinflation to the rest of the world and pulling global growth down. The US won’t be immune from that.

We expect then to see far more rate cuts than are currently priced, with US data returning to the disinflationary trend as the pre-election spend, sugar high fizzles and a slowing global economy, led by China, blows back to the US. Meanwhile, inflation fears on the incoming admin policies are likely to soften as the market realises with Trump’s posturing, this is simply the “art of the deal.”

Liquidity set to flow…

The Fed also doesn't act in a vacuum according to their inflation and employment mandate.

The US has got to refinance over $7trn in debt this year and ultimately, the Fed will need to help keep rates low and likely start to flood the market with liquidity to fund that rollover. To date, the insane deficits the US has been running have largely been funded via the Yellen pivot towards bill issuance and draining the RRP to the tune of $2trn.

There’s now just under 200mio now left in the RRP. Once that’s drained, the Fed will have to end QT (which will be viewed as a positive liquidity development.)

The debt ceiling, which according to Yellen hits some time around the 14th Jan, also gives some reprieve to the huge Treasury supply that markets have had to digest (the US can’t issue new debt once the debt ceiling triggers.) This will also bring more liquidity as the TGA (Treasury General Account which is the cash the Treasury hold with the Fed) gets drawn down to fund government spending - this is potentially a $750bn cash injection to markets 🌊🌊🌊

Once the RRP and TGA have been exhausted, the Fed will need to do some form of “not QE QE” to stop another repo blow up a la 2019 and support the Treasury bill market.

So our base scenario is that US data rolls over from here (eco surprises have started to turn negative) and the dollar and yields subsequently top out.

Liquidity floods the market in Q1 with the RRP drain followed by the TGA drawdown alongside the necessary end of QT, all the while the Fed will need to start some “not QE QE” monetary operations to stop another repo funding blow up.

China will also flood the market with liquidity in an attempt to reflate their economy whilst the rest of the world will be cutting rates and injecting liquidity as they get sucked into China’s deflationary spiral.

Worth noting as well, China has started to let the currency weaken, after resolutely defending 7.30 against the dollar for months. This will accelerate capital flows out of China, which is evident with the pressure Chinese stocks have been under to start the year. Bitcoin will be an obvious destination for those flows, especially given the capital controls in place in China, making it difficult for capital to exit via more traditional channels. When China devalued in 2015, Bitcoin promptly traded over 3x higher 👀

All roads lead to Bitcoin…

Lots of moving parts then as we kick off a new year and we’d be remiss not to highlight the short term risks to Bitcoin and crypto as the negative dynamic of higher US yields and a stronger dollar threaten to “break things” in the traditional world. However, as outlined, we believe this US “reflation” narrative looks stretched and US yields and the dollar are peaking and are set to reverse. Meanwhile, the liquidity pulse remains strong and is set to dial up over the coming weeks which should provide a powerful counter to the negative macro headwinds, keeping Bitcoin and broader risk supported.

Bitcoin also has a powerful demand/supply dynamic as sidelined cash continues to move into the space given the paradigm shift in the US regulatory outlook for crypto post the election. If Trump signs an executive order to make Bitcoin a strategic reserve asset, then no one is prepared for the demand shock that will result 😳

Shorter term, if we are wrong on US yields topping out here, then events of this past week simply bring us closer to the liquidity damn breaking and flooding markets. The US and global economy simply can’t handle rates this high and 10yr yields above 5% would start to really break things.

Financial repression will be the response. US debt sustainability fears will also grow and Bitcoin will outperform as the ultimate hedge against the failure of existing economic structures.

All roads lead to Bitcoin. This bull market is not close to being done 🚀

Native News

Key news from the crypto native space this week.

Circle's CEO Jeremy Allaire said the crypto firm has donated $1 million USDC to Donald Trump's inaugural committee. According to a number of news reports multiple crypto firms, including Ripple and Coinbase, alongside tech firms such as Amazon, Google and Apple, have donated funds to Trump's inaugural committee. Circle CEO Jeremy Allaire said "We are excited to be building a great American company, and the fact that the Committee took payment in USDC is an indicator of how far we have come, and the potential and power of digital dollars."

Securitize Credit is partnering with digital asset trading firm QCP on a strategy incorporating the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) into Securitize’s yield-generating strategies. The partnership involves Securitize Credit entering into a basis trade with QCP, using the tokenised BUIDL fund as collateral. According to the press release, this marks the first derivatives trade backed by BlackRock’s onchain fund as collateral. The bitcoin-based basis trade is apparently earning Securitize 20.71% returns per annum. According to the press release, Securitize previously collateralised its six-month bitcoin-based basis trade using stablecoins, earning the company approximately 11.95% per annum.

Institutional Corner

Top stories from the big institutions

The UK Treasury has amended financial legislation to clarify that crypto staking—an essential component of proof-of-stake blockchains like Ethereum and Solana—does not fall under the definition of a "collective investment scheme." The amendment of the Financial Services and Markets Act 2000 provides clarity for cryptocurrency firms operating within the UK, enabling them to offer staking services without being subject to the stringent regulations governing CIS activities. The UK Treasury’s amendment to the legislation introduces a new provision specifying that arrangements for "qualifying cryptoasset staking" do not constitute a CIS. The amendment defines "qualifying cryptoasset staking" as the process of validating transactions on a blockchain or similar distributed ledger technology network. This clarification acknowledges the constraints that the regulatory framework for CIS would have on staking activities. The updates legislation said "The Government’s view is that it would be undesirable for arrangements for qualifying cryptoasset staking to be treated as a collective investment scheme". "The regulations for the establishment, operation, and winding up of collective investment schemes were not designed with cryptoasset staking in mind, and their application would represent a significant hindrance to the effective operation of blockchains and staking arrangements provided to customers in the United Kingdom." The amended legislation was laid before the UK Parliament on Thursday, and is set to take effect on Jan. 31, 2025. Read the full legislation HERE.

Hong Kong has set up a “supervisory incubator” to facilitate banks to properly adopt blockchain technology. Hong Kong Monetary Authority announced that the incubator is designed to help banks manage the risks associated with experimenting with blockchain or DLT implementation. They added that the incubator will focus on tokenised deposits as the initiative aims to address potential risks when banks move to productionise relevant services — such as deposits and loans — that would “cut across DLT-based and legacy banking infrastructures.” The HKMA plans to set up a supervisory platform for individual banks to review their risk control approaches before launching a blockchain-based product. Read the full announcement from HKMA HERE.

The US Consumer Financial Protection Bureau (CFPB) has proposed a rule that could require crypto asset service providers to reimburse users for funds stolen through illicit activities, including hacks. In a notice on Friday, the CFPB proposed a rule that could allow accounts or wallets using “emerging payment mechanisms” set up for personal use to be subject to similar protections as fiat bank accounts. The US regulator suggested that the same rights that “guard against error and fraud” under the Electronic Fund Transfer Act (EFTA) could protect consumers transacting in stablecoins or “any other similarly-situated fungible assets that either operate as a medium of exchange or as a means of paying for goods or services.” The proposed rule said that “Based on the plain language used in EFTA and the reasoning of judicial decisions, as well as the CFPB’s experience in market monitoring, it has long been clear that the term ‘funds’ in EFTA is not limited to fiat currency like US dollars.” “The CFPB interprets the term ‘funds’ to include assets that act or are used like money, in the sense that they are accepted as a medium of exchange, a measure of value, or a means of payment.” Read the full notice from the CFPB HERE.

Standard Chartered has received a license in Luxembourg to offer crypto custody services through a new entity. In a statement released Thursday, the bank said that it has opened a new entity in Luxembourg to “act as its EU regulatory entry point” to offer crypto custody services to EU clients in line with the Markets in Crypto Assets (MiCA) regulation. Standard Chartered has named Laurent Marochini as the new CEO of its Luxembourg operations. Marochini previously held the position of Head of Innovation at Société Générale. Margaret Harwood-Jones, global head of financing and securities services at Standard Chartered said “We are really excited to be able to offer our digital asset custody services to the EU region, enabling us to support our clients with a product that is changing the landscape of traditional finance, whilst also providing the level of security that comes with being an appropriately regulated entity.” Read the full statement HERE.

Charts of the Week

Because charts are just as important as macro.

In 2024, the most profitable narratives were AI, with average price gains of 2,940% YTD, followed by memecoins, which saw returns of 2,185%, and RWA, with returns of 820%. Hat tip to CoinGecko for the chart.

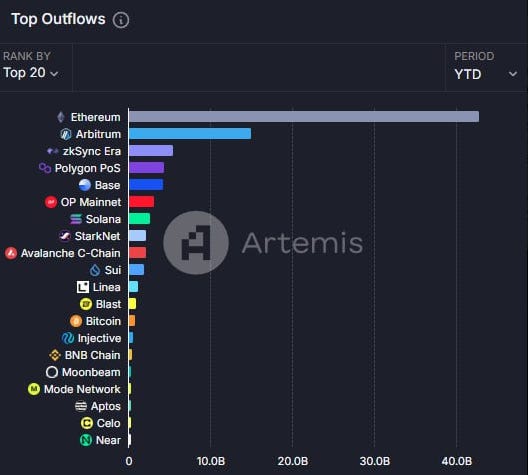

The Ethereum network experienced outflows of $43.5 billion in 2024, with a net outflow of $7.7 billion. Hat tip to Artemis for the chart.

In Q4 there was an increase in demand for BTC from Corporates. Companies like KULR Technology, Rumble, and Genius Group began adding Bitcoin to their balance sheets in Q4. Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Trading Assistant Crypto Options at Keyrock

Venture Investments Lead at ChainLink Labs

Institutional Sales Manager at KuCoin Exchange

European Localised Operation at MEXC

DeFi Analyst at Archimed Capital

Business Development Manager Institutional at OSL

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

Excellent analysis. Only thing missing is addressing the Saylor blackout window + future prospects (QQQ inclusion, ATM offerings, and of course converts). Seems like demand for convertible notes may be slowing but that is my layman’s take!

excellent report guys! would love to hear your views on what Saylor is doing with his BTC Yield and 21/21 plans etc. What interesting times we live in!