For the 50 new subscribers that joined us in the last week, welcome!

As always, if you find our content useful, our only ask is that you share it with your colleagues, friends and family. We really appreciate your support.

Here’s what you’re getting this week:

Bonus Section: Key takeaways from this weeks Crypto Legends event. Bridging Web2 to Web3 and the dreaded R word…Regulation!

Macro: US data still strong, rates continue to reprice but liquidity remains supportive.

Crypto Native: Coinbase launched Base and released its financials plus Numeus Research’s brilliant crypto hedge fund report.

Institutional News: Statements from the IMF and the Fed plus CryptoCompare’s Stablecoin and CBDC report.

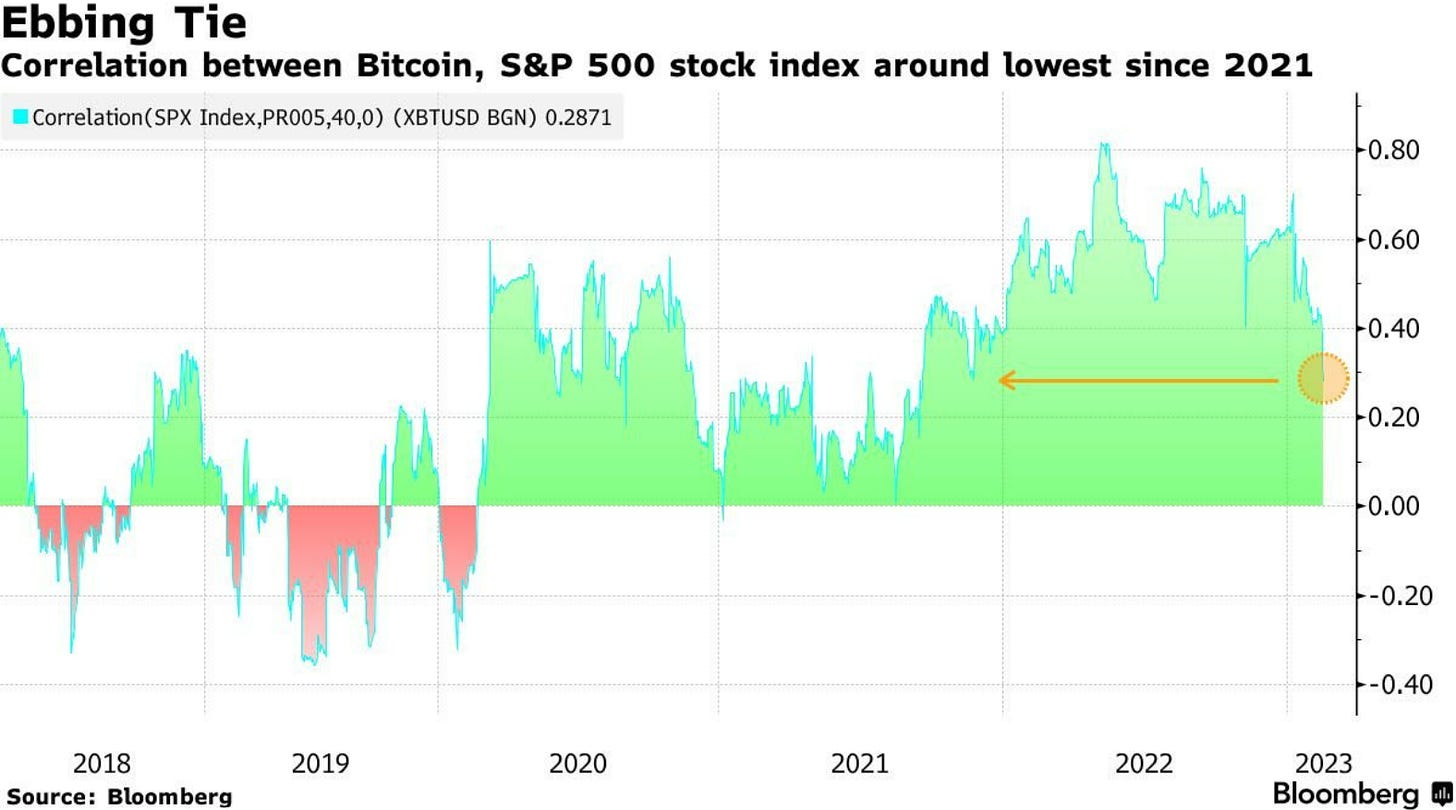

Chart of the Week: Bitcoin/S&P 500 correlation breakdown.

Top Jobs in Crypto: Featuring Copper, Wintermute, Bitpanda, Binance and Crypto.com

Bonus Section!

Another week, another great crypto event. This week I attended the Crypto Legends event hosted by Fiat Republic. There were 2 panel discussion topics, here’s the key takeaways:

Bridging Web2 to Web3

2 key challenges. Crypto to fiat integration and regulation. Crypto to fiat integration is built on legacy code, so underlying infrastructure needs continued development. Regulators are learning as they’re going, but innovators should be working together with the regulators.

Other things to consider…

Relationships with banks. Many banks don’t see crypto as a threat, but the compliance overhead is so huge, its hard for them to innovate in the space.

Building trust with both users and regulators. The way you conduct yourself in the market is very important, things like responsible marketing and consistent communication with customers. However, relationships with regulators can be dependent on your jurisdiction. You need a proactive regulator!

Evolving in the Crypto Winter. The larger institutions are already active or on their way into crypto. They want to keep things simple when looking for solutions to their problems. 2022 was about institutional speculation, now its about mature investment products and tokenisation.

How to become ‘Compliance fit’

According to the panel, French regulation is the most forward thinking and one of the ‘heaviest lifts’ to achieve. France is ahead of MiCA in its development according to some.

The UK has made great strides in regulation in the last year. Dubai’s regulations are very well put together. Hong Kong has made good progress recently, particularly for retail investors.

Scaling regulation. Regulatory and compliance requirements were previously AML heavy. But there’s a tsunami of requirements now, like segregations of assets, treatment of clients etc. The only way crypto firms can deal with this is to grow their compliance teams. Well rounded compliance individuals are those with both prudential regulation and fintech experience.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

US PCE data on Friday rounded off a month of stronger data that continued to reinforce the rapid rates repricing since January. Core PCE Price Index (the Fed’s preferred inflation gauge) came in at 4.7% YoY Vs a 4.3% consensus and worryingly, a tick higher from December’s 4.6%. Personal spending also came in hot at 1.8% MoM in Jan, up from -0.1% in Dec.

The US data remains stubbornly strong and after trending lower since last fall, is showing signs of a re-acceleration which will keep the Fed actively engaged, taking the terminal rate higher.

Markets are now pricing a peak rate of 5.4% from just below 5% only a few weeks ago and is a concerning dynamic for risk. Data over the coming weeks take on extra significance as we look to determine if Jan was just a blip to the weakening data trend that will pose a greater challenge to our peak inflation, peak rates view.

Off-setting rates however, is still supportive liquidity, much of which is being driven by the East as the PBOC continues to inject cash to maintain liquidity post covid-zero.

The BoJ meanwhile continues to print in an effort to maintain Yield Curve Control. Interesting and somewhat under the radar given the PCE data, new incoming Governor Kazuo Ueda, who is seen as more hawkish than his predecessor, reiterated a commitment to maintain Japan’s ultra-loose monetary policy in his first address to Japan’s Diet on Friday.

Ueda spoke of the risks of tightening monetary policy when underlying demand remained weak and suggested January’s 41 year high core inflation print of 4.2% was probably the “peak.” The recent bond sell-off coincided with Ueda's nomination and this more cautious tone perhaps returns some stability to rates markets into this week.

Native News

Key news from the crypto native space this week.

Coinbase announced the introduction of its Layer 2 called Base. Coinbase describe it as an “Ethereum Layer 2 network offering a secure low-cost, developer friendly way for anyone anywhere to build decentralised apps on-chain”. They describe their goal for Base to make on-chain the next online and on-board over 1 billion people into the cryptoeconomy. Base is built with the underlying security of Ethereum and the scalability needed to power decentralised apps. Full details of the launch can be found here: Joint Statement on Liquidity Risks to Banking Organizations Resulting from Crypto-Asset Market Vulnerabilities (federalreserve.gov)

Double Coinbase news…The crypto exchange reported its financial results this week. Fourth-quarter net revenue was $605 million, ahead of analyst estimates of $588 million, and up 5% from $590 million in the third quarter. But its transaction volume fell 12% quarter over quarter to $322 million. Subscription and service revenues, an area of focus by the company, grew 34% quarter over quarter to $283 million in Q4. Subscriptions and services accounted for nearly 50% of overall revenue in Q4, mostly thanks to interest income, which came in at $162.2 million.

This week crypto firm Numeus Research released a brilliant report titled ‘The Emergence of Crypto Hedge Funds – Opportunities and Outlook’. I can say its brilliant because I have read it. Some of the high level takeaways include: “Many institutions and finance professionals have migrated into the crypto hedge fund space in recent years. The new opportunities in the crypto hedge fund space also provide a new set of challenges. Both investment and operational professionals must take care to properly navigate and assess the nuances of crypto markets and draw on specific expertise when selecting partners. The crypto industry faced significant challenges during 2022, but silver linings have been found. There have been improvements in infrastructure, risk management and regulation is accelerating, with measures such as off- exchange settlement becoming a necessity for traders. This has paved the way for larger institutional players to feel comfortable operating in the space.”

Numeus believe that crypto hedge funds continue to present an attractive investment opportunity for investors, one where an early- stage industry combined with rapid innovation and increasingly accomplished investment expertise to offer unique alpha capture opportunities. You can read the full report here: Numeus | The Emergence of Crypto Hedge Funds: Opportunities and Outlook

Institutional Corner

Top stories from the big institutions.

On Thursday the International Monetary Fund released a report titled ‘Elements of Effective Policies for Crypto Assets’. It lays out a nine-point action plan for how countries should treat crypto assets, with point number one “to safeguard monetary sovereignty and stability by strengthening monetary policy frameworks and do not grant crypto assets official currency or legal tender status”. Other points on the list include guarding against excessive capital flows, adopting unambiguous tax rules and laws around crypto assets, and developing and enforcing oversight requirements for all crypto market actors. You can read the full report here: IMF Executive Board Discusses Elements of Effective Policies for Crypto Assets

Again on Thursday, the Board of Governors of the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) issued a statement titled ‘Joint Statement on Liquidity Risks to Banking Organizations Resulting from Crypto-Asset Market Vulnerabilities’. The statement focuses on the liquidity risks presented by certain sources of funding from crypto-asset-related entities, due to the unpredictability of the scale and timing of deposit inflows and outflows, and some effective practices to manage such risks. You can read the full report here: Joint Statement on Liquidity Risks to Banking Organizations Resulting from Crypto-Asset Market Vulnerabilities (federalreserve.gov)

This week CryptoCompare released their monthly Stablecoin and CBDC report. Some of the highlights include: The Stablecoin market cap fell for 11th consecutive month, USDT Stablecoin dominance reached its highest level since October 2021 following the BUSD decline, the SEC charged Binance USD causing significant outflows of Paxos stablecoins, resulting in BUSD and USDP's market cap dropping by 15.8% and 24.37% respectively and China officially included its CBDC (e-CNY) circulation data in their financial statistics for the first time in February. You can read the full report here: Stablecoins Report - February 2023 (cryptocompare.com)

Chart of the Week

Because charts are just as important as macro

Nice chart from Bloomberg showing that the correlation between Bitcoin and the S&P 500 index is the lowest since 2021.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Junior Settlement Specialist at Wintermute

MLRO & Compliance Officer at Bitpanda

Macro Research Analyst at Binance

UK Head of Compliance and MLRO at Crypto.com

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.