Before we start, just wanted to mention that ill be in Singapore next week for Token2049/Solana Breakpoint. If anyone wants to catch up, just reply to this email.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Macro backdrop remains incredibly important, our latest update below is not to be missed!

Crypto Native News: New stablecoin report released and Grayscale launching an XRP trust.

Institutional Corner: US House Financial Services Committee held a hearing on DeFi, the FBI releases its annual report on cryptocurrencies, the UK’s Ministry of Justice introduces a new Bill to Parliament aiming to clarify digital assets ownership, eToro agrees to pay SEC fine.

Charts of the Week: Large BTC trade volumes in the first 8 months of 2024, increased bitcoin outflows from exchanges, BTC/S&P500 correlation increases.

Top Jobs in Crypto: Featuring Kraken, XTX Markets, Talos, Binance and Coinbase.

Macro Update

This is where we connect the dots between macro and crypto.

A Rising Tide Lifts all Boats

A busy week saw stocks recover most of the September losses, with the Nasdaq up 6%, its strongest week since November, whilst Bitcoin back at 60k had its best week in 2 months.

Yields continued to break down in bull steepening fashion, with a Wall Street Journal article from the “Fed Whisperer” Nick Timiraos suggesting the upcoming Fed meeting is a close call between 25 or 50bps sending rate cut expectations soaring. The disinversion of the 2s10s yield curve now at 7bps, with 2yr yields at 2.58% and 10yr at 3.65%.

The dollar consequently remained on the back foot, with USDJPY testing towards 140 and now flat on the year. Interesting perhaps that the continued USDJPY breakdown this time coinciding with stocks ripping higher. A juxtaposition to the August “carry unwind” FUD.

Carry on…

As we suggested then, August was less a carry trade unwind than a highly levered, momentum trade that blew up, triggered by USDJPY falling (market was long USDJPY, Nikkei, Nasdaq.) This unwind is now done. The bigger carry or funding unwind that the bears get excited about is the repatriation of the circa $4trn of foreign assets held by Japan. Yet it’s unlikely the large pension and lifer funds who own these assets will materially change the long term portfolio mix with JGB’s yielding sub 1%. Circa 60% of those foreign asset holdings are also held in bonds. If there was a funding trade unwind, you’d expect bonds to also sell off, not rally as treasuries are doing.

They will however be incentivised to increase hedge ratios which cheapen with a narrowing interest rate differential. This will continue to weigh on USDJPY and can help feed a broadly weaker dollar which is actually liquidity and risk positive. USDJPY is now being driven by the US yield breakdown and is no longer the barometer for risk. Just look at how closely it’s now trading with 2yr yields 👇

USDJPY Vs US 2yr yields

In terms of the data this week, in the US, we maintain the view of a “goldilocks” backdrop with continued disinflation alongside a slowing, not collapsing economy and a Fed with a lot of fire power in its arsenal.

Headline inflation slowed from 2.9% to 2.5%, the lowest level since early 2021, although core was a touch stronger than expectations at 0.3% MoM, flat on a YoY basis from July at 3.2%. Headline producer price inputs (PPI) also fell from 2.1% to 1.7%. The Fed will be comfortable that inflation is no longer a concern. Indeed, market inflationary expectations, as measured by breakevens, agree that the inflation dragon has been slayed. 5yr breakevens now 1.95% suggesting inflation will average sub 2% over the next 5 years.

On the now more important Labour market, jobless claims this week ticked up to 230k Vs 228K the week prior. The high frequency labour market data not showing a concerning deterioration in the labour market…yet.

China’s Big Bazooka

Somewhere where the data is however more concerning is China. China continues to battle a deflationary, slowing economy. Annual inflation came in at a weaker 0.6%, whilst PPI YoY was negative 1.8%. Whilst exports did increase from 7% to 8.7% YoY, imports fell from 7.2% to 0.5%, reflecting an increasingly stressed domestic consumer. The beleaguered housing market also saw house prices fall 5.3% YoY in August. China continues to weigh on global trade and emit a disinflationary pulse across the world.

To date, the stimulatory policies pursued in China have been somewhat piecemeal. We’ve said frequently that we expect China to eventually fire the big bazooka of monetary and fiscal stimulus and a softer dollar into a Fed cutting cycle will provide the cover for them to do so. The latest data flow has ramped up expectations for this bazooka to be delivered very soon. Local Chinese media are now urging the authorities to step up fiscal and monetary support. Former PBOC governor Yi Gang calling for swift action to reverse deflationary pressures.

Global Money supply is starting to surge and tends to lead BTC by circa 3 months (H/T to Zerohedge for below chart)

Bitcoin should start to catch up to the rising global money supply, but a stimulus bazooka from China would kick us into overdrive 🚀

Debt Spiral…

Another data point this week which got less attention 🤷 than CPI, was the Federal Budget numbers. The US deficit continues to ramp, unabated (there’s an election to win you know!) August’s deficit of $380bn was an eye watering 95bn more than forecast and an increase of $136bn on the month before. Fiscal year interest on US debt has now surpassed $1trn and is the second largest expense in the budget next to social security. This is just insanity on a scale which is hard to articulate.

Gold certainly got the memo and continued to push new highs, but it’s no surprise that Bitcoin also had a strong week in light of these deficit numbers. Indeed, gold is leading the way right now and perfectly incorporating the macro back-drop as the Fed gets ready to embark on a rate cutting cycle, real rates falling and global liquidity rising all while the US is spending money “banana republic” style.

Gold has had the benefit of strong central bank demand, without an off-setting negative supply dynamic. Bitcoin has had to digest a lot of supply, from the German and US Government, plus the Mt Gox distribution, despite its own positive demand shock via the success of the ETF’s. Yet with this negative supply dynamic now fading, it feels like Bitcoin may be ready to play catch up.

A lot of focus on the Fed on Wednesday, but this was an important week for Bitcoin. As the Fed begin the start of a rate cutting cycle, amidst global liquidity rising, China set to unleash the big bazooka and the US spending like a drunken sailor, this feels like a “buy everything” market 👀

Native News

Key news from the crypto native space this week.

Castle Island Ventures, asset manager Brevan Howard, data firm Artemis, and Visa Crypto plus others released a report on a survey it completed on stablecoins. The survey titled “Stablecoins: The Emerging Market Story” found that of the $2.6 trillion worth of value settled in stablecoins so far this year, much had a real-world application. Castle Island’s Nic Carter said “We felt there was a lack of data around how folks are actually using stablecoins around the world, especially in emerging markets, so we commissioned a survey of 2500 users in Brazil, Nigeria, Turkey, Indonesia, and India” Carter added “This is the first survey of its kind, and I think it’s very revealing regarding real-world usage of stablecoins (rather than just stables for crypto speculation).” By applying a methodology to remove noise from MEV trading, arbitrage and lending transactions, and other apparent inorganic use cases like intra-exchange transfers, the surveyors put forward a conservative estimate that $3.7 trillion worth of value was settled using stablecoins in 2023. The survey was conducted between May 29, 2024, and June 13, 2024, via YouGov. It involved 500 adults who self-reported using cryptocurrencies in each of the emerging market countries: Brazil, Nigeria, Turkey, Indonesia and India. Stablecoin usage appears to be growing. In the first half of 2024, around $2.62 trillion was settled using stablecoins, putting the sector at an annualised pace of $5.28 trillion.

The price of XRP rallied 8% instantly on the news that crypto fund manager Grayscale is launching an XRP trust that could eventually pave the way for a spot XRP exchange-traded fund (ETF) in the U.S. The closed-end fund will offer accredited investors direct exposure to XRP. Grayscale previously offered an XRP Trust but dissolved it in 2021 following the U.S. Securities and Exchange Commission’s 2020 lawsuit against Ripple Labs that alleged the XRP token is a security under federal securities law. Ripple has since emerged victorious in a widely-followed court case against the SEC, clearing the regulatory headwinds for the closely related XRP token. Grayscale’s Head of Product & Research, Rayhaneh Sharif-Askary said “We believe Grayscale XRP Trust gives investors exposure to a protocol with an important real-world use case,” "By facilitating cross-border payments that take just seconds to complete, XRP can potentially transform the legacy financial infrastructure." Read the full press release from Grayscale HERE.

Institutional Corner

Top stories from the big institutions

This week the US House Financial Services Committee held a hearing titled “Decoding DeFi: Breaking Down the Future of Decentralised Finance” It was the first ever congressional hearing on DeFi and aimed to explore emerging topics like tokenisation and how blockchains can be used in finance. The nearly two-and-a-half-hour-long hearing highlighted the disunity between Republican and Democratic lawmakers over the technology. Republican subcommittee chair French Hill opened the hearing by stating, “Substituting intermediaries for autonomous, self-executing code, decentralized finance can shift the way the financial markets and transactions are currently structured and governed.” He advocated for “a peer-to-peer future where the Canadian prime minister of the future can’t freeze off your bank account just for going to a protest,” a reference to Justin Trudeau’s 2022 freeze of crypto headed to protesters. Crypto critics such as Democratic Representative Brad Sherman were not convinced, claiming that DeFi was only used for crime, sanctions evasion, and primarily tax evasion. “What we have here is an effort to liberate billionaires from income taxation.” Read the full summary from CoinTelegraph HERE.

On Monday, the U.S. Federal Bureau of Investigations (FBI) released its annual report on cryptocurrecies. According to the recorded there was a 45% uptick last year in losses tied to crypto since 2022. The report says that the FBI's Internet Crime Complaint Center received over 69,000 crypto-related complaints which resulted in $5.6 billion in losses in 2023. Crypto accounted for 10% of total financial fraud complaints and about half of the total losses. People over the age of 60 filed the most complaints in 2023, followed by consumers in their 30s and 40s. Investment scams were the most reported crime, according to the report. The agency said "Over the years, cryptocurrency’s widespread promotion as an investment vehicle, combined with a mindset associated with the 'fear of missing out,' has led to opportunities for criminals to target consumers and retail investors — particularly those who seek to profit from investing but are unfamiliar with the technology and the attendant risks." Read the full report from the FBI HERE.

The UK’s Ministry of Justice has introduced a new Bill to Parliament aiming to clarify that digital assets and certain other things can be considered as ‘property’ in England and Wales. It will cover many digital assets such as cryptocurrencies, non-fungible tokens, voluntary carbon credits and in-game digital assets. As the legislation points out, until recently, there were only two types of personal property. These include things in possession – usually physical things like a car, house or watch – and things in action. The ‘action’ part relates to legal action, or the right of a person to sue. Hence, it includes contracts (such as a debt), copyright, or the right to enforce a court judgment. The bill will clarify that these assets are considered personal property under British law. Once enacted, it will give the legal profession guidelines to follow when there's a dispute on ownership, such as during a divorce. It will also provide protection to crypto owners, whether individuals or companies, who are hit by fraud and scams. Central to the proposal is a new category of property in addition to the existing "things in possession,” which covers items such as money and cars, and “things in action,” such as debt and shares. The new category of “thing” will allow certain digital assets to attract personal property rights, Justice Minister Heidi Alexander said in a statement. Read the full Bill HERE.

The Securities and Exchange Commission announced this week that eToro USA LLC has agreed to pay $1.5 million to settle charges that it operated an unregistered broker and unregistered clearing agency in connection with its trading platform that facilitated buying and selling certain crypto assets as securities. eToro has agreed to cease and desist from violating the applicable federal securities laws and will make only a limited set of crypto assets available for trading. The SEC’s order finds that, since at least 2020, eToro operated as a broker and clearing agency by providing U.S. customers the ability, through eToro’s online trading platform, to trade crypto assets being offered and sold as securities, but eToro did not comply with the registration provisions of the federal securities laws. eToro publicly announced that, going forward and subject to the provisions of the SEC’s order in this matter, the only crypto assets that U.S. customers can trade on the company’s platform will be Bitcoin, Bitcoin Cash, and Ether. eToro publicly announced that it will provide its customers with functionality to sell all other crypto assets for only 180 days after the issuance of the SEC’s order. Read the full release from the SEC HERE.

Charts of the Week

Because charts are just as important as macro.

The bitcoin market reached unprecedented activity in the first eight months of 2024, surpassing the record notional trading volume seen during the bull market of 2021. The cumulative trading volume or the dollar value of the number of BTC bought and sold on centralised exchanges amounted to $2.874 trillion in the first eight months. Hat tip to Kaiko Data for the chart.

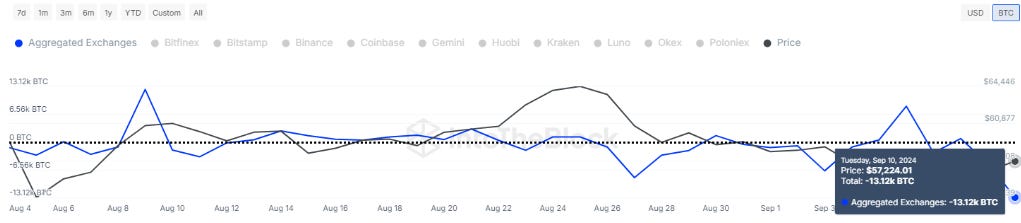

Recent data reveals a significant rise in Bitcoin outflows from exchanges, with approximately $750 million in assets withdrawn on 10 September. This represents the largest net outflow of Bitcoin since May. Data from IntoTheBlock.

The 30-day correlation between BTC and the S&P 500 has surged to levels not seen since Oct 2022.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Software Engineer at Kraken

Trading Operations Crypto focused at XTX Markets

Binance Accelerator Programme - Academy Business Development at Binance

Legal Counsel, Institutional at Coinbase

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.

great read as always, keep up the good work :)

"disinversion of the 2s10s yield curve now at 7bps" - should this say 107bps or am I missing something?