Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our Twitter a follow HERE.

We’re only a few off of 1,000 subscribers so we’d like to ask a favour…

Could you share this newsletter with just 1 person you think might find it helpful. Thank you !

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The confluence of positive factors continue to drive momentum, China’s liquidity injections continue to ramp up and G3 central banks have some tough choices to make.

Crypto Native News: Kraken appoints a new UK boss, Kraken to share users data with the IRS, Grayscale launches crypto indices and Bitcoin market dominance reaches a 30 month high.

Institutional News: The UK publishes a final draft for stablecoin regulation, UK lawmakers allow crypto to be seized if used for illicit purposes, SEC Chair Gensler speaks at the Securities Enforcement Forum and Taiwan launches its first Virtual Asset Management Bill.

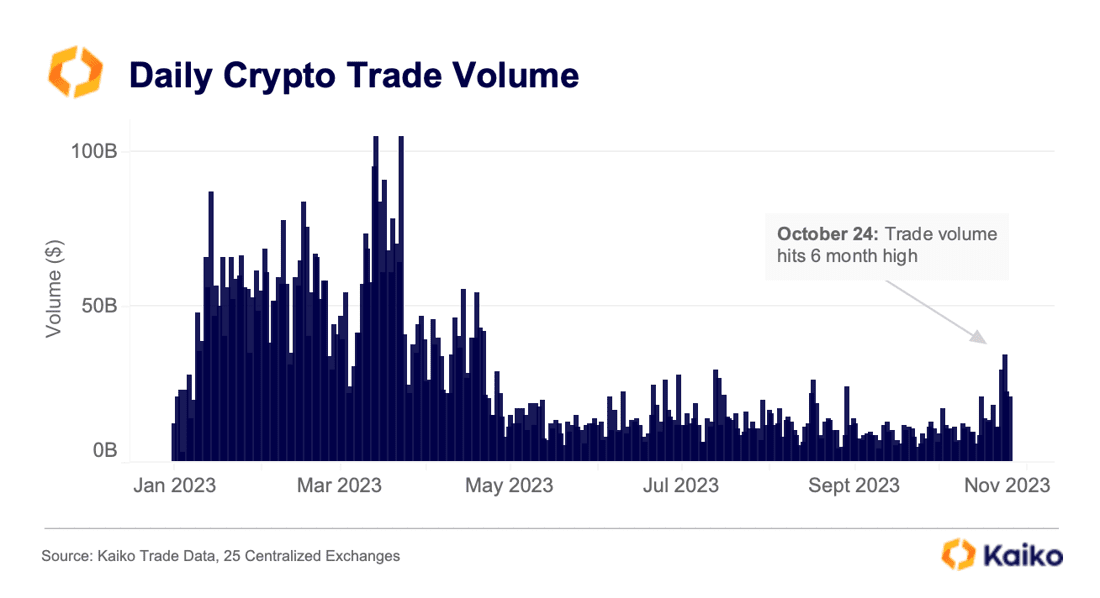

Chart of the Week: Crypto volumes hit 6 month high

Top Jobs in Crypto: Featuring Jump Trading, Crypto.com, ardotec, Quant Trader Network, TP ICAP, DWS Group, Fireblocks, Numeus.

Macro Update

This is where we connect the dots between macro and crypto.

Reaching the Cross-roads of Impossible Choices

Bitcoin soared to new highs last week, briefly trading above 35k as the confluence of positive factors we highlighted continued to drive momentum. Encouragingly, pull backs have remained shallow which looks constructive given the size of the move over the past couple of weeks. The market remains under-positioned and performance chasing will maintain an underlying bid. This move has further to run 🚀

Chinese liquidity continues to ramp up and the thus-far piecemeal stimulus stepped up a gear with the Chinese government authorising the issuance of RMB 1trn of special treasury bonds during the fourth quarter. This will expand the budget deficit to around 3.8% for the year, well above the 3% level set in March. China rarely adjusts the budget mid-year, with previous examples coming during periods of crisis. Things are getting serious 👀

Underscoring growth and financial stability concerns, President Xi made his first known visit to China’s Central Bank and the State Administration of Foreign Exchange (SAFE.) Whilst details of the meeting remain unclear, China is mobilising a more significant response to shore up support for the country’s financial markets and economy. All roads lead to more debt and more liquidity and as capital looks to flow out of China, Bitcoin will be a major beneficiary.

Elsewhere, US data continues to display resilience, with Q3 GDP coming in at an annualised pace of 4.9%, up from 2.1% prior although core PCE Prices ticked lower to 3.7% YoY and does little to alter expectations for the Fed to once again stay on hold this Wednesday. Indeed, with expectations for a much weaker Q4, it looks like we’re through peak growth and we continue to expect the Fed to now be on hold, with the discussion less centered around “how high” but for “how long.”

The ECB was also the latest major Central Bank to join the “pause” camp, holding rates steady at 4%. The decline in both business activity and inflation continues to accelerate in the EU, with ECB President Lagarde conceding that the economy was “weak” and will remain so for the rest of the year. Despite the push back, markets continue to price for ECB cuts to begin in April and given the pace of disinflation plus an economy which already looks to be in recession, the ECB may well lead the Central Bank cutting cycle in 2024.

The end of the rate hike cycle then a positive tailwind for Bitcoin. Usually, this should start to see longer dated yields peak, but as discussed previously, the rising term premium continues to keep longer dated bonds under pressure as markets grow increasingly concerned about the spiralling US deficit. Indeed, as Bloomberg notes, this Wednesday’s quarterly refinancing, where the US Treasury will announce new borrowing plans, is for once the big bond market event, not the Fed rate decision.

We would add to that, that the biggest Central Bank meeting this week with the potential to impact the US bond market is the Bank of Japan. Core inflation accelerated to 2.7% in October and has sparked some expectation that the BoJ may again announce a tweak to their Yield Curve Control (YCC) policy. 10yr Japanese yields keep pushing new highs towards the BoJ’s 1.0% upper bound, prompting more unscheduled bond buying last week, the 5th unscheduled operation since July. This is also weighing on the JPY, with USDJPY breaking above 150, renewing intervention fears.

As the world’s largest creditor and largest holder of foreign bonds (including US treasuries), rising JGB yields have the potential to see domestic Japanese investors selling their foreign bonds and repatriating back home. This can reverberate across global bond markets, intensifying the sell off, as well as impacting global equities and the potential to spark a volatility event.

The BoJ faces a dilemma. Either continue with current policy, requiring continued balance sheet expansion to support YCC, hitting the currency even harder, or, allow yields to re-price higher, sparking a global volatility event.

We suspect if the latter option is chosen, the Fed and others will be forced to enact their own version of YCC. Either way, the interconnected, global fiat monetary system is approaching the cross-roads of impossible choices. Gold and Bitcoin remain on high alert.

Native News

Key news from the crypto native space this week.

Kraken have appointed a new Managing Director to runs its UK business. Bivu Das who was a former head of operations strategy at fintech Starling Bank, is taking over from Blair Halliday. Das will oversee Kraken’s efforts to build out its business in the UK, where it boasts 275 staff. The exchange claims to account for 50% of GBP spot trading volume in crypto and Das said of the UK market “It’s very important, It’s one of our strongest and biggest markets and even in the market that we’re in today volumes have stayed relatively consistent.”

Staying with Kraken, the crypto exchange said that they will share data on thousands of users with the US Internal Revenue Service (IRS). This is to comply with a court order from June. Specifically, Kraken will share information regarding crypto transactions above Kraken customers between 2016 and 2020. The 42,017 Kraken customers that were effected were emailed and informed on Wednesday.

Grayscale Investments, the crypto asset management company, is venturing into the crypto indices business together with the London-based indices provider FTSE Russell, a London Stock Exchange subsidiary. They are launching a product called Crypto Sector Index Series. It will include several indices tracking the prices of various buckets of digital assets according to their use cases. The groups will include: cryptocurrencies that serve as a medium of exchange of store of value (like bitcoin, litecoin), smart contract projects (like ether, solana, polygon), tokens representing financial services (uniswap, compound, curve), coins representing art, gaming and media assets (NFT projects) and projects oriented on real-life applications (chainlink, filecoin and others).

Bitcoin’s market dominance (the ratio of bitcoin’s market cap vs that of all other altcoins) reached 54% last week, its highest in the last 30 months (see chart below). Bitcoin’s market dominance began reviving at the start of October, when it rose from below 49% to reach this new two-and-a-half-year high.

Institutional Corner

Top stories from the big institutions

Today, the UK government published a final policy draft concerning the regulation of fiat-backed stablecoins. The report says that it is the government’s intention to facilitate and regulate the use of fiat-backed stablecoins in UK payment chains. This is because certain stablecoins have the potential to become a widespread means of retail payment, driving consumer choice and efficiencies. The report continues, that in order to deliver this, the government intends to bring the regulation of certain activities relating to fiat-backed stablecoins within the UK’s financial services regulatory perimeter. This will include bringing the use of fiat-backed stablecoins in payment chains into the Payment Services Regulations 2017 (PSR 2017) and bringing the activities of issuance and custody of fiat-backed stablecoins where the coin is issued in or from the UK within the regulatory perimeter of the Financial Services and Markets Act 2000 (FSMA 2000). Read the full policy draft HERE.

Lawmakers in the United Kingdom have passed legislation allowing authorities to seize and freeze cryptocurrencies like Bitcoin if used for illicit purposes. According to the U.K.’s parliamentary acts website, the Economic Crime and Corporate Transparency Bill is expected to receive royal assent. The legislation aims to expand authorities’ ability to crack down on the use of cryptocurrency in crimes like cybercrime, scams and drug trafficking. One of the provisions of the Bill permits the recovery of crypto assets used in crimes without conviction, as some individuals may avoid conviction by remaining remote. The legislation also aims to combat the use of digital assets “for the purposes of terrorism” or related reasons. Read full details on the Bill HERE.

SEC Chair Gary Gensler spoke on Wednesday at the at the 2023 Securities Enforcement Forum on the economic perspective of the SEC’s enforcement action. Gensler noted that the agency filed more than 780 enforcement actions in 2023, including over 500 standalone cases. The enforcement actions led to judgments and orders totalling $5 billion, of which $930 million was distributed to harmed investors. There were a number of mentions of crypto in the speech. Gensler reiterated his stance on crypto, claiming that most of the crypto market falls under the securities bracket and must be governed under the same law. In his explanation of the broad definition of security, Gensler explained the concept of an investment contract and why a major chunk of the cryptocurrency market resembles it. According to Gensler, most cryptocurrency assets will pass the investment contract test, bringing them under securities regulations. He added “Don’t get me started on crypto. I won’t even name all the individuals we’ve charged in this highly noncompliant field.” I recommend reading the full speech HERE (less than 10 min read).

Taiwanese legislators introduced the Virtual Asset Management Bill to parliament. The bill aims to provide “better protection” for customers and “properly supervise” the industry. The 30 page bill is relatively high level and suggests some common-sense obligations for virtual asset service providers (VASPs), such as separating customer funds from the company’s reserve funds, establishing an internal control and audit system, and joining the local trade association. The Bill doesn’t require stablecoin issuers to hold a 1:1 ratio of reserve funds, and it doesn’t mention algorithmic stablecoins. As to marketing activities, the rules for advertising are to be determined by the “competent authority.”

Chart of the Week

Because charts are just as important as macro.

Looking at 25 centralised exchanges, daily crypto volumes hit a 6 month high last week.

Hat tip to Kaiko Data for the chart.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

OTC Sales Trader at Crypto.com

Product Director Crypto at ardotec

Crypto Quant Trader via Quant Trader Network

Digital Assets Options Broker at TP ICAP

Risk Manager Digital Assets at DWS Group

Business Solutions Associate EMEA at Fireblocks

Blockchain Research Analyst at Numeus

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.