Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: Tether launches a tokenisation platform, Coinbase launches the Coinbase 50 Index, Canary Capital applies for a HBAR ETF, LayerZero to streamline transfers between Ethereum and Solana.

Institutional Corner: 18 attorney generals sue the SEC, Sygnum Bank releases its Future Finance survey results.

Charts of the Week: Deribit options open interest hits an all time high, highest number of on chain transactions in US election week, Stablecoin use continues to grow.

Top Jobs in Crypto: Featuring Multiplyers, Coinbase, Bullish, Ripple, Bitstamp, P2P

Macro Update

This is where we connect the dots between macro and crypto.

Let's Get This Party Started

The Trump Pump stalled somewhat this week, with US equities giving back a good proportion of the post election gains. We said in our note last week that crypto is clearly the biggest winner from the “red sweep” and Bitcoin continued to make new record highs, pushing above 93K on Wednesday before running into some profit taking and feeling some of the macro headwinds blowing on broader risk assets.

Those headwinds emanate from higher US yields and a stronger dollar, driven both by the anticipation of a more reflationary administration under Trump, as well as a recent run of stronger data in the US.

The latest data point to reinforce the bond vigilante conviction came in the form of CPI which saw headline inflation rise for the first time since March from 2.4% to 2.6% whilst core remained flat at 3.3%. Core PPI also picked up on a YoY basis from 2.9% to 3.1%. Expectations for a December rate cut now sit at 60% from 70% prior and the market continues to price out cuts for 2025.

Macro dynamic unchanged…

Comments from JPow this week contained a cautious tone which felt to us like a Fed trying to give themselves some optionality. The phrase that best capsulated the current view was that Powell expects “inflation to continue to come down toward the 2% goal, on a sometimes bumpy path.” He also said “the economy is not signalling a need for the Fed to hurry rate cuts.” So the path remains to keep lowering rates to more neutral levels over the forecast period and inflation is expected to continue towards target, but a resilient economy will allow the Fed to go slow and even pause, if inflation remains sticky.

Little then in our view to really change the current macro dynamic. The Fed remains on course to cut rates, and although the pace and depth of those cuts remain uncertain, the direction is clear. We also push back on the latest macro doomers reigniting the inflation fear👇

First, Biden and Co ramped up spending into the election to buy votes, so we expect a seasonal bump in inflation and economic activity which likely dissipates from here. Second, a clearly slowing China and weak global growth backdrop alongside falling oil prices, which are down over 12% YoY, does not make for an inflationary environment. Third, the dollar has reversed the entire summer sell off and now at the strongest levels in a year. This is a huge inflation headwind which should limit any reacceleration in prices from here.

The last disinflationary leg towards 2% was always going to be the hardest and as the Fed acknowledged, expect a bumpier path from here. Yet little to concern us that inflation is set to reaccelerate causing the Fed to reverse course and start hiking. The balance of risks and concern remain in the labor market (let’s not forget the last NFP print at a paltry 12k jobs added) and we expect that to have more influence on the path of Fed cuts.

Is the US bond sell-off overdone?...

Nonetheless, the recent move higher in US yields and the dollar is acting as a headwind to risk, although we still believe we are on course for a “santa rally” into year end with more money to come off the sidelines with the election uncertainty removed. Further, with deficits running high, global liquidity ample and a global central bank cutting cycle under way, there is little to concern us here.

A more disorderly sell off in treasuries could have a bigger impact on risk, although we view this move as overdone and yields are likely peaking here. Encouragingly, we’ve had a large move lower in the MOVE index (index for Treasury bond volatility) which augurs well for liquidity and risk and we think 10yr yields will be anchored by the weakness in oil which is under pressure from slowing global growth and a less war hungry administration incoming. Indeed, 10yr yields have diverged markedly from oil and suggest to us that they will top out and correct lower here, adding a tailwind to our markets.

Is the bond sell off overdone? 10yr yields diverging from oil

Keep an eye then on the US bond market as a deeper, more volatile sell off could hamper risk more broadly and act as a bigger pull on the crypto space, yet this is not our base case.

Accelerated returns ahead...

Additionally, Bitcoin and crypto have their own idiosyncratic story currently given the paradigm shift in the regulatory outlook as a crypto friendly administration moves into the White House. Talk that Howard Lutnick, the pro Bitcoin CEO of Cantor Fitzgerald could be the next Treasury secretary, currently endorsed by Elon Musk and RFK Jr, would be another narrative boost which will firm expectations that BTC could be made a US strategic reserve asset.

So despite some short term caution on broader risk assets given the US dollar and yield move, we see the “red wave” as inducing an earthquake sized demand shock which will continue to drive institutional money into the space and Bitcoin, as the only commodity with a truly fixed supply, looks set to drive higher and break the vaunted $100k level.

As for the broader crypto space, the kneejerk outperformance of altcoins has faded, perhaps with the aforementioned risk and liquidity headwinds. Bitcoin dominance (measured as a BTC market cap as a percentage of total crypto market cap) remains above 60%. In previous bull markets, this fell to as low as 40%. With various leverage metrics still showing little signs of froth, all the fun and accelerated returns remain ahead of us. Let’s get this party started 🚀

Native News

Key news from the crypto native space this week.

Stablecoin issuer Tether announced on Thursday it has launched a real-world asset tokenisation platform called Hadron, that will allow users to tokenise "anything." Tether said in its statement "Tether’s new platform aims to offer a vast variety of asset types starting with vanilla reference products such as fiat-pegged or commodity-backed stablecoins, to more complex solutions such as digital asset collateralised tokens including basket-collateralised products." Although Tether specifically mentions users being able to tokenise stocks, bonds, stablecoins and loyalty points, the release says the platform "will allow the tokenisation of anything" and includes an illustration showing images of physical assets like a golf course, bitcoin mining equipment, jewellery and a sports jersey. Read the full release from Tether HERE.

Crypto exchange Coinbase has introduced the Coinbase 50 Index (COIN50) - a new benchmark for tracking over 50 digital assets listed on the exchange. The Index promises exposure to crypto market trends, with six cryptocurrencies making up 91% of the benchmark weight: BTC, ETH, SOL, DOGE, XRP and ADA. The new product primarily targets emerging markets and crypto-friendly jurisdictions since derivatives products tied to the index exclude major markets like the United States, the United Kingdom, and Canada. According to the exchange, only eligible institutional traders will be able to get exposure to the index via perpetual futures contract — which allows traders to speculate on the assets’ performance indefinitely — on Coinbase International Exchange. Eligible retail users will be able to access the product via Coinbase Advanced.

Investment firm Canary Capital has reportedly submitted a Form S-1 registration statement to the United States Securities and Exchange Commission (SEC), seeking permission to list and trade shares of its spot Hedera exchange-traded fund on an unnamed exchange. According to the filing, the Canary HBAR ETF intends to hold only HBAR directly without using derivatives, futures, or other financial instruments. This makes it the first of its kind for the asset.

PayPal's U.S.-dollar pegged stablecoin is now using LayerZero to streamline transfers between Ethereum and Solana. PYUSD on Ethereum's market cap has remained relatively unchanged in recent months, at about $350 million. The stablecoin's supply on Solana, however, has fallen from over $660 million in August to $186 million. The statement from PayPal said "The integration eliminates liquidity fragmentation and ensures fast, secure, and cost-effective transactions for both users and businesses. We believe that PYUSD holders will welcome the flexibility and convenience offered by LayerZero.” LayerZero Labs' CEO Bryan Pellegrino said that LayerZero's Omnichain Fungible Token, or OFT, is what now makes the transfers between Ethereum and Solana possible "The OFT standard unlocks a new level of interoperability for stablecoins. By using LayerZero, PYUSD can move seamlessly between Ethereum and Solana, helping holders move their tokens between chains to use how they want and when they need to."

Institutional Corner

Top stories from the big institutions

Eighteen Republican attorney generals sued the U.S. Securities and Exchange Commission (SEC), accusing the agency of superseding its authority to regulate digital assets at the state level. Attorneys General for Kentucky, Nebraska, Tennessee, West Virgina, Iowa, Texas, Mississippi, Montana, Arkansas, Kansas, Missouri, Indiana, Utah, Louisiana, South Carolina, Oklahoma, Florida as well as the DeFi Education Fund filed their lawsuit in the U.S. District Court for the Eastern District of Kentucky. The attorneys general asked the court to declare that a "digital asset transaction is not an investment contract," as well as an order blocking the SEC from bringing future charges "premised on the failure of digital asset platforms facilitating such secondary transactions to register as securities exchanges, dealers, brokers, or clearing agencies."

According to a survey released by Sygnum Bank on Thursday, 57% of institutions surveyed plan to increase their cryptocurrency exposure, fuelled by a growing willingness to take risks and long-term confidence in the asset class. 65% of the survey respondents are bullish in the long-term, with 63% mulling more allocation to digital assets in the next three-to-six months. 56% of respondents said they expect to change their outlook to bullish within a year. Over 70% of the survey respondents said that the ETFs have increased their confidence in the asset class. Nearly 30% said that digital assets are superior to traditional investments.

Charts of the Week

Because charts are just as important as macro.

Deribit reached an all-time high in options open interest Thursday, with $37.6 billion across bitcoin and ether contracts, bringing the total platform open interest to $40.8 billion.

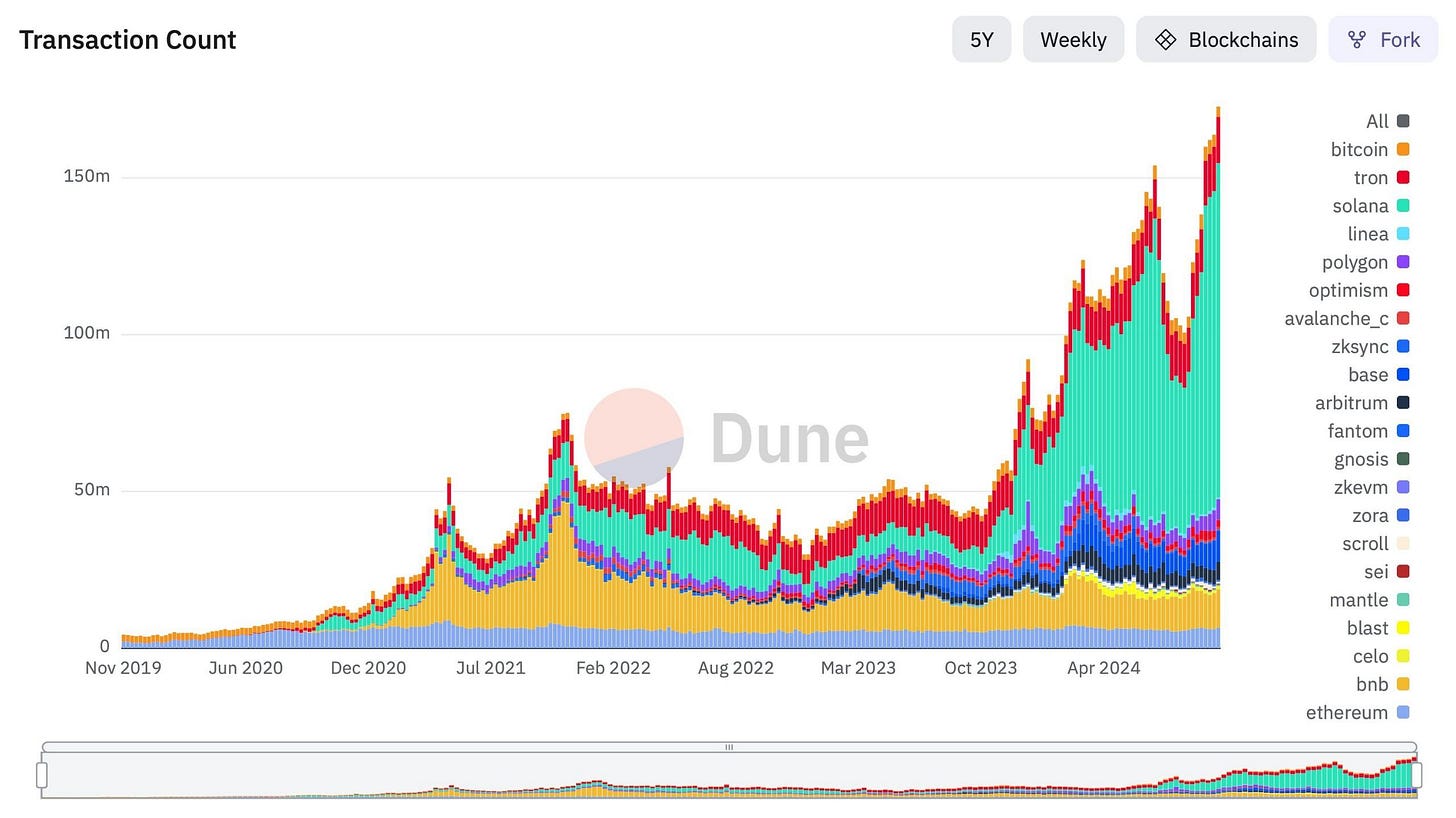

The week of the US election was also the week with the highest on-chain transaction count - 172 million transactions in total.

Stablecoins are catching up to established settlement networks. In the space of 6 years, stables have gone from ~0 to near parity with Visa.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Venture Capital Analyst at Multiplyers

Execution Services Trader at Coinbase

Specialist, Treasury and Trading Operations at Bullish

Senior Management, Business Development at Ripple

Senior Product Manager Institutions at Bitstamp

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

Ample liquidity? I have seen some people say the opposite, like Michael Howell pointing towards troublesome levels of liquidity atm. Curious to hear what exactly the liquidity levels are that you guys are monitoring

Very interesting analysis!

I fully agree that macroeconomists who are forecasting a reacceleration of inflation at this point are wrong. Very interesting what you say regarding deflationary headwinds, especially with regard to China's economic growth.

The divergence chart between oil and US bond yields is clearly an anomaly; I also agree that yields will pause at this level.

All indications are that we will have good performance in equities for the remainder of November and December.