Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: The SEC files a lawsuit against Cumberland DRW, Uniswap to launch a layer-2 called Unichain, Ethena reveals the assets in its reserve fund.

Institutional Corner: PWC and AIMA release their 6th annual crypto report, South Koreas FSC evaluating lifting crypto ban, the Thai SEC to allow mutual and private funds to invest in digital asset, Stripe to reintroduce crypto payments for US businesses.

Charts of the Week: Solana Memecoin market cap passes $10bn, BTC-to-Gold ration falls, Solana’s staking TVL reaches 66% of Ethereum’s, Bitcoin has outperformed over the last 5 years.

Top Jobs in Crypto: Featuring 21Shares, Trireme, Trust Wallet, Global Blockchain Show, GK8 by Galaxy and Copper.

Macro Update

This is where we connect the dots between macro and crypto.

A Rising Tide Lifts All Boats

Another week, another record high for the S&P 500 as the “Goldilocks” backdrop we’ve outlined continues to push risk assets higher. NVIDIA led the outperformance for growth over value stocks, a theme we expect to continue in a lower rate, liquidity driven world. We see little reason to fade this bull market which can maintain its run well into 2025, perhaps with additional vigor should Trump regain the White House.

On that, we continue to monitor the prediction markets, which according to Polymarket started to see Trump build a lead over Kamala this week, perhaps adding to the bullish sentiment.

Post last week's stronger payrolls print, the US dollar and yields had a decent bounce in what felt like a return to the “reflation” trade. However, just as we dismissed the “recession” narrative, we also dismiss the talk of reflation.

Goldilocks…

Everything we see right now suggests a slowing, not collapsing US growth backdrop, into a disinflationary economy. This is the Goldilocks scenario that we continue to see providing fertile ground for risk and we expect post election, will drive a Santa rally “melt up” as an under positioned market is forced to chase performance.

On the inflation front, this week’s CPI came in a touch hotter than expected, although continued the disinflationary theme, with the headline rate dropping from 2.5% YoY to 2.4%, the lowest level since Feb 2021. Core inflation did tick up to 3.3% YoY from 3.2%, driven by sharp increases in the seasonally adjusted prices of medical care and transportation services, but to quote the Fed’s Bostic, the latest inflation date was “janky” exhibiting the choppiness one would largely expect month to month.

Perhaps more importantly given the closer focus now on employment was the jump in jobless claims to a 14 month high at 258k, with continuing claims rising to the highest level since late July at 1.86mio.

The stronger data pulse seeing a market price out the 50bp cuts, with back to back 25bps in Nov and Dec now consensus. In Europe meanwhile, the market continues to price the ECB more dovishly, despite a more cautious outlook in the ECB minutes. German factory orders dropping 5.8% adding to concerns over Europe’s “growth engine” with the German ministry for economic affairs forecasting the German economy will contract 0.2% this year, a substantial downward revision from its expectation of a 0.3% expansion. The ECB looks well behind the curve to us, especially given the exposure to the global manufacturing cycle which remains mired in recession, which means the response to counter the “mistake” will be a more aggressive easing of policy.

The only major central bank attempting to tighten policy, the Bank of Japan, saw real wages in Japan fall 0.6% YoY in August. We’ve been on the more dovish side in relation to the BoJ. Largely, they continue to have a structurally disinflationary economy and given the huge debt/gdp levels they need to service, have little room to normalize rates. The sluggish wage data, as well household spending which fell 1.9% YoY in August provides little case for damaging rate hikes. This reinforces our view that the Yen funding trade is in no danger of unwinding any time soon as Yen rates remain relatively low and close to the zero bound. Sorry doomers, if this was underpinning your bear case, you need to look for another catalyst. We don’t see any right now!

Financial markets are not the economy…

In China, a holiday shortened week saw heightened volatility, with sharp moves in major indices as stimulus hopes were tempered. Bitcoin we feel has underperformed with the run higher in Chinese stocks as Chinese retail sell their crypto to buy domestic stocks. USDT under pressure supporting that view. A lot of focus was consequently on Saturday’s fiscal announcements from Lan Foan, the Minister of Finance.

In the event, China pledged to “significantly increase debt” to revive the economy, but stopped short of providing any numbers on the overall size of any such package which may disappoint markets on Monday morning. Perhaps this weekend’s pop in Bitcoin is front running a rotation back into crypto, out of domestic Chinese stocks 🤔.

Key takeaways from Saturday’s announcement however, courtesy of CN Wire:

🇨🇳China will borrow more to raise money and help local governments finance their “hidden debt” or off-balance sheet borrowing, easing debt pressure for regional authorities.

🇨🇳Local governments can use money raised from their special bonds to buy unsold homes and turn into subsidized housing, in an attempt attempt to address the country’s property slowdown.

🇨🇳Officials say there is still “large” room for the central government to raise debt and for the headline fiscal deficit to increase, but stopped short on offering specifics. (Attention now moves to the upcoming meeting of China’s top legislature as soon as the end of this month for any announcement.

🇨🇳Major state banks will get help to replenish their capital. The top six lenders have capital levels that far exceed requirements, but the support will help ease any pressure after the central bank announced interest rate reductions to mortgage and key policy rates.

Importantly perhaps, there were no measures aimed specifically to incentivise consumption. This lack of measure to address the main problem in China, the lack of domestic consumption, is likely what will disappoint markets on the open.

A rising tide lifts all boats…

However, we remain of the view that China’s almost open-ended, “whatever it takes” approach to arresting a deflationary slowdown will mean a flood of liquidity into markets. The real economy will benefit far less than the financial economy. Whilst short term portfolio flows may have hampered Bitcoin (on the rotation out of crypto into Chinese stocks) the flood of liquidity will start to leak into all assets and Bitcoin will outperform. China is engaging in the currency debasement games that the West have been engaged in ever since the financial crisis and our own balance sheet led recession.

Uptober may have gotten off to a false start, with intensifying geopolitical tensions damaging early momentum and there still appears to be a negative supply dynamic making the big technical resistance levels difficult to break. We do note however that most of the gains come in the second half of October and Bitcoin has typically performed well running into the election.

We can’t emphasise strongly enough the bullish macro backdrop, with major central banks cutting rates, global liquidity rising and now the giant which is China firing a big stimulus bazooka. Questions remain just how much the US election is hampering risk taking, but be under no doubt, pressure is building for a violent move to the upside for crypto and broad risk assets. The macro doomers will try to argue why “this time is different” but as we like to say at London Crypto Club…don’t over complicate it. The rising tide of liquidity will lift all boats, but the Bitcoin boat will be lifted highest.

Native News

Key news from the crypto native space this week.

The Securities & Exchange Commission (SEC) filed a lawsuit on Thursday against Chicago-based trading firm Cumberland DRW for operating as an unregistered securities dealer. The SEC claims that Cumberland has been operating as an unregistered broker from 2018 through the present. The SEC further alleges that Cumberland engaged in trading cryptocurrencies as investment contracts on third-party exchanges as part of its regular business. Jorge G. Tenreiro, Acting Chief of the SEC’s Crypto Assets and Cyber Unit (CACU) said “The federal securities laws require all dealers in all securities to register with the Commission, and those who operate in the crypto asset markets are no exception.” In response to the charges, Cumberland DRW stated that it has continuously complied with all the rules laid down by regulators. As a result, the company stated that it would not make any changes to its business operations. Cumberland also called the SEC's action an "Enforcement-first approach in stifling innovation." It also claims to have acquired a broker-dealer registration in 2019 in compliance with the SEC's directive. The cryptocurrencies the SEC mentioned as securities in the suit include Polygon’s MATIC (now POL), ATOM, Algorand (ALGO), Filecoin (FIL) and Solana (SOL).

Uniswap announced plans to launch its own layer-2 network called Unichain, which will be built on Optimism tech. Uniswap Labs framed the move as one to cut costs, improve transaction speeds, and boost liquidity across various chains. The project's technical development is being led by Uniswap Labs, relying on technology borrowed from the Ethereum layer-2 team Optimism's OP Stack. As such, Unichain will become a part of the Superchain, a federation of Optimism-affiliated networks that includes the U.S. crypto exchange Coinbase's own layer-2 blockchain, Base. Uniswap Labs CEO Hayden Adams said “After years of building and scaling DeFi products, we’ve seen where blockchains need improvement and what’s required to continue advancing Ethereum’s roadmap. Unichain will deliver the speed and cost savings already enabled by L2s, but with better access to liquidity across chains and more decentralisation.”

On Thursday, Ethena unveiled the investments selected by its risk committee to allocate its real-world assets (RWA) reserve fund. Previously, Ethena’s risk committee received 25 nominations but ultimately narrowed it down to four assets that met their criteria.

BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

USDS stablecoin from Sky (Maker)

Superstate’s Short Duration US Government Securities Fund (USTB) and

USDM stablecoin from Mountain Protocol

According to the risk committee, these assets meet important criteria such as product maturity, liquidity, redemption time, and several other metrics. Currently, the total value of assets in the reserve fund exceeds $46.6 million.

Institutional Corner

Top stories from the big institutions

PWC and the AIMA released their 6th annual crypto report this week. The main headline from the report is an increase in exposure to digital assets by traditional hedge funds. The report includes data from 100 hedge funds with a total of $125bn AUM. Nearly half (47%) of traditional hedge funds surveyed this year have exposure to digital assets, up from 29% in 2023 and 37% in 2022, driven by increased regulatory clarity and the launch of spot cryptocurrency ETFs in Asia and the U.S. Among those already invested, 67% plan to maintain the same level of capital employed while the remaining 33% plan to invest more capital by the end of 2024. Other key findings include an increase in derivative trading, rising to 58%, up from 38% in 2023, increased interest in tokenisation, and rising institutional client demand. Read full details HERE.

South Korea’s top financial watchdog the Financial Services Commission (FSC) said it would re-evaluate lifting the existing ban on local spot cryptocurrency exchange-traded funds and institutional accounts on crypto exchanges. The Financial Services Commission (FSC) said in its report for the annual audit on Thursday that its new cryptocurrency committee, a newly formed advisory group for discussing digital asset policies, will review the current ban. This signals a shift from the regulator's strict opposition to digital asset exposure in traditional financial markets. The country’s legislators have been calling for change. The winning Democratic Party and the opposition party had pledged the approval of local spot bitcoin ETFs in their general election campaigns earlier this year. The winning left-wing party reportedly announced in May that it would request the FSC to review the ban.

The Thai Securities and Exchange Commission (SEC) has proposed new regulations that would allow mutual and private funds to invest in digital assets in an effort to align with international developments and address growing interest from institutional investors. A draft proposal, published on Wednesday, is seeking public feedback on revisions to the criteria for funds investing in digital assets. The SEC is proposing to allow securities companies and asset management firms to offer services to large investors interested in diversifying into crypto-related products, such as exchange-traded funds. The regulator aims to align with international developments in digital assets and create more opportunities for investors to diversify their portfolios under expert management. Read the full draft HERE.

Payment processing firm Stripe reintroduced crypto payments for US businesses on Wednesday, enabling merchants to accept USDC via Ethereum, Solana and Polygon. Stripe became the first major payments company to offer bitcoin payment support in 2014. However, the feature was wound down in 2018, citing declining demand amid long confirmation times, higher fees and price volatility. After a six-year wait, U.S. businesses can accept the stablecoin for payments from customers in more than 150 countries, with the merchants receiving dollars, according to Stripe product lead Jeff Weinstein. The integration works with checkout, elements or payment intents, and soon for the company’s subscriptions feature, he explained. “Official launch and support for USDC payments in Stripe products rolling out for businesses in the U.S. Stripe had initially planned to roll out USDC payments in the U.S. this summer but encountered some delays. “When we said "coming this summer", we meant San Francisco summer, which is ~October,” Weinstein said, adding that support for more countries would be enabled in the future.

Charts of the Week

Because charts are just as important as macro.

The total market cap of Solana memecoins has surpassed $10 billion this week. Hat tip to Solana Floor for the chart.

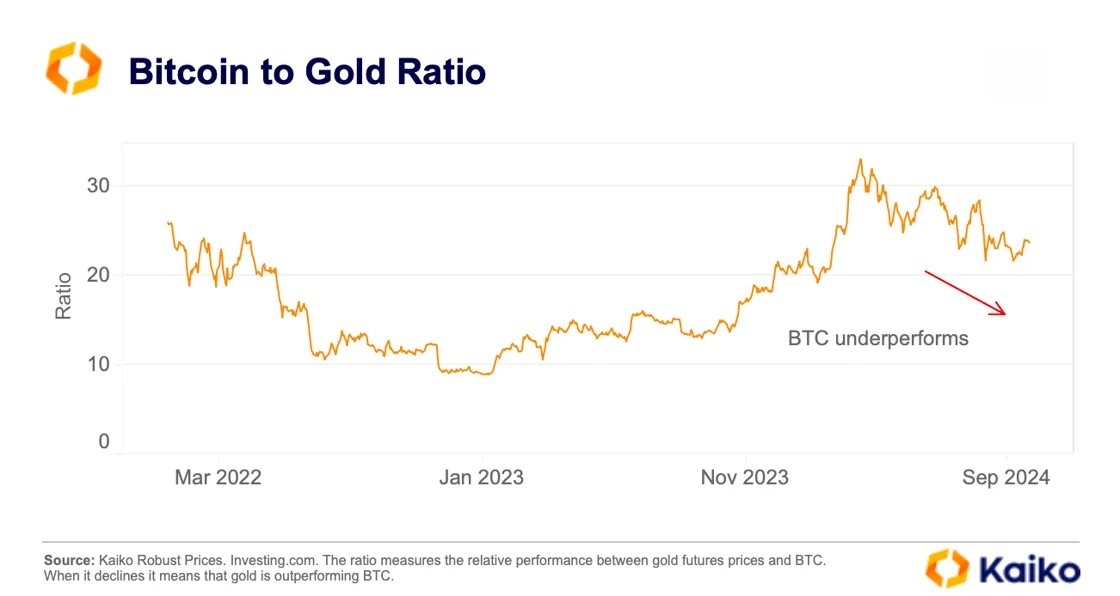

The BTC-to-Gold ratio has fallen to 24 ounces per BTC from 33 in March. Hat tip to Kaiko Data for the chart.

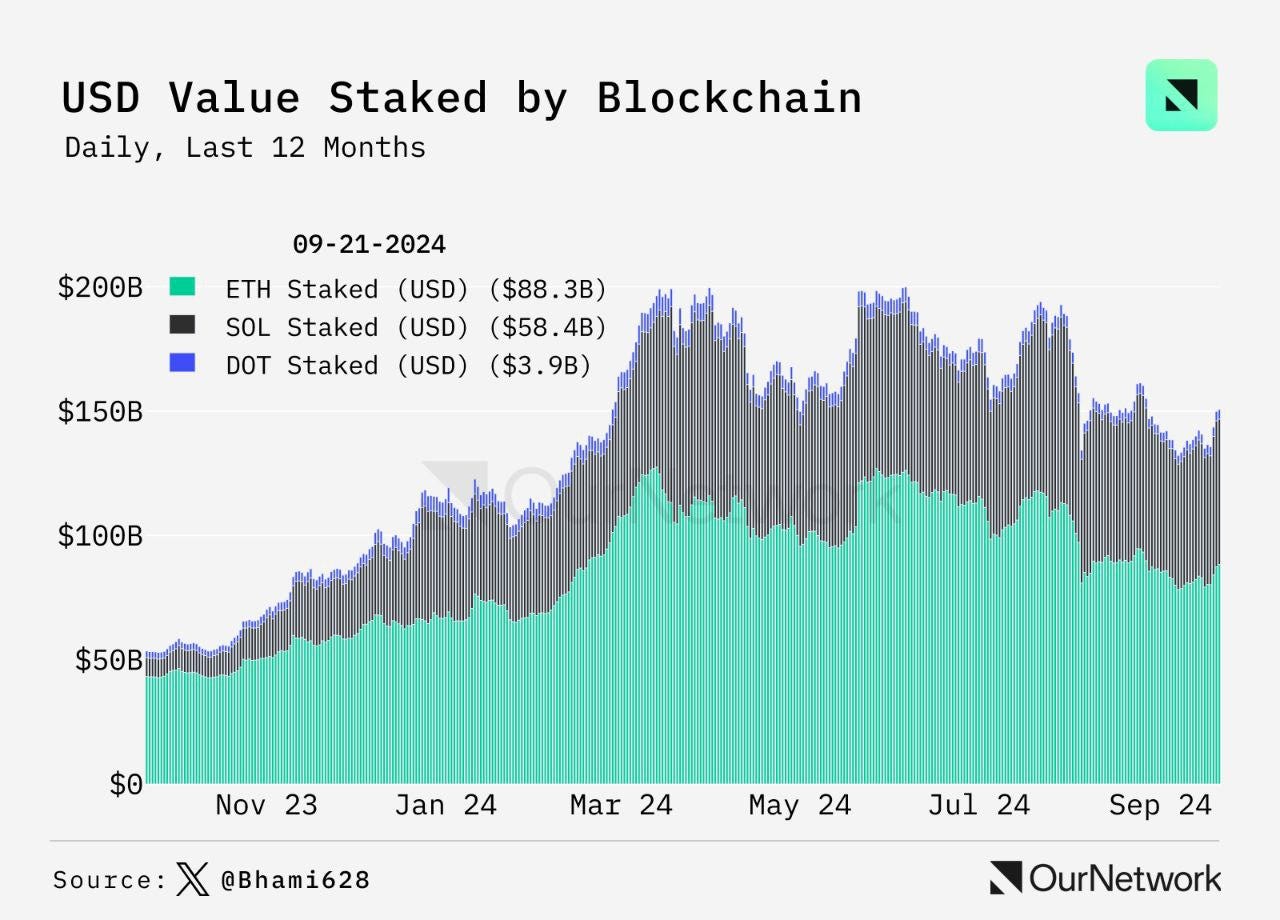

Solana’s staking TVL reaches 66% of Ethereum’s in September 2024, with over $58 billion staked.

Bitcoins outperformance over the last 5 years. Hat tip to Lyn Alden for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Research Strategist at 21Shares

Crypto Trader Analyst at Trireme

Social Media Specialist - Web3 at Trust Wallet

Web3 Community Manager at Global Blockchain Show

Head of Partnerships at GX8 by Galaxy

Senior Product Manager Prime at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.