Connecting the Dots

Episode 50 - Welcome to the Bull Market

50 Episodes!

Incredibly proud to have reached that milestone. This newsletter was started to provide institutional grade educational content for free. We hope you continue to find value in what we write and as always, our only ask is that you share it with others. Thanks for the continued support !

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Softer than expected inflation data nailed shut the lid on the coffin of the rate hike cycle and our long term bullish thesis on Bitcoin continues to gather pace and be priced by markets.

Crypto Native News: Strike announces a partnership with checkout.com, Glassnode analysis shows capital is flowing into crypto and Hut8 releases its Q3 bitcoin mining report.

Institutional News: Blackrock file for a spot Ethereum ETF, Commerzbank obtains a crypto custody license, the IOSCO releases a paper on regulating crypto and the BIS releases a report on stablecoins.

Charts of the Week: 3 Chart bonus! Bitcoin spot volumes growing the most in 3 locations, tether winning the stablecoin race and CME volumes growing.

Top Jobs in Crypto: Featuring Paysafe, Kraken, Revolut, the FCA, DWS Group and Blockdaemon.

Macro Update

This is where we connect the dots between macro and crypto.

Welcome to the Bull Market

The global rates repricing gathered momentum this week as softer inflation data nailed shut the lid on the coffin of the rate hike cycle. The “macro purgatory” which we have described, has ended and with markets now fully able to embrace the “pause,” risk markets transitioned over to macro heaven and equities ripped higher.

Inflation surprised on the downside across the major releases. US headline CPI coming in at 3.2% down from 3.7% with core at 4% (Vs 4.1% exp). Similarly in the UK, headline inflation dropped by more than expected to 4.6%, down from 6.7%. In the EU, annual inflation fell to 2.9% from 4.3%, its lowest levels since July 2021.

Clearly, inflation whipsawed higher on the huge monetary and fiscal response to Covid at a time when global supply chains were heavily disrupted. The mean reversion from that now well underway and the balance of risks for policy makers lean heavily towards the downside for growth (no more so than for the ECB who we suspect will be the first to cut)

As we’ve written about frequently in Connecting the Dots, the market is under positioned for this huge shift in the macro dynamic.

The data lags are, in JPow’s words, long and variable, yet many impatient macro investors have confused the lagged impacts of monetary policy for a structural change in the rates and inflation dynamic. Indeed, a consensus has formed that we’re in a structurally higher rates and inflation regime, a view which we’ve never subscribed to here at London Crypto Club as we expected the data to “true up” into Q4. That is now playing out and the market is throwing the towel in on the reflation trade, as witnessed by the sharp sell off in oil and the rally in bonds.

Indeed, there is a risk into 2024 that we revert back into a low growth, disinflationary world necessitating lower real rates and artificially inflated asset prices - even Walmart’s CEO in an earnings call last week raising the prospect of deflation 😳. In a highly indebted world, deflation is far more problematic than inflation as it increases the “real” debt burden. Whilst we are some ways off that right now, Ray Dalio this week described the US as being at an “inflection point” where debt growth is outpacing income growth and we’re witnessing an acceleration in the debt spiral.

Underpinning our long term bullish thesis on Bitcoin, is the idea that this debt burden will need to be reduced by both keeping yields artificially low as well as inflating asset prices to lower the debt coverage ratio. This will all be achieved by a financial repression that ultimately debases the value of fiat currency. We expect then, equities, in dollar terms, will reprice to new record highs over the coming months and Bitcoin as the hardest, deflationary asset, to outperform all other macro assets.

Markets are severely under-positioned for this with many in the macro world waiting for a bear market to show up as the global economy falls into recession under the weight of higher real rates. Yet markets which are forward looking, priced this scenario in 2022. Forward looking scenarios are now starting to price a lower rate world, with rising liquidity and that rising tide will lift all boats, but crypto boats get lifted highest. Welcome to the Bull Market!

Native News

Key news from the crypto native space this week.

On Thursday, the crypto app Strike announced an expansion to its services via a new partnership with the payment processing platform Checkout.com. The partnership will allow users in more than 65 countries to buy Bitcoin directly with their debit card. Strike Founder Jack Mallers said “We’re rolling out a highly anticipated feature that Bitcoiners worldwide have requested for years,” “Now, Strike users around the globe can experience the ease of buying bitcoin directly through our platform.” Global users will incur a 3.9% fee on their buys. Mallers hopes to lower the cost eventually, but points out that this fee is lower than most of Strike's competitors.

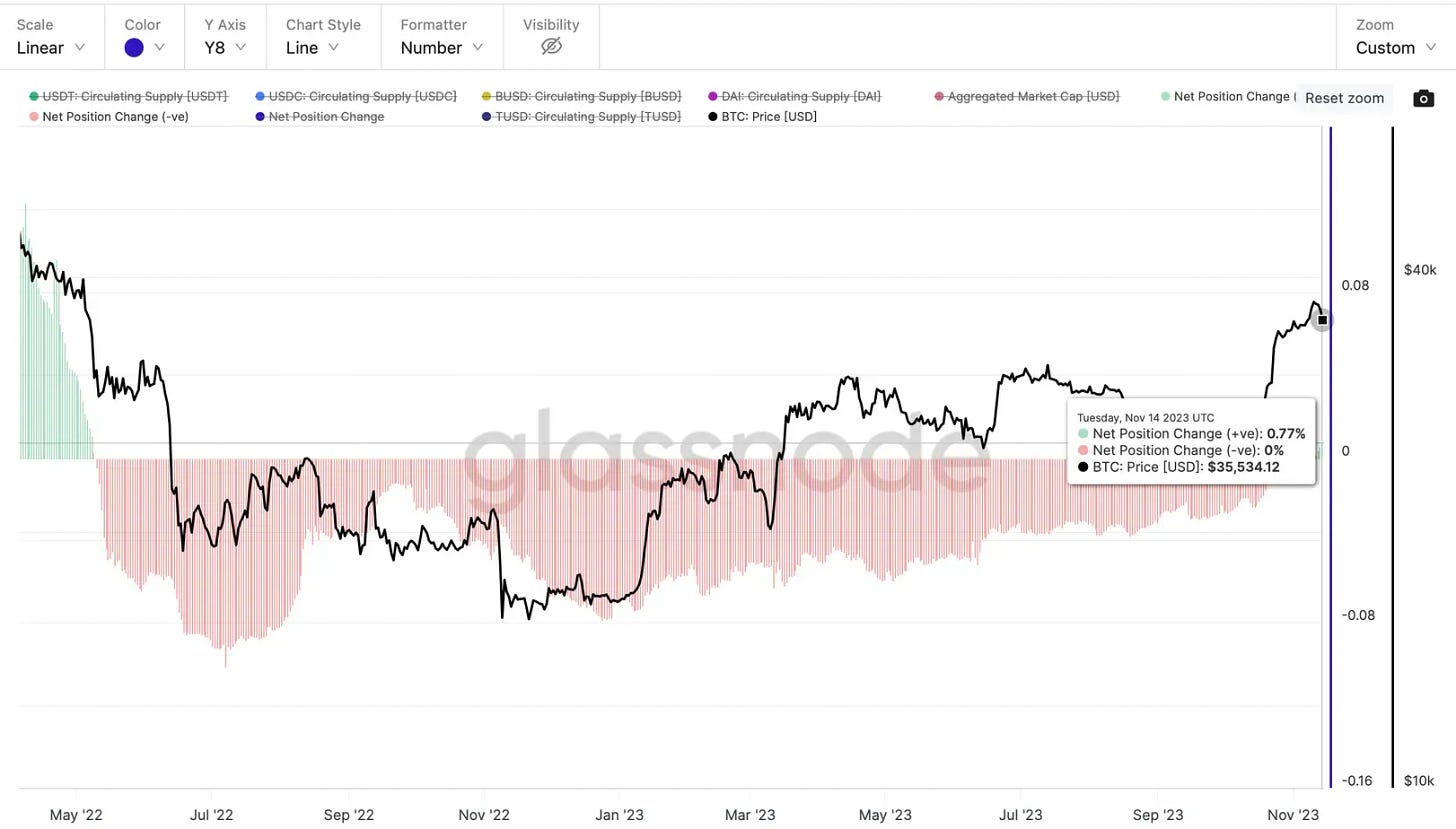

According to blockchain analytics firm, Glassnode, capital is flowing into the crypto market through stablecoins or the U.S. dollar-pegged tokens for the first time in over a year. The 90 day net change in the supply of the top four stablecoins – tether (USDT), USD Coin (USDC), Binance USD (BUSD) and Dai (DAI) – has turned noticeably positive, the first such instance since the collapse of Terra in mid-May 2022, see chart below.

In the bitcoin mining space, Canadian bitcoin mining firm Hut 8 released its Q3 financial this week. The report said its third-quarter net loss more than doubled and revenue fell 46% from a year earlier as it mined fewer coins due to a higher network difficulty, operational issues and the suspension of some operations. Read the full set of financial results HERE.

Institutional Corner

Top stories from the big institutions

Following weeks of rumours, this week Blackrock officially filed for a spot Ethereum exchange-traded fund with the US SEC. According to the S-1 form filed with the SEC, the ETF, dubbed iShares Ethereum Trust, seeks to "reflect generally the performance of the price of ether." BlackRock has selected Coinbase Custody Trust Company as the custodian for its proposed spot Ether ETF. Additionally, the CME CF Bitcoin Reference Rate from administrator CF Benchmarks, has been chosen as the proposed ETF's benchmark. These selections align with those made for its proposed spot Bitcoin ETF. Following the announcement, the price of ether (ETH) jumped nearly 2% to around $2,080 on the news. Read the full filing HERE.

German bank Commerzbank announced that it has obtained a crypto custody license in Germany. According to Commerzbank, it is the first full-service bank in Germany to obtain the license and hopes to set up a secure custody platform for digital assets. The license will allow the bank offer a broad range of digital asset services, "with particular emphasis on crypto assets”. Commerzbank’s COO said “Now that we have been granted the license, we have achieved an important milestone. This highlights our ongoing commitment to applying the latest technologies and innovations, and it forms the foundation for supporting our customers in the areas of digital assets”. Read the full release from Commerzbank HERE.

The International Organization of Securities Commissions (IOSCO), the global standards setter for securities markets regulation, published a document with recommendations for regulating crypto. The recommendations are meant to help establish a coordinated global regulatory response to the risks posed by crypto asset service providers (CASPs) among the group's members. Those risks include market abuse, conflict of interest, client asset protection and disclosures. The IOSCO denied crypto industry requests for a bespoke regime for stablecoins but agreed to demands for greater accountability from so-called financial influencers. Tuang Lee Lim, chair of IOSCO's financial task force, said in a statement "The activities of CASPs and their associated risks frequently mirror those observed in traditional financial markets," "The regulatory approach taken is therefore consistent with IOSCO’s principles and associated standards for securities markets regulation." Read the full release HERE.

The Bank for International Settlements (BIS) published a report on stablecoins titled “Will the real stablecoin please stand up?” (I don’t miss central bank humour). Of the 68 stablecoins that the BIS reviewed, they concluded that “Not one of the stablecoins assessed in this paper has been able to maintain their closing prices in parity with their peg.” The BIS said that stablecoins were “not a safe store of value” adding that from January 2019 to September 2023, fiat-backed stablecoins maintained their peg ratio only 94% of the time, less than the 100% often promised in projects’ white papers. Meanwhile, the peg ratio for crypto-backed and commodity-backed stablecoins was far less at 77% and 50%, respectively. They said that “Only seven fiat backed stablecoins have been able to keep their deviations from the peg below 1% for more than 97% of their life span.” Both Tether (USDT) and USD Coin (USDC) met this standard. The BIS also warned that some stablecoin issuers do not solicit independent certified public accountants to examine their reserves. For those who do, the reserve reports often do not follow a common reporting standard. Read the full report from the BIS HERE.

Chart of the Week - 3 chart bonus!

Because charts are just as important as macro.

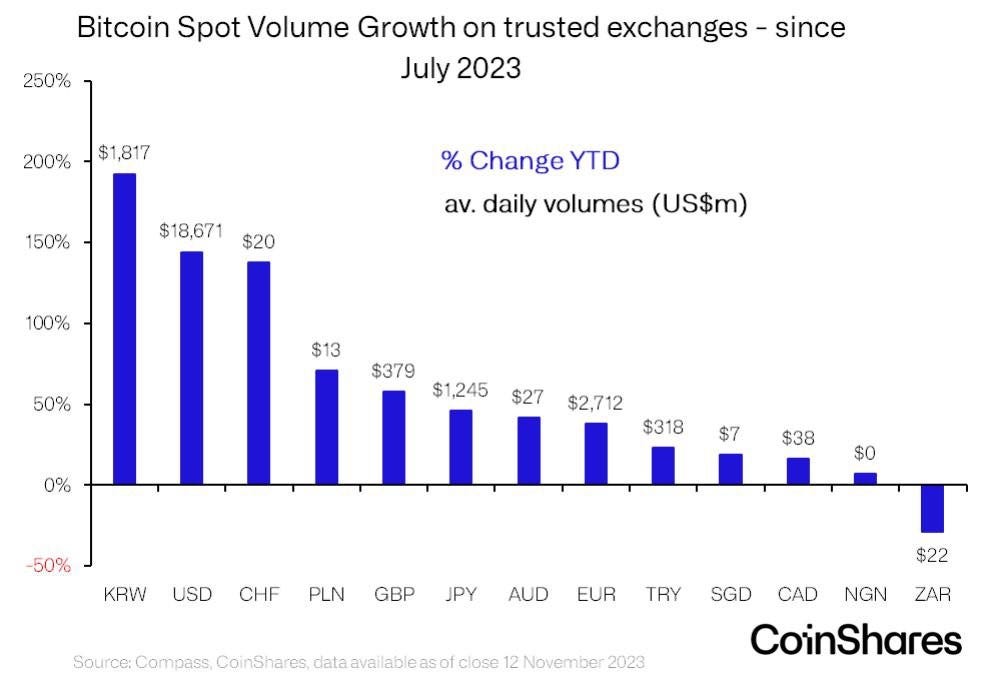

From the latest Coinshares crypto report, bitcoin spot volumes have grown the most in Korea, the US and Switzerland.

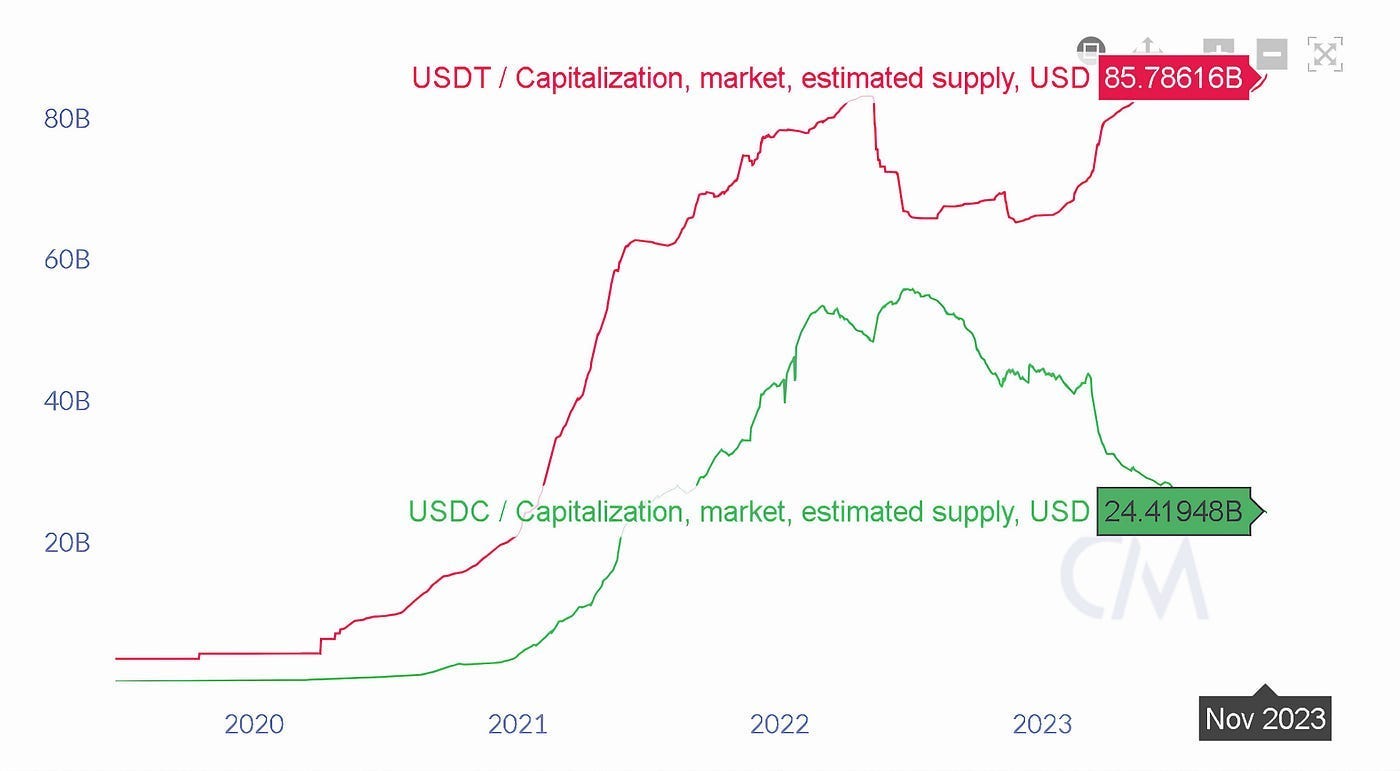

From Anton Golub’s Substack….Tether winning the stablecoin market cap race.

Derivatives trading volume on the CME exchange rose 73.5% to $57.4bn, recording the highest volumes since November 2021.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Account Manager for Crypto at Paysafe

Structurer for Crypto Derivatives at Kraken

Business Development Manager for Crypto at Revolut

Specialist in Cryptoasset Business Models at the FCA

Senior Risk Manager for Digital Assets at DWS Group

Business Solutions Associate at Blockdaemon

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.