Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Central bankers and politicians highlight their concerns, stability in China allows BTC to rise and is the market under positioned for this demand shock ?

Crypto Native News: MicroStrategy announces its Q4 2023 results, EU counts for only a small portion of Bitcoin mining, Baakt in trouble.

Institutional News: The SEC adopts new liquidity provision rules.

Charts of the Week: Coinbase sees a big chunk of US BTC liquidity, US BTC ETF’s only represent a small percentage of trading volume, the 9 new ETF’s surpass MicroStrategy’s holdings and the Bitcoin ETF’s the most popular in history.

Top Jobs in Crypto: Featuring Ripple, The Tie, Xcede Recruiters, Copper, Blockchain.com and LSEG

Macro Update

This is where we connect the dots between macro and crypto.

Chasing the Dragon

A relatively quiet week on the macro front, with little in terms of top tier data to provide fresh catalysts, leaving markets to ruminate on that strong NFP print and the Fed’s push back on the timing for rate cuts. US yields grind higher on the week, with a heavy corporate bond issuance calendar adding some weight to Treasuries (buyers of corporate bonds typically taking a pure credit view, hedge out the interest rate risk by selling treasuries.)

Ahead of the Monday open, JPow’s appearance on 60 minutes aired. Powell reiterated that he saw no need to cut rates immediately, but more interesting perhaps as it relates to the long term bull case for Bitcoin, were his comments on US deficits. JPow expressed concern on the sustainability of US debt, saying “in the long run, the US is on an unsustainable fiscal path…and that means the debt is growing faster than than the economy...effectively we’re borrowing from future generations”

Of course, what he didn’t say was, there is no way out from this spiral and they will need to default by the stealth devaluation of fiat currency. What JPow is telling us, is that in the long run, Bitcoin is a better, safer investment than holding US Treasuries 💪.

Whilst the macro continues to provide short term crypto headwinds as markets temper expectations for rate cuts (March cut only priced at 16% now), percolating banking stress and continued stresses in China continue to lurk in the background with potential to drive a more explosive upside move.

Despite recovering late in the week, US regional bank stocks remain under pressure, with New York Community Bancorp (NYCB) share price continuing lower (falling another 22% on Tuesday.) Powell in his 60 minutes interview suggested some smaller banks will likely close or merge due to commercial real estate (CRE) weakness, and reminiscent of Bernanke’s ill-fated “subprime is contained” comments, said the problem is ultimately “manageable.” Yellen further suggested the problem is “manageable” on Wednesday, but expressed concern over CRE exposure and said regulators are working closely with banks to ensure “loan loss reserves are built up to cover losses.”

You don’t need us to tell you that when the central bankers and politicians are openly admitting to concerns, then the problem likely runs very deep. Indeed, those problems are also spreading to Europe, with Germany’s Deutsche Pfandbriefbank seeing its bonds slump as they increase US CRE loan loss provisions. The bank described the current turmoil as “the greatest real estate crisis since the financial crisis.” Bitcoin certainly got the memo this week.

Over in China, a holiday shortened week saw stocks record solid 5% gains as the government's recent measures to provide support took effect. The real economy problems however were further highlighted with Thursday’s inflation report showing a YoY price decline of 0.8% (Vs -0.5% exp.) This is the fastest decline since 2009 and comes as China battles a slowing economy with a sprawling property crisis. This will continue to have a global disinflationary impact as China cuts prices, exporting deflation and over capacity to the rest of the world. This feeds our view of a continued easier rate and liquidity outlook to provide a tailwind to crypto throughout 2024.

This week’s stability in Chinese stocks is important if China is to stem capital flight. We’ve suggested that stability there would be an important prerequisite for Bitcoin to continue higher given the incentives for China to keep a lid on BTC and disincentivise the world's hardest asset being used as a conduit for capital outflows. It doesn’t feel like a coincidence then that BTC has started to break higher just as Chinese stocks stabilise.

Also starting to play out for Bitcoin is the ETF effect. After the “sell the news” reflex post launch and the battle between the inflows into the Nine’s Vs the Grayscale outflows, Grayscale outflows are now slowing significantly (Friday saw just 51.8mio outflow.) The last two trading days saw a net inflow of $947mio into the ETF’s taking the net inflow now to $2.6bn. Both the Blackrock and Fidelity ETF’s have eclipsed the AUM after 1 month of any other ETF in history (see charts of the week!) 🤯.

The market in our view is under-positioned for this demand shock, which especially into the halving, will create a powerful demand/supply dynamic that will propel Bitcoin to new record highs in 2024. This is the moment markets can start to really “price” the ETF’s outside of the short-term headline noise. With the banking system looking fragile once more and the Fed chair openly admitting that US debt is unsustainable, the case for holding Bitcoin in a portfolio allocation has never looked stronger.

As our Chinese friends and readers celebrate New Year, the year of the dragon looks set to breath new fire into crypto 🔥

Native News

Key news from the crypto native space this week.

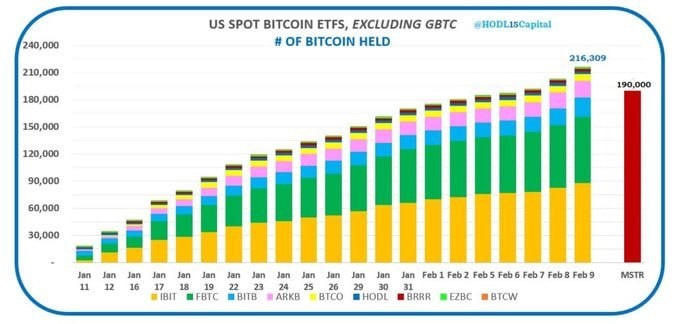

MicroStrategy announced their Q4 2023 financial results this week. The key headlines are that MicroStrategy acquired 31,755 bitcoins since the end of Q3 for $1.25 billion, or $39,411 per bitcoin. They now hold 190,000 bitcoin at a total cost of $5.93 billion, or $31,224 per bitcoin, as of February 5, 2024. Their total revenues were $124.5 million, down 6% year-over-year. Subscription service revenues were $21.5 million, up 23% year-over-year. Read the full press release from MicroStrategy HERE.

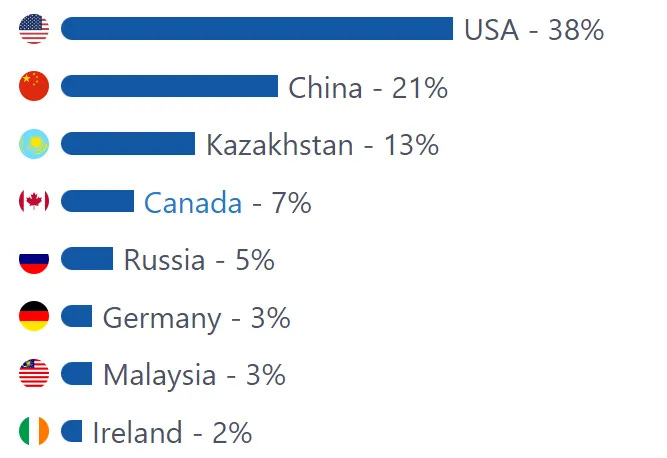

According to a report from BanklessTimes this week, looking at Bitcoin mining, the European Union countries collectively account for only 6% of the global Bitcoin mining hashrate. The United States emerged as the undisputed leader with a commanding 38%, followed by a diverse array of countries, including China (21%), Kazakhstan (13%), Canada (7%), Russia (5%), Germany (3%), Malaysia (3%), and Ireland (2%). Read the full report HERE.

Baakt, the cryptocurrency platform founded founded by Intercontinental Exchange (ICE) in 2018, warned that it may not have enough capital to stay in business. In a regulatory filing, Bakkt said there is doubt over whether its available cash can sustain ongoing operations for the next 12 months. The firm said in a now-deleted post on X that it has filed an amended Form S-3 registration with the SEC. The firm mentioned that it will allow them to raise additional capital to sustain their vision. Read the full filing from Baakt HERE.

Institutional Corner

Top stories from the big institutions

On Tuesday the Securities and Exchange Commission (SEC) voted to adopt rules that require market participants who have significant liquidity-providing roles to comply with federal securities laws. The 247-page rule adopted on Tuesday will apply to people transacting in crypto assets that meet the definition of securities or government securities, with the exception of having assets less than $50 million. The rules would affect decentralised finance. A statement from the ruling says "If a person’s trading activities in crypto asset securities, including products, structures and activities involved in the so-called DeFi market, meet the definition of 'as part of a regular business' as set forth in the final rules (i.e., the person engages in a regular pattern of buying and selling crypto asset securities that has the effect of providing liquidity to other market participants as stated in the qualitative standard), and no exception or exclusion applies, that person would be required to register as a dealer or government securities dealer." Read the fact sheet from the SEC HERE.

Charts of the Week

Because charts are just as important as macro.

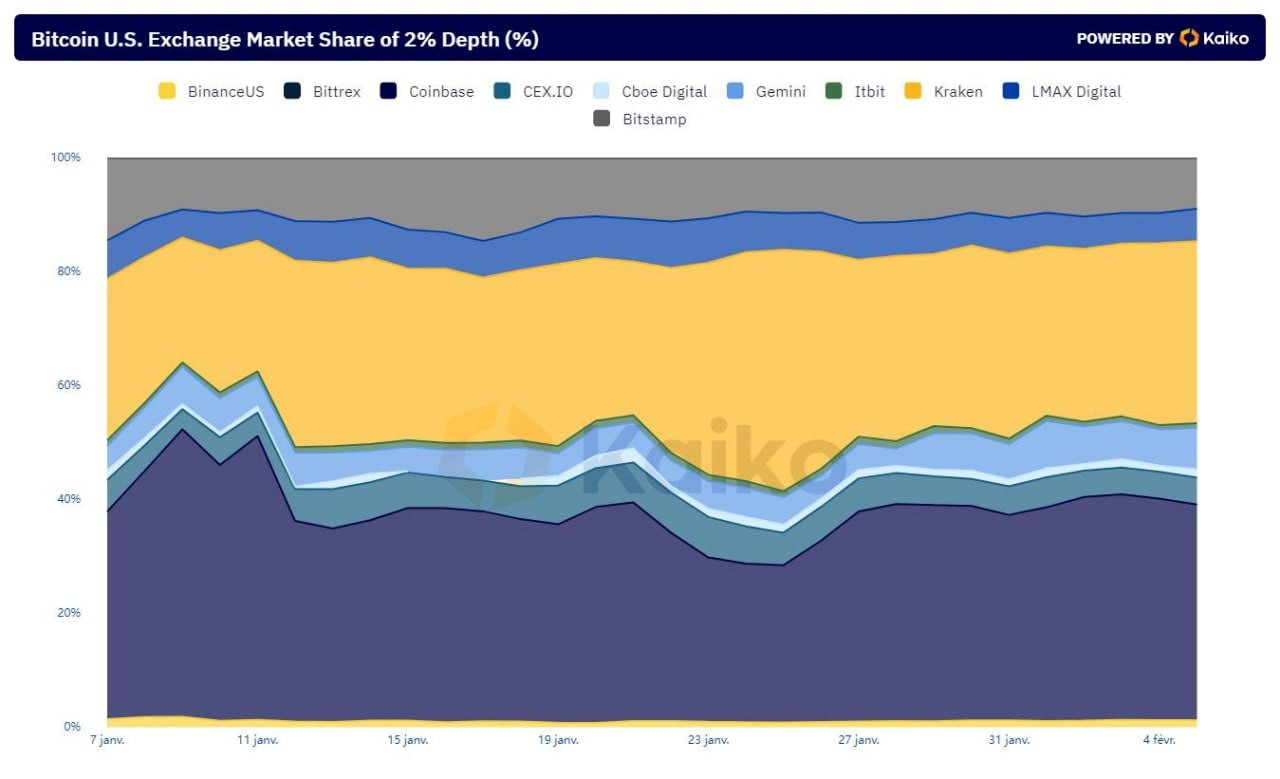

Coinbase holds nearly 40% of BTC liquidity in the US, followed by Kraken (33% and Bitstamp (9%). Hat tip to Kaiko Data for the chart.

According to a Coinbase report, US-based ETFs currently represent only 10-15% of the total BTC spot trading volume across global centralised exchanges and only 3% of outstanding bitcoin supply (or around 650k BTC).

Nine spot Bitcoin ETFs have purchased 216,309 Bitcoins (worth $10.3 billion) in the 21 days since their launch, surpassing MicroStrategy’s current holdings of 190,000 Bitcoins. Hat tip to Hodl15Capital for the chart.

The Bitcoin ETF’s the most popular in history. Hat tip to DocumentingBTC for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Senior Business Development Associate at Ripple

Institutional Sales for Crypto at The Tie

Quant Developer Python Crypto Desk via Xcede Recruiters

Director of Engineering, Growth and Monetisation at Blockchain.com

Senior Blockchain Engineering Lead at LSEG

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.