It was a busy week in macro and crypto which included an FOMC rate decision and some BIG news in the crypto space. We have you covered with all the details below.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE. This thread gained some huge attention this week and is a snippet of what you can expect…

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Mixed messages from the Fed, whilst the macro looks set to provide a useful tailwind, especially with China readying a stimulus package.

Crypto Native News: OKX seeks regulatory approval in Dubai and Bitstamp received regulatory approval by the FCA in the UK.

Institutional News: HKMA encourage major investment banks to accept crypto clients, Bank of China issued tokenised securities on Ethereum, Blackrock files an application with the SEC for a spot bitcoin ETF, the BIS and Bank of England test CBDC functionalities and the Central Bank of Colombia partners with Ripple to pilot blockchain technology on the XRP ledger.

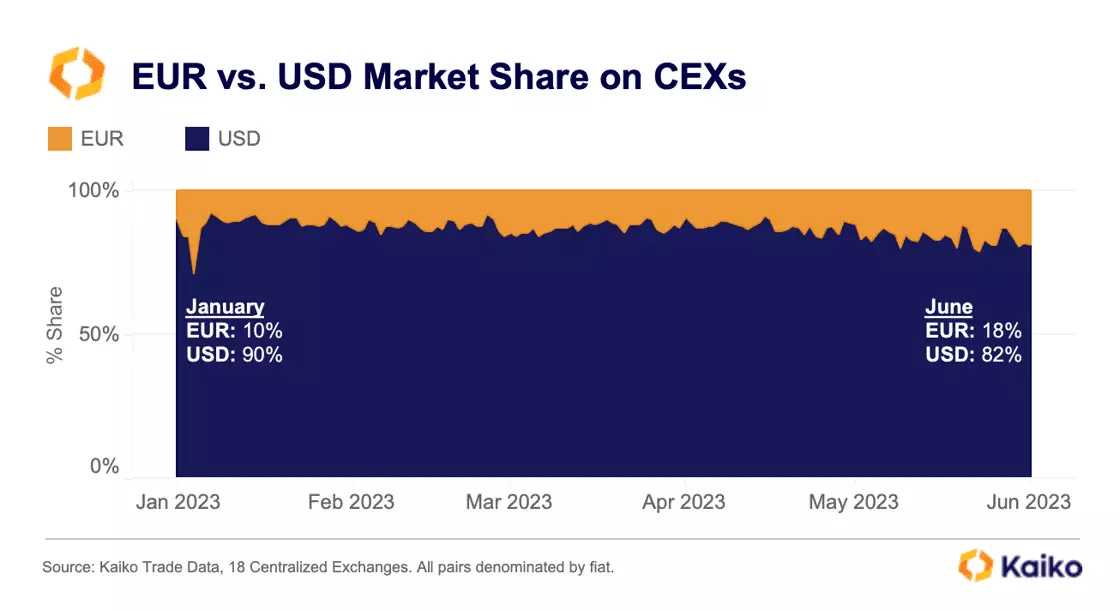

Chart of the Week: Drop in dollar market share on major exchanges.

Top Jobs in Crypto: Featuring Coinbase, Wintermute, Bitpanda Pro, Ultra Intelligence and Deutsche Bank.

Macro Update

This is where we connect the dots between macro and crypto.

The Plot Thickens

The Fed paused for the first time in 10 meetings, holding rates steady at 5.00-5.25%, as expected.

Not expected however and contradicting the decision to “skip,” was the upward revisions to the dot plot, which took the median terminal rate estimations to 5.6%. This suggests members see two more hikes this year compared to March estimates.

Forecasts for inflation and growth also edged higher and JPow emphasized that the risks for inflation are tilted to the upside, with core inflation making painfully slow progress (headline inflation data last week falling from 4.9% down to 4%. Core from 5.5% to 5.3%).

Despite the more hawkish forecasts, the JPow presser was a little more balanced, making no commitment to more hikes, but simply stating July is a “live” meeting.

This is a data dependent Fed and as we’ve written about before, the data is rolling over. JPow doesn’t want the market to quickly price a “pause followed by cuts,” so the dots were a warning signal. But we favour the next move from here will indeed be a cut, following a lengthy pause.

Make no mistake. We’ve been bullish risk on this changing Macro dynamic away from the sharpest Fed tightening cycle in history, towards a pause/pivot. This is a major landmark on that path.

For crypto, the negative rates and liquidity dynamic that decimated price in 2022 has bottomed. To us, this is a buy the dip market.

Elsewhere, China’s deepening slowdown finally prompted action from the Central Bank, which cut rates for the first time since August, reducing the 1yr loan rate 10bps to 2.65%, following a 10bp cut to the 7-day repo rate.

Reports also suggest that China is readying a 1 trillion Yuan stimulus package. This is BIG news as it relates to global liquidity. Even in the US, the feared liquidity drain has so far failed to materialize as the Treasury has focused on T-Bill issuance and the Reverse Repo has started to fall, with $116bn pumping into the market over the past week.

The Macro then is starting to once more provide a tail wind to crypto. Liquidity is easing, dollar falling, rates have topped out. Combined with finally some better crypto specific news this week, the recent pull back from the year highs in Crypto majors looks done. Engines are readying for the next run higher.

Native News

Key news from the crypto native space this week.

OKX is seeking regulatory approval to operate in Dubai as it plans to expand the company's Middle East operations. OKX Global Head of Government Relations Tim Byun said "We would like to get ahead of that curve and be regulated in a sound manner” Byun added that OKX plans to hire 30 staff after opening an office last month in the Dubai World Trade Center in the business and financial hub of the United Arab Emirates.

Bitstamp has received regulatory approval from the Financial Conduct Authority (FCA) to operate in the UK. The approval, granted on 13 June, makes Bitstamp UK Limited the latest addition to the FCA's crypto register and comes just a day after broker/dealer trading company Interactive Brokers (UK) secured approval. Notably, the FCA had not approved any crypto asset firms since Hidden Road’s registration in December. These recent approvals are the first in around 6 months, companies already on the list include TP ICAP, Revolut, Gemini, Kraken and eToro.

Institutional Corner

Top stories from the big institutions.

Some very positive news this week, we think the next 3 stories are significant for global crypto…

The Financial Times (FT) reported this week that the Hong Kong Monetary Authority (HKMA) questioned HSBC, Standard Chartered and Bank of China as to why they were not accepting crypto exchanges as clients. The HKMA said to the banks in a letter that due diligence on potential customers should not “create undue burden”, particularly “for those setting up office in Hong Kong to look for opportunities here”. The HKMA encouraged the banks to “not be afraid,” they added that “There is resistance from a conventional banking mindset…we are seeing some resistance from senior executives at traditional banks”.

The Bank of China’s investment banking arm BOCI issued tokenised securities on Ethereum in Hong Kong. The BOCI offered CNH 200 million ($28 million) of structured notes, with Swiss bank UBS underwriting the issuance and placing with clients in Asia Pacific. This was the first time a Chinese financial institution issued tokenised securities on a public blockchain in Hong Kong. The deputy CEO of BOCI, Ying Wang, said that they are "driving the simplification of digital asset markets and products, for customers in Asia Pacific through the development of blockchain-based digital structured products." This move is part of a broader trend, with UBS expanding its tokenisation across structured products, fixed income, and repo financing.

BlackRock has partnered with Coinbase to file an application with the U.S. Securities and Exchange Commission (SEC) to register a spot Bitcoin exchange-traded fund (ETF). So far only futures ETF’s have been approved by the SEC and at least 5 spot ETF applications have been rejected. BlackRock will use Coinbase Custody for custody of assets and Bank of New York for custody of the cash. Dubbed the BlackRock iShares Bitcoin Trust, it would be traded as Commodity-based Trust Shares, with the Bitcoin price updating "at least" every 15 seconds on regular market trading using the CF Benchmarks Index. HERE’s the FT coverage on the filing.

This week the London Innovation hub of the Bank for International Settlements, together with the Bank of England completed an experiment by testing ways to connect monetary authorities and the private sector to facilitate retail digital currency payments. They did this by developing 33 application programming interface (API) functionalities to test more than 30 central bank digital currency (CBDC) use cases, including offline payments. The experiment called “Project Rosalind” looked at how an API layer could support a retail CBDC and facilitate safe and secure payments through different use cases. The Quant Network was part of the collaboration on the project. Read the comments from Quant CEO HERE.

Banco de la República, Colombia’s central bank, is partnering with Peersyst and Ripple to pilot blockchain technology on the XRP ledger. The Ministry of Information and Communications Technologies (MinTIC) in Colombia will oversee the project, which will use Ripple’s recently launched central bank digital currency (CBDC) platform. The pilot will run through 2023 and states that its purpose is to demonstrate the technology’s utility to the public. A statement on the release says “The goal of the third phase of MinTIC’s experimentation of blockchain will be to educate national and territorial public entities through interactive and collaborative real-world application experiments of how blockchain technology’s unparalleled speed, scalability, and transparency can revolutionize payment systems and data management.” Read the full press release from Ripple HERE.

Chart of the Week

Because charts are just as important as macro

Hat tip to Kaiko Data for this weeks chart. Since the U.S. regulatory crackdown and banking crisis there has been a drop in dollar market share relative to the euro. Euro market share is now 18%, up from just 9% at the start of the year relative to the dollar.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

International Derivative Exchange Lead at Coinbase

Trading Assistant at Wintermute

Regional Business Development Manager UK and Nordics at Bitpanda Pro

Chief Crypto Architect at Ultra Intelligence and Communications

Global Anti-Financial Crime Digital Assets Lead at Deutsche Bank

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.