Welcome to the new subscribers that have joined us over the last week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family.

To hear more from us on a daily basis, give our Twitter a follow at https://twitter.com/LDNCryptoClub

Onto the newsletter. Here’s what you’re getting this week:

Macro: US recession fears gain traction as US data continues to underperform. The macro continues to play out in line with our peak rates thematic.

Crypto Native News: Binance Australia looses its derivatives license, BTG Pactual, the largest investment bank in Latin America, announced the launch of its first stablecoin through Mynt, the Bank's crypto platform, Moon mortgage launces a mortgage product for crypto investors.

Institutional News: The US Treasury releases its latest report on Defi, France is exploring ways to regulate Defi, PostFinance, one of Switzerland’s leading financial institutions launches digital asset banking services, the Central Bank of Ireland has removed its pre-submission requirement for Irish regulated crypto funds and eNaira adoption grows in Nigeria.

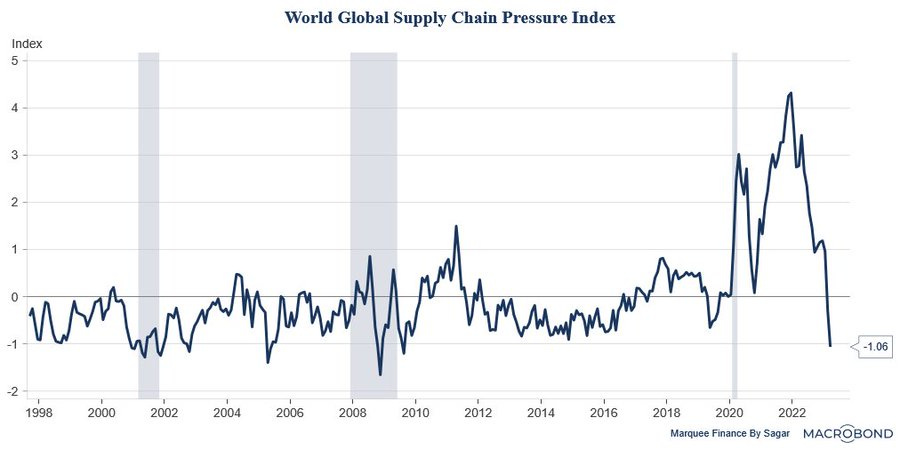

Chart of the Week: World global supply chain pressure index.

Top Jobs in Crypto: Featuring the FCA, Kinsei Recruitment, Circle, Wintermute, Gemini and Binance.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

Data Jolt

An Easter shortened week was not short on macro events to drive our markets. Weekend news that OPEC+ agreed to voluntarily cut production a further 1.16mio barrels per day saw oil prices spike 8% on the open and rates markets sell off (yields higher) as the inflationary consequences of higher oil re-ignited inflation fears.

10yr yields initially jumped 7bps to 3.55% but the move was short lived perhaps as markets realized that OPEC are cutting to stabilize oil prices because global growth is weak and artificially higher oil prices only act to weigh on growth even more. In fact, cutting oil supply in response to a negative demand shock is often counterproductive and often leads to a lower output, lower price equilibrium.

Recession fears gained traction as the week progressed with the US data flow showing a marked deterioration.

First up came US Manufacturing ISM, which fell deeper into contraction territory at 46.3, down from 47.7. Manufacturing new orders also fell to a recessionary 44.3 from 47 (and against 49 exp.) Ouch!

For the first time, the “resilient” labor market also started to show signs of weakness. The number of job openings on the JOLTS survey fell below 10mio for the first time in 2 years, dropping a massive 632k to 9.93mio (Vs 10.4mio exp).

Next up came the ISM services which fell to 51.2 from 55.1 prior (and against 54.5 exp.) Post the covid re-opening, the service sector, which accounts for just under 80% of US GDP, has been the key driver of growth and inflation. Whilst a reading above 50 is not outright contraction, this suggests a sharp slowing. New orders also fell to 52.2 down from 62.6. Additionally, ISM service prices clocked in at 59.5 down from 65.6. The slowing in services inflation is perhaps underway.

Back to the jobs market and on Thursday, initial jobless claims soared to 228k Vs 200k expected and perhaps more significantly, back-dated revisions were huuuge. Last week's claims were revised from 198k to 246k and the week before that, 247k revised up from 191k. The week before that, 230k revised up from 192k. These are significant revisions. In fact, during growth slowdowns/recession, jobs numbers are frequently over estimated given assumptions made when making adjustments.

The week however finished with Non Farm Payrolls which bucked the trend and came in with a solid headline print of 236k (230k exp) with the unemployment rate dipping to 3.5% from 3.6%. Giving a “goldilocks” glow was average hourly earnings growth falling to 4.2% down from 4.6%.

Yields reversed some of the early week losses with 10yr closing at 3.41%, 2yr at 3.99% and odds of a 25bp hike in May rising to 70bps. However, the veil of labor market strength is starting to slip and signs this week that the lagged impact of the Fed’s aggressive rate hike cycle is starting to bite.

The pause is coming. The macro continues to play out in line with our peak rates thematic. Long duration plays should continue to perform and crypto being the longest duration asset can continue its ascent!

Native News

Key news from the crypto native space this week.

On Thursday, the Australian Securities and Investments Commission cancelled the Australian financial services license held by Oztures Trading Pty, which is trading as Binance Australia Derivatives. The license cancellation was effective immediately. Following the cancellation, with effect from 14 April 2023, clients will not be able to increase derivatives positions or open new positions with Binance, Binance will require clients to close any existing derivative positions before 21 April 2023 and on 21 April 2023, Binance will close any remaining open positions. Read the full release from the ASIC HERE

BTG Pactual, the largest investment bank in Latin America, announced the launch of its first stablecoin through Mynt, the Bank's crypto platform. The stablecoin is called BTG Dol with a price backed by the US dollar at 1 to 1. BTG Dol is structured as a stablecoin, a type of crypto asset backed by a stable asset, in this case the US dollar (USD), it offers its holders the opportunity to 'dollarise' part of their equity in a simple, efficient, and secure manner. André Portilho, Head of Digital Assets at BTG Pactual said "Once again, we are innovating in using financial technology in our clients' benefit. When buying BTG Dol, investors have access to an easier, safer and smarter way to invest in dollars” Marcel Monteiro, Head of Operations at Mynt, says the new cryptocurrency positions BTG as a benchmark in the market. "We recently launched eight new assets, we already have 22 cryptocurrencies on the platform, and now we have our own stablecoin. This shows that the Bank trusts technology and will continue with its commitment to offering new innovative digital products and services, with the solidity and trust that are BTG's hallmark"

Moon Mortgage, a crypto lending platform that raised $3.5m last October, has launched a mortgage product for crypto investors. One of the recurring challenges for people who generate capital in the Web3 space is how to actually deploy it in order to improve their life in the real world. Providing a mortgage collateralised by digital assets is one of the more mainstream use cases that we have seen, especially as price of real estate remain unaffordable in the current rate environment. The core product, called “Trade and Borrow”, allows investors to borrow against the total value of their portfolio, offering loans with a minimum amount of $6,000 at a 12% loan percentage and an LTV of website 40%. Supported assets include BTC, ETH, and USDC, with no origination fees or prepayment penalties, but positions will be liquidated if there is a 50% drop in a borrower's portfolio value. Check out the full website HERE

Institutional Corner

Top stories from the big institutions.

The US Treasury released a report titled 2023 Defi Illicit Finance Risk Assessment. According to the report, decentralised finance (DeFi) services that aren’t compliant with anti-money laundering and terrorist financing rules pose “the most significant current illicit finance risk” in that corner of the crypto sector. Also in the report, published Thursday, the Treasury Department said thieves, scammers, ransomware cyber criminals and actors for the Democratic People’s Republic of Korea (DPRK) are using DeFi to launder proceeds from crime. Due to the findings, the department recommends an assessment of “possible enhancements” to U.S. anti-money laundering (AML) requirements and the rules for countering the financing of terrorism (CFT) as they should be applied to DeFi services. The report also warns that “DeFi services at present often do not implement AML/CFT controls or other processes to identify customers, allowing layering of proceeds to take place instantaneously and pseudonymously.” You can read the full report HERE

France is exploring ways to regulate decentralised finance. The French banking supervisory body Autorité de Contrôle Prudentiel et de Résolution (ACPR) has opened a comment period on a series of proposals to regulate intermediary-free financial services related to crypto assets. The consultation, in which crypto-asset companies, clients and observers are invited to take part, will run until 19 May, ACPR said in a statement this week. Secretary General Nathalie Aufauvre said, “Our approach should be understood as a positive signal for decentralised finance,” “This innovation will grow, and because of that it is important to put in place a suitable regulatory framework.” The ACPR said its proposals aim to ensure that blockchain infrastructures are resilient, for instance by imposing security standards. The banking authority also wants to strengthen the safety of smart contracts, or algorithmic services, by certifying their underlying code, and better monitor the companies providing crypto services.

PostFinance, one of Switzerland’s leading financial institutions and largest retail banks has partnered with Sygnum, the world’s first digital asset bank, to offer its customers a range of regulated digital asset banking services via Sygnum's B2B banking platform. PostFinance's customers will be able to buy, store and sell leading cryptocurrencies such as Bitcoin and Ethereum. Philipp Merkt, Chief Investment Officer of PostFinance Ltd, says "Digital assets have become an integral part of the financial world, and our customers want access to this market at PostFinance, their trusted principal bank. A reputable and established partner like Sygnum Bank with an excellent service offering is more important than ever." Fritz Jost, Chief B2B Officer, Sygnum Bank, adds “Our all-in-one B2B banking platform enables our fifteen-plus B2B partner banks to expand their range of regulated digital asset services at scale and speed. We are pleased to empower PostFinance to deliver institutional-grade digital asset services to their customers. We are committed to continuously drive further innovation and positive change for the industry and our partner banks’ customers.”

The Central Bank of Ireland has removed its pre-submission requirement for Irish regulated crypto funds. Qualifying Investor Alternative Investment Funds (QIAIF) may now indirectly invest up to 50% of NAV in digital assets. If a QIAIF invests 20% of NAV or more, it must be closed-ended or open-ended with limited liquidity. Direct investment by a QIAIF will only be available once a depositary can demonstrate that it can comply with its AIFMD obligations with regard to safekeeping but most depositaries should currently be able to facilitate indirect investment through the use of derivatives (including specialised depositaries). Read full Alternative Investment Funds Managers Directors Directive HERE

In the CBDC space, the adoption of eNaira, the digital version of Naira issued by the Nigerian central bank, is on the rise. Since October, the number of eNaira wallets has grown 12 times larger to 13 million wallets. The value transacted in 2022 was up 63% to 22 billion Naira ($48m), though average transaction volume per person is relatively low at around $4.00. For context, there are 213 million people in Nigeria, suggesting that 6% of the population is now utilising the CBDC.

Chart of the Week

Because charts are just as important as macro.

The world global supply chain pressure index at 13 year lows!

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Digital Assets Lead Associates at the FCA

Crypto Hedge Fund Trader via Kinsei Recruitment

Senior Developer Relations and Ecosystem Marketing at Circle

Trading Assistant at Wintermute

Senior Associate, Market Risk at Gemini

Growth Product Manager at Binance

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.