Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: Our latest view on the macro and its impact on crypto markets.

Crypto Native News: The Bitcoin ETF holdings exceed Satoshi Nakamoto’s holdings of BTC, Coinbase integrates ApplePay to its fiat to crypto offering, spot crypto exchange volumes reach the highest level since May 2021.

Institutional Corner: Florida expected to launch a Bitcoin strategic reserve, David Sacks announced at the White House AI and Crypto Czar, BlackRock Bitcoin ETF surpasses $50bn AUM, the fastest ETF to do that in history.

Charts of the Week: Spot Crypto exchange volume at high since 2021, Crypto market cap at all time high, Base reached all time high for daily transactions.

Top Jobs in Crypto: Featuring QuantumLight, Galaxy Digital, ONE, ForceField, Wintermute and Coinbase.

Macro Update

This is where we connect the dots between macro and crypto.

Digital Gold

Another huge milestone for Bitcoin as we finally crack $100k per coin 🎉

The demand shock post the election of Donald Trump continues unabated and the crossing of $100k will reinforce conviction in the asset class. According to Coinshares, digital asset investment products saw the largest weekly inflows on record last week, totalling $3.85bn, with $2.5bn of that flowing into Bitcoin. ETH saw its largest weekly inflows on record of $1.2bn as it also reclaimed the $4k handle. These flows are just huge 🤯

As we write, Bitcoin is back below 100k and clearly there will continue to be some chop up here with long term HODLERS taking some profit. We’ve also seen US government and MT Gox wallets on the move so potential for some increased supply to digest. Yet this paradigm shift in the regulatory and political environment for the US will likely keep the demand side high for the foreseeable future. To that point, Trump's pick for SEC chairman, Paul Atkins, is another crypto friendly appointment whilst the creation of the new “Crypto Czar” position, to be held by David Sacks underscores the new administration's intent on putting the US in the crypto driving seat.

Digital Gold…

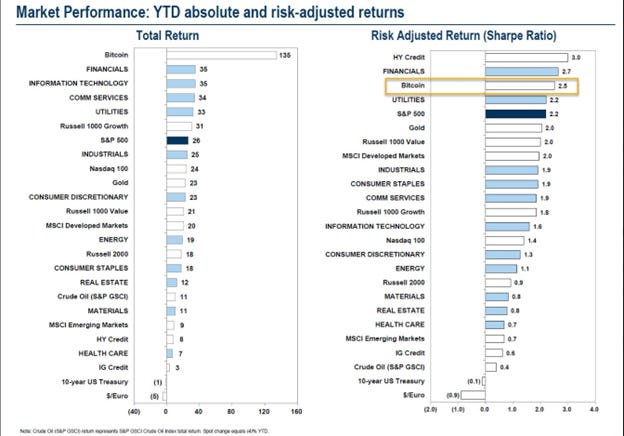

JPow also shared his thoughts on Bitcoin in the week, describing it not as a competitor to the dollar, but as “digital gold” - which is our characterisation (or digital property to be more exact.) Where he was wrong however was in suggesting “it’s not a store of value, it’s too volatile” - this is a common refrain we hear from some of our no coiner friends. However, Bitcoin has been the best performing risk adjusted macro asset, with a higher risk-adjusted return than the S&P 500, treasuries or gold. The volatility is more than compensated by the returns. Holding treasuries is a riskier trade than holding Bitcoin, something all corporate treasury managers should consider 👇 (h/t Zero Hedge for below chart)

On to the macro, Friday’s Non Farm Payroll print rebounded from October's hurricane impacted print of (upwardly revised) 36k to a slightly firmer than expected 227K. Unemployment rate however, ticked higher to 4.2%. Taken together, the data reinforced the markets expectations that the Fed will cut 25bps next week. Fed Governor Waller also stated that despite the recent stalling in inflation, he’s still leaning towards a Dec cut.

Other important data saw ISM services at a weaker 52.1 Vs 55.5 exp and down from 56 prior. This was the biggest drop since June and was driven by a plunge in new orders. This is in keeping with our view of a slowing, not collapsing US economy that will provide room for the Fed to continue the rate normalisation process back to more neutral levels ✅

Rates markets subsequently priced in higher rate cut odds, which saw US yields come lower across the curve and continue to take some steam out of the dollar. As we stated last week, macro headwinds are now becoming supportive tailwinds.

Political turmoil…

Elsewhere, political turmoil in France with the collapse of Michel Barnier’s minority government saw French 10yr yields to Germany widen to the most since 2012 😬 Macro data in Germany also continues to spiral lower, with German manufacturing recession intensifying. The market rightly pricing in faster policy easing by the ECB. Even the ECB’s Chief Economist Philip Lane suggested the need to drop the backward looking data dependence and “focus more on upcoming risks.”

Speaking of political turmoil, South Korea saw the imposition and subsequent withdrawal of martial law by President Yoon Suk Yeol, who the opposition Democratic Party is now threatening to charge with treason and impeachment. Following the turmoil, trading volumes on Korean crypto exchanges surged, hitting a record $34.2bn, almost double the $18bn record set earlier in December.

Bitcoin remains the ultimate hedge to political and economic instability and there’s certainly plenty of that to hedge in the world right now!

All in all, the macro is turning more supportive for Bitcoin, with global rates coming lower (led in no small part by China!) and steam being taken out of the dollar as US rates price lower. Liquidity also remains abundant (RRP has fallen circa $67bn in Dec, injecting yet more cash into these markets) and there’s still cash to come off the sidelines into our markets.

The idiosyncratic demand/supply dynamic continues to dominate Bitcoin over the macro, yet given the now positive macro tailwinds and still unrelenting demand, with the 100k barrier removed, Bitcoin looks set to still have a final push higher into Christmas to end the year on a high. This is a BTFD market 🚀

Native News

Key news from the crypto native space this week.

This week, the U.S. spot Bitcoin ETF holdings have exceeded Satoshi Nakamoto's total holdings, reaching approximately 1,104,534 BTC, making it the entity with the most Bitcoin in the world, and the cumulative holding time of these ETFs is less than one year. Satoshi Nakamoto's holdings of approximately 1,100,000 BTC ranked second, followed by Binance (633,103), MicroStrategy (402,100), and the U.S. government (198,109).

Coinbase, the largest U.S. exchange, is integrating Apple Pay into its fiat-to-crypto payments offering. The product, Coinbase Onramp, provides a one-click buy that reduces the number of hoops people have to jump through to fund their self-custody wallets. As Coinbase said in a statement, using crypto often involves “a lot of friction, and as a result, users abandon ship.” "It was rolled out right before Thanksgiving to a select group of clients first," a representative for Coinbase. “Onboarding to crypto can be a pain for your users: it can take a long time, require them to go through lengthy KYC (often requiring back and forth interactions), and use multiple apps to name just a few of the headaches,” the company said in its documentation. Onramp, formerly known as Coinbase Pay, is essentially a software development kit (CDK) and series of APIs that enables coders to embed a fiat-to-crypto ramp into their mobile or web applications and browser extensions. The tool is widely used, including in popular wallets like Ethereum’s Metamask and Rainbow, Solana’s Phantom and the exchange’s own Coinbase Wallet. Read full details from Coinbase HERE.

Monthly trade volume across spot crypto exchanges reached $2.71 trillion in November, the highest level since May 2021. The size is more than double October's trade volume of $1.14 trillion. According to data from The Block, around 36% of the monthly trade volume in November came from Binance, which processed over $986 billion. Crypto.com, Upbit, and Bybit followed, each recording a monthly volume exceeding $200 billion. A significant month-over-month increase in trading volume was observed globally across all regions. Meanwhile, November’s total trading volume for Bitcoin futures on exchanges reached $2.59 trillion, while Ethereum futures hit $1.28 trillion, both marking their highest levels since May 2021.

Institutional Corner

Top stories from the big institutions

According to news reports the US state of Florida is expected to launch a strategic Bitcoin reserve in the upcoming legislative session in the first quarter of 2025. The investments could be made through its $185.7 billion pension fund, the fourth largest pension fund in the United States. It suggested allocating 1% of the pension fund, or $1.857 billion. Samuel Armes, President of the Florida Blockchain Business Association (FBBA), is confident that Florida “has a very good chance of creating a strategic Bitcoin reserve” during the upcoming legislative session, which begins in the first quarter of 2025. Armes also proposed utilizing Florida’s $116.5 billion budget surplus from FY 2024-25 to invest in Bitcoin. “Florida often has a budget surplus because we.. have a very well-run state,” he added. “Investing even one percent of this surplus would be $1.16 billion."

U.S. President-elect Donald Trump announced Thursday that Yammer founder and former Paypal COO David O. Sacks will be the “White House A.I. and Crypto Czar.” Trump said in the announcement “In this important role, David will guide policy for the Administration in Artificial Intelligence and Cryptocurrency, two areas critical to the future of American competitiveness.” The president-elect added that Sacks will work to develop a legal framework to provide the U.S. cryptocurrency sector with more clarity. Sacks will also lead the Presidential Council of Advisors for Science and Technology. Sachs is currently a Partner at venture capital firm Craft Ventures which has has invested in cryptocurrency projects including: dYdX, Lightning Labs, River Financial, Kresus, Set Protocol, FOLD, Harbor, Handshake, Voltage, Galoy, Lumina, and Rare Bits.

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed $50 billion in assets under management, achieving the milestone in just 228 days—more than five times faster than any other ETF in history. The previous record-holder, BlackRock’s iShares Core MSCI EAFE ETF (IEFA), took 1,329 days to reach the same threshold

Charts of the Week

Because charts are just as important as macro.

Spot crypto exchange volume hit $2.7 trillion in November, highest since May 2021.

Crypto market cap reached an all time hight again this week at $3.70tn.

Base reached another all-time high with 8.8 million daily transactions on its network on Thursday.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

Intern for Investment Management Team at QuantumLight

Sales Support Analyst at Galaxy Digital

KOL Manager (Web3) at ForceField

DeFi Trader/Developer at Wintermute

Base Global Ecosystem Growth Lead at Coinbase

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.