CORRECTION - Copy and paste error, the macro section has now been corrected! Apologies!

Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

As one reader described it “The most succinct, easy to digest macro summary I have read in all crypto newsletters!”

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: A higher for longer Fed, falling behind the curve of a disinflationary, slowing economy, we continue to believe we’re at the start of a new bond bull market, which will drive yields substantially lower from here and flip what has been a Bitcoin headwind into a powerful tailwind.

Crypto Native News: FlowBank shuts down, Terraform Labs and SEC settlement agreed.

Institutional Corner: Gensler speaks on Ether ETF’s, Payment firm Kima raises $5m, JPM raises doubts over crypto inflows, Trump meets with bitcoin miners and Taiwan forms a Virtual Asset Service Provider Association.

Charts of the Week: Bitcoin price vs Cryptoasset summary, Bitstamp a popular CEX in the US, USD backed stablecoins continue to dominate.

Top Jobs in Crypto: Featuring Kraken, BCB Group, XTX Markets, Revolut Ledger and KuCoin.

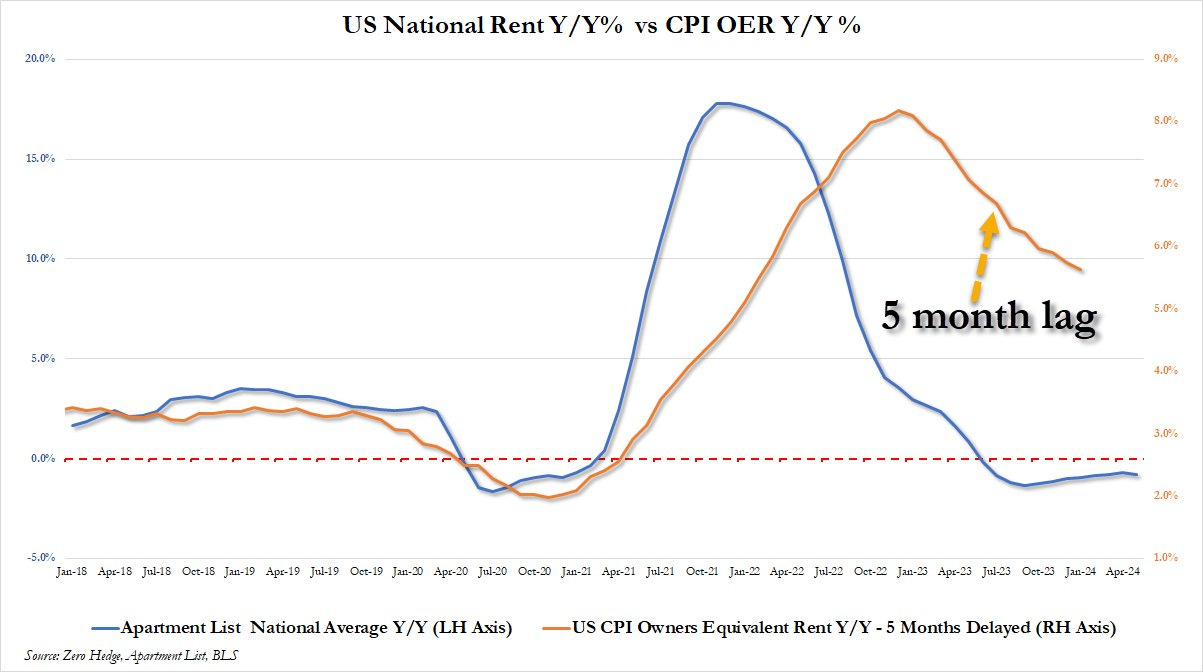

Macro Chart of the Week - A downside buffer core CPI? Real time rents are flat/negative while BLS reports OER at +5.6%. This will provide an inflation cushion for the next 18 months. Hat tip to ZeroHedge for the chart.

Macro Update

This is where we connect the dots between macro and crypto.

The Calm Before the Storm

Another big week for the macro which continued to support our “peak reflation” view of the world. Someone just needs to update the Fed!

US CPI came in at a softer 3.3% YoY Vs 3.4% prior and flat on the month (first time in 2 years) with core at 3.4% YoY down from 3.6%. The Supercore services gauge which excludes housing, fell 0.04%, the first decline since 2021 which points to a favourable print for the Fed’s preferred PCE measure later this month.

Backing up the softer CPI, the PPI (Producer Price Inflation) also came in soft at 2.2% Vs 2.5% expected and declining 0.2% on the month. We’ve written previously that after a meaningful pace of disinflation, we tend to get a bumpy, sideways move before the next disinflationary leg lower. This latest data points to the next disinflationary leg being under way 🎉

Post the CPI, US Treasuries rallied hard, with yields falling to fully unwind the NFP spike, yet the momentum was momentarily dented by a “hawkish” Fed. The hawkish twist coming from the dot plot which showed the median forecast for 2024 cuts at 1, down from 3 in the March forecast. The Fed did however acknowledge that there had been “modest further progress on inflation” and JPow continued to take a neutral, data dependent stance and further reinforced the point that the next move will be a cut, with no one on the FOMC having hike as a base case. The Fed was merely “marking to market” the current expectations for rate cuts.

Interesting too, Jpow said that “unexpected weakness in the labor market could also call for a response” and as we highlighted last week when we dismissed the headline NFP strength which contradicted underlying signs of weakness, Powell also said that there is “an argument that payrolls may be a bit overstated.” Does JPow read Connecting the Dots? 🤔

Policy Mistake

Adding to signs of labor market weakness, jobless claims this week jumped to 242k, with continuing claims up to 1.82mio. Americans filing for unemployment are the most in a year. Given employment is the most lagging indicator of the economy and given its tendency to follow an “up the stairs, down the elevator shaft” pattern, the early signs of deterioration reignited the slow growth/recessionary fears and US yields continued the path lower, with 10yr trading below 4.20% for the first time since April.

Combined with the renewed disinflationary signals, markets are starting to price another Fed mistake. In 2021, the Fed wanted to see the “whites of the eyes” of inflation before hiking. Now it seems they want a slowing economy to punch them in the face before reacting with rate cuts.

Given this dynamic, a higher for longer Fed, falling behind the curve of a disinflationary, slowing economy, we continue to believe we’re at the start of a new bond bull market, which will drive yields substantially lower from here and flip what has been a Bitcoin headwind into a powerful tailwind. The longer the Fed remains behind the curve, the deeper and faster the required rate cuts and easing policy response will be. This will also drive Bitcoin to higher peak levels in this bull run for which we are still in the early innings.

Global stress…

Also alleviating the pressure on bonds was a dovish BoJ which disappointed market hawks expecting them to announce a tapering of its JGB purchases. In the event, policy remained unchanged and the taper decision was postponed until July, following discussions with market participants. This reaffirmed a point we continue to make on the BoJ, that any changes to policy will likely be simply tweaking around the edges and does not pose the risk the macro bears are baying for to drive an unwind of the carry trade. The BoJ is another central bank trapped, facing impossible policy choices and with debt/gdp over 260% (and negative GDP growth! - Q1 GDP contracted 1.8%) have little choice but to maintain a sufficient level of financial repression, keeping yields artificially low and sacrificing the domestic currency.

Elsewhere, political uncertainty in Europe, following French President Macron’s call for a snap election in response to the broad shift towards right winged parties in the European elections, spooked European bond markets and weighed on the EUR. France’s 10yr yields rising as high as 3.34% and spreads to German bunds increasing at the fastest pace since 2011 when Europe was in the throes of a sovereign debt crisis. This will do little to help the country’s already fragile public finances! With the European banking system also heavily exposed to European government debt, French and peripheral banks suffered heavy losses.

Bitcoin is the ultimate hedge against the failure of existing political and economic structures. Combined with the move lower in US yields and a market starting to price a Fed policy mistake, this should have been a positive week for Bitcoin. However we continue to face stiff resistance in the 70/72k zone, with a noted seller persistently on the offer at $70k. Market conjecture on who is selling, but certainly there appears to be a “flow” that is keeping Bitcoin heavy and trading in this 65-75k range. Patience then required and short term caution warranted until we can break above $72k. Yet the macro continues to unfold perfectly and supports our bullish view. This feels like the calm before the storm…

Native News

Key news from the crypto native space this week.

FlowBank, an online Swiss bank that offered customers exposure to crypto, has been shut down and put into bankruptcy by Switzerland’s financial regulator. The Swiss Financial Market Supervisory Authority (FINMA) announced its decision to close down FlowBank on Thursday, saying the lender “no longer had sufficient capital for its operations as a bank” and that minimum capital requirements had been “significantly and seriously breached.” FINMA also said that there are “well-founded concerns that the bank is currently over-indebted,” with “no prospect” of a restructuring. According to a document posted on FINMA’s website, FlowBank customers with up to 100,000 Swiss francs (approximately $111,710) in deposits are considered protected, and will receive their money back within seven working days. FlowBank launched in 2020 and had extensive crypto ties, including partial ownership by crypto asset manager CoinShares which, in 2021, purchased a 9% stake in the bank for $11.8 million. Earlier this year, it was reported that Binance would allow larger traders to hold their crypto assets at FlowBank or Sygnum, another crypto-friendly Swiss bank.

A United States district court judge has signed off on the $4.5 billion settlement between Terraform Labs, its co-founder Do Kwon and the Securities and Exchange Commission. Under the deal, Terraform will pay nearly $3.6 billion in disgorgement, a $420 million civil penalty and around $467 million in prejudgement interest. On a joint basis with Terraform, Kwon agreed to pay $110 million in disgorgement and $14.3 million in prejudgment interest — along with an $80 million civil penalty. However reports suggest the SEC could end up receiving only a small portion of its multibillion-dollar settlement with Terraform Labs. In bankruptcy, claims are prioritised. Secured creditors typically get paid first, followed by unsecured creditors, which often include fines and penalties owed to government agencies like the SEC.

Institutional Corner

Top stories from the big institutions

Speaking at the Senate Banking Committee on Thursday US SEC Chair Gary Gensler suggested to lawmakers that the regulator could sign off on the final approvals for listing and trading shares of spot Ether exchange-traded funds (ETFs) within three months. Speaking at the committee discussing U.S. President Joe Biden’s 2025 budget requests for the SEC, Gensler said he expected the commission to approve S-1 registration statements for asset managers “sometime over the course of this summer.” As a reminder On May 23, the SEC approved 19b-4 filings from eight companies, but the applications require S-1 approvals before the ETFs can begin trading on U.S. exchanges. Tennessee Senator Bill Hagerty questioned Gensler on why the commission hadn’t “fully approved Ether ETFs,” claiming the SEC chair was not prioritizing a “constructive set of rules of the road for the crypto industry.” Though Commodity Futures Trading Commission Chair Rostin Behmam said Ether was a commodity in response to Senator Hagerty, Gensler did not directly answer the question but pivoted to Ether ETFs. “The Ethereum exchange-traded product of filings that were in front of us from stock exchanges — I think there were eight or nine of them — were all jointly approved,” said Gensler. “Individual issuers still are working through the registration process that’s working smoothly, and I would envision sometime over the course of this summer...”

Payment firm Kima raised $5 million of pre-seed funding through equity and token funding rounds, bringing the firm's total funding to $8 million. Blockchange, FinSec Innovation Lab, a research and development accelerator out of the payment giant Mastercard, and several angel investors led the equity round. Additional support from the token fundraise came from Outlier Ventures, Blockchange, Big Brain Holdings, Castrum Capital, Kangaroo Capital and Maven Capital. Kima builds a web3, decentralized settlement protocol that connects traditional financial services, such as fiat bank accounts and credit cards, with decentralized finance (DeFi) tools.

In a report this week, JP Morgan raised doubts over the sustainability of the £12bn year to date inflows into crypto assets. They say "Given how high bitcoin prices are relative to its production cost or relative to gold, we are sceptical that the YTD pace of $12bn will continue into the remainder of the year." Spot bitcoin ETFs have attracted $16 billion in inflows year-to-date, and adding the flow impulse implied by CME futures and fundraising by crypto venture capital funds, total inflows into crypto have reached $25 billion year-to-date. The analysts said that many investors have likely shifted from crypto wallets on exchanges to spot bitcoin ETFs due to cost-effectiveness, liquidity and regulatory benefits. They added that this shift is evident in the decrease of bitcoin reserves on exchanges by 220,000 bitcoins or $13 billion since the ETFs launch in January, citing data from CryptoQuant.

Donald Trump met with a number of bitcoin miners at Mar-a-lago this week, including representatives from Nasdaq-listed bitcoin mining firm CleanSpark Inc. and Riot Platforms. Trump reportedly told participants that he would advocate for bitcoin mining in the White House, saying that miners contribute to energy grid stability.

On Thursday, Taiwan's crypto advocacy body, the Taiwan Virtual Asset Service Provider Association, was formally established with a founding meeting of 24 cryptocurrency-related entities. The body will aim to act as a bridge as the private sector and the government work together to supervise the industry. Its first task will be to formulate a self-regulation code that covers industry classification, listing and delisting, consumer protection, risk control, transaction monitoring and advertising solicitation. Taiwan's Interior Ministry approved the formation of the body in line with the law in March 2024 and the founding meeting was held on Thursday. BitoPro founder and CEO Titan Cheng will be the chair and XREX Chief Revenue Officer Winston Hsiao will be the vice chair.

Charts of the Week

Because charts are just as important as macro.

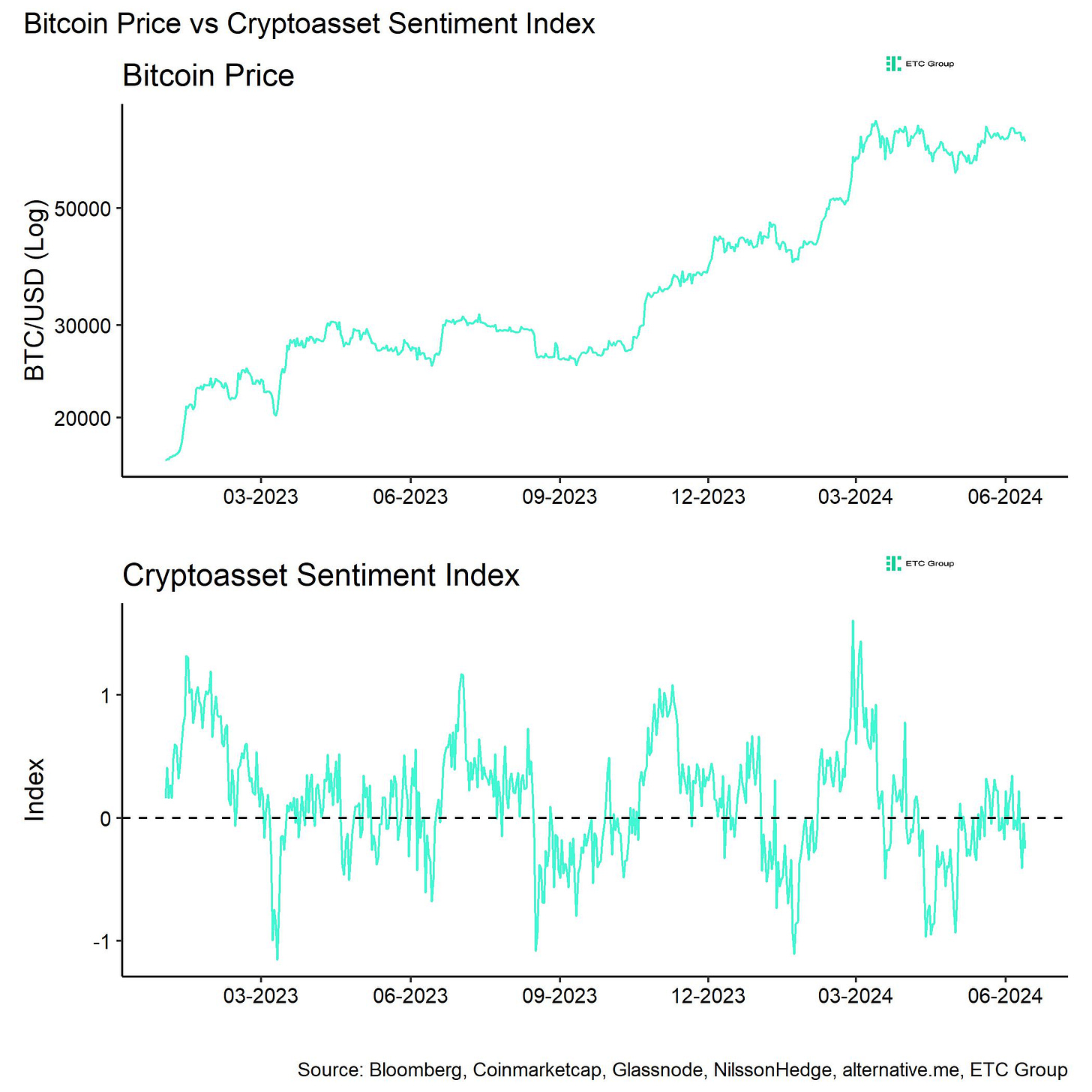

Bitcoin Price vs Cryptoasset Sentiment. Crypto asset sentiment relatively bearish, so short term downside for BTC limited? Hat tip to Andre Dragosch for the chart.

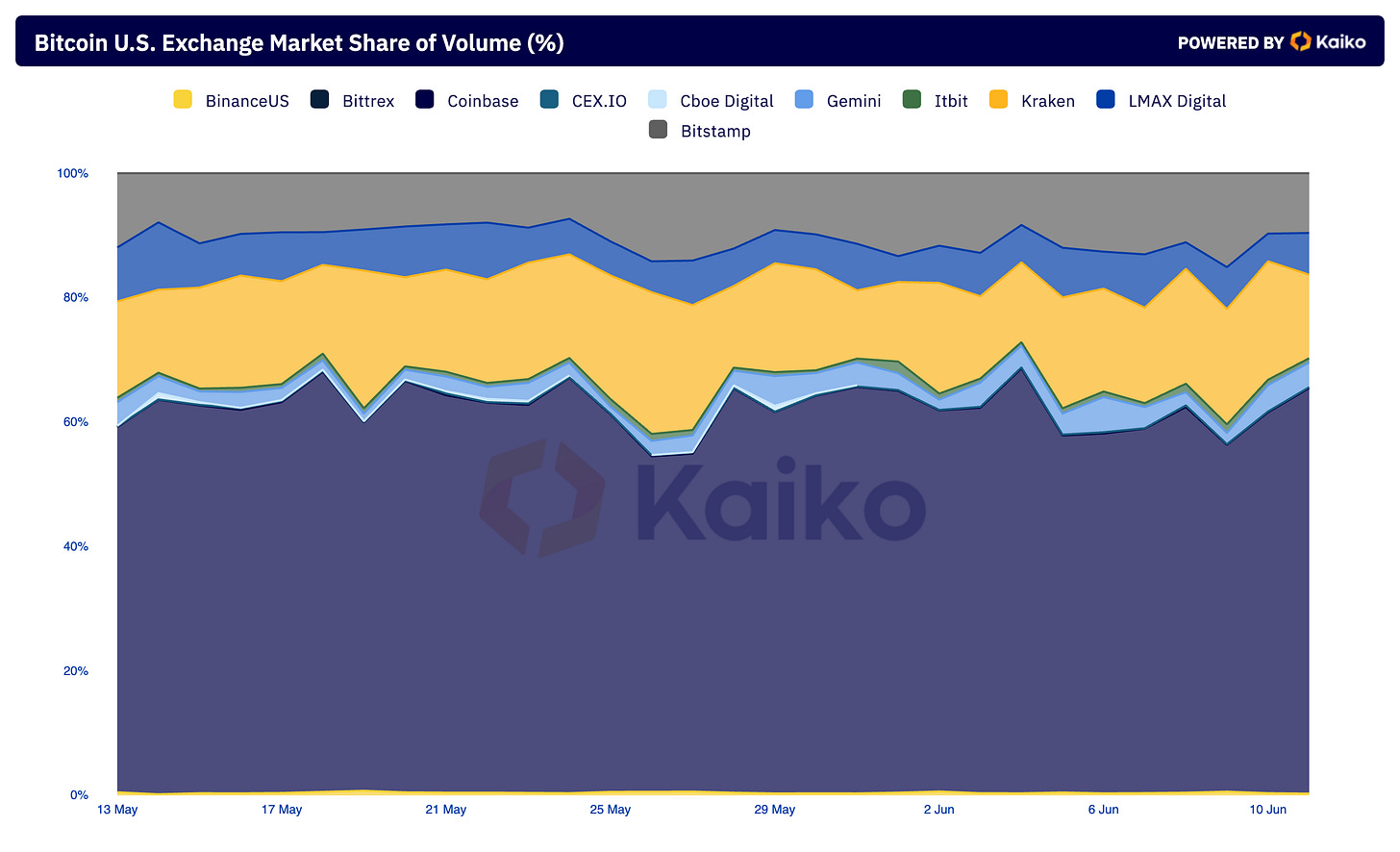

Bitstamp is one of the most popular CEXes in the US for BTC trade volume, regularly clocking in at over $100 million in daily trade volume. This suggests Bitstamp commands between 10-15% of US BTC trade volume, depending on the day. Hat tip to KaikoData for the chart.

USD-backed stablecoin continues to dominate the crypto market. Nearly 90% of all crypto transactions are executed using USD-backed stablecoins relative to the USD. Their average weekly volume in 2024 was $270bn which is 70 times higher than their EU counterparts. Hat tip to Kaiko Data for the chart.

Subscribed

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Product Manager, Platform Custody and Crypto Funding at Kraken

Product Manager - Trading and Liquidity at BCB Group

Operations Analyst for Crypto at XTX Markets

Legal Council Regulatory for Crypto at Revolut

Institutional Sales Lead - EMEA at Ledger

Business Development Manager at KuCoin Exchange

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.