Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Will the end of summer spark the start of crypto summer? Find out our view below.

Crypto Native News: Cardano heading into a major upgrade, Australia Bitcoin ATM’s growing, Time.fun raises $3m led by Brevan Howard Digital.

Institutional Corner: FCA crypto registrations has dropped, several crypto hearings coming up in the US, El Salvador President speaks on Bitcoin adoption.

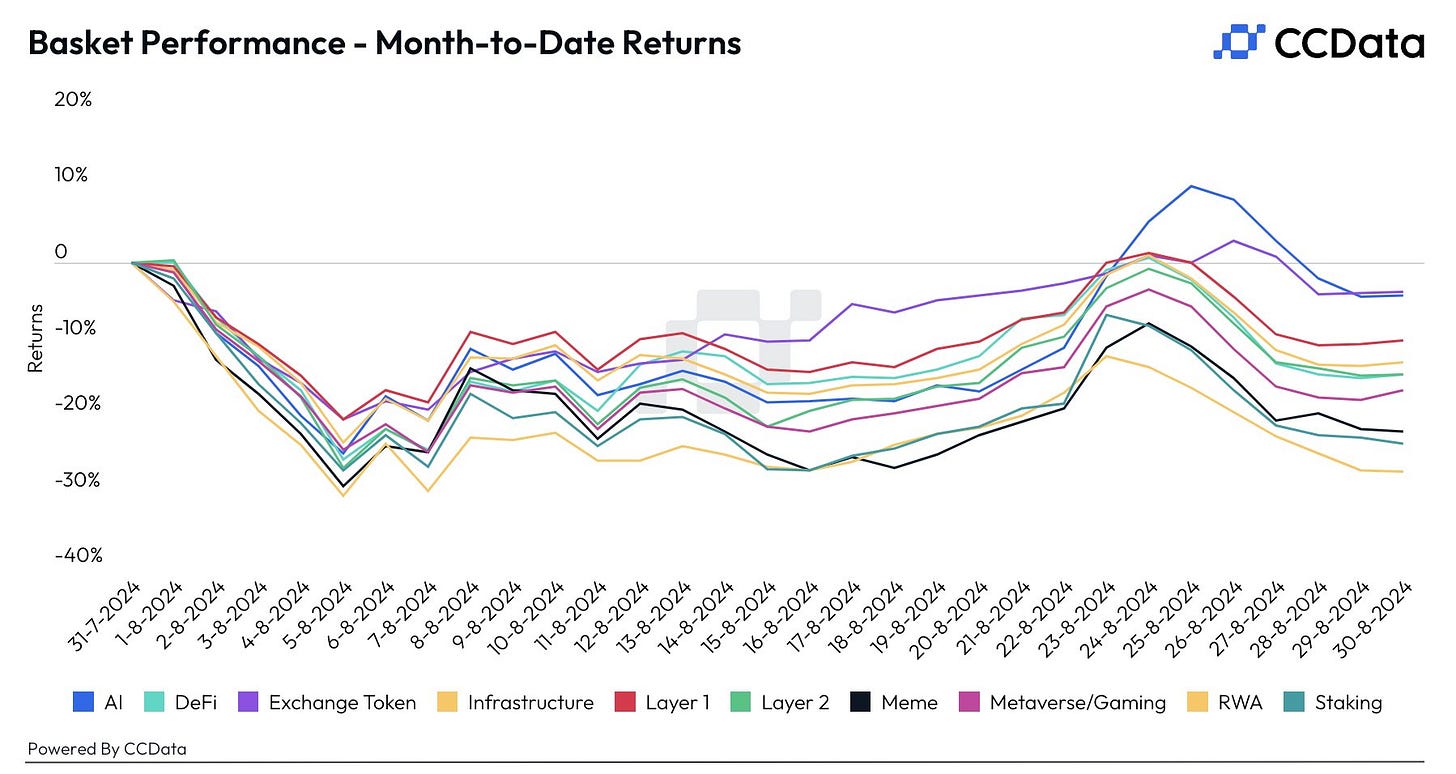

Charts of the Week: BTC held on exchanges hits a low for the year, all crypto baskets down this month.

Top Jobs in Crypto: Featuring DAZN, DRW, Kraken, Crypto.com, Uphold, IAC and Deutsche Bank.

Macro Update

This is where we connect the dots between macro and crypto.

Summer Days, Drifting Away

Another disappointing week for Bitcoin which reversed the post Jackson Hole gains to fall back into this sleepy 58k-62k range and end the month circa 10% lower.

As we concluded last week, despite the positive macro tailwinds, crypto still continues to digest a supply overhang and needs sustained, real demand to come back into this market. A week where month end considerations dominate was unlikely to be that week. Indeed, from a liquidity perspective, month end tends to be negative and mechanical position adjustments and rebalancing typically create noise that one is best to not try to read too much into. The following couple of weeks will be more instructive, particularly as summer holidays end and traders return to their desks.

On the US data front, the “goldilocks” thematic continued, with upward revisions to annualized Q2 GDP from 2.8% to 3% whilst the Fed’s preferred inflation reading, core PCE came in flat at 2.5%, but a tick below the consensus. The beta to inflation prints perhaps smaller with the Fed seemingly comfortable with the pace of disinflation and attention now more keenly focused on the labor market softening.

To that point, this week’s Conference Board consumer confidence data showed another sharp rise in “jobs hard to get minus plentiful” balance (H/T SocGen’s Albert Edwards) which is consistent with a continued rise in unemployment. Despite signs of consumer resilience (personal spending rose 0.5% MoM Vs 0,3% prior) it’s this labor market softening that will provide the confidence for sequential Fed rate cuts.

Conference Board’s hard to find - jobs plentiful lead on rising unemployment

Elsewhere, Eurozone inflation dropped to 2.2% in August, down from 2.6% in July, the lowest level in 3 years, reinforcing expectations of continued rate cuts out of the ECB, despite caution expressed by policy makers. Germany IFO business climate index falling to 86.6, the lowest levels since Feb, a reminder of the challenges facing Europe’s biggest economy and perhaps a barometer of the continued weakness in global manufacturing. Ifo President Clemens Fuest describing the German economy as “falling into crisis.”

The ECB appears more behind the curve than the Fed. Which of course means we can expect a flood of liquidity and negative real rates as the central bankers are forced to atone for yet another error!

Meanwhile in Japan, stronger inflation data supported expectations for continued policy normalization. Tokyo core CPI (a leading indicator of nationwide trends) rising to 2.4% Vs 2.2% prior. The rise largely reflects a phase out of subsidies on utility bills, but Japan policy normalization remains a market risk factor as we saw in early August. Still, we remain of the view that weak growth will return Japan to its disinflationary trend, whilst the risk of market volatility from rising rates for an economy running over 260% debt/gdp, likely keeps the BoJ sidelined. Past sins will necessarily require continued financial repression.

Overall, a light volume week saw mixed equity performance with value outperform growth. NVIDIA weighing on the “growthy” tech stocks, despite a stronger earnings report. It’s no longer sufficient for NVIDIA to beat expectations, it needs to smash them! Still, despite the incessant bearish calls for a top in NVIDIA, there appears to be little cause for concern for this bellwether of the secular AI trend.

Risk continues to look well supported as global liquidity picks up and the Fed gets set to begin the rate cutting cycle. Dollar bouncing this week, but looks set to continue its downtrend, along with falling US yields. With USDCNH now trading sub 7.10, this will continue to feed a broadly weaker dollar and provides the breathing room for China to ease further.

The macro is evolving perfectly in line for Bitcoin to resume the trend higher, yet we continue to await the spark. It would be ironic if the end of summer sparked the start of crypto summer. As Elon Musk once quipped, “the most ironic outcome is the most likely.” Let’s hope he’s right!

Macro Chart of the Week - Zoom Out - Bitcoin YTD returns still the highest. Hat tip to Mohamed El-Erian for the chart.

Native News

Key news from the crypto native space this week.

Cardano, launched in 2017 by Ethereum co-founder Charles Hoskinson, is approaching its biggest upgrade in two years, with major changes to the structure of its main network. The upgrade, known as the "Chang hard fork," is a major milestone in Cardano’s roadmap, punctuated by the much-awaited addition of smart-contracts functionality in 2021. The Chang hard fork was initially set to go through this week, but Hoskinson announced on Friday that it had been pushed back to 1st September so some exchanges, including Binance, could prepare their systems. The main feature of the latest upgrade is to give Cardano the ability to introduce on-chain governance features. Those that hold ADA, Cardano’s native token, will be able to elect representatives (called Delegate Representatives, or dReps) and vote on improvement proposals as well as future technical changes to the blockchain. The Cardano Foundation, the main organisation supporting the blockchain said “This will mark the first step towards a minimum-viable community-run governance structure outlined in CIP-1694, meaning that the Cardano community will be responsible for maintaining and shaping the blockchain network.”

Australia has become the fastest growing country for the installation of Bitcoin ATM’s. As a reminder, users of the ATM’s can feed in cashto receive crypto into their digital wallets or obtain physical notes from token sales. Australia is now in third spit for the number of Bitcoin ATM’s at 1,162, up from 73 just two years ago. The US accounts for th vast majority of the market with around 32,000 machines followed by around 3,000 in Canada.

Time.fun, a crypto startup that tokenises people's time, has raised $3 million in a seed funding round led by Brevan Howard Digital. Other investors in the round included Coinbase Ventures, Breed VC, Zee Prime Capital and Arthur Hayes' family office, Maelstrom. Angel investors such as Solana co-founders Anatoly Yakovenko and Raj Gokal, Helius co-founder Mert Mumtaz and Santiago Santos also participated. Time.fun is a tokenisation platform built on the Ethereum Layer 2 blockchain Base and helps creators tokenise their time. When creators tokenise their time, traders can buy, sell and redeem that time in minutes, which can then be used to direct message or have 1-on-1 calls with the creator. Creators earn fees when their time is traded or redeemed.

Institutional Corner

Top stories from the big institutions

According to a Freedom of Information request by law firm Reed Smith, applications for registration as a crypto asset exchange or custodian wallet provider through the Financial Conduct Authority (FCA) have fallen by 51% in the last three years. Figures provided by the FCA reveal that just 29 applications were received in the last year (May 1 2023 – April 30 2024), compared with 42 and 59 in the two years prior. Just seven applications were received in Q1 2024 – the latest period for which complete data is available – the joint second lowest quarter in the last three years. The average time taken to approve applications within the last three years standing at 459 days

According to news reports from the US, the U.S. House Financial Services Committee is poised to launch a series of crypto hearings covering several aspects of the industry. The topics are expected to include decentralised finance (DeFi), the Securities and Exchange Commission's oversight of digital assets businesses and the implications of "pig butchering" scams. The congressional panel, which has oversight over U.S. securities and most financial products, will set a September hearing calendar filled with crypto-relevant topics. The committee chairman, Rep. Patrick McHenry (R-N.C.), is retiring at the end of the year and has said one of his top remaining priorities is finishing one of the bills to begin establishing tailored federal rules for crypto. The first of the hearings on 10 September will be a long-awaited subcommittee examination of DeFi. On 18 September there will be two hearings, one in the morning on the enforcement practices of the SEC and one later on the implications of so-called pig butchering, the practice of posing as a romantic partner to scam people out of their assets. But a full-committee hearing on 23 September could carry the most crypto weight, with the SEC set to testify. The House panel is said to be seeking testimony from Chair Gary Gensler and the rest of the five-member commission in the same hearing.

El Salvador President Nayib Bukele spoke on the countries Bitcoin adoption in an interview with Time Magazine this week. As a reminder, Bukele announced in 2021 that Bitcoin would be made legal tender—alongside the U.S. dollar. The policy means that businesses need to accept the cryptocurrency if they have the technological means to do so. El Salvador now holds 5,857.76 BTC worth approx. $348,200,000. President Bukele said in the interview that “It hasn’t had the adoption we expected,” “The positive aspect is that it is voluntary—we have never forced anyone to adopt it.” He went on to say the Bitcoin experiment “could have worked better, and there is still time to make some improvements, but it hadn’t resulted in “anything negative.” He added “If [Salvadorans] use it now, they will probably have gains in the future, If they do not want to use it, this is a free country. I expected more adoption, definitely, but we always prided ourselves on being a free country, free in every way.”

Charts of the Week

Because charts are just as important as macro.

BTC held on exchanges hit a new low for the year this week. Hat tip to CryptoQuant for the chart.

Month to date crypto basket returns, as of 30 Aug. Hat tip to CCData for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Head of Brand Partnerships at DAZN

Sales Manager for Staking at Kraken Institutional

Trader Delta One Derivatives at Crypto.com

Senior DeFi Engineer at Uphold

Digital Asset Crypto Executive at IAC

Head of New Business Office, Artificial Intelligence (AI), and Digital Assets Framework, Regulatory and Audit at Deutsche Bank (might need a bigger business card).

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.