Busy week for crypto in London, I hope to see many of you at CCDAS and Zebu Live Conferences. If you want to catch up at either event, drop me a message by replying to this email.

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

As always, our only ask is that you share this newsletter with your colleagues, friends and family.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Last week rounded off a difficult quarter for crypto, the market is questioning the sustainability of US debt and heading into Q4, Bitcoin is telling us were nearing a pivot point.

Crypto Native News: Binance and MUFG team up to explore Japanese stablecoins, Coinbase CEO calls out Chase UK for banning crypto payments, Woo and OpenTrade partner to offer tokenised T-Bills.

Institutional News: Valkyrie receives approval for ETH futures ETF, but multiple spot bitcoin ETFs delayed and the US introduces a bill aiming to impose additional reporting requirements on crypto market participants.

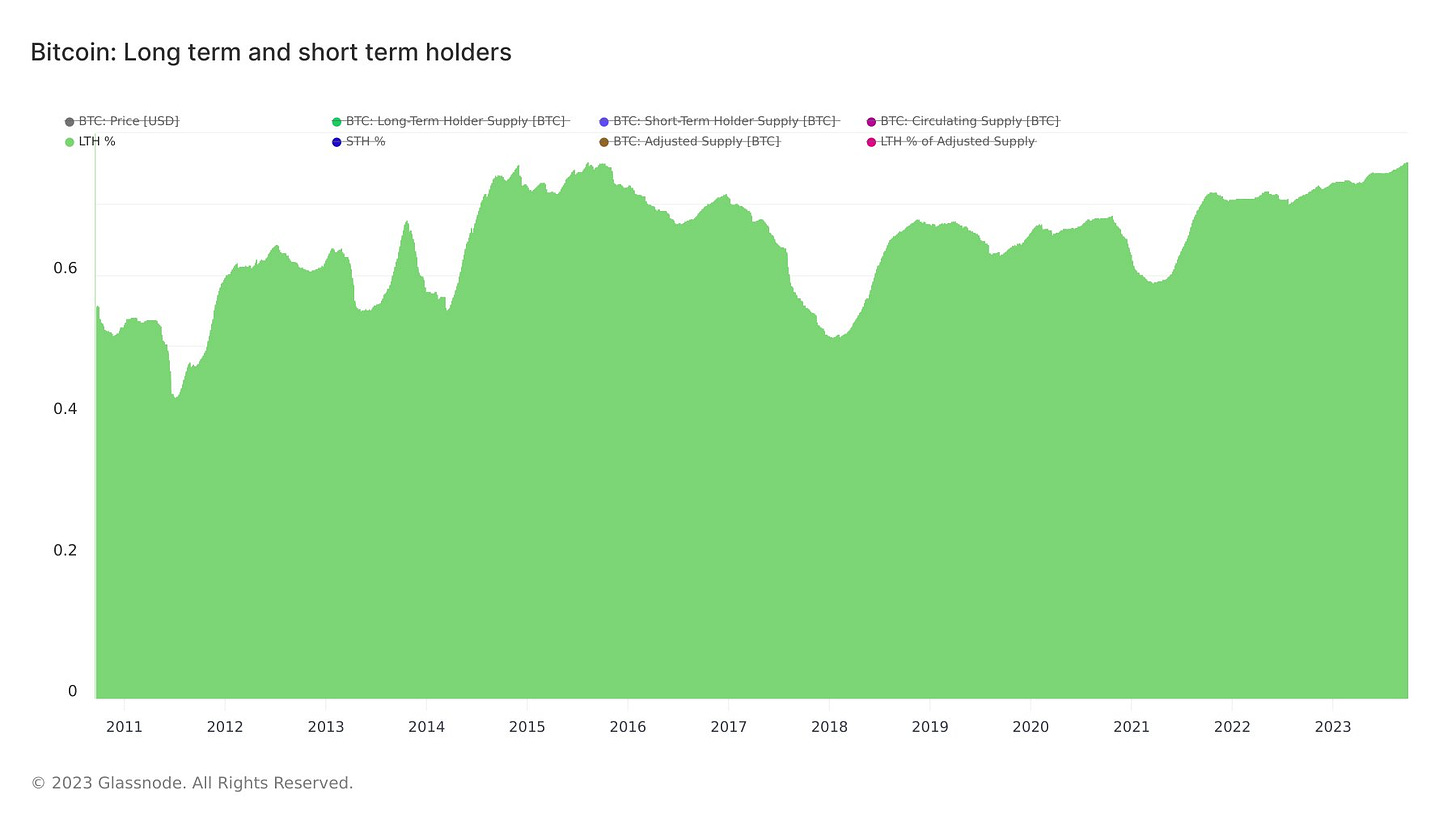

Chart of the Week: Long term bitcoin holders reaches highest level.

Top Jobs in Crypto: Featuring Copper, Clear Bank, PayPal, Kraken, Numeus and Ripple.

Macro Update

This is where we connect the dots between macro and crypto.

Hedging Against Fiat System Failure

Last week rounded out the end of a difficult quarter for crypto and broader risk as resilient US data and sticky inflation spiced up the hawkish rhetoric from the Fed and a pause, became a skip and left us in this macro purgatory, unable to embrace the shift in macro regime that is unfolding.

Remember, we’re a function of rates and liquidity and Q3 reinforced that hypothesis. Indeed, global net liquidity also declined over the period as the balance sheet unwind from major central banks via QT continued and off-set somewhat timid liquidity injections from the PBOC. The BoJ also drove bond market volatility with a tweak to their yield curve control policy.

Nonetheless, with the Bank of England taking a pause, the ECB signalling a pause and the Fed holding fire in September, this, as we’ve written before, is a very different macro regime to 2022 and we find it difficult to be overly bearish as we transition to a pause which will lead into a rate cutting regime and a turn higher in global liquidity.

Whilst the oil rally is a concern as it relates to inflation, the global growth slowdown which is underway provides a disinflationary off-set which has seen market measures of inflation remain muted. Last week’s core PCE (the Fed’s favoured inflation measure) also came in at 3.9% YoY, the lowest level in 2 years, albeit above the Fed’s 2% target.

With bank deposits draining, impeding the ability for banks to extend credit (banking stocks are coming under renewed pressure 👀) and the excess pandemic savings depleted, the risks increasingly look tilted towards growth Vs inflation heading into Q4 and we have likely seen the end of the Fed hike cycle.

Despite the weakening growth backdrop however, US yields have continued to drive higher which, all things equal, provides a macro headwind to risk and crypto.

However, all things aren’t equal. Yields are not rising now on a “credible” Fed hiking cycle as they were earlier in the year, but we’re seeing instead an increase in “term premia” - that is the extra yield investors require to hold longer dated debt. US debt is spiralling out of control (US debt exceeded 33trn last week!!) and the market is questioning the sustainability of US debt. This questioning of debt sustainability has coincided with Bitcoin’s recent stability.

This weekend, the US narrowly averted a government shutdown with a stop-gap funding bill. This follows June’s raising of the debt ceiling. The perpetual debt cycle continues unabated. Bitcoin is the ultimate hedge against fiat system failure.

The one thing the current doomsday folk on fintwit overlook however is ability and the willingness for the Fed to act to stave off any bond market “crisis.”

Central banks have removed the left tail risk the bears are betting on and there remains an unlimited tool box of “not QE QE” measures. It doesn’t matter if those interventions contradict tightening policy.

US regional bank crisis? $400bn of liquidity support measures in 2 weeks.

UK gilt crisis? BoE emergency bond buying programme

Money printer will go brrr, fiat currency will ultimately be the escape valve and “real assets” will re-price sharply higher in fiat terms.

Heading into Q4, Bitcoin is telling us we’re nearing a pivot point.

The tail risk you should position for is on the right.

Native News

Key news from the crypto native space this week.

Crypto exchange Binance is teaming up with Japan’s largest bank, the Mitsubishi UFJ Trust and Banking Corporation (MUTB), to explore the issuance of stablecoins in Japan. Binance Japan announced a joint study that aims to see the companies issue Japanese yen and other fiat-backed stablecoins to accelerate Web3 adoption in Japan. The pair plans to utilize MUFG’s stablecoin issuance platform, Progmat Coin. The Japanese bank would be pioneering the development of the Progmat Coin platform as infrastructure for issuing stablecoins under Japan’s recently revised and enforced Payments Services Act. The legislation, which took effect in June, allows Japanese banks and regulated crypto providers to issue stablecoins.

Coinbase CEO Brian Armstrong this week said that it wasn’t right for private companies to “de-platform” the crypto industry after Chase UK announced a ban on crypto related transactions. Chase UK said this week that it was no longer allowing customers to purchase cryptocurrencies using its debit cards or through bank transfers. Coinbase’s Armstrong said that the UK government should take heed of the move given the UK says it wants to become a Web3 and Crypto hub. Armstrong added “I don’t think that’s OK. I don’t think that’s the rule of things in our society. I think the government should decide what’s allowed and what’s not”.

Crypto exchange WOO X has partnered with OpenTrade, a platform for tokenised real world assets, to offer tokenised US treasury bill products in Asia. The partnership allows its users to earn yield via access to tokenised T-Bills and borrow USDC-secured loans against liquid assets. “We are seeing an increasing demand for tokenised T-Bills, fuelled by higher yields on US government bonds compared to those in decentralised finance,” Jack Tan, founder and CEO of WOO, said in the statement. “The partnership with OpenTrade will further help strengthen our position in Asia as we give our users access to tokenised T-bills without incurring high switching costs.”

Institutional Corner

Top stories from the big institutions

Asset Manager Valkyrie was the first firm to get approval for ETH futures ETF. Asset manager Valkyrie started buying Ether (ETH) futures contracts, after getting approval to convert its existing bitcoin futures exchange traded fund (ETF) to a two-for-one investment vehicle. "Today, the Valkyrie Bitcoin Strategy ETF began adding exposure to Ether futures contracts, making it the first US ETF to provide exposure to Ether and Bitcoin futures contracts under one wrapper" The funds new strategy to combine both BTC and ETH futures contract into one ETF will be effective from 3 October and the name will be updated to Valkyrie Bitcoin and Ether Strategy ETF and the ticker will remain BTF.

Staying with the ETF space, the spot bitcoin ETF applications of Invesco, Bitwise and Valkyrie were delayed by the SEC this week, adding to the delay of Blackrock’s spot bitcoin ETF some weeks back. Many expect Fidelity, VanEck and WisdomTree’s applications to also be pushed back in the coming weeks. The announcements of the delays came a few weeks earlier than expected due to the possible government shutdown in the US on 1 October.

US Representative Don Beyer introduced a bill aiming to impose additional reporting requirements on crypto market participants. The ‘Off-Chain Digital Commodity Transaction Reporting Act’ necessitates that trading platforms report every transaction to a CFTC registered repository within 24 hours. The proposed legislation seeks to address a lack of transparency, which is in response to concerns regarding the lack of transparency which ‘can leave investors and consumers vulnerable to fraud and manipulation.’

Chart of the Week

Because charts are just as important as macro.

The percentage of Bitcoin supply held by long-term holders just officially reached its highest level ever at 76.09%.

Hat tip to Will Clemente for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Software Engineer - Blockchain integrations at Copper

Staff Engineer - AppSec at Clear Bank

UK Crypto MLRO Manager at PayPal

Compliance Officer - Crypto Facilities at Kraken

Blockchain Research Analyst at Numeus

Product Manager - Liquidity Optimisation at Ripple

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.