Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

Macro Update: Argentina votes in a bitcoin friendly leader, China continues its liquidity injections, and global liquidity continues its steady increase.

Crypto Native News: Binance and CZ fined by the US authorities, SEC lawsuit filed against Kraken.

Institutional News: UK budget provides some good news for digital asset space, the Investment Association releases a report on tokenisation, and the MAS tightens regulatory measures for digital payment token services.

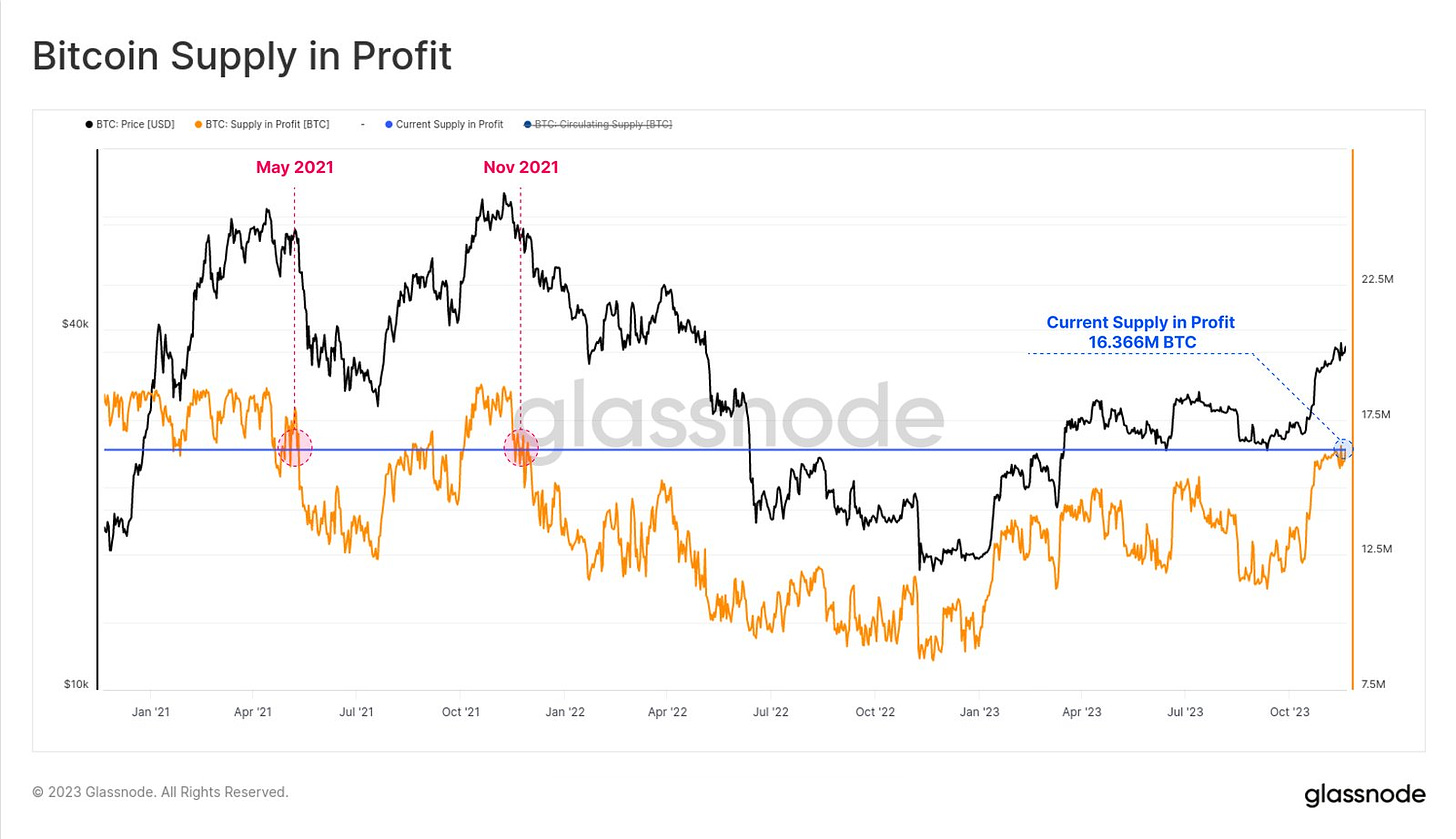

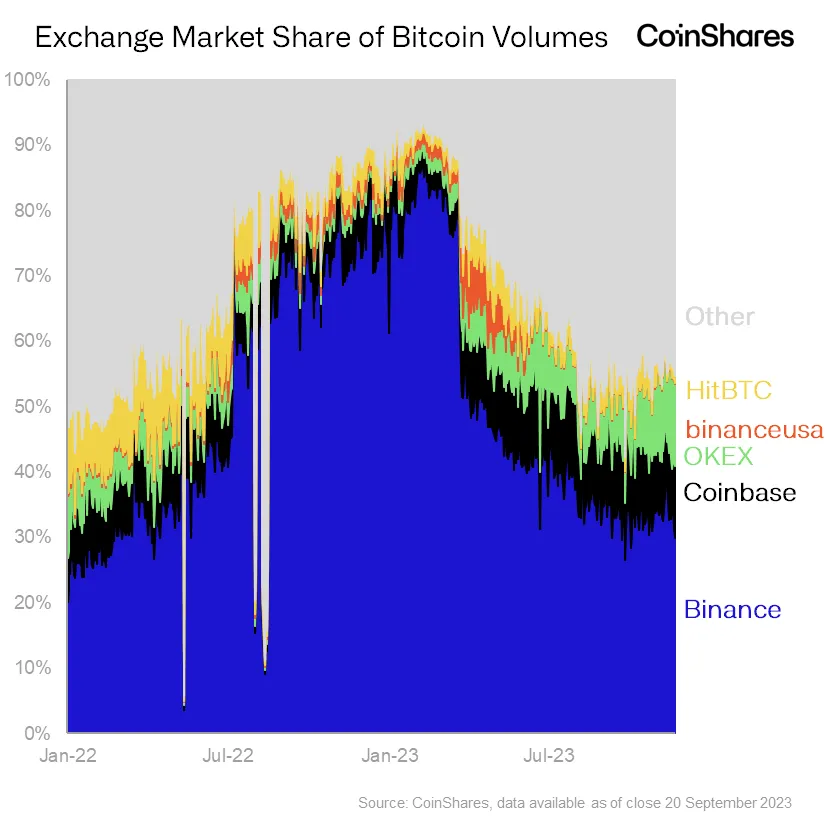

Charts of the Week: Nearly 84% of circulating BTC supply in profit, Binance market share slowly reducing.

Top Jobs in Crypto: Featuring Revolut, Paysafe, Jump Trading, Moneturn, Numeus and Copper.

Macro Update

This is where we connect the dots between macro and crypto.

The Bitcoin, the Fed and the Ugly

A quiet week on the Macro with the US Thanksgiving holiday, but with Bitcoin making new 2023 highs this week, perhaps a few US families were orange pilled over the turkey dinner!

The week began with the electoral victory of Javier Milei in Argentina, a libertarian, crypto friendly politician who has described Bitcoin as representing “the return of money to its original creator - the private sector.” Whilst his plans to salvage a country ravaged by triple digit inflation are to “dollarise” the economy, rather than Bitcoinisation, Milei’s intentions to liberalise money and allow Argentines to use their preferred currency will continue to support adoption in a country where ⅓ of the population already uses crypto.

Further, as Milei intends to abolish the Central Bank of Argentina, his controversial appointment represents the failure of yet another fiat, debt driven system and highlights once more the need for decentralised, trustless forms of value exchange. Certainly, Argentinians will understand the value proposition of Bitcoin more readily than perhaps those in the US where the financial repression is happening more subtly, albeit assuredly.

Milei himself described 4 categories of central banks. “The bad ones, like the Federal Reserve, the very bad ones, like the ones in Latin America, the horribly bad ones, and the Central Bank of Argentina” - Milei for now choosing to hitch the wagon to the least bad Fed. A natural evolution will be towards the hardest, deflationary asset with a predefined monetary policy governed by code, rather than the profligate whims of central bankers and governments.

On the data front, weak US durable goods orders, down 5.4% in October, the second biggest decline since April 2020 and S&P PMI’s which noted firms cutting workforce numbers for the first time since 2020, continued to support the dovish repricing for Fed rates. 100bps of easing are now priced for 2024.

China meanwhile continues to scramble to shore up an evolving property crisis, formulating a funding plan for property developers and encouraging banks to accelerate support measures to reduce the risks of further defaults. Meanwhile, a major wealth management company in China (Zhongzi Enterprise Group) has told investors it can’t pay its bills, reigniting fears that the real estate crisis is spilling over into the $3 trillion shadow banking sector. Ultimately, this all leads down one road. The artificial inflation of property prices via more liquidity injections and debasement of the RMB.

Indeed, the PBOC continues to inject huge amounts of liquidity. The previous week, RMB 1.45 trillion was injected into the banking system via its medium-term lending facility and with RMB 850bn in maturing loans, this was the largest net injection since December 2016. As we’ve highlighted before, PBOC liquidity injections correlate positively with Bitcoin, all things equal.

USD liquidity has also been improving as the drawdown of the overnight reverse repo (RRP) facility (cash that was previously parked overnight at the Fed is now coming back into markets to seek the higher T-bill yields) is outpacing the fall in the Fed balance sheet under quantitative tightening. Indeed, cash being parked at the Fed every day under this facility is now down to $865bn. This was over $2trn at the end of June. The pace of this run down perhaps needs to start being monitored as once it reaches zero, there will likely be funding issues and front end rates will start to spike. A story for another day, but ultimately as the RRP approaches zero, the Fed will have to end quantitative tightening, or cut rates.

Global Net Liquidity, as proxied by a combination of the PBOC, BoJ, ECB, BoE and Fed balance sheet (alongside the Treasury General Account and RRP balances) has also been steadily increasing throughout Q3 and is acting as a nice tailwind to a consistently improving crypto narrative.

Global Net Liquidity turning higher in Q4

Remember, markets are a function of rates and liquidity. Whilst the macro doomsayers want to conflate the “real economy” with the “financial economy” and continue to position bearishly for a bear market that has been and gone, the liquidity cycle is turning higher and the rates cycle has peaked and heading lower. This rally in equities and crypto is not for fading 🚀

Native News

Key news from the crypto native space this week.

I’m sure you would have seen the news this week on Binance and its founder CZ, but here’s what happened in a nutshell. Binance agreed to pay the US authorities $4.3bn in fines and restitution for “violating anti money laundering laws” aswell as “facilitating trading for criminals and terrorist organisations”. As part of the deal, Binance will pay $1.81 billion within 15 months and a further $2.51 billion forfeiture. Founder Changpeng Zhao, who also pleaded guilty, has agreed to a $50 million fine and to step down as CEO. As part of the new requirements, Binance must now report suspicious activity to federal authorities. You can read CZ’s X (Twitter) comments HERE.

On Monday, the SEC filed a lawsuit against crypto exchange Kraken, accusing it of violating securities laws. the SEC said “Kraken acted as a broker, dealer, exchange and clearing agency regarding these crypto assets without registering with the SEC in any capacity. In doing so Kraken created risks for investors without complying with, or even acknowledging the requirements of US securities law designed to protect investors” The SEC also said that Kraken sometimes co-mingled customer crypto assets worth over $33bn with its own cash. In response, Kraken expressed its disagreement with the SEC’s allegations and plans to defend its position. Kraken also emphasised that the charges will not impact its current offerings of products and services.

Institutional Corner

Top stories from the big institutions

The UK mini budget took place this week and there was some positive news for the digital asset space. UK Chancellor of the Exchequer Jeremy Hunt outlined 110 measures for growing the nation's economy in his Autumn Statement. This included a governmental initiative to facilitate the expansion of the digital assets sector. The UK government will pass legislation to implement the Digital Securities Sandbox (DSS), which aims to facilitate the adoption of digital assets across financial markets. The statement said "The government will lay a statutory instrument to implement the Digital Securities Sandbox, delivering on the Edinburgh Reform announcement to implement a Financial Market Infrastructure Sandbox in 2023" The upcoming Digital Securities Sandbox will differ from the already functioning Digital Sandbox, which was launched by the UK's Financial Conduct Authority this August.

The Investment Association released a report this week titled UK Fund Tokenisation: A Blueprint for Implementation. The paper is an output of the Asset Management Taskforce and details the first phase of its work on harnessing the potential of innovative technologies for the UK asset management industry. The report focuses on the application of distributed ledger technology (DLT) through investment fund tokenisation, which presents a strategic opportunity to improve efficiency, transparency, and the international competitiveness of the UK’s investment sector. The report says that funds authorised by Britain's Financial Conduct Authority can take the first steps towards offering tokenised funds, provided the investments are in mainstream assets and valuation and settlement arrangements don't change. For the full detail and recommendations, read the full report HERE.

The Monetary Authority of Singapore (MAS) announced this week that it was tightening the regulatory measures for digital payment token services. The measures will include barring crypto service providers in Singapore from accepting locally issued credit card payments, offering incentives to trade in cryptocurrencies and providing financing, margin or leverage transactions for retail customers. The regulator will also issue rules for business conduct, such as requiring crypto service providers to publish policies, procedures and criteria that govern the listing of a digital payment token and establish effective procedures to handle customer complaints and resolve disputes. Read the full details from MAS HERE.

Charts of the Week

Because charts are just as important as macro.

Over 16.366M BTC are now held in profit, equivalent to 83.6% of the circulating supply. This puts the coin volume in profit at levels similar to the 2021 bull market highs. Hat tip to Glassnode for the chart.

In terms of Bitcoin volumes (and total volumes), Binance has the largest market share of any major exchange. This, however, has come down quite significantly from its peak in January 2023, decreasing from ~83% to ~31% at present. Taken from Coinshares crypto report

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

FinCrime Manager for Crypto at Revolut

Senior Sales Manager for Crypto at Paysafe

Crypto Content Editor at Moneturn

Blockchain Research Analyst at Numeus

Content and Social Media Manager at Copper

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.