Welcome to the new subscribers that have joined us over the last week. The aim of this newsletter is to help you navigate the world of crypto. There’s an incredible amount of information out there so we try to distil it into the things you MUST know each week, covering both macro and crypto.

For snippets and analysis on institutional crypto trading, give our X account a follow HERE.

If you think someone will benefit from reading this newsletter, we’d be really grateful if you could share it with them. Thanks!

Onto the newsletter. Here’s what you’re getting this week:

Macro Update: The powerful supply/demand flow dynamic continues to drive bitcoin, don’t fight the flows!

Crypto Native News: Ripple acquires Standard Custody and Trust Co, Coinbase releases its Q4 earnings.

Institutional News: The SEC widens its definition of a dealer, Franklin Templeton files for ether spot ETF, Robinhood reports its Q4 earnings and Philippines to issue a CBDC but not using blockchain technology.

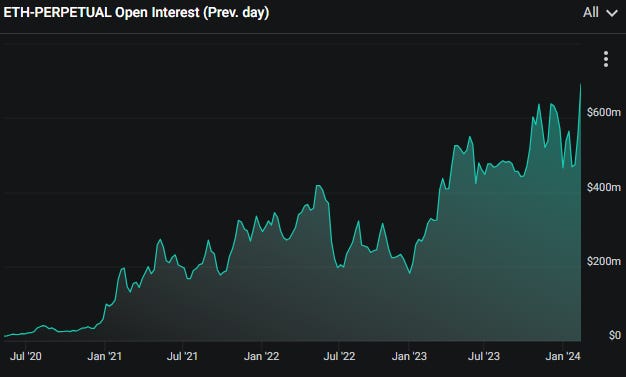

Charts of the Week: CME volumes on the rise, Bitcoin ETF vs Gold ETF flows, Ether perpetual futures open interest surges.

Top Jobs in Crypto: Featuring ONE Trading, Cryptonary, Quant Street, fscom, FCA and Paysafe.

Macro Update

This is where we connect the dots between macro and crypto.

All Roads Lead to Bitcoin

Hotter US inflation failed to dent the mood for crypto, despite driving yields higher and the dollar stronger this week.

We highlighted last week the powerful demand/supply dynamic driving Bitcoin as the ETF demand shock starts to take effect. Daily net inflows this week averaged just under $500mio. For context, daily supply of BTC is 900 BTC, circa $45mio, so net daily ETF demand is currently 10x the daily supply 🤯. Whilst we argued the “headline effect” of the ETF’s was priced for BTC back in Jan, hence the “sell the news” reflex, the market is now just starting to price properly the ETF impact. On the supply side, with the halving due in April, daily supply will be cut to circa 450 BTC. If net ETF inflows are sustained, daily demand will be 20x the supply of BTC! Don’t fight the flows 🌊

Back to the data and US inflation put another dent in hopes for a March rate cut, coming in a stronger 0.3% on the month, with headline CPI at 3.1%, down from 3.4% but hotter than the 2.9% expected. Core inflation stayed at 3.9% YoY, with stubbornly high shelter prices accounting for much of the rise. Friday’s Producer Price Input data also came in strong, with Core PPI rising to 2% from 1.7% and headline PPI YoY at 0.9%, down from 1% but stronger than the 0.6% expected. As the market continued to temper rate cut expectations, US yields moved higher, with the 10yr up over 10bps on the week at 4.29%.

Offsetting some of the “hawkish” rates pricing was a very weak US retail sales print, which recorded the worst YoY growth since Covid lockdowns. Retail sales fell 0.8% in Jan, with YoY sales at 0.6% down from 5.3%. First signs perhaps that the US consumer is finally tapped out? Elsewhere, both Japan and the UK slipped into a technical recession, continuing the slowing global growth theme and driving a bid for the dollar as US exceptionalism reigns supreme.

The move in US yields and the dollar, all things equal, continues to provide a headwind to an otherwise powerfully bid market in crypto. Equally, the momentum in stocks has continued in the face of these headwinds. We continue to point at liquidity as one of the key drivers of risk however, and liquidity remains ample. Indeed, the Fed’s balance sheet has actually been increasing for the past 2 weeks (the Fed balance sheet has increased 4 of the past 6 weeks) whilst on Thursday, the RRP dropped $82bn to sit under $500bn. As we’ve written about extensively, this is a huge cash injection into markets. No wonder bears are getting frustrated!

Big picture, despite the resilience in US data and still sticky inflation, little has changed in terms of the direction of travel as we transition from the sharpest rate hike cycle to now a global cutting cycle. Fed speakers this week continue to map out a path for cuts, with Goolsbee telling a New York conference that slightly higher inflation in the coming months is still consistent with the path back to 2%, whilst the Fed’s Daly this weekend re-emphasised her expectation of 3 cuts this year, highlighting that “the bumpy economic data this week was normal for turning points in the economy” and “we can’t wait for inflation to reach 2% before cutting rates.”

Still also bubbling in the background, is a looming crisis in commercial real estate and regional bank exposure. Bloomberg this week ran a review article which found “22 banks with $10billion to $100billion of assets hold commercial property loans three times greater than their capital.” With circa $1trn of these loans needing to be rolled this year, the lagged effects of these rate hikes will start to be sorely felt. Meanwhile, the US debt continues to spiral, with annual interest in excess of $1trn.

If inflation were to re-accelerate (not our base case) then the Fed will face an impossible choice. Keep rates on hold/lower to ease the spiralling debt costs and to relieve pressure on regional banks, allowing inflation to run hot. Or hike rates to address inflation and risk blowing up the system. Either way, all roads lead to Bitcoin 🚀

Interesting Bloomberg interview coming up: Crypto: A Year in Review. A look at the current themes in the market plus a look ahead to the rest of 2024.

Sign up to watch for free HERE.

Native News

Key news from the crypto native space this week.

This week, Ripple struck a deal to acquire Standard Custody & Trust Co., in order to secure a New York trust charter in an ongoing expansion of its U.S. regulatory licensing. The limited purpose trust charter held in New York by the company Ripple is buying will let it offer more in-house services, including to financial firms seeking to tokenise assets. The company is trying to push beyond the payments network it's known for and into other financial products in which their institutional customers can benefit from blockchain technology. Ripple President Monica Long said "We want to offer more and more of these infrastructure pieces to these financial institutions," "We see this as giving us a lot of flexibility." Read more details on the trust charter HERE.

Coinbase released its Q4 earnings this week and they exceeded expectations. It earned $1.04 per share, beating the average analyst estimate of $0.02 per share, according to FactSet data. Revenue of $953.8 million also exceeded the analyst forecast of $826.1 million. It also saw 100% more trading volume during the quarter versus the third quarter. Fourth-quarter volume amounted to $154 billion, ahead of the estimate of $142.7 billion. Anil Gupta, vice president of investor relations at Coinbase said "We’re really pleased with the results,” “Operational rigor that we set forth early in the year really paid off over the course of 2023.” Read the full details from Coinbase HERE.

Institutional Corner

Top stories from the big institutions

This week the U.S. Securities and Exchange Commission (SEC) widened its definition of a dealer to pull many more financial operations into its jurisdiction – including, as it warned in a footnote of its original proposal – those dealing in crypto securities. In its statement the commission said, "The commission is not excluding any particular type of securities, including crypto asset securities, from the application of the final rules," "The dealer framework is a functional analysis based on the securities trading activities undertaken by a person, not the type of security being traded." Read full details from the SEC HERE.

Asset Manager Franklin Templeton filed to list a spot ether ETF with the Securities and Exchange Commission, joining BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy and Hashdex, which have all submitted applications in recent months. The move comes roughly four weeks after Franklin, among nine other issuers, launched a spot bitcoin ETF, which has only brought in about $70 million in inflows since launch (compared to BlackRock’s $3.5 billion). The SEC has so far delayed all decisions to approve an Ethereum ETF, as expected by experts. JP Morgan currently sees a less than 50% chance of an approval by May.

Robinhood reported its forth quarter earnings this week. Transaction-based revenues were up 8% year-over-year to $200 million and were boosted by cryptocurrency revenue which came in at $43m. The report from Robinhood added that it “plans to explore opportunities to continue growing its customer base outside the US” following its expansion into the UK and EU with the brokerage waitlist launch and the European Union crypto launch.

According to local media reports, the central bank of the Philippines is planning to introduce a wholesale central bank digital currency (CBDC) in the next few years. Notably, Eli Remolona, the Governor of Bangko Sentral ng Pilipinas (BSP), stated that the central bank will not use blockchain technology in the project. Instead, the CBDC will operate on a payment and settlement system owned by the central bank. The central bank is sceptical about potential problems with the retail CBDC, including disintermediation, bank runs during financial stress and the further magnifying of the central bank’s footprint.

Charts of the Week

Because charts are just as important as macro.

Trading volumes on the CME surged by 35% in January, reaching a high of $94.9 billion, the most substantial volume since October 2021. The trading volume for ether futures on the CME also increased by 15.6% in January. Hat tip to CCData for the chart.

Bitcoin ETF inflows vs Gold ETF outflows since the start of the year. Hat tip to James Van Straten for the chart.

Ether perpetual futures open interest has surged on centralised exchanges, hitting an all-time high on Deribit.

Top Jobs in Crypto

Well, we all want to work in Crypto don’t we. Here’s a bit of help on your job search!

FX/Crypto Trader at One Trading

Crypto Research Analyst at Cryptonary

Crypto Quant Trader at Quant Street

Digital Assets Policy Manager at the FCA

Relationship Manager for Crypto at Paysafe

DISCLAIMER: The content in this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice or a recommendation to buy or sell any assets or to make any financial decisions. Crypto markets are volatile, please be careful and do your own research.