Looks like summer is finally here in London. The suns out and the crypto market continues to come together to collaborate. For those of you at the various conferences over the last week, like Crypto Valley in Switzerland, I’d love you to reply to this email and let me know your key takeaways.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distill it into the things you MUST know this week.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE. Here’s an example of what you can expect:

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro: Fridays NFP was “goldilocks”, China could provide the next liquidity pump, crypto markets remains cautious but things are about to get interesting.

Crypto Native News: Crypto.com granted licenses by the MAS, Gemini looking to acquire crypto license in the UAE and CZ responds to Binance lay off talk.

Institutional News: Standard Chartered and PWC partner to produce a CBDC white paper in the Greater Bay Area in China, the CFTC proposed changes to its risk management system and the UAE issues new ALM guidance for institutions dealing with virtual assets.

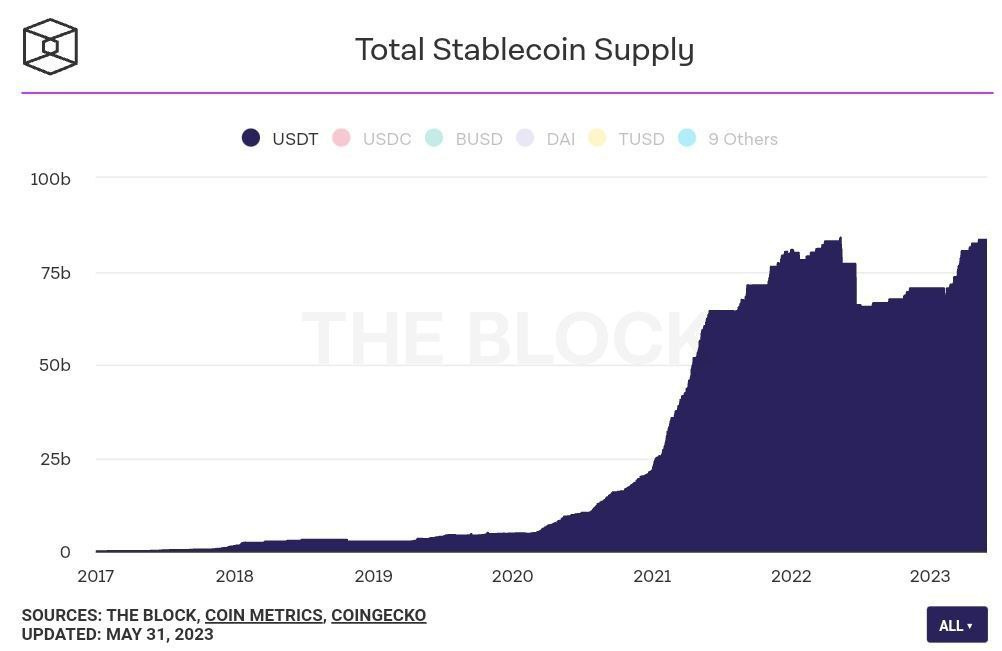

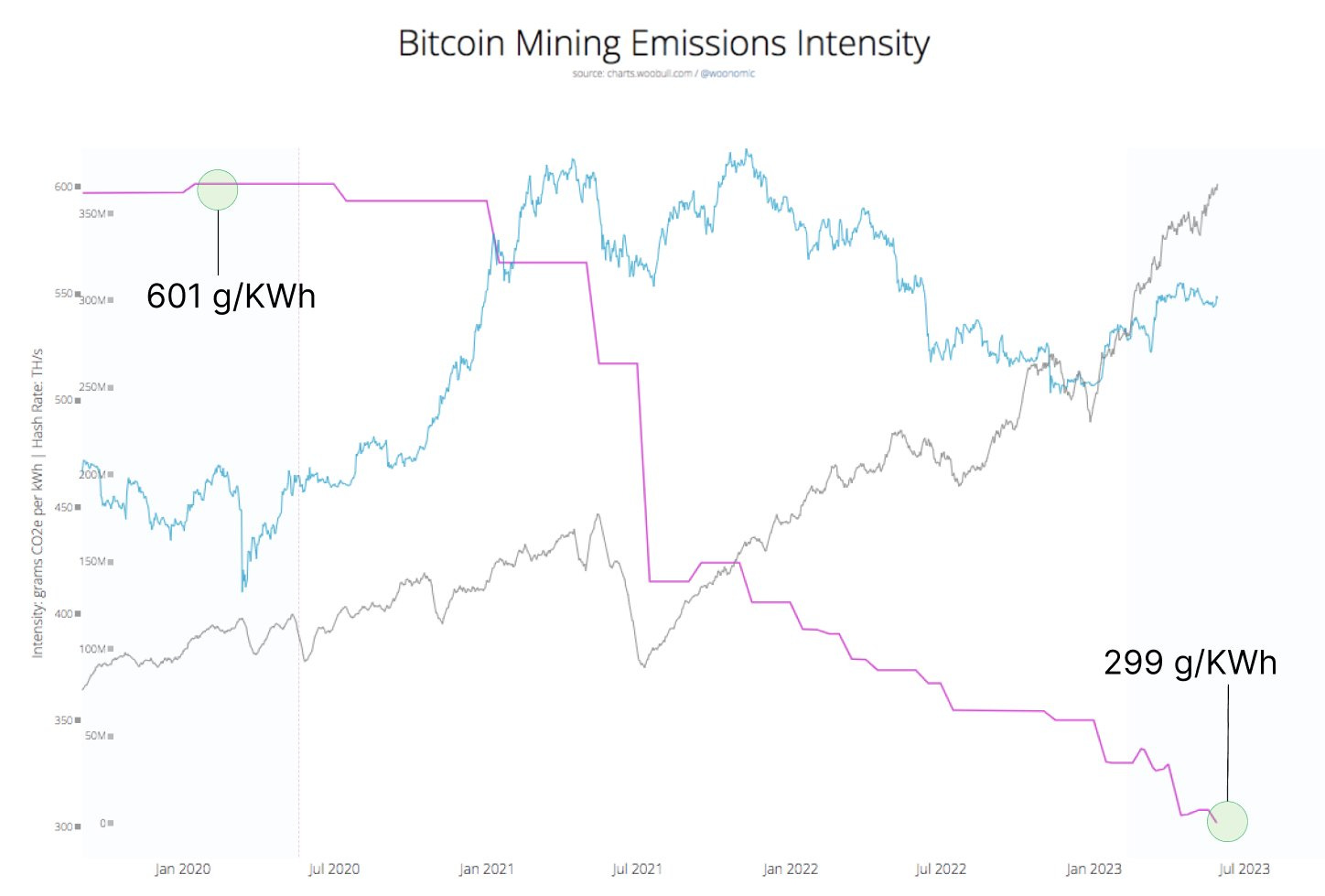

Chart of the Week: (2 chart special!): USDT supply reached all time high and Bitcoin mining emissions going in the right direction.

Top Jobs in Crypto: Featuring the Bank of England, FCA, Binance, xGo, Socios and Blockdaemon,

Macro Update

This is where we connect the dots between macro and crypto.

Things Are About to Get Interesting.

As Biden this weekend signed the bill that suspends the U.S government's $31.4trn debt ceiling, averting a potential 5th June default, markets are free to focus on the macro and nervously anticipate the coming liquidity drain.

Friday’s Non Farm Payrolls was “goldilocks” with headline jobs gaining 339k in May, yet average earnings declined to 4.3% from 4.4% allaying any “wage spiral” fears (not for nothing, Unit Labour Costs earlier in the week came in at 4.2% Vs 6.3% exp). Under the hood however, some signs of weakness, with the unemployment rate jumping from 3.4% to 3.7% and average weekly hours falling to 34.3, below their average level from 2017 to 2019 while the household survey showed a LOSS of 310k jobs in May. Whilst the labor market remains resilient, there was enough in the report for the Fed to “skip” a June hike which has been the latest phrase from the Fed speakers this week. June is now just priced for 10bps of hikes, with the full 25 “skipping” to July.

Meanwhile China continues to slow and looks set to prime the liquidity pump.

China’s official manufacturing PMI’s unexpectedly fell to 48.8 from 49.2 in April, with non-manufacturing PMI’s moderating to 54.5 from 56.4 in April. This saw more pressure on the domestic currency, with USDCNH climbing to the highest levels since Nov ‘22 above 7.12. What’s especially interesting, is that China appears content to let the CNY weaken as they look to boost exports to battle a slowing domestic economy. In doing so, they will export their disinflation across the developed world, which in some ways will be welcomed in the West (softer CPI prints in Europe this week, with headline EZ CPI falling from 7% to 6.1%) however it acts to reinforce the global slowdown that is underway.

News on Friday that China is mulling a new property support package to boost the economy and support the ailing sector gave regional stocks a boost. Moooar debt, moooar liquidity the default response and should China start pumping liquidity more aggressively over the coming weeks, it would provide a timely off-set to the expected liquidity drain from the US.

The Nasdaq continued to pump to new year highs and is now back to its levels from when the Fed started hiking in March 2022. Crypto not yet fully joining the party, concerned that the liquidity punchbowl is about to be taken away. Caution remains then short term and we await to see how the TGA gets refilled. With potential off-sets however from China, not to mention Hong Kong retail inflows, signs perhaps that this lackluster, range bound price action could be forming a base for the next leg higher. Things are about to get interesting.

Native News

Key news from the crypto native space this week.

Crypto exchange Crypto.com announced this week that it has been granted a major payment institution (MPI) license for digital payment token (DPT) services by the Monetary Authority of Singapore (MAS). Crypto.com received its in-principle approval from the MAS in June last year. With the MPI license Crypro.com is now authorised to offer its DTP services in Singapore. The exchange has also been granted registration as a digital asset service provider by the Autorité des Marchés Financiers in France and as a crypto asset business by the United Kingdom’s Financial Conduct Authority. Crypto.com received approval for its minimal viable product preparatory license from the Dubai Virtual Assets Regulatory Authority, and acquired Electronic Financial Transaction Act and Virtual Asset Service Provider registration in South Korea.

Crypto exchange Gemini is looking to expand into the United Arab Emirates (UAE). The Winklevoss twins who own the exchange said they will “soon begin the process of acquiring a crypto licence to serve customers” They said in a blog “As a forward-thinking, global financial hub, the UAE is continuing its tradition of leadership by establishing itself as a fast-emerging hub for crypto,” “By applying for a license, we will be taking another step towards making Gemini a truly global company and advancing our mission to unlock the next era of financial, personal, and creative freedom for all.” The news came after Gemini announced that it will set up new European headquarters in Ireland.

Changpeng Zhao, CEO of Binance, has answered the rumours about mass layoffs on the exchange saying that the layoffs at Binance were nothing new, clarifying that the exchange had a “bottom out” policy that laid off employees qualified as “not strong fits” for the company. CZ said “Many of them are great people or high performers, but may not fit our unique culture/situation. Small example, WFH [work from home] is not for everyone”. Giving some more context CZ said “I also push for cost cutting, servers, flights, meals, etc, every week too. This may be why … Binance has stay profitable since month 4 of our inception. From Oct 2017 onwards, through 2 crypto winters, Binance maintained profitability on a daily, weekly and monthly basis”

Institutional Corner

Top stories from the big institutions.

Standard Chartered and PWC China have teamed up to produce a white paper on applications for a central bank digital currency (CBDC) in the Greater Bay Area (GBA) of China, which is made up of Guangdong Province, Hong Kong and Macau. They say that Greater Bay Area presents a interesting test case because of the multiple currencies used in multiple jurisdictions. The report added that “The successful launch of programmable use cases in the GBA could provide a foundational framework for how other CBDC’s could interact in cross border commercial scenarios.” CBDC smart contracts could be launched in the implementation of cross border trade, in the supply chain for invoice settlement and added currency settlement and by retailers for streamlining service and loyalty programs by using a single multicurrency wallet. Read the full whitepaper HERE.

On Thursday the CFTC issued a proposal to invite comments on possible changes to the agency’s risk management program. Speaking on the proposal, CFTC Commissioner Christy Goldsmith Romero, said the changes should insist that firms prepare themselves for crypto volatility and the risks from holding customers digital assets. In her statement, Romero said that “technologies like digital assets, artificial intelligence and cloud services have emerged as areas that carry significant risk”. Romero added, “These technological advancements, with their accompanying risks, necessitate the commission revisiting our regulatory oversight, including our risk management requirements,” “Integration of digital assets with banks and brokers, and the risks that could be posed, could continue to evolve.” She also flagged the ongoing issues regarding the industry’s custody practices, saying “brokers may explore holding customer property in the form of stablecoins or other digital assets that could result in unknown and unique risks.” Read the proposal from CFTC HERE. Read Romero’s statement HERE.

This week, the UAE Central Bank issued new anti-money laundering and counter-terrorism financing guidance for financial institutions when dealing with virtual assets, such as cryptocurrencies and non-fungible tokens. The new guidance discusses the risks arising from dealing with virtual assets and virtual asset service providers, including on due diligence for licensed financial institutions when dealing with these customers and counterparties. The guidance will come into effect within a month and will apply to banks, finance companies, exchange houses, payment service providers, registered hawala providers and insurance companies, agents and brokers. The bank said the guidance takes Financial Action Task Force (FATF) standards into account. The FATF in March 2022 included the UAE on a list of jurisdictions subject to increased monitoring, known as its “grey” list.

Chart of the Week (2 chart special!)

Because charts are just as important as macro.

This week, supply of Tether USDT reached an all-time high, surpassing previous record of $83.2 billion, set in May 2022.

Bitcoin network trending in the right direction: Hashrate (in grey) rising steeply, Emissions intensity dropping steeply. Hat tip to Daniel Batten for the chart

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Head of the Digital Pound Project at Bank of England

Senior Supervisor in Crypto Supervision at the FCA

Sanctions System and Technology Manager at Binance

Risk Officer - Treasury at xGo

Head of Partnerships at Socios

Junior Sales Executive at Blockdaemon

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.