Welcome to the new subscribers that have joined us over the last week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

If you want daily market colour and opinion, check out our Twitter HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Broad dollar complex continues higher, the positive liquidity tailwind is set to turn into a full blown headwind as the debt ceiling lifts…stormy waters ahead.

Crypto Native News: Hidden Road obtains Netherlands license, Galaxy offers OTC options on chain, Ripple launches a CBDC platform.

Institutional News: MiCA regulation fully signed off in the EU, France continues to welcome crypto firms and the HKMA launches the e-HKD pilot programme.

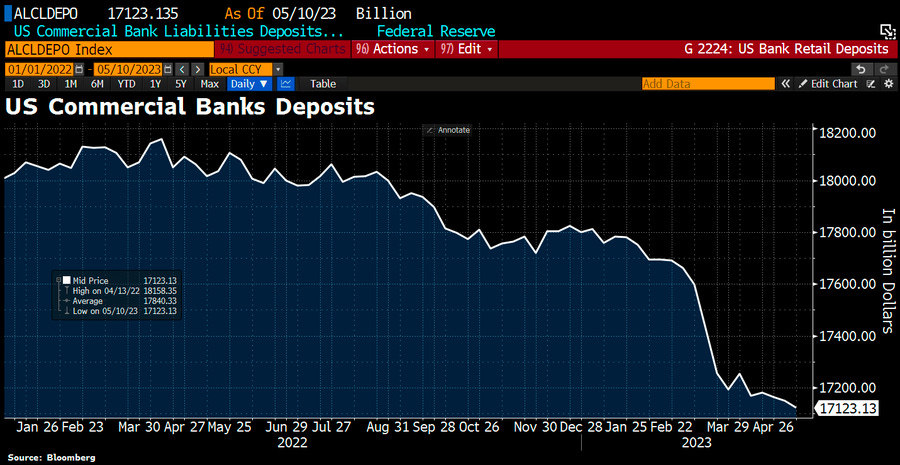

Chart of the Week: US bank deposits fall to lowest level in around 2 years.

Top Jobs in Crypto: Featuring Galaxy, Revolut, Coinshares, Algo Capital Group, Laser Digital and Chainlink Labs.

Macro Update

This is where we connect the dots between macro and crypto.

Storm Clouds Gathering

Risk on in TradFi land this week as optimism that a deal will be reached to lift the debt ceiling powered stocks higher, with the Nasdaq hitting 13 month highs. AI excitement with investors getting bulled up on the potential productivity and margin gains adding a positive narrative, although as we’ve written about previously, for a market under positioned risk, pain is to the upside and this felt like a painful “grabby” move to chase higher.

Crypto not joining the party, continuing its divergence away from equity correlations as higher US yields, a stronger dollar and anticipation of a post debt ceiling lift liquidity squeeze creates a strong headwind to offset the risk-on pull. Consequently, we chopped in tight ranges around 27k and 1,800 for BTC and ETH respectively.

US economic data, whilst mixed, broadly continues to come in on the soft side and perhaps best summarized by the Leading Economic Index (LEI) which fell 0.6% in April, declining for the 13th month in a row and the lowest reading since September 2020, continues to scream recession.

However, the continued deterioration in the data was overshadowed this week by hawkish Fed speak, with the general tone being one of “still more work to do” and more hikes remain possible. JPow speaking on Friday backing up what feels like coordinated messaging to talk the market down from expectations of rate cuts, although he did continue to signal a pause by saying “we can afford to look at the data” and once again highlighted the on-going credit tightening as doing the Fed’s job and lowering the terminal rate end point.

A negative dynamic is currently forming then for Bitcoin, with USDCNH breaking above 7.00 leading the broad dollar complex higher, whilst expectations of the debt ceiling lift see front end rates spike higher, aided by a small repricing for Fed rate cuts.

Further, the positive liquidity tailwind is set to turn into a full blown headwind as the debt ceiling lift allows a rebuild of the Treasury General Account, which is targeted to be rebuilt back to $500bn by the end of June. That’s a lot of liquidity to drain out of this market.

Whilst we remain positive on the medium term outlook for Crypto on the changing macro cycle, the ensuing negative liquidity dynamic poses a major short term challenge. The broad risk party looks set to be interrupted. Bitcoin’s lethargy is forewarning of stormier waters ahead.

Native News

Key news from the crypto native space this week.

This week, Hidden Road Partners, the global credit network for institutions, announced that’s its Netherlands entity has been granted a license as an investment firm by the Netherlands Authority for the Financial Markets (AFM). This license enables Hidden Road to offer spot and derivative products to institutional counterparties within the European Economic Area. The AFM's approval complements the firm's UK entity, Hidden Road Partners CIV UK Limited, which is an FCA-registered MiFID and AMLD5 investment firm. Together, these registrations enable Hidden Road to offer spot and derivatives products across both traditional and digital assets throughout the EU and UK. The firm also recently achieved SOC 2 Type 1 and UK Cyber Essentials certifications, signifying their commitment to security.

Crypto firm Galaxy is now able to trade over the counter (OTC) option on chain. Jason Urban, Galaxy’s global head of trading said trading the options on-chain alleviates credit risk typically associated with traditional OTC options trades, while also protecting privacy. He added “You’re essentially using smart contracts to manage the collateral, ensuring that even if a counterparty defaults, the other party on the trade can get the money they’re owed” “Previously, margining had to be done off-chain, so a typical OTC option in crypto looked a lot like an OTC option within another asset class.” To execute, margin and settle the trade, Galaxy used Aevo, an on-chain options trading platform developed by Ribbon Finance. Read the full detail HERE

Ripple is starting a central bank digital currency (CBDC) platform which allows central banks, governments, and financial institutions to issue their own digital currency. Using Ripple's platform, government institutions can manage and customise the entire life cycle of the CBDC, which includes minting, distribution, redemption and token burning. Financial institutions would also be able to manage and participate in inter-institutional settlement and distribution functions using the CBDC. Central banks can issue both wholesale and retail CBDCs, which can make offline transactions as well. The CBDC platform will be powered by the same blockchain technology as Ripple's public XRP Ledger. You can read more HERE

Institutional Corner

Top stories from the big institutions.

On Tuesday, the Markets in Crypto Asset regulation (MiCA) was unanimously (27 votes to nil) signed off by the Finance Ministers of the European Union. That makes the EU the first major jurisdiction in the world to confirm a crypto licensing regime. It also agreed new anti-money laundering measures on crypto fund transfers. Sweden’s minister of finance said, “I am very pleased that today we are delivering on our promise to start regulating the crypto-assets sector,” “Recent events have confirmed the urgent need for imposing rules which will better protect Europeans who have invested in these assets, and prevent the misuse of crypto industry for the purposes of money laundering and financing of terrorism." You can read more detail HERE.

Crypto firms leaving the US due to the regulatory uncertainty are being welcomed with open arms in France. France already has 74 registered crypto companies and that is expected to rise through 100 following the MiCA regulation being signed off on Tuesday. The Secretary General of the Autorité des marchés financiers (AMF) said “In France, we are proud to be pioneers” with the crypto service asset provider regime, known as PSAN, that was legislated in 2019. He added “If American players want to benefit, in the very short term, from the French regime, and from the start of 2025 from European arrangements, clearly they are welcome,” he added. “We have good relations and discussions with our U.S. counterparts.”

Eddie Yue Wai-man, CEO of the Hong Kong Monetary Authority, hosted a ceremony on Thursday evening to mark the start of an e-HKD pilot programme. The public will be able to use the virtual coin to shop, eat out and make money transfers. According to a statement from the Hong Kong Monetary Authority, 16 banks and payment companies have selected a small groups of their clients to test six potential uses for the e-HKD - online payments, payments in shops and restaurants, collecting government payouts, tokenised deposits, tokenised asset settlement and Web3 trading and clearing. Read full details from the HKMA HERE.

Chart of the Week

Because charts are just as important as macro.

US bank deposits fell for 3rd week to lowest level in ~2yrs. Deposits at commercial banks decreased by $26.4bn to $17.1tn.

Hat tip to Holger Zschaepitz for the chart.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

VP Java e-trading Developer at Galaxy

Market Risk Manager (FX and Crypto) at Revolut

Ethereum Research Associate at CoinShares

Portfolio Manager at Algo Capital Group

Cyber Security Engineer at Laser Digital

Treasury Analyst at ChainLink Labs

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.