In case you didn’t know, together, the 2 authors of this newsletter have a combined 38 years experience working in trading or sales roles across central banks and investment banks. However, we both moved to institutional crypto trading over the last 2 years.

In this newsletter you won’t find any pump and dump, shilling of altcoins, just our take on the world of crypto built on experience and integrity. We hope you enjoy this latest episode and as always, please share with your colleagues, friends and family if you found it useful.

Don’t forget to follow our twitter for daily updates on news, macro and a bit of old school opinion from the two of us. https://twitter.com/LDNCryptoClub

So to this weeks newsletter, here’s our take on the most important things you need to know in crypto.

Macro Update

We’re macro at heart, this is where we try to connect the dots between the macro and crypto.

A quieter week in terms of top tier macro data left markets digesting the strong NFP and ISM prints. In bond markets, front end rates repriced aggressively with 35bps of additional hikes priced in for the Fed over the course of the week which rippled throughout the yield curve. 2yr yields climbed to 4.50%, 10yr yields to 3.75%. Equities consequently repricing lower. Remember what we have always said: markets are a function of rates and liquidity. Good news is bad news in a market addicted to low rates and liquidity.

Fed Chair Powell spoke at the Economic Club of Washington and reiterated the statement from the FOMC presser that he believes “the disinflationary process has begun,” with all the usual caveats that it will take some time and that he will be prepared to hike more than is priced should the data continue strong. Powell knows that markets watch his every word, so we think its meaningful that he decided to use the statement “the disinflationary process has begun”.

Chinese Producer Price Inflation (PPI) released on Friday shrank at an annualized pace of 0.8% (vs -0.5% exp and worse than Dec’s -0.7%) as high covid cases and weaker global demand limit the inflation impact from re-opening. Don’t forget, we get US CPI data this Tuesday and Chinese PPI has often been a good lead on US CPI. In December US CPI fell to 6.5%, while core prices fell to 5.7% from 6%. CPI expected to rise 0.4% on a monthly basis, and by 6.2% year on year. Core prices are expected to rise by 0.5% and 5.4% year on year. Together with US money supply growth in negative territory, we expect inflation in the US to come sharply lower the months ahead.

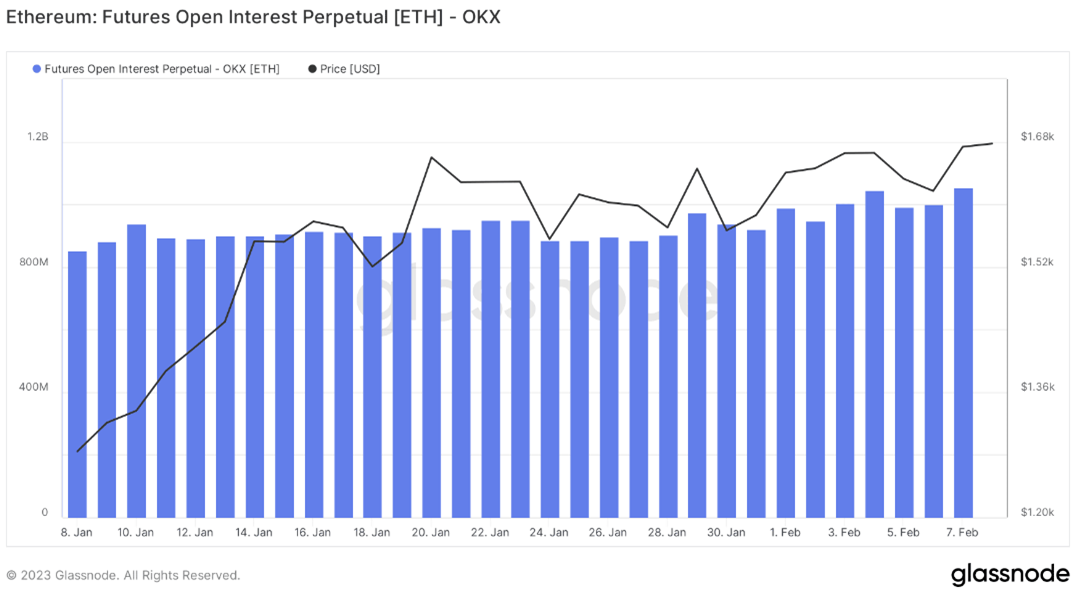

Elsewhere, liquidity and flows remain supportive for crypto markets. The market came into 2023 “under weight” and whether in equities or crypto, investors are chasing performance. The narrative remains to “buy the dip” and perhaps that’s why equities, relative to the move in rates, held up quite well last week (Nasdaq off circa 2% is no cause for panic). With much of the leverage now taken out of the system, there’s also not the same negative flow dynamic in crypto that we were forced to endure in 2022. And Crypto open interest has been building (see chart of the week below!).

Native News

Key news from the crypto native space this week.

The U.S. Securities and Exchange Commission (SEC) has sued cryptocurrency exchange Kraken for their staking-as-a-service program, who settled with the regulator and agreed to pay a $30 million fine and close its staking operations. The fine was also accompanies by a press release from the SEC which you can read in full here SEC.gov | Kraken to Discontinue Unregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges SEC Chairman Gary Gensler said in his statement “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.” Data from Dune Analytics shows that Kraken had 1,233,696 ETH staked, representing 7.42% of the total market and ranking third in market share behind Lido (29%) and Coinbase (12%).

Post the FTX event in November last year, Binance announced it would allow for its data to be publicly available regarding the status of its reserves held in proportion to customer assets, also know as “Proof of Reserves”. Given many in the crypto industry hold 2 values very dear, transparency and privacy, Binance made an announcement this week to improve the original Proof of Reserves system, implementing a form of zero knowledge proof. Zero-knowledge proofs allow one party to determine the validity of a statement provided by another party, without needing to know personal information, trust the other party, or have sensitive content regarding the account made visible. In this case, Binance wants to prove it has backed its users’ funds in full, without revealing individual user balances.

Since I’ve worked in the crypto space, its always amazed me how dynamic the people and the firms are. And most are good at heart. The two have gone hand in hand this week as we saw a number of crypto firms donate to the people of Turkey after the horrific earthquake. Airdropping tokens direct to people’s wallets. Incredible. Binance airdropped a total of $5m worth of BNB tokens direct to wallets and OKX, Bybit and Huobi also made donations.

Institutional Corner

Top stories from the big institutions.

The Bank of England and UK Treasury launched a consultation on the design of the proposed digital pound which suggested the potential roll out the central bank digital currency (CBDC) during the second half of the decade. Some selected statements by BOE Governor Bailey include. “There are a number of implications which our technical work will need to carefully consider,” “This consultation and the further work the bank will now do will be the foundation for what would be a profound decision for the country on the way we use money.” No decision to launch a digital pound has yet been taken but the officials said “a central bank digital currency was likely to be needed later this decade” The move is in part driven by the decline in cash but a growing need to improve the flow of payments. It’s hoped that this will act to knit together different private-sector payment systems, from credit and debit cards to stablecoins produced by other cryptocurrency offerings. We’ll see.

Moodys is reportedly planning to develop a scoring system for stablecoins. The system will include an analysis of up to 20 stablecoins based on the quality of attestations on the reserves backing them. The chairman of the Federal Deposit Insurance Corporation (FDIC) Martin Gruenberg said last October that “all payment stablecoin issuers should – just like banks, whether Federal or state-chartered, be subject to prudential regulation and oversight.” Market leaders Tether and Circle have also ballooned over the past several years, cumulatively hitting a market capitalization of more than $100 billion.

Dubai’s Virtual Asset Regulatory Authority (VARA), has issued its Virtual Assets and Related Activities Regulations 2023. The Regulations set out a comprehensive Virtual Asset (VA) Framework built on principles of economic sustainability and cross-border financial security. The regulatory objectives listed include, positioning Dubai as a regional and international hub, to empower investors and increase awareness about Virtual Asset services and products, to promote the new world of Virtual Assets and attract investments and businesses to set up their base in the Emirate of Dubai, to promote a shared responsibility in developing efficient and bespoke regulations for the protection of investors and to curb illegal practices and to develop the regulations, rules and standards required for regulating, supervising and overseeing Virtual Asset Platforms and Service Providers. You can find the full set of regulation here: Virtual Assets Regulatory Authority (VARA)

Chart of the Week

Because charts are just as important as macro.

According to data from Glassnode, open Interest in ETH perpetual futures contracts reached a two-year high. In the context of futures contracts, “Open Interest” refers to the total number of open contracts that have not yet been settled or closed. Contracts for perpetual futures can be held eternally, unlike ordinary futures contracts with a termination date. If Open Interest rises, this may indicate buoyant market activity, liquidity, and bullishness!

Top jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Venture Capital Investment Principal at Laser Digital

Quantitative Analyst for a Hedge Fund via Vennbridge Recruiters

Senior Associate for Cryptoassets at the Financial Conduct Authority (FCA)

Head of Crypto Trading for ZFX

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.