Connecting the Dots

Episode 73 - Macro Takes Control

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Bitcoin reconnecting with the macro, with moves impacted by the data and the feed through to expectations for Fed rate cuts. Big week ahead for macro data.

Crypto Native News: Stablecoins traded on Ethereum rise, DCG report higher revenues, BlockFi works with Coinbase to be distribution partner.

Institutional News: Biden and Trump speak on crypto, Wells Fargo discloses exposure to Bitcoin ETF’s.

Charts of the Week: Coinbase volumes rise, US commercial real estate prices falling, BTC vol less than some major stocks.

Top Jobs in Crypto: Featuring BTI Group, Joy Network, fscom, LSEG, Blockchain.com and Keyrock.

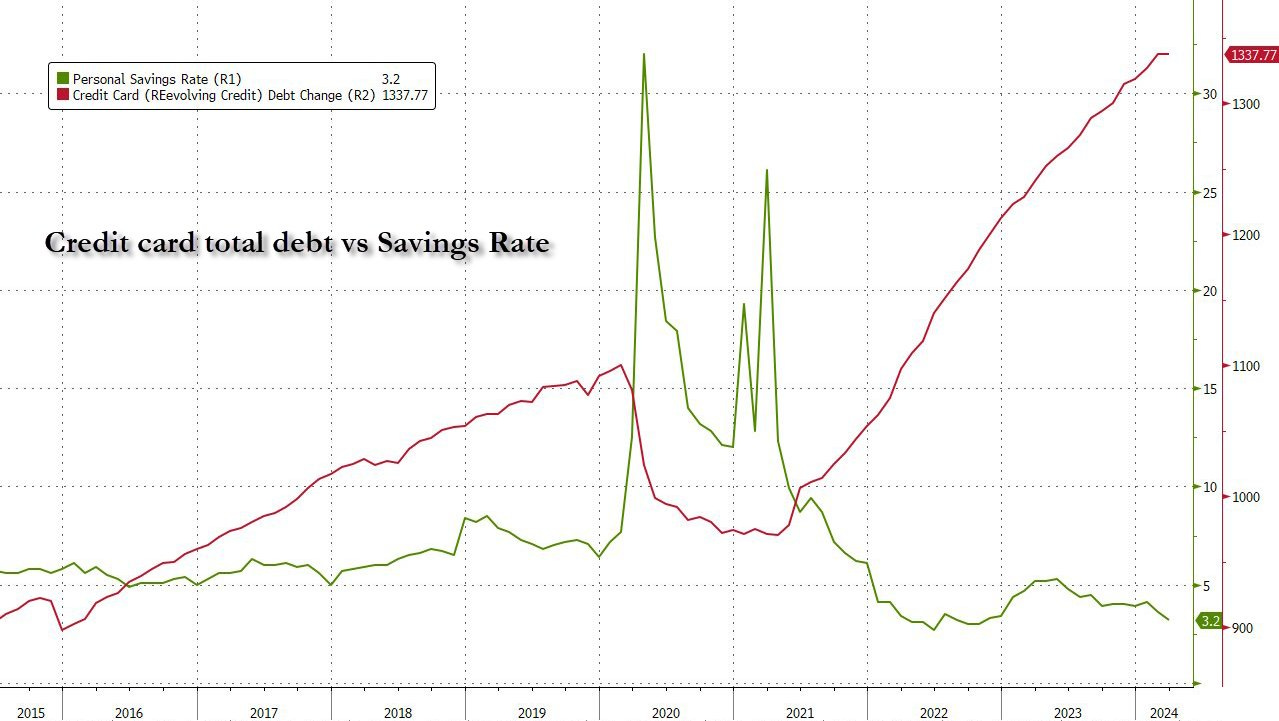

Macro Chart of the Week - US credit card debt record high, personal savings rate record low. Hat tip to ZeroHedge for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

Macro Takes Control

A relatively subdued market with little in terms of top tier US data, saw Bitcoin give back some of the post Fed and NFP gains, as the dollar and US yields retraced off of the recent lows. The lack of follow through is disappointing, especially in the context of equities which managed to climb back towards record highs.

Liquidity perhaps playing a role however after the market had to digest $125bn of 3yr, 10yr and 30yr treasuries. The auctions were met with solid demand, yet for yields to be relatively unchanged on the week in the face of heavy supply, supports our view that yields and the dollar have peaked here.

We continue to also see an easier liquidity environment throughout Q2. Broad Treasury issuance for the quarter of $243bn is substantially lower than Q1’s $748bn and combined with the QT taper which sees an additional $35bn a month reinvested by the Fed into Treasuries as well as the Treasury buyback programme of $2bn a week from the end of May, Q2 faces an improved US liquidity outlook. With this early deluge of treasury supply out of the way, this coming week should allow for an easier backdrop for Bitcoin to make a real test of the 65k resistance zone, ceteris paribus.

All about the Macro…

It’s quite notable how Bitcoin has reconnected with the macro, with moves impacted by the data and the feed through to expectations for Fed rate cuts. Friday’s University of Michigan report reinforcing the “stagflation” narrative with consumer sentiment plunging from 77.2 to 67.4 whilst 1yr inflation expectations jumped from 3.2% to 3.5%, the highest since November. The “flation” part seeing yields and the dollar jump and Bitcoin dump heading into the weekend. Wednesday’s CPI print then will be an important release directionally for Bitcoin.

That said, we continue to see an asymmetry for data reactions. The Fed, having effectively taken the prospect for further rate hikes off the table are looking for reasons to cut. Stronger data is simply higher for longer. Weaker data opens the path to cuts and a stronger reaction for markets. Indeed, data has been softening, with the Citi US Surprise Index sliding to its lowest levels since Jan 2023. Meanwhile, this week brought further evidence of a softening in the labor market, with jobless claims jumping to 231k, it’s highest level since last August. The Fed will be particularly sensitive to signs of labor market weakness.

Citi Economic Surprise Index - US data softening

Elsewhere, the “peak rates” narrative continues to be reinforced, with the Bank of England on hold at 5.25% but with 2 members voting for cuts (including former hawk Ramsden voting to cut) and Governor Bailey sounding a dovish note, not ruling out a June rate cut. Sweden’s Riksbank meanwhile delivered a 25bp cut, the first cut in 16 years. The RBA, on hold but maintaining a neutral bias. We continue to inch our way to an easier rate environment.

Into a big week for macro data, headlined by US CPI, Bitcoin continues to chop in this 60-65k range. Yet with the liquidity environment easing and major central banks about to start rate cuts, we see limited downside with an asymmetric upside risk-reward profile. A weak CPI print on Wednesday would light the touch paper. A stronger print and patience may be required. Yet it remains a case of when, not if, we make new highs for Bitcoin given the unfolding macro dynamic.

Native News

Key news from the crypto native space this week.

The total volume of stablecoins traded on Ethereum last month was significantly higher than any month previously, but the majority of volume was contributed by a single stablecoin, DAI. DAI has been increasingly involved in complex MEV transactions utilising flash loans, seemingly accounting for the increase in volume. The data point comes with an important caveat: though, flash loan activity is counted, rather than filtered out. Without flash loan activity, stablecoin volume still had a solid month, which saw FDUSD have its best month on record, though the filtered stablecoin volume came in slightly below March's level. But including flash loan activity in the data shows a record-breaking month for stablecoin volume, thanks to DAI.

Digital Currency Group (DCG), the parent company of asset manager Grayscale, reported a first quarter revenue up 11% from the previous quarter to $229 million. On a yearly basis, DCG’s first quarter revenue was up 51% versus the same period last year. In a letter to shareholders on Tuesday, the firm said Grayscale accounted for $156 million of its first quarter revenue. The company also said “While Grayscale expected outflows alongside increased competition under the ETF wrapper, Q1 revenue attributable to GBTC nevertheless exceeded our expectations.”

BlockFi announced that they have engaged with Coinbase as a distribution partner to ensure continuity of their crypto withdrawals. The withdrawals are available to eligible BlockFi Interest Account, Retail Loan and Private clients. The note highlights that the window to request a withdrawal for the initial round of eligible assets has closed but working with Coinbase will allow for withdrawals on specific situations (full details in the link below). BlockFi also noted that they will not be partnering with any other providers for crypto distributions. Read the full release from BlockFi HERE.

Institutional Corner

Top stories from the big institutions

There’s been some focus on crypto during the US election campaigns this week…The Biden administration made a statement saying they would veto any legislation that would allow banks to custody crypto. This statement was prior to a House of Representatives vote to stop the Securities and Exchange Commission (SEC) from using the restrictive regulation. Thankfully for the crypto industry, the House voted for stopping the regulation, even with Biden’s veto threat. The SEC’s Staff Accounting Bulletin No.121 states banks should hold customers’ crypto as liabilities on their own balance sheets. This forces banks to hold reserves against the crypto they had in custody. Doing this is highly unattractive for banks and causes them burdensome capital requirements. Additionally, no other assets require this rule for custody. This strongly disincentives banks from holding crypto for their customer. Biden’s election rival, Donald Trump, also made comments on crypto. This time they were in a positive light. The former president was hosting an event for his own NFTs where he stated he was “for crypto.” He also mentioned he doesn’t want US crypto companies going elsewhere due to hostile regulations. Trump also stated he will now try to accept campaign donations in crypto.

Wells Fargo disclosed investments in multiple Bitcoin ETFs on Friday, as per a regulatory filing. Paperwork filed with the U.S. Securities and Exchange Commission (SEC) shows that the bank has bought shares of Grayscale's GBTC spot Bitcoin exchange-traded fund (ETF), and that it also has exposure to Bitcoin Depot Inc., a Bitcoin ATM provider. The document also shows that the bank has invested in ProShares Bitcoin Strategy ETF (BITO), which gives investors exposure to BTC futures. See details of the filing HERE.

Charts of the Week

Because charts are just as important as macro.

Coinbase saw trade volume in Q1 more than double to $312bn. Institutional volume increased faster than retail, accounting for 82% share of the total.

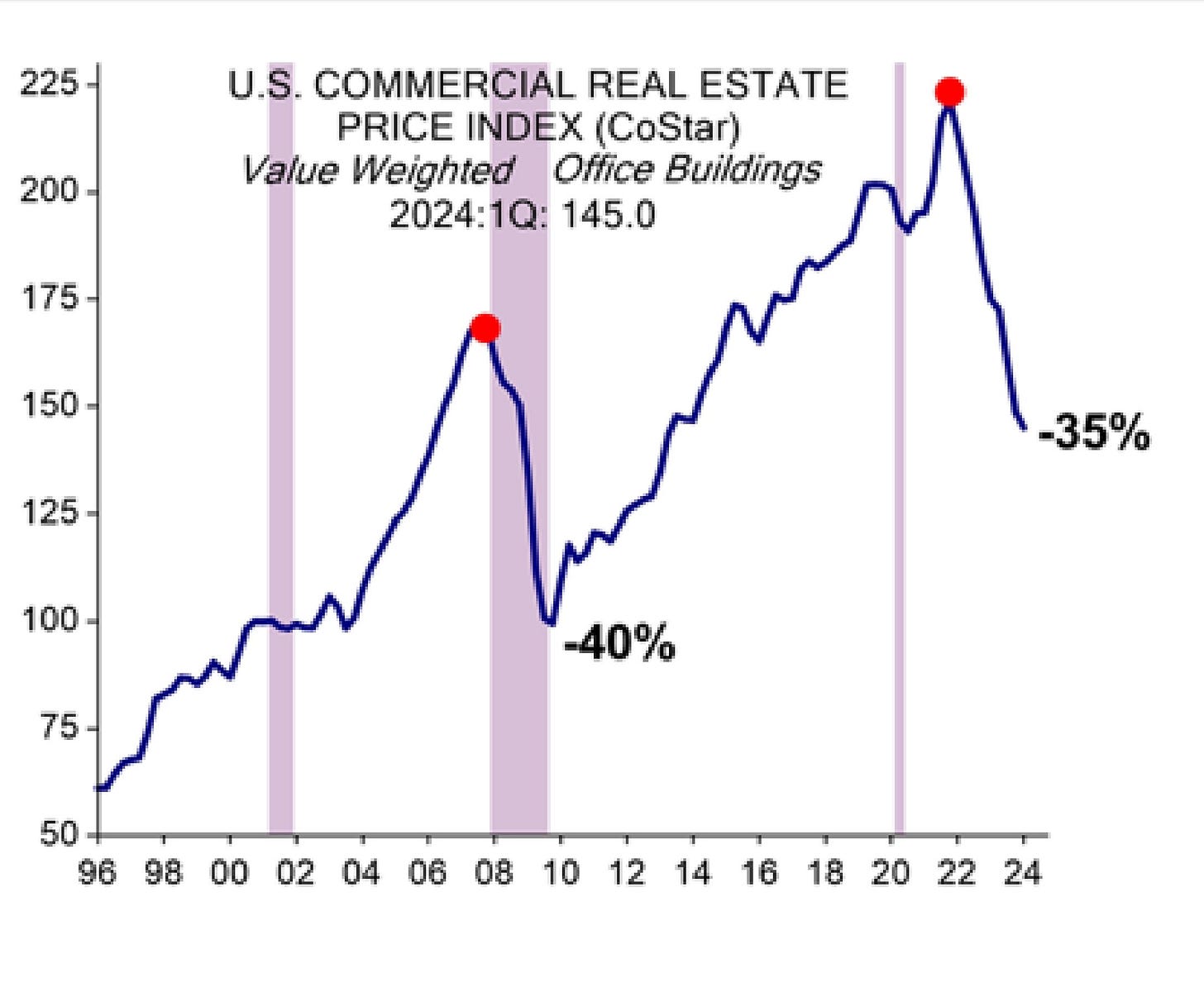

US commercial real estate prices falling sharply. Lots of commercial real estate loans need refinancing so could see some defaults. Hat tip to Dan Tapiero for the chart.

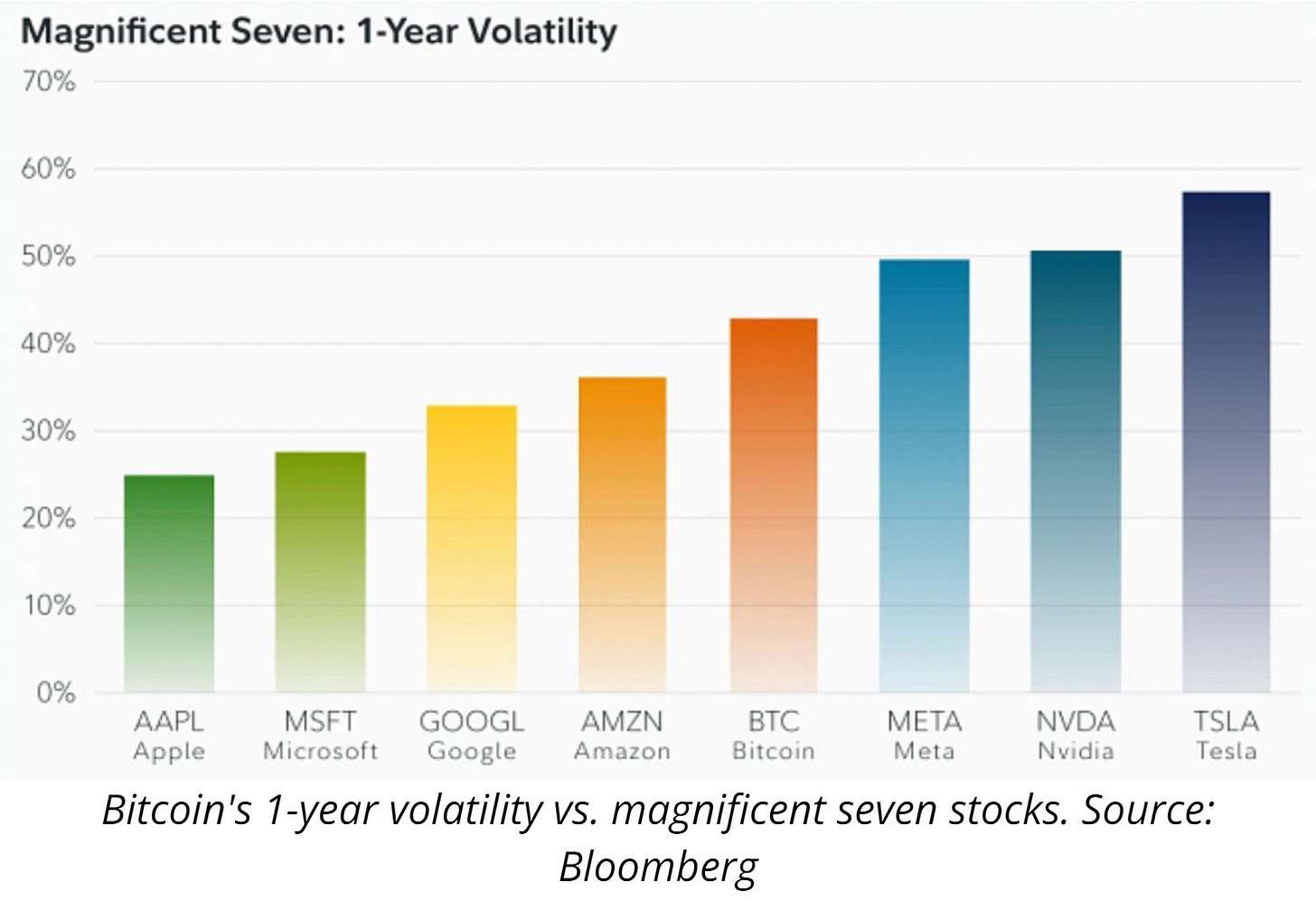

Annually, BTC volatility has dropped below that of top tech stocks, including Tesla, Meta and Nvidia. Hat tip to CoinTelegraph for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Crypto Ambassador at BTI Group

Marketing Lead for Crypto at Joy Network

Head of Digital Assets at fscom

Product Director Digital Assets at LSEG

Risk Manager at Blockchain.com

Strategic Project Manager for Digital Assets at Keyrock

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.