Welcome to the 60 new subscribers that joined us this week.

The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know this week.

As always, our only ask is that you share this with your colleagues, friends and family. Thanks for your support.

Here’s what you’re getting this week:

Macro: Powell and NFP’s pushed aside by SVB.

Crypto Native News: New York AG claims that ETH is a “security” in case against KuCoin, Coinbase acquires One River AM and Silvergate voluntarily liquidates.

Institutional News: Bidens budget plan proposes 30% tax on crypto mining, Swift releases a report on CBDC solution.

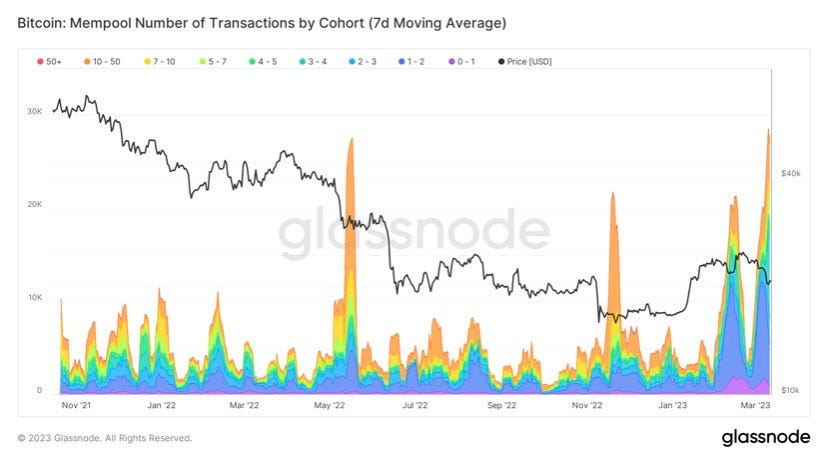

Chart of the Week: Bitcoin mempool transactions at all time high.

Top Jobs in Crypto: Featuring Nomura, the MWek Company, Binance, KPMG, Hudson River Trading and Elwood.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

Powell’s testimony on Tuesday was deemed to be “hawkish” as he opened up the potential for a 50bps hike in March. As the odds rose to 70% for the Fed to quicken the pace of hikes, front end yields rose, and risk assets fell. However, Powell dialled back his comments on Wednesday placing weight on the decision of 25 or 50bps being dependent on the “totality of the data '' (This was post Fridays NFP and this week’s CPI release).

On Friday, Non Farm Payrolls (NFP) again came in strong on the headline at 311k, down from 504K the month prior, but exceeding expectations of 205k. However, the unemployment rate also ticked up 2bps to 3.6% and average earnings posted at 0.2% which was the slowest increase since Feb 2022.

The focus on macro data was swept aside on Friday as we heard of the failure of Silicon Valley Bank (SVB), the second largest US bank failure in history. This also followed the earlier announcement of the voluntary liquidation of crypto friendly bank Silvergate. US bank stocks took a huge hit Friday, with regional banks under massive pressure. The S&P 500 regional banks index closed 18% on the week, its worst week since 2009.

We saw a flight to quality across major financial markets, with 10yr treasury yields trading down to 3.70% (from testing 4% post Jpow mid week) and 2yr yields dropping sharply from highs around 5.08% in the week, to close 4.59%. Gold traded to a 1 month high and the Japanese yen rose to a 2-week high against the US dollar.

The week ahead will be dominated by the SVB situation though the key macro data comes on Tuesday with the release of US CPI for February. The Year-on-Year number is expected to post at 6.0% down from 6.4% last month. The SVB situation is too fluid to provide any meaningful analysis, but I can say from experience, Central Banks will be watching the situation very closely, so let’s wait for some concrete announcements on Monday.

In case you haven’t been with us from the start, the first episode of our newsletter that we wrote in October spoke of the “impossible choices” that central banks will have to make. This seems like s sensible time to come back to our ultimate macro story and how that plays out for crypto. Here’s a snippet from Episode 1, read the full piece HERE.

“As central banks attempt to remove the last decade of stimulus to try and control inflation, they risk blowing up the entire financial system. With the cost of living crisis, inflation is the dominant consideration currently. However, we are approaching the point where impossible choices need to be made once more. The lesser of two evils will once again come out on top, to artificially inflate assets and sacrifice fiat currency”.

Native News

Key news from the crypto native space this week.

The New York Attorney General's office filed a lawsuit against cryptocurrency exchange KuCoin for allegedly violating securities and commodities laws in the state. The lawsuit targets KuCoin for allegedly “falsely representing itself as an exchange” when really it is a “securities and commodities broker-dealer.” Maybe more significant is the claim about Ethereum being a security. Here’s what NY Attorney General Letitia James says on her website “On its platform, KuCoin investors can buy and sell popular virtual currencies, including ETH, LUNA, and TerraUSD (UST), which are securities and commodities. This action is one of the first times a regulator is claiming in court that ETH, one of the largest cryptocurrencies available, is a security. The petition argues that ETH, just like LUNA and UST, is a speculative asset that relies on the efforts of third-party developers in order to provide profit to the holders of ETH. Because of that, KuCoin was required to register before selling ETH, LUNA, or UST.” You can read the full report from the NY Attorney Generals office HERE.

Coinbase has entered into a deal to acquire the asset management arm of One River Asset Management. The asset management arm are will be rebranded as Coinbase Asset Management. Coinbase says that the SEC-registered investment adviser One River Digital Asset Management (Ordam) will remain as a separate business which will offer investment advisory services to a range of new and existing institutional clients.

On Wednesday the holding company of Silvergate Bank said it will voluntarily liquidate its assets and shut down operations. Here is a cut of the official press release “In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward. The Bank’s wind down and liquidation plan includes full repayment of all deposits. The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets"

With the news flow veering toward the negative side this week, the Crypto market cap fell approx. $100bn on the week closing around $921bn on Friday (according to CoinMarketCap).

Institutional Corner

Top stories from the big institutions.

US President Joe Biden revealed a budget blueprint this week and it proposed a 30% tax on crypto mining electricity usage. The Department of the Treasury supplementary budget explainer paper said any firm using resources — whether they be owned or rented — would be “subject to an excise tax equal to 30 percent of the costs of electricity used in digital asset mining.” The proposed tax would be phased in over three years at a rate of 10% a year, reaching the max 30% tax rate by the third year. The report says that Crypto miners would have reporting requirements on the "amount and type of electricity used as well as the value of that electricity." In its reasoning for the tax, the Treasury claimed the energy consumption of crypto mining operations “has negative environmental effects,” increases prices for those sharing a grid with the operations and creates “uncertainty and risks to local utilities and communities.” You can read the full explainer paper HERE.

This week Swift, the financial payment/messaging network, released a report detailing the results of its experimental solution for interlinking Central Bank Digital Currencies (CBDCs). They reported that 18 central and commercial banks found “clear potential and value” in the API-based CBDC connector after a comprehensive review. During a 12-week testing period, SWIFT simulated nearly 5,000 transactions between two different blockchain networks and existing fiat payment systems. Some of the financial institutions that participated in the study, included the Royal Bank of Canada, Banque de France, Société Générale, BNP Paribas, Monetary Authority of Singapore, HSBC, Deutsche Bundesbank, NatWest and more. The report suggests that the Swift innovation enables CBDCs to move seamlessly on existing financial infrastructure and efficiently scale for international transactions across more than 200 countries. Swift will also build beta version for further testing and explore additional use cases in securities settlement and trade finance. Within the next couple of years, the OMFIF Digital Monetary Institute expects 24% of central banks to develop a CBDC solution. You can read the full report HERE.

Chart of the Week

Because charts are just as important as macro.

The number of transactions in the Bitcoin mempool* reached an all time high this weekend. Higher than the Luna and FTX collapses.

*The mempool is the gateway to the blockchain. Before anything can be written on a block, it must first move through the mempool. The mempool dictates how every transaction gets written to and confirmed on-chain.

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Investment Transformation – Blockchain and Digital Assets at Nomura

Hedge Fund Operations for Crypto via The MWek Company

Compliance Systems and Analytics Director at Binance

Senior Manager, Risk and Regulatory Advisory Services – Digital Assets at KPMG

Crypto Trading Support Engineer at Hudson River Trading

Lead Software Developer in Test (SDET) at Elwood Technologies

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.